2023 Nov 22, US Market

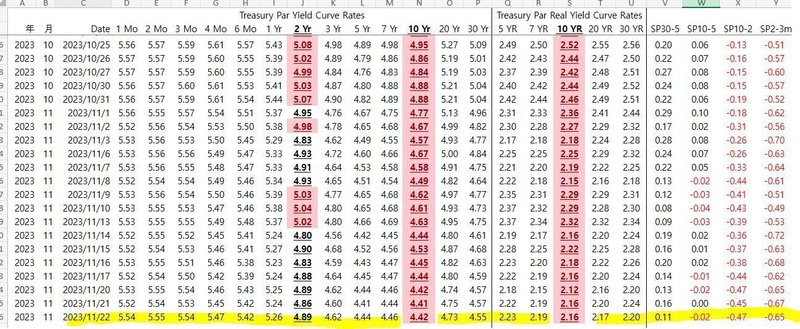

Treasury yields climbed after data revealed an increase in consumer year-ahead inflation forecasts, with some traders profiting from the Federal Reserve's dovish bets.

The S&P 500 edged higher in a thin trading session ahead of the Thanksgiving holiday. Amazon climbed ahead of Black Friday and Cyber Monday sales. Microsoft gained on news Sam Altman will return to lead OpenAI. NVIDIA fell after its results. The dollar advanced. Oil fell.

According to the latest November reading from the University of Michigan, Americans expect inflation to rise at an annual rate of 4.5% over the next year, up from 4.4% earlier in the month, and 3.2% over the following five to ten years, according to statistics released Wednesday.

In other economic news, applications for US unemployment benefits fell last week after a string of increases, providing a brief respite in what has otherwise been a gradually cooling labour market. Durable goods orders fell more than expected in October, as commercial aircraft bookings fell and demand for business equipment weakened.

The liquidation of dovish hedges has stepped up in the SOFR options market on Wednesday, indicating that traders are taking profits on dovish Fed wagers placed as recently as September.

Nvidia (NVDA) shares are slightly lower/higher near midday despite a report last night that Wall Street analysts called "stellar" and "just another run-of-the-mill blowout quarter"

HP Inc. (HPQ) reported in-line fiscal Q4 financials and reaffirmed 2024 guidance across key items, though its Q1 earnings outlook is slightly below expectations

Deere (DE) beat consensus expectations for its fiscal Q4, but forecast net income for 2024 that missed the average analyst estimate

Sam Altman is set to return as CEO of OpenAI five days after the board fired him and Microsoft (MSFT) said it agreed to hire him

Alibaba founder Jack Ma pulls back on plans to trim stake, Bloomberg reports

Citi (C) in discussions to start new private credit strategy, Bloomberg reports

Last week's court ruling on German finances could cost Intel (INTC) billions of euros in subsidies, Reuters reports

Activist investors are putting pressure on Entain (GMVHF), FT reports

Silver Lake is likely to sell "a lot" of Broadcom (AVGO) shares the firm receives as a holder of VMware (VMW) stock, CNBC says

London tribunal has ruled Sony (SNY) must answer to a $7.9B lawsuit regarding unfair prices for customers, Reuters reports

Hims & Hers (HIMS) higher after BofA added the stock to its "Endeavor List"

DLocal (DLO) falls after reporting quarterly results and announcing its CFO will step down to pursue new opportunities

Tesla (TSLA) declines after cutting its Model Y inventory prices

APA Corp (APA) lower after Citi downgraded the stock to Neutral

Safety Shot (SHOT) drops after Capybara Research targets in short report

Urban Outfitters (URBN) reported Q3 EPS and revenue that beat consensus

Nordstrom (JWN) reported Q3 results and narrowed its FY23 guidance, with CEO Erik Nordstrom commenting "we're especially pleased with the resulting improvements in gross margins and earnings"

Guess (GES) reported Q3 results and cut its FY24 guidance

Autodesk (ADSK) reported Q3 results and provided guidance, with Piper Sandler downgrading the stock to Neutral and commenting the company's outlook is "substantially less optimistic"

GDS Holdings (GDS) reported Q3 EPS and revenue that missed consensus

Nomura upgraded Baidu (BIDU) to Buy from Neutral with a price target of $145, up from $135. The "cheap valuation" following the stock's 30% decline since the July peak plus the company's resolution to buy back shares aggressively from now "seem to warrant the benefit of doubt" about its artificial intelligence initiative, the firm tells investors in a research note.

JPMorgan upgraded Clorox (CLX) to Neutral from Underweight with a price target of $145, up from $124. The firm now thinks there is a significant upside risk to consensus estimates post earnings rebase last quarter as it is seeing improvement in tracked channel demand.

RBC Capital upgraded GoDaddy (GDDY) to Outperform from Sector Perform with a price target of $124, up from $90. The firm likes the company's "structurally hedged" customer acquisition model and has rising confidence in margin expansion coming out of RBC's conference.

Redburn Atlantic upgraded Applied Materials (AMAT) to Buy from Neutral with a $175 price target. The firm has turned positive on the semiconductor sector ahead of the last consensus earnings cuts expected in Q1 of 2024.

Wells Fargo upgraded Southwestern Energy (SWN) to Equal Weight from Underweight with a price target of $6.90, up from $6.30. The firm cites improving free cash flow outlook and the increasing likelihood of potential M&A for the upgrade.

Williams Trading downgraded Foot Locker (FL) to Sell from Hold with a price target of $15, down from $16, ahead of the Q3 report. The firm believes the loss of marquee product allocations from Nike (NKE) will drive an earnings miss and full-year guidance cut.

Piper Sandler downgraded Autodesk (ADSK) to Neutral from Overweight with a price target of $215, down from $240. The firm says that based on fiscal 2025 growth expectations of 9% and tempered margin expectations, the outlook is "substantially less optimistic."

Morgan Stanley downgraded Virgin Galactic (SPCE) to Underweight from Equal Weight with a price target of $1.75, down from $4. The firm likes Virgin Galactic's long term potential, but sees limited opportunities for share price accretion during an upcoming lull period.

JPMorgan downgraded Reynolds Consumer Products (REYN) to Neutral from Overweight with a price target of $28, down from $29. Demand for the categories Reynolds competes in is softening faster than anticipated, the firm tells investors in a research note.

Raymond James downgraded Jacobs Solutions (J) to Market Perform from Outperform without a price target. The firm sees increased execution risk with the Reverse Morris Trust spin and a longer road to create shareholder value for existing shareholders leading to a range-bound stock over the next several quarters.

Redburn Atlantic initiated coverage of Lam Research (LRCX) with a Buy rating and $800 price target. Lam has "powerful" market positions in two key etch processes, namely conductor and dielectric, both of which the firm believes will benefit from increasing process steps as chipmaking adopts the vertical scaling of GAA and BSPN.

Cantor Fitzgerald initiated coverage of GitLab (GTLB) with an Overweight rating and $55 price target. The firm believes GitLab's strength in source code management and continuous integration/deployment sets up as a solid foundation to capture the adjacent areas in DevSecOps.

Redburn Atlantic initiated coverage of KLA Corp. (KLAC) with a Neutral rating and $550 price target. KLA offers a stable growth trajectory but the company's attributes are well understood by investors, the firm notes.

BMO Capital initiated coverage of Saia (SAIA) with a Market Perform rating and $450 price target. The firm cites a muted macro-outlook and valuation that is at the high end of the historical range.

UBS initiated coverage of TD Synnex (SNX) with a Neutral rating and $105 price target. Given near-term macro pressure and a lack of catalysts to drive a multiple re-rating, UBS looks for a better entry point into TD Synnex shares.

この記事が気に入ったらサポートをしてみませんか?