2023 Nov 9, US Market

Treasury yields rose alongside the dollar, while stocks fell as Jerome Powell slammed Wall Street's dovish bets.

Only eight days after his speech fueled speculation that the Federal Reserve was done raising interest rates, Powell said officials will not hesitate to tighten again if necessary. While this is essentially what several Fed speakers have said, it was the part that drew investors' attention on Thursday, especially given the recent rally in both stocks and bonds.

The S&P 500 halted what would have been its longest gain since 2004, while two-year interest rates surpassed 5%. A poor performance of 30-year notes weighed on sentiment, raising concerns about the market's ability to absorb new debt. Powell's remarks also increased traders' expectations of another Fed hike, while decreasing expectations of a rate cut before July.

Meanwhile, the amount of money that investors are parking at a major Fed facility dropped below $1 trillion for the first time in more than two years. Demand for the facility has been fading this year, especially as the Treasury ramped up fresh bill issuance, offering an alternative for short-term investors. That buying has accelerated as traders bet that the Fed is near the end of its interest-rate hiking cycle.

Fed's Powell: The Fed is in the range of restrictive policy, question of whether the neutral rate has risen is less interesting.

Fed's Powell: The Fed is still trying to judge if it needs to do more, then we will consider how long to keep rates high.

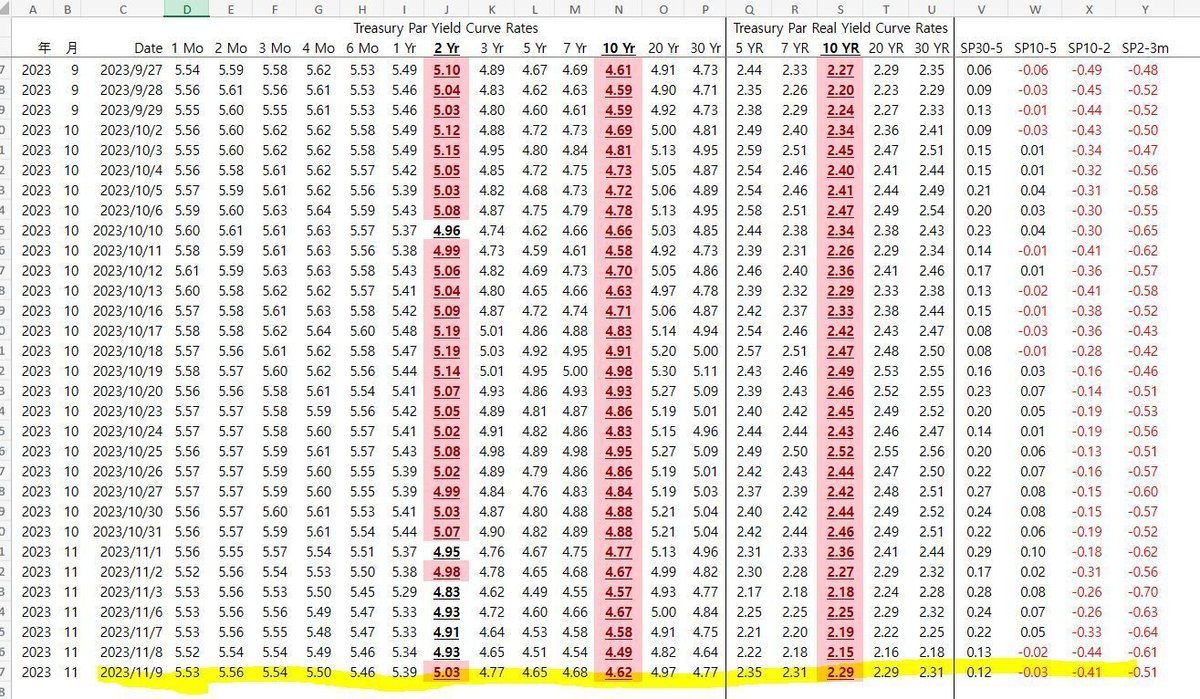

On Thursday, investors tapped the brakes after a government sale of $24 billion in long-term debt didn’t entice as many buyers as anticipated. Benchmark 10-year yields, which offer practically risk-free returns, ticked higher afterward to 4.629%.

The resulting decline in stocks accelerated after Powell said at a conference in Washington that it was too early to declare victory against price pressures. “Inflation has given us a few head fakes,” he said. “If it becomes appropriate to tighten policy further, we will not hesitate to do so.”

The question now is whether increasingly bullish investors will believe him.

“At this hour, the Fed is neither friend nor foe, which is a lot better than being a foe,” said Thorne Perkin, president of Papamarkou Wellner Perkin.

“I really feel like the worst is behind us,” he said. “To me, the U.S. economy is a big rolling snowball.”

Disney (DIS) reported upbeat Q4 earnings, noting that Disney+ added nearly 7M core subscribers during the quarter

Arm (ARM) reported a year-over-year increase in Q2 earnings and revenue and provided guidance for Q3 and FY24

Bloomberg reported that Intel (INTC) is planning to release a new AI chip for China, while the Financial Times reported earlier that Nvidia (NVDA) has developed three new AI chips tailored for China

Bill (BILL) denied a Bloomberg report that it is in talks over a takeover of Melio, saying it is "not pursuing any such acquisition"

Federal Reserve chair Jerome Powell said the Fed will "continue to move carefully"

Morgan Stanley's (MS) wealth-management arm is under scrutiny by the Federal Reserve, WSJ reports

The joint venture between Toyota (TM) and Chinese FAW Group informed its dealers the company will reduce production until February 2024, DigiTimes reports

Hollywood actors, studios, streamers reach agreement to end strike, WSJ reports

Corning (GLW) to sell German laser-technology business to China's Suzhou Delphi Laser, Bloomberg reports

McDonald's (MCD) and Krispy Kreme (DNUT) are in talks to expand their partnership, CNBC reports

Virgin Galactic (SPCE) gains after reporting quarterly results and providing guidance for Q4

CareDx (CDNA) and Affirm (AFRM) increase after reporting quarterly results

Infinera (INFN) higher after raising its Q3 EPS view

Amylyx (AMLX) and Freyr Battery (FREY) decline in New York after reporting quarterly results

Cipher Mining (CIFR) falls after Bitfury announced the sale of 10M shares of its stock

AstraZeneca (AZN) provided a "beat and raise" report for Q3

Lyft (LYFT) reported Q3 results and provided guidance for Q4, with Roth MKM commenting the results were "better than feared"

Twilio (TWLO) reported Q3 results, provided guidance for Q4, and raised its FY23 guidance

Krispy Kreme (DNUT) reported Q3 results and backed its FY23 guidance, with CEO Mike Tattersfield commenting, "Our third quarter results showed the strength of our team, business model, and the power of our brand"

AppLovin (APP) reported Q3 results and announced its CFO will depart

Barclays upgraded Kellanova (K) to Equal Weight from Underweight with a price target of $55, down from $57, as the spinoff of the company's North America cereal business is now "firmly in the rear view."

Wolfe Research upgraded Spirit AeroSystems (SPR) to Outperform from Peer Perform with a $34 price target following what the firm calls "a cascade of derisking that should set the stock up to work on the expected production upcycle."

Deutsche Bank upgraded Parker-Hannifin (PH) to Buy from Hold with a price target of $506, up from $462. The firm believes Parker-Hannifin is increasingly becoming a core holding within industrials for PMs, and rightfully so, as the company has proven its ability to deliver superior operational execution in many macro environments.

EvercoreISI upgraded TopBuild (BLD) to Outperform from In Line with a price target of $368, up from $308. The firm says Q3 earnings were "generally healthy" across the housing coverage group, with both homebuilders and building product companies exceeding Street estimates.

Barclays upgraded Valaris (VAL) to Overweight from Equal Weight with a price target of $106, up from $84. Despite the recent selloff in offshore driller stocks, the firm remains positive on the group ahead of the "next wave of multi-year contract announcements" set to begin in Q4.

Stephens downgraded Topgolf Callaway (MODG) to Equal Weight from Overweight with a price target of $13, down from $24. The Topgolf SVS outlook is softer than anticipated in Q4 and into early 2024 and the long-term cash flow is below previous expectations, the firm tells investors. JPMorgan also downgraded Topgolf Callaway to Neutral from Overweight with a price target of $13, down from $23.

Stephens downgraded Masonite (DOOR) to Equal Weight from Overweight with a price target of $93, down from $130. Q3 results "slightly missed expectations across the board" and management pointed to the mid-point of the sales guidance and the low-end of the adjusted EBITDA guide for calendar 2023, the firm notes.

BTIG downgraded Ginkgo Bioworks (DNA) to Neutral from Buy without a price target after the company reported a Q3 miss on cell programs, and lowered its cell program guide for 2023.

Jefferies downgraded Navient (NAVI) to Hold from Buy with a price target of $16, down from $22. The firm sees "incremental risk" after management lowered origination guidance and the reconsideration of investment in direct-to-consumer loan platform.

Oppenheimer downgraded PureCycle Technologies (PCT) to Perform from Outperform without a price target. The company's implementation of a two-week shutdown to remedy mechanical issues in pelletization and seal quality could remove key bottlenecks to continuous production, but postpone proof points of a ramp until later this quarter, the firm tells investors in a research note.

HSBC initiated coverage of Tesla (TSLA) with a Reduce rating and $146 price target. Tesla cars may well be the main driver of revenue and profits currently, but if the group is to be taken at its word, the future for Tesla is about robots, autonomous vehicles, energy storage and super-computers, the firm argues.

Goldman Sachs initiated coverage of Cytokinetics (CYTK) with a Buy rating and $50 price target. The firm sees an attractive risk/reward on both the company's near catalysts and the intermediate term commercial opportunity.

Goldman Sachs initiated coverage of Apellis (APLS) with a Buy rating and $74 price target. The firm has "increasing comfort on Syfovre's profile" given stabilization of the rate of retinal vasculitis at 0.01% per injection.

Jefferies initiated coverage of Ironwood (IRWD) with a Buy rating and $21 price target. The firm believes the stock is currently trading around the Linzess "floor" and that the Street currently isn't appreciating the potential upside from the company's GLP-2 agonist, apraglutide.

Wells Fargo initiated coverage of CSG Systems (CSGS) with an Equal Weight rating and $49 price target. The firm views the company's customer concentration, competition and structural concerns as "key offsets," leaving the firm balanced on the shares.

この記事が気に入ったらサポートをしてみませんか?