第658回:日銀、行く手を阻む債務超過と、後門からせまる利上げプレッシャーの挟撃に遭う

前週時点で152円前後と急激な円高に晒されたドル円ですが、前回のコラムで予想した通り、無事に元の木阿弥に戻ることになり、執筆時点で155.70近辺をウロウロしております。本稿読者の皆様におかれましてはドル円ロングで爆益取れたかと存じます、誠に、おめでとうございます。

ということで、前週コラム執筆の後に、幾多、続報が出てまいりまして、一応、報道をそのまま読むと、やはりイエレンさんは激オコであったようです。

参考1)米財務長官、為替介入「まれであるべきだ」-慎重姿勢示す

まあ普通に考えればね。怒るでしょうそりゃ。数日で9円近く動く通貨なんて、国際通貨市場で評価されるわけがありませんからね。そもそも、米国は利回り問題がやっと解消するかもしれない株価上昇基調にあって、完全に冷水をかぶせられた形となったわけですから、『マジで円高に介入とか余計なことすんなよ今』、と間違いなく思ったはずです。

で、割とメディアやSNSで話題になっていたこちらのネタも合わせて嗜みましょう。

参考2)植田日銀総裁が岸田首相と会談、円安「注視していくこと確認」

え、前回と全然言ってること違うやんw

参考3)日銀総裁、円安巡る発言を修正「物価に影響しやすく」

これが4月の記者会見時点で発表していた植田総裁の見解と、岸田総理と会談後の見解のギャップを解説した記事です。植田総裁も、知力の足りない方々に囲まれて可哀想な限りですが、これでようやく介入指示した正体が分かりましたね。明らかに岸田総理(現自民党政権)でしょう。やはり東京15区含めて選挙に負け倒したのが効いたのかな。

介入を実務担当している某神田財務官も、植田総裁も、マッジで優秀なのに、こうした政権のフラつきに右往左往されて可哀想だなと思いますよ本当に。心から。心中お察しします。お疲れ様でございます。だって、ドル円が160円まで走ったのは、為替介入しないからじゃないからね。“国が掲げている金融緩和政策”がそうさせているだけだからね。先進国の中で唯一、特攻隊ばりに金融緩和し続けないといけない(そうしないとアメリカに怒られる)政策が、構造的にそう(円安に)なっているだけだからね。だって、米国債買って、日本がドル買わないと、米国破綻しますよ。ただそれだけの話しでしょ。そこに、日本バブル、台湾有事(戦争)想定で、世界中の産業が日本に拠点を創ろう、となって、株高に拍車がかかり、日米金利差が開いて、更に円安になったんだからね。『これ、いま介入しても意味ねえだろ全くw』、ということくらい、某神田財務官も腹心の方も百も承知で馬鹿な政策につきあわされているんですよね。本当にお疲れ様です。でも無意味なんで円高さようなら。そもそも、金融緩和政策継続しながら、円高に為替介入とか、ブレーキとアクセル療法、じゃなかった、両方踏んでるくらい病的なアクションでしょこんなの。マジで馬鹿なんじゃないの、と思われる方も多いと存じます。そうです、馬鹿なんだと思います。これは、馬鹿な判断をしなければならない環境を呼称しているまでであって、個別事案や個々人を批判しているわけではないのであしからず。まさに、日本は、政権の皆さんは、『失敗の本質(中公文庫 と 18-1』を100万回読み直したほうが良いね。芯がある政策がないんだよシンプルに。途中でブレるなよ。やりきれ。死ぬなら死ぬまで。その先にしか生きる道はない。新渡戸稲造です。武士道ですよ。

米国も含めて、世界はインフレに悩んでいる。それどころか、『本格的に物価上昇したのに景気が悪いじゃねえか』と、スタグフレーションの到来に皆さん(よ~やく)気づき始めているわけです。そんな中で、円の信任の中核をなす外貨準備高のベースを取り崩してまで、円高に介入なんぞする意味あるわけがねえじゃねえか。そして、財務省の天才国士チームは、知っています。日本は借金大国。その通り。でも、国民視点からみると、債権大国(貯金中毒の国民が金を貸しまくっているからね銀行を経由して政府に)。この債権価値を下落させれば、日本政府は借金を合法的に棒引きできる。そのための手段は?円安に決まってんじゃねえかwその逆張りをわざわざする必要なんざない。まず、植田総裁がどれだけ賢いか、この記事をご覧ください。

できないことを約束しても実現する手段がないんだから地獄になるよってのは20年以上前から予告されていたことで日本経済はこの時の懸念どおりの道筋を辿っているだけなんだよな。その後始末を植田さんがつけることになるってのはドラマチックにもほどがある。 pic.twitter.com/7HXfthUyry

— シラカワスキー (@shirakawa_love) May 9, 2024

これはとある識者がX(Twitter)で投稿してくれた、20数年前の植田総裁と他の委員の会話のやりとりなんだけど、ここにはっきりこう書いてある。目をかっぽじって二万回読んでください。

『緩和要求が来ると短期金融資産では間に合わなくなり長期国債を買い入れるしかなくなるが、それによって生まれた流動性が景気にプラスになれば良いものの、ならないと地獄になる(超訳)』

・・・。そのとおりですね。天才植田総裁が、20数年前以上に想定していた惨状の伏線を、自ら総裁になって回収しなければならないというのはまさに皮肉。これぞ人生。嗚呼、青春の日々。毎日が青春です。我々が直面している(今後更にすることになる)のは地獄です。青春in地獄なうです。

まあこんなもん経済学とかコンドラチェフの波とか回帰分析の定理とかマニアックな理屈を知らずとも、考えりゃ誰でもわかる。供給が増えたら、需要が減る。当たり前。以上。いつもの需給の原理。世の中の真理は、需給の原理以外に、ない。ハイブランドも一次産業も金融も男女の問題も芸能業界も空が青いのも郵便ポストが赤いのも、全て需給の原理。全て。全てです。

で、世界は、なんとかインフレから離脱しようと、利上げしてドル価値を上げようとしたり、利下げして景気を刺激しようとしたり、あくせく働いているわけだけど、かくいう日本は、特攻人形(ひとがた)片道人間魚雷戦法で、日銀の無限紙幣増刷と国債買い入れ無限列車を繰り返しているわけだから、こんなもん円安にならないほうがおかしい。で、その刷った金を何に使ってるかと言えば、(米国債を通じて)ドルを買い、新NISAで外国株を買っている。走る為替ペアは?ドル買いの円安やんけ。円安になるに決まってんじゃねえか。阿呆かマジで。はい360円です。360円。もうすぐ200円。年内190円。お疲れ様でございます。

という、『またてめえのコラムはいつもと同じ話かつまんねえよ最後はビットコインだろどうせ』という読者の皆様の心の声が聞こえてきそうなものですので、今日はちょびっと、視点を変えてみたいと思います。というのも、どうも、このニュースが出てから、というか、このニュースを皮切りに、日本株のフローがおかしくなっています。日本時間に、やたらと売国奴が日本株を売っていやがる。インフレになるのに。スタグフレーションなのに。なんだか分からない不気味な予兆を感じているのです。

参考4)最高益なのに…トヨタ経営陣、なぜ表情硬い 中長期で根深い課題

まあ、ね。もちろん株の世界では、最高益出してるのに馬鹿売りされることはよくある。決算最高なのに、何故か決算通過して、馬鹿売りかよ、みたいな展開はよくある。から、そこは分かるんだけれども、にしても金曜日なんて自動車滅多売りされてたでしょ。円安確定しているのに。わけわからんくない?しかも日本時間。ということを、今日は解析していきたいと思います。

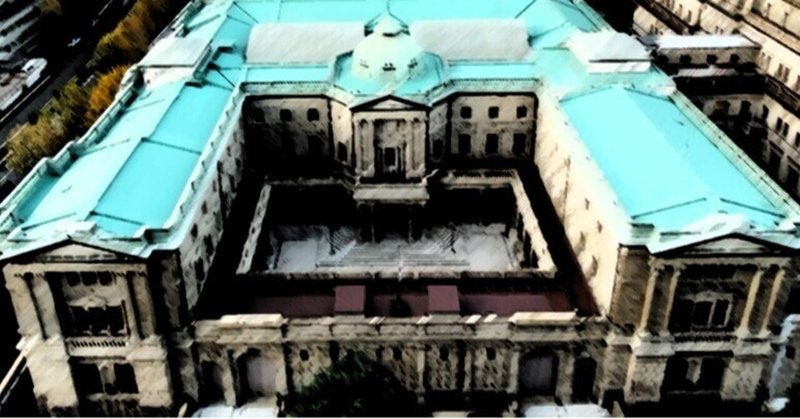

先に本誌の結論めいたことから触れますと、『現時点で、確信はないが日銀の危機が主因であろう』です。正直、可能性のレベルでしか探れない。この、日本時間に限定した、円安・株安の、極端なダブル安は。ただ、ちょっと、変な感じを受けてはいるので、本日はその違和感の正体を、余す所なく解説していきたいと思います。主役は日銀。それでは参りましょう。

1.具体指摘され始めた、日銀の債務超過リスク

ちょっと古い記事(今年の1月)ですが、この記事が一番まともそうなので、取り上げさせて頂きたいと思います。

参考5)FRBが利上げで過去最大の赤字:日銀は政策金利+0.6%で赤字、+2.8%で債務超過に

要するに、アメリカの中央銀行(FRB)が大幅な赤字を計上していて、この赤字は量的緩和政策という未曾有の政策によるもので、日銀もそのリスクに晒されているよ、という話なのです。記事が難しくて分からない方向けに超訳して解説すると、

・日銀の自己資本は12.7兆円

・現状の政策金利は-0.1%程度

・この政策金利が0.3%まで上がると日銀の保有資産から計算した利益は逆ざやになる

・2.8%まで政策金利が上昇すると日銀は債務超過になる

こんなところです。

米国ならまだしも、日本の政策金利が2.8%っていうのは、結構衝撃的な数値に見えて、『お前は馬鹿かそんなに利上げするわけねえだろボケ』と思われるかもしれませんが、『じゃあ3年前にタイムスリップしてドル円が160円になるって言ったら信じるんですか?』と言い返す向きも出てきそうで、正直、割と起こり得るかもしれない。この水準の金利までは。

というのもですね。利上げって、マジで、一番効くのよ。マジで、一番効く。何故なら、金利って、経済の血液だから。『金を刷ります~』とか、『補助金ばら撒きます~』とか、色んな金融政策があるんだけど、『利回りを上げ(下げ)る政策をします~』が、マジで一番効く。金利は全てだから。マジで効く。で、この利上げを、やらざるを得ない、状況に置かれている。日本は。何故か?インフレだから。もう少しはっきり書くと、不景気下のインフレ、つまりスタグフレーションだから。これ見てよもう。

参考6)3月実質賃金2.5%減、24カ月連続マイナス 減少幅拡大=毎月勤労統計

実質賃金が初めて24ヶ月連続でマイナスになって、物価上昇率に負けた、という記事。これ、答え書いてあるじゃんもうwスタグフレーションですよね。明らかに。

単なるインフレが加熱した場合、金利を上げれば、加熱した景気を冷やすことが出来、通過の供給を絞り、物価上昇を抑制することが出来ます。内閣府の出している資料をご覧ください。

参考7)付注3-1 過去の主な景気循環のパターン

義務教育を受けた知力のある方なら、政治・経済や公民で習った、センター試験でおなじみの神武景気やいざなぎ景気。この時は、人口ボーナス、途上国から先進国への成長曲線という追い風もあって、金融引き締め政策を行って景気を冷やし、また金利を抑えて景気を刺激し、ということが、極めて有効であったわけです。

ところが、インフレ+不景気、つまり、スタグフレーションの状況下で、利上げをすると何が起こるのか、といえば、インフレ抑制+不景気の加速、という力学が働き、経済・金融市場が壊滅的になるリスクが高まる一方で、インフレ抑制によるディスインフレ状態(デフレの前)になります。これは諸説あって、ディスインフレとデフレの違いや、インフレによるMMT理論の有効性など、色んな御用学者がギャンギャン汚いつばを飛ばしながら議論しているので参考文献は是非各自で読んでください。その有効性に本誌で触れることはしませんが、『利上げをしたからといってすかさずデフレになるというロジックは乱暴であろう』という保守的な知見からディスインフレという表現を使っています。他意はありません。とにかく、『インフレは抑制できるかもしれないけれど、経済は墜落するよ』、という危機に、直面していると考えてください。だから、日銀の植田総裁は、利上げに慎重なのです。もとい、『もう利上げして地獄の底でアウフヘーベンしちまおうぜ』、くらい、腹をくくってる可能性もあります。天才植田総裁のことなので。慎重なのは政府なんだろうな多分。

まあとにかくだ。インフレが激しい。インフレと不景気がセットになっている。名目どころか実質賃金が半永久にマイナスだ。物価上昇は止まらない。さあどうする?となった時に、対応できる“有効な政策”は利上げしかねえんだよ。で、利上げするとさ、どうなるかっていうと、冒頭の野村総研の記事に戻ってくれ。そう、日銀は債務超過になるんだ。

2.日銀が債務超過になると、果たしてどうなる?

とにかく、偉い人や頭のいい人たちの悪い癖は、『なんだかおどろおどろしい言葉を多用して、偉い人の都合の悪いことは、世の中的に悪いことだ』、と印象付けようとすることにあるよね。倒産とか賄賂とか破産とか債務超過とか。いやー。悪そうだなwどれも。だから、日銀の債務超過、とか書くと、『日本オワタ・・・・』みたいに思うかもしれませんが、結論から言えば別に『日本はオワタ』にならん。というか、既にオワタしてるから、もはや今更ジタバタしてもなんにも意味がない。日銀が債務超過になったら、『そうですか。任務ご苦労さまでした。敬礼!』、で終了です。だって、日銀は、みんなの旧JASDAQ上場企業だからね!(今はスタンダードでもプライムでもグロースでもない)

参考8)消えた日銀出資証券

いやー、なんで日銀が、未だにプライムとかスタンダードとか、区分されてないんだ?日銀法が邪魔してるのか?55%は政府だけど、残りの開示されていない大株主である個人が実は皇室でバックファイナンスしているのがロスチャイルド家だから日本政府ですら手が・・・(これ以上は闇が深いので身の安全を保持すべくやめます)。

とにかく、日銀が債務超過になったら、東証のルールでは、適時開示をして、債務超過になりました、とやり、“債務超過解消に向けた当社取り組みのお知らせ”という糞シュールな開示が東証の指導のもと我らが日本銀行から出るだけですwwwいやーみたい、みたいぞ、この開示、むしろ見せてくれ、歴史の生き証人になりたい。まあ、そんな開示出したところで、それこそ、日銀法に基づく政府の救済が発動し、純資産(自己資本)がプラスになるまで政府資金が注入される。それで終わる。だから、日本の政策金利が2.8%という衝撃的な数値になったとて、そして日銀が債務超過になったとて、『で?だからどうしたの?』という話にしかならない。

日銀に資金注入する政府の資金原資は?税金だそんなもんは。あと物価上昇に伴う紙幣価値の逓減分だ、つまり日本円の価値が安くなり紙くずになった分、皆さんの債権(貯金w)が目減りして、そのキャピタルロス(政府からするとキャピタルゲイン)で帳尻を合わせるんだ。つまり、日本政府からすると、万が一、2.8%まで政策金利が上昇する事態が起こると、日銀が晴れて“債務超過解消に向けた取り組みのお知らせ”を適時開示することが出来、完全合法的に、“日本政府から出資の申し入れがありましたので行内で慎重に検討した結果、お受け致します”みたいな開示が出て、自己資本比率が回復するんだ。

で、そもそも、政策金利が2.8%なんちゅうキチガイ金利になっている時は、自動車ローン返せないクレジットカード債権滞留マイホームドリーム破壊で生産年齢人口の半分近くがホームレス、みたいな、北斗神拳見参の世界になってるわけだから、政府としても非常に都合が良いわけだ。合法的に借金も棒引きできたし、円安で『ギミーチョコレート』と叫び続けられるからね。中国とアメリカとロシアに対して。『戦後かよ』、みたいな話になるから、政府からすると、美味しい。国民からすると、溜まったもんじゃない。

3.日銀が債務超過にならずに円高に誘導するウルトラC

日銀が利上げをして、政策金利が2.8%超えると債務超過になる。マジック点灯まであと2.9%。政策金利を上げずに放置するという手もあるが、その場合インフレ(スタグフレーション)が加速し、円安になる。下手すると、マジで数年で360円になる。ただ、日銀が債務超過になろうが、円安になろうが、どちらも、シナリオの決着点は同じで、日本政府の借金が棒引きになって、日本国民が本来有すべき全ての資産価値・債権価値がゼロにリセットされる。だから、政府からすると、非常~に都合が良い。なので、どうでもいい。国民のカネなんざ。と、マジで政権中枢の偉い人はみんな思ってると思います。一部の国士を除いて。

さはさりながら、ここで書いている債務超過やインフレ加速は、ハードランディングはハードランディングのシナリオなので、その手前で、日銀の植田総裁は何とかしないといかんな、と思っている。愛国者だろうし、天才だから。そのための方法・手段として、実は虎の子の“アレ”を使う方法がある。

参考9)日銀金融正常化へ一歩、気になる保有ETF70兆円の行方-

要するに、日銀は70兆円もの、気が触れたレベルの日本株をETFを経由して持っている。これを持ち続ける限り、配当は入ってくるし、日本株の株価が上がれば、当然にキャピタルゲインも膨大なものになる。

前掲した野村総研の分析による、2.8%で債務超過理論が、このETFの現時点における含み益をちゃんとカウントしているのかどうか不明なので、取り敢えず日銀の決算書を読んでみよう。

https://www.boj.or.jp/about/account/data/zai2311a.pdf

あれ、取り敢えず、貸借対照表を拝見、金銭の信託(信託財産指数連動型上場投資信託)を見つけたんだけど、37兆円しかなくね?70兆円は貸出金の中に含まれてるのかな。実務に詳しい人教えて。そんで、純資産が、5兆4700億円くらいしかなくね。あれ、意外に少ないのねw そして、適時開示とかの厳格な東証ルールを無視して、半年の一度の財産目録開示で許されるストロングスタイル。流石です。流石“にっぽんぎんこう”。

さておき、損益計算書をみると、金銭の信託(信託財産指数連動型上場投資信託)運用益とPLに入ってるね、てことは、これを加味して純資産が計算されてるね。にしても、5兆円って、むっちゃ少なくねこれ大丈夫かよw

日銀の財務諸表見学はこのあたりにして、ともかく、日銀には日本株を集積したETFってのがある。BSでは37兆円あって、トータル70兆円はあるらしい(残りの34兆円がどの勘定科目に隠れているかは不明)。こいつを使うと、債務超過を余裕で解消する方法がある。簡単に言えば、日経平均を、2倍にすれば良い。今の平均が38,000円前後として、76,000円にしゃくりあげる。ただし、日銀がETFを無限買いすることはもう出来なくなったので(政策変更)、外人に買わせまくれば良い。外人が日本株を買いにきたら、その為替ヘッジで円売り/ドル買いをしてくるはずなので、そこで思いっきりドル売りをぶつければいい。某神田財務官が。この、ETFというか日本株を買わせながら、外貨準備高を売り崩しまくっていけば、少なくとも日銀の債務超過問題は薄れていくし、円高に誘導することが出来る。無駄な弾を使う必要もない。

日銀のETF平均取得単価が21,000円程度とされているので、仮に76,000円までしゃくりあげれば、70兆円の3.5倍、245兆円の資産に膨張し、含み益だけで165兆円取れる話にある。『債務超過、どこへ?w』となる。

逆に、日本株を売る、ETFを日銀が捌いていこうとすると、日本株が下落し、円高に触れていく、外人が日本株を損切りし、為替ヘッジが解消されるから。

そう、ここまで考察を書くと、冒頭で記載した日本時間の異様な株売りの正体は、朧気ながら見えてくる。つまり、憶測となるが、『日銀さん、ETFの売却話をフォワードガイダンスしてません?』ということになる。あるいは、日銀の債務超過問題を先回りして情報入手している国内勢力が、日銀のETF売りを警戒して空売りをしている可能性がある。そうなると、日本時間に発生する奇妙な日本株売りのフローの正体が見えてくる。

結局、日銀の手駒で、一番重要なのは、短期的にはETFであり、長期的には国債である、ということになる。利回りを上げていくために、国債の買い入れをストップする、という強硬策を始める前に、先にETFの問題を処理したほうが良い。というか、むしろこの武器を使ったほうが良い。つまり、どうせ360円になるんだったら、死ぬほど円安に振りまくって日経平均暴騰させて、(政府の力を借りず)日銀の純資産300兆円くらいまで膨らませたあとに、外人の株買いに思いっきり米国債売りをぶつけて、全部円天、じゃなかった、円転して、莫大な円で鬼のように米国債を買いまくれば良い。期中で処理して、決算またがなければバレないだろイエレンにもw その時、イエレンがいるのか知らんけども。公会計だし、半期に一度とかの開示だろどうせ。360円から180円くらいまで円高に振って、日銀の債務超過も円安も解決しちまえば良い。これがウルトラC。保有したETFを、どうレバレッジかけて使うかが、日銀の勝負の分かれ道になる。

ETFの問題が片付いたら、次に国債の問題が残る。ただ、これはもうどうしようもねえ、だって、国債保有残高、586兆円ですよwwwどうすんだよこれ。売るのか?償却できるのか?そんなもの出来ねえわな国債(期日が定められた返済義務のある証券)だから。つまり政府が発行すればするほど、この国債保有残高は増えることになる。これをなんというか?禁じ手、財政ファイナンスといいますw 明々白々に、日本の法律(財政法)で禁止されています。でも、事実上、財政ファイナンスをやっちまってるわけだな日銀さんは。

一つラッキーなのは、政府にとっても日銀にとっても、日本人の金融リテラシーが著しく低く、未だに貯金貴族が無限にいるから、対外債務を抱えなくて良い、という点にある。格付会社とかが無茶なレーティングダウンをしてこない限り、日本は本当に強い。何故なら、国民は無知蒙昧であり、国を信じて、貯金wをするから。そして、政府はその、国内に滞留した預金を担保に、無限に債券を発行するから。国民に対して。で、無限に発行された債券は、全部日銀が買うから。うん、これで、どうしたらインフレにならないのwwなるに決まっている。冷静に考えれば、損しているのは、債権を持っている国民。国民が質実剛健、勤勉努力、一生懸命働き、預金して、『100万溜まったあ』、『一千万円になったあ』、『10億円あるから俺は豪族だ』、みたいになっている。そんな人々の資産価値が、インフレによって根こそぎ奪われていることを知らない、気付きもしない、だから、こうしたリテラシーの国民に支えられている限り、日本政府(日銀)は沈まない。だって、自分の預金(貸付)に対して、雀の涙ほどの金利しかもらえないのに、この0.1%の政策金利の時代に、住宅や自動車ローンで2~15%払ってるんでしょ?どんだけドMプレーなんですかこれ。大企業に貸すカネがあるのに、ウシジマ君から金借りてどうする。いやでもマジで、これ、大丈夫なのかな。預金たんまり持ったまま住宅ローン借りてる人とか、アマゾンの未開の地にしか生息しないと思ってるんだけど、意外にいるんですよね現代に。『あなたが払っている金利は、あなたが預金しているお金から信用創造された架空のお金が原資ですよ??』。もう一度いいます。『あなたが1,000万円預金すると、銀行はそのお金を原資に信用創造して、あなたに1~15%でカネを貸してくるんですよ?』。伝わんないんだろうなこれが。このクオリティがクールジャパンです。最高。国民所得収奪計画ですね。大日本帝国バンザイ。

『朝起きて身を粉にして働いておられますが、始発・終電でお仕事しながら、出勤中に日本円燃やして大変ですよね』、と聞いても、何を言っているのか相手に言語が伝わらない。そう、日本円を貰い受けて、日本円の生活圏で生活していると、自分の預金(資産)が30%も50%も減価していることに、気づくことすらしないわけだ。まさに、ドリームランド。夢の国。頭が完全にメタバースに飛散している。こうした国民に支えられたことで、これまでもこれからも、この夢の国で行きていく。それでもいつか、夢は覚める。覚めた時にやっと気づく。ここが涅槃(ニルバーナ)か、と。

【ご案内】

「革命家」松田元が、今だからこそ話せる真実を全て語ります。

■こんな方におすすめのメンバーシップ(サークル)です

・WWBの創世記と真相、現状と未来の可能性にご興味のある方

・WWXが誕生した背景と真実、これからの見通しに興味のある方

・なぜ、c0banをホワイトリストに乗せたのか知りたい方

・暗号通貨の相場見通しに興味がある方(BTC、ETH、他)

・なぜ、不可能と言われていた仮想通貨交換業の登録が出来たのか知りたい方

・上場企業経営を通して積んだ経験について意見、見解を聞きたい方

・メンバー間でジョイントベンチャーを希望される方

・暗号通貨マイニングの設置・運営について興味のある方

・コミュニティで新規発行されるデジタルクーポンの無料ドロップを求める方

・資金調達(上場・非上場)、広報・IR(上場)に関する助言を求める方

・企業価値(株価)を実態とともに適切に市場へ伝えるコツを知りたい方

・企業経営全般に関するサポートを求める方

・これから眼前にする冥府魔道において、生き方に悩みを抱える方

【 2018年8月23日発売!ブロックチェーン、仮想通貨をテーマにした松田元新著がKKロングセラーさんから出版されました】

「価値観」「生き方」までも塗り替える、「新・資本主義」の幕開け。

善人が勝つための新しい経済のしくみはこうして生まれる。

ブロックチェーンの普及で見直される「共感」「感動」「慈悲」「赦し」「リスペクト」。

ブロックチェーンの普及によって、仕事をしなくても「善人ならばお金が入ってくる世の中」になる!?

現在、ビットコインなどの仮想通貨は、主には投機商品としか扱われていませんが、これからは、本来の通貨としての役割を果たすようになります。仮想通貨の正体は勝手な書き換えができないデジタルデータ「ブロックチェーン」です。

今まで、インターネットが、人々の暮らしを大きく変えてきましたが、ブロックチェーンも近い将来、AIなどの新技術とともに、人々の暮らしを新たな形へ変えていくことになります。仮想通貨業界に参入した新進気鋭の起業家が、仮想通貨の未来を予測する!

▼書籍購入はこちらから▼

「いい人がお金に困らない 仮想通貨 新時代のルール 」

【2018年1月6日発売!松田元共著のICOをテーマにした日本初の書籍を出版しました】

仮想通貨サービス・ICOの本質とそれぞれの企業の戦略が見える!

ビットコインの神(ビットコインジーザス)と呼ばれるbitcoin.com・CEOのロジャー・バー氏と、兼元謙任氏、そして松田元のトリプルコラボによる1冊です。

仮想通貨がもたらす未来をあなたはまだ理解していない……未来は確実に近づいています!

・なぜ仮想通貨で世界は変わるのか?

・どのようにWowooは、世界を変えていこうとしているのか?

・国はどうなっていくのか?

・貨幣はどうなっていくのか?

・私たちの生活はどうなっていくのか?

二十世紀に、パソコンやインターネットが世の中に出回り始めた時点で、「これらが人類の生活を根底から変える」と気づくことができた人は、ごく少数のはずです。

現時点でのブロックチェーンも、そのような「あまりにも画期的すぎて、凄さが理解されづらい」立場にあると考えています。

まずは、ブロックチェーンの具体的な使いみちについて知っていただきたいのです。

ビットコインにもブロックチェーン技術が使われています。よって、誰から誰の口座へ、いくら渡ったのかが、二〇〇九年から全て記録されています。

しかも、その取引記録を後で変えることはできないため、仮想通貨を盗んだり横領したりすることもできません。

仮想通貨は目に見えないので、うさんくさく感じられる方も多いでしょう。

しかし、ブロックチェーンで裏づけられている以上、むしろ現金よりも遥かに不正行為が難しいお金なのです。

さらに言えば、仮想通貨は、銀行や証券会社など、従来型の金融機関の役割を大きく揺るがしかねないほどの破壊的なイノベーションです。

そして今、ICO(Initial Coin Offering:イニシャル・コイン・オファリング/新規仮想通貨公開)という仕組みが稼働を始め、ビジネスの世界も大きな変革が始まっています。

▼書籍購入はこちらから▼

「世界は逆転する!仮想通貨サービス・ICOで世界を変える」

Episode 658:The Bank of Japan faces a pincer attack of debt overload and mounting pressure for interest rate hikes

The dollar-yen pair, which was exposed to a sharp yen appreciation of around 152 yen as of the previous week, has, as predicted in the previous column, safely returned to its original state, hovering around 155.70 at the time of writing. Congratulations to all the readers who profited from a long position on the dollar-yen pair.

Following the writing of last week's column, there have been numerous follow-up reports, and if one reads the news reports as they are, it seems that Ms. Yellen was indeed deeply angered.

Reference 1) U.S. Treasury Secretary: Exchange rate intervention "should be rare" - cautious stance shown

Well, if you think about it normally, she'd be angry, wouldn't she? I mean, a currency that moves nearly 9 yen in a matter of days isn't going to be well-regarded in the international currency markets. Besides, the United States was finally seeing a trend of rising stock prices, which might have resolved the yield issue, and then they were completely doused with cold water. So, they must have definitely thought, "Seriously, don't go meddling with the yen appreciation now," without a doubt.

And let's also take a look at this topic that was quite popular in the media and on social media.

Reference 2) Bank of Japan Governor Ueda meets with Prime Minister Kishida, confirms "monitoring" yen depreciation.

Huh? That's totally different from what was said last time.LOL

Reference 3) Bank of Japan Governor corrects comments regarding yen depreciation, stating it is "easily influenced by prices".

This is an article explaining the gap between the views expressed by Governor Ueda during the April press conference and the views expressed after the meeting with Prime Minister Kishida. It's quite pitiful for Governor Ueda to be surrounded by people lacking in intelligence, but now we finally understand the true identity behind the intervention directive. It's clearly Prime Minister Kishida (of the current Liberal Democratic Party government). Perhaps losing heavily in the elections, including in Tokyo's 15th district, had an impact after all.

It's really pitiful to see certain officials like Finance Minister Kanda and Governor Ueda, who are both extremely talented, being tossed around by the wavering of this administration. Truly, from the bottom of my heart, I sympathize. Well done. You must be exhausted. Because, you know, the reason the dollar-yen pair surged to 160 yen wasn't because they didn't intervene in the exchange rate. It's simply because of the "monetary easing policy" that the country has adopted. Japan is the only advanced country that has to continue easing monetary policy like kamikaze pilots (otherwise, America gets angry). It's structurally inclined to do so (to depreciate the yen). Because, you see, if Japan doesn't buy U.S. bonds and doesn't buy dollars, America will collapse. It's as simple as that. Then, on top of that, you have Japan's bubble, the anticipation of a Taiwan crisis (war), which prompted industries around the world to establish bases in Japan, leading to a rise in stocks, widening the interest rate differential between Japan and the U.S., and further depreciation of the yen. "Even if we intervene now, it won't make any sense at all," certain officials, including Finance Minister Kanda and his close aides, must be fully aware that they are being dragged along by foolish policies. Truly, well done. But it's pointless, so let the yen appreciate. I mean, trying to intervene in the exchange rate while continuing monetary easing is like applying both the brakes and the accelerator, it's a pathological action. Many people probably think, "This is seriously stupid." Yes, it is stupid. I'm not criticizing individual cases or individuals, but rather referring to an environment that requires stupid decisions. Japan's government officials really should read "The Essence of Failure" a million times over. They need a policy with a backbone, simple as that. Don't waver halfway. Follow through. If you're going to die, die all the way. There's no other way to live. It's Inazo Nitobe. It's Bushido.

The world, including the United States, is grappling with inflation. In fact, people are starting to realize (finally) that "even though prices have risen significantly, the economy is still bad," and the arrival of stagflation is becoming apparent. In such a situation, it doesn't make any sense to intervene to appreciate the yen by destabilizing the base of foreign reserves that underpins yen confidence. And the brilliant patriots at the Ministry of Finance know this. Yes, Japan is a heavily indebted nation. That's true. But from the perspective of the citizens, it's a creditor nation (because the citizens, addicted to saving, lend money through banks to the government). If the value of these assets declines, the Japanese government can legally write off its debt. What's the means to achieve that? Obviously, it's a weaker yen. There's no need to go against the flow. First, see how smart Governor Ueda is, please read this article.。

できないことを約束しても実現する手段がないんだから地獄になるよってのは20年以上前から予告されていたことで日本経済はこの時の懸念どおりの道筋を辿っているだけなんだよな。その後始末を植田さんがつけることになるってのはドラマチックにもほどがある。 pic.twitter.com/7HXfthUyry

— シラカワスキー (@shirakawa_love) May 9, 2024

This is a conversation between Governor Ueda and other committee members from over 20 years ago, posted by a certain expert on X (Twitter). It's clearly written here. Please open your eyes wide and read it 20,000 times.

"When easing demands arise, short-term financial assets become insufficient, forcing us to resort to purchasing long-term government bonds. However, if the liquidity generated by this does not have a positive effect on the economy, it becomes hell (super translation)."

... That's right. It's ironic that the genius Governor Ueda, who anticipated the dire situation over 20 years ago, now finds himself having to deal with the consequences as governor. Such is life. Ah, the days of youth. Every day is youth. What we are facing (and will continue to face) is hell. It's like youth in hell right now.

Well, even without knowing economic theories, Kondratiev waves, regression analysis theorems, or geeky reasoning, anyone can understand this by just thinking about it. If supply increases, demand decreases. It's obvious. That's the principle of supply and demand, plain and simple. There's no truth in the world other than the principle of supply and demand. Whether it's high-end brands, primary industries, finance, gender issues, the entertainment industry, the blue sky, or the red color of mailboxes, it's all governed by the principle of supply and demand. Everything. Absolutely everything.

So, while the world is trying to break free from inflation by raising interest rates to boost the value of the dollar or cutting interest rates to stimulate the economy, Japan, on the other hand, is repeatedly printing infinite banknotes through the Bank of Japan's infinite money printing and buying infinite amounts of government bonds using kamikaze human torpedo tactics. So, it's odd if the yen doesn't depreciate. And what are they using that printed money for? Buying dollars (through U.S. bonds) and buying foreign stocks with the new NISA. Which way is the exchange rate pair running? It's buying dollars, which depreciates the yen. It's obvious the yen will depreciate. Seriously, what foolishness. Yes, it's 360 yen. Soon it'll be 200 yen. By the end of the year, it'll be 190 yen. Well done.

It seems like I can hear the inner voice of readers saying, "Your column is always the same old story and boring. It's probably going to end with Bitcoin anyway." So, today, I'd like to change the perspective just a bit. The reason is, ever since this news came out, or rather, starting from this news, something strange has been happening with the flow of Japanese stocks. At Japanese trading hours, there's an absurd amount of traitors selling Japanese stocks. Despite inflation. Despite stagflation. I sense some eerie premonitions, and I can't quite put my finger on it.

Reference 4) Despite record profits... Why Toyota's management looks so stern - Deep-seated issues in the medium to long term

Well, yeah. Of course, in the stock world, it's not uncommon for stocks to be foolishly sold even when they're posting record profits. It's often the case that despite record earnings, they somehow get sold off after the earnings announcement, leaving you scratching your head wondering, "Why the heck are they selling after such great earnings?" So, I get that part. But still, on Friday, there was a lot of unwarranted selling of automotive stocks, right? Even though the depreciation of the yen was confirmed. Doesn't that seem absurd? And it was during Japanese trading hours. Today, I'd like to analyze that.

Let me touch upon what seems like the conclusion of this magazine first: "At the present moment, there is no certainty, but the crisis at the Bank of Japan is likely the main cause." Frankly, we can only explore this at the level of possibility. This extreme double decline in the yen and stocks, limited to Japanese trading hours. However, it feels a bit strange, so today, I'd like to thoroughly explain the nature of that discomfort. The protagonist is the Bank of Japan. Let's go.

1.The specific risk of the Bank of Japan's debt exceeding

While it's a bit of an older article (from January this year), it seems to be the most reliable, so I'd like to bring it up.

Reference 5) Federal Reserve Board Posts Largest Loss Ever Due to Rate Hike: Bank of Japan Records Deficit at Policy Rate +0.6%, Exceeds Debt at +2.8%

In essence, this is about how the Federal Reserve Board (FRB) in the U.S. is recording significant deficits due to unprecedented policies like quantitative easing, and how the Bank of Japan is exposed to similar risks. For those who find the article difficult to understand, here's a simplified explanation:

・The Bank of Japan's capital is 12.7 trillion yen.

・The current policy interest rate is around -0.1%.

・If this policy interest rate rises to 0.3%, the profits calculated from the Bank of Japan's assets will turn negative.

・If the policy interest rate rises to 2.8%, the Bank of Japan will exceed its debt.

That's the gist of it.

While a policy interest rate of 2.8% might seem quite shocking, especially for Japan, compared to the U.S., where such rates are not uncommon, some might think, "Are you stupid? You're not going to raise rates that much, idiot." However, there might be some who retort, "So, would you believe if I told you three years ago that the dollar-yen rate would be 160 yen now?" Honestly, it's quite plausible up to this level of interest rates.

The thing is, you see, rate hikes are seriously the most effective. Seriously, they're the most effective. Why? Because interest rates are like the blood of the economy. There are various monetary policies like "printing money" or "distributing subsidies," but "implementing policies to raise (or lower) interest rates" is seriously the most effective because interest rates are everything. Seriously effective. And Japan is in a situation where it has no choice but to implement this rate hike. Why? Because of inflation. To be more precise, it's stagflation, which is inflation during a recession. Look at this.

Reference 6) Real wages decreased by 2.5% in March, marking the 24th consecutive month of decline - Monthly Labor Survey

The article talks about how real wages have been negative for the first time in 24 consecutive months, losing to the inflation rate. The answer is right there already, isn't it? It's stagflation, clearly.

When inflation heats up, raising interest rates can cool down the overheated economy, tighten currency supply, and restrain price increases. Please refer to the materials released by the Cabinet Office.

Reference 7) Note 3-1 - Past major economic cycle patterns

For those with the intellectual capacity from receiving compulsory education, it's likely familiar from political and economic studies, or public affairs, or even from exams like the Center Test, the Kamiwaki and Izanagi economic booms. During those times, with the tailwind of demographic bonuses and the growth curve from developing to advanced countries, the policy of tightening monetary supply to cool down the economy while keeping interest rates low to stimulate it was extremely effective.

However, in a situation like inflation combined with a recession, in other words, stagflation, if you ask what happens when interest rates are raised, it's a dynamic where inflation is suppressed but the recession accelerates, increasing the risk of economic and financial market devastation, while also leading to a disinflationary state (before deflation). There are various opinions on this, with different scholars fiercely debating the differences between disinflation and deflation, and the effectiveness of Modern Monetary Theory (MMT) in countering inflation. Please refer to the literature on your own. While this magazine doesn't delve into its effectiveness, the term "disinflation" is used from a conservative perspective that asserts, "It would be crude to assume that raising interest rates would immediately lead to deflation." There's no ulterior motive. Anyway, please consider that we might be facing a crisis where "we might be able to control inflation, but the economy will crash." Therefore, Bank of Japan Governor Ueda is cautious about raising interest rates. Well, maybe he's actually preparing himself, saying, "Let's just raise rates and face the bottom of hell head-on," given he's the genius Governor Ueda. It's probably the government that's cautious, not him.

Well, anyway. Inflation is intense. Inflation and recession are coupled together. Nominal, let alone real wages, have been negative for what feels like forever. Price increases show no signs of stopping. So, what do we do now? When it comes to effective policies that can be implemented, there's nothing but raising interest rates. And when you raise rates, well, take a look back at Reference 5) from Nomura Research Institute's article. That's right, the Bank of Japan will go into debt.

2.What happens when the Bank of Japan goes into debt?

Anyway, the bad habit of important or intelligent people is to use "scary" words excessively to imprint the idea that anything inconvenient for these important people is inherently bad. Bankruptcy, bribery, insolvency, debt overhang, you name it. Oh boy, they all sound so ominous, don't they? Because of that, when you hear about the Bank of Japan's debt overhang, you might think, "Japan is doomed..." But to cut to the chase, it's not like Japan is doomed. In fact, Japan might already be doomed, so floundering around now won't make any difference. If the Bank of Japan goes into debt, it's like, "Oh, okay. Thanks for your service. Salute!" That's it. Because, you see, the Bank of Japan is just like everyone's old JASDAQ-listed company! (Not a Standard, Prime, or Growth anymore.)

Reference 8) The vanished Bank of Japan sponsored securities.

Well, why hasn't the Bank of Japan been classified as Prime, Standard, or something like that yet? Is it because of the Bank of Japan Act? While 55% is owned by the government, the remaining undisclosed major shareholder is actually backing the Imperial Family through the Rothschild family, so even the Japanese government might be hesitant... (I'll stop here for safety reasons; it gets too deep into the shadows).

Anyway, if the Bank of Japan goes into debt, according to the rules of the Tokyo Stock Exchange, they'll have to make a timely disclosure stating, "We have gone into debt," and then issue a surreal disclosure titled "Notice of Our Efforts to Resolve Debt Excess," all under the guidance of the Tokyo Stock Exchange. That's all that will come out of our beloved Bank of Japan! Haha! Seriously though, I'd like to see that disclosure, I'd even want to become a living witness of history. Well, even if they make such a disclosure, it'll trigger government intervention under the Bank of Japan Act, and government funds will be injected until the net assets (equity capital) turn positive. And that's it. So, even if Japan's policy interest rate reaches a shocking 2.8%, and even if the Bank of Japan goes into debt, it all boils down to the question, "So what? What are you going to do about it?"

The source of government funds injected into the Bank of Japan? Taxes, of course. Plus, the portion of the currency devaluation due to inflation, meaning the devaluation of the Japanese yen, resulting in your assets (savings, haha) diminishing, and the government balancing its books with those capital losses (capital gains for the government). In other words, from the perspective of the Japanese government, in the unlikely event that the policy interest rate rises to 2.8%, the Bank of Japan can cheerfully disclose timely notices of "efforts to resolve debt excess," and completely legally issue disclosures like, "We have received an offer of investment from the Japanese government, and after careful consideration within the institution, we have accepted," to restore the capital adequacy ratio.

And when the policy interest rate reaches the insane level of 2.8%, it's a boon for the government because it's a world where people can't pay off their auto loans, credit card debts pile up, dreams of owning a home are shattered, and nearly half of the working-age population becomes homeless, like something out of Fist of the North Star. So, it's very convenient for the government. They can legally write off debts, and with a weak yen, they can keep shouting, "Give me chocolate!" to China, America, and Russia. It's like a post-war scenario, which is quite delicious for the government but not so much for the citizens.

3.The Ultra-C to Guide Yen Strength Without Bankruptcy

If the Bank of Japan raises interest rates and the policy rate exceeds 2.8%, it will become over-indebted. The magic number is just 2.9% away. While one option is to leave the policy rate unchanged, doing so could accelerate inflation (stagflation), leading to yen depreciation. It's possible that within a few years, the exchange rate could seriously hit 360 yen. However, whether the Bank of Japan becomes over-indebted or the yen depreciates, the resolution point of both scenarios remains the same: Japan's government debt will be written off, resetting the value of all assets and bond holdings owned by Japanese citizens to zero. So, from the government's perspective, it's extremely convenient. Therefore, they don't really care about the people's money. That's what the powerful people in the government probably think, except for a few national heroes.

Nevertheless, the over-indebtedness and accelerated inflation discussed here are scenarios of a hard landing, so before that happens, Governor Ueda of the Bank of Japan must find a solution. He's a patriot and a genius, after all. As a method or means for that purpose, there's actually a way to use the Bank's prized possession.

Reference 9) One Step Closer to BOJ Financial Normalization, Concerns Over the Fate of Holdings of 70 Trillion Yen in ETFs

In essence, the Bank of Japan holds a staggering amount of 70 trillion yen worth of Japanese stocks through ETFs. As long as they continue to hold these assets, dividends will flow in, and if the stock prices of Japanese companies rise, capital gains will naturally be substantial.

Given the analysis by Nomura Research Institute cited earlier, which presents the theory of over-indebtedness at 2.8%, it remains unclear whether this theory properly accounts for the unrealized gains of these ETF holdings at the current moment. Therefore, let's start by examining the Bank of Japan's financial statements.

https://www.boj.or.jp/about/account/data/zai2311a.pdf

Hmm, so I took a look at the balance sheet, and I found the monetary trust (exchange-traded funds linked to trust property indices), but it's only 37 trillion yen, isn't it? I wonder if the remaining 70 trillion yen is included in loans outstanding. Can someone knowledgeable about practical matters enlighten me? And then, the net assets are only about 5.47 trillion yen. That's surprisingly low, isn't it? And they seem to be ignoring the strict rules of the Tokyo Stock Exchange, such as timely disclosure, and instead opting for a strong-style approach permitted by semi-annual asset disclosure. Well done. Truly "Nippon Ginko" .

Anyway, looking at the income statement, the operating income from the monetary trust (exchange-traded funds linked to trust property indices) is included in the profit and loss, so I guess this is factored into the calculation of net assets. Still, 5 trillion yen seems awfully low. Is everything okay with this?

Let's call it a day with inspecting the Bank of Japan's financial statements. Anyway, the Bank of Japan has ETFs that accumulate Japanese stocks. There's 37 trillion yen in the balance sheet, and apparently a total of 70 trillion yen (it's unclear which account the remaining 34 trillion yen is hidden in). With this, there's an easy way for them to resolve the debt excess. Simply put, they just need to double the Nikkei average. If the current average is around 38,000 yen, they should boost it up to 76,000 yen. However, since the Bank of Japan can no longer endlessly purchase ETFs (policy change), they should let foreigners buy them in abundance. When foreigners come to buy Japanese stocks, they should hit them hard with dollar selling/yen buying through currency hedging. That's what a certain Kanda Finance Ministry official said. By selling off foreign reserves while encouraging the purchase of ETFs or Japanese stocks, at least the Bank of Japan's debt excess problem will diminish, and they can guide the yen to appreciate. There's no need to waste unnecessary ammunition.

The Bank of Japan's average acquisition price for ETFs is estimated to be around 21,000 yen, so if they were to boost it up to 76,000 yen, their assets would expand to 245 trillion yen, 3.5 times the original 70 trillion yen, and they would gain a profit of 165 trillion yen from unrealized gains alone. "Debt excess, where did it go? 😄"

On the flip side, if the Bank of Japan were to sell Japanese stocks and unload ETFs, it would cause a decline in Japanese stocks and a rise in the yen, as foreigners would cut their losses on Japanese stocks and currency hedges would be unwound.

So, when we consider all this, the peculiar selling of Japanese stocks during Japanese trading hours that was mentioned at the beginning starts to become somewhat clear. Speculatively, it could be inferred that the Bank of Japan has signaled forward guidance on selling ETFs. Alternatively, domestic entities that might have obtained advance information about the Bank of Japan's debt excess problem could be cautious about the Bank of Japan's ETF sales and engaging in short selling. In that case, the identity of the strange flow of Japanese stock selling during Japanese trading hours becomes apparent.

In the end, the most important tool in the Bank of Japan's arsenal is, in the short term, ETFs, and in the long term, government bonds. Before implementing a tough measure like stopping government bond purchases to raise yields, it would be better to address the ETF issue first, or rather, it would be better to use this weapon. In other words, if it's going to hit 360 yen anyway, it would be better to massively depreciate the yen by wildly boosting the Nikkei average, expanding the Bank of Japan's net assets to around 300 trillion yen (without relying on the government), then aggressively selling US bonds to foreign stock buyers, turning everything into yen, no, I mean, converting everything into yen, and buying vast amounts of US bonds with enormous yen. Deal with it midway, and as long as it doesn't span financial reporting periods, it won't be exposed, even to Yellen 😄. At that time, whether Yellen is still around or not, who knows? It's public accounting, so it's disclosed every six months anyway. Swing the yen from 360 yen to around 180 yen, resolve both the Bank of Japan's debt excess and yen appreciation, and that's Ultra C. The pivotal point for the Bank of Japan is how to leverage its ETF holdings.

Once the ETF issue is settled, the next challenge will be the government bonds. However, this is already a tricky situation because, you know, the outstanding balance of government bonds is 586 trillion yen 😄. What are we going to do about this? Sell them? Can we even redeem them? We can't do that with government bonds (securities with a fixed repayment obligation). In other words, the more the government issues, the more this outstanding balance of government bonds will increase. What do we call this? A forbidden move, fiscal financing, haha. It's openly prohibited by Japan's laws (the Fiscal Law), but in reality, the Bank of Japan is actually engaging in fiscal financing.

One lucky thing for both the government and the Bank of Japan is that the financial literacy of Japanese people is remarkably low, and there are still plenty of savings hoarders, so there's no need to worry about external debt. As long as rating agencies don't come up with unreasonable downgrades, Japan remains truly strong. Why? Because citizens are ignorant and naive, they trust the government and save money. And the government, using those domestically held deposits as collateral, issues bonds indefinitely. To the citizens. And then the infinitely issued bonds are all bought by the Bank of Japan. Yeah, how on earth could this not lead to inflation 😄. If you think calmly about it, who's losing out? It's the citizens holding bonds. They work diligently, save diligently, accumulate wealth, thinking, "I've saved a million yen," "I've reached ten million yen," "I have a billion yen, so I'm wealthy." They don't know, they don't realize that the value of their assets is being completely eroded by inflation. So, supported by these financially illiterate citizens, the Japanese government (and the Bank of Japan) won't sink. After all, even though they only get a measly interest rate on their deposits (or loans), they're paying 2 to 15% interest on housing or car loans in this era of 0.1% policy rates. How masochistic is this? Why borrow money from Ushijima when you have money to lend to big companies? But seriously, is this really okay? There are people out there who still think they can have a pile of savings while taking out a mortgage, like they're living in some unexplored Amazonian territory, but surprisingly, they exist in the modern world. "The interest you're paying is created from imaginary money created by the deposits you've made?" Let me say it again. "When you deposit 10 million yen, the bank uses that money to create credit and lends it back to you at 1-15%." I doubt this sinks in. This is the cool Japan quality. The grand plan of national income expropriation. Long live the Great Japanese Empire!

Even if you tell them, 'You're working tirelessly from dawn till dusk, burning through Japanese yen during your commute,' the message doesn't get through to the other person. Yes, receiving yen and living within the yen ecosystem, they don't even realize that their deposits (assets) have depreciated by 30% or even 50%. It's truly a dreamland. A fantasy world. Their minds are completely scattered into the metaverse. Supported by these citizens, we've lived in this dreamland so far, and we'll continue to do so in the future. Yet, someday, the dream will end. When they finally wake up, they'll realize. Is this Nirvana?

【Notice】

"Revolutionary" MATSUDA GEN will reveal all the truths that can now be spoken.

This is a membership (circle) recommended for the following individuals:

Those interested in the genesis and truth of WWB, its current status, and future possibilities.

Those curious about the background and truth behind the birth of WWX, as well as its future outlook.

Those who want to know why c0ban was placed on the whitelist.

Individuals interested in cryptocurrency market forecasts (BTC, ETH, and others).

Those who want to understand why it became possible to register a cryptocurrency exchange business that was once deemed impossible.

Individuals who would like to hear opinions and insights about the experiences gained through running a publicly-listed company.

Those who are interested in joint ventures among members.

Those interested in cryptocurrency mining setup and operation.

Individuals looking for free drops of digital coupons issued within the community.

Those seeking advice on fundraising (listed or unlisted) and public relations/investor relations (for listed companies).

Individuals who want to learn how to effectively convey a company's value (stock price) to the market, along with its actual performance.

Those in need of support related to overall corporate management.

Individuals facing existential dilemmas in navigating the underworld of the business world that lies ahead.

"Released on August 23, 2018! MATSUDA GEN's new book on blockchain and cryptocurrency themes has been published by KK Longseller.

A new era of "capitalism," rewriting "values" and "ways of life." The new economic system for good people to win is born here.

With the proliferation of blockchain, we rethink "empathy," "inspiration," "compassion," "forgiveness," and "respect."

Thanks to the spread of blockchain, will we live in a world where "good people receive money even without working?"

Currently, cryptocurrencies like Bitcoin are primarily treated as speculative commodities, but in the future, they will play their intended role as real currencies.

The true identity of cryptocurrency is the unalterable digital data called "blockchain."

Just as the Internet has significantly changed people's lives until now, blockchain will also, in the near future, transform people's lives into new forms, along with new technologies like AI.

Enterprising newcomers to the cryptocurrency industry predict the future of cryptocurrencies!

▼Purchase the book here▼

"Released on January 6, 2018! We have published the first book in Japan on the theme of ICO, co-authored by MATSUDA GEN. It reveals the essence of cryptocurrency services and ICOs, along with the strategies of various companies!

This book, a triple collaboration between Roger Ver, known as the "Bitcoin Jesus" and CEO of bitcoin.com, Kanemoto Kaneto, and MATSUDA GEN, delves into the future that cryptocurrency will undoubtedly bring closer.

Why will the world change with cryptocurrency?

How is Wowoo trying to change the world?

What will happen to nations?

What will happen to currency?

What will happen to our lives?

In the 20th century, when personal computers and the internet began to spread in society, only a very small number of people realized that these technologies would fundamentally change human life. At this point, blockchain is in a similarly revolutionary position, often considered "too groundbreaking to easily comprehend."

First and foremost, we want you to understand the specific use cases of blockchain. Bitcoin also uses blockchain technology. Therefore, every transaction, from whom and to whom, and for how much, has been recorded since 2009. Moreover, since these transaction records cannot be altered later, it is impossible to steal or embezzle cryptocurrency.

Cryptocurrency may seem suspicious to many because it is invisible. However, backed by blockchain, it is actually much more resistant to fraudulent activities than physical cash. Furthermore, cryptocurrency is a disruptive innovation that could significantly shake the role of conventional financial institutions like banks and securities companies.

Now, the ICO (Initial Coin Offering) mechanism has started to operate, and the world of business is undergoing a major transformation.

▼Purchase the book here▼

この記事が気に入ったらサポートをしてみませんか?