2023 Nov 16, US Market

Mizuho upgraded Intel (INTC) to Buy from Neutral with a price target of $50, up from $37. The firm believes Intel is lining up "significant" new server product launches and foundry customer announcements in the next six months.

Guggenheim upgraded BorgWarner (BWA) to Buy from Neutral with a $41 price target. The firm views post earnings weakness as "unjustified" given its view that the "market fundamentally has EV risks wrong" and that long-term BorgWarner continues to win in electrification, with attractive customer mix.

BofA upgraded ITT (ITT) to Buy from Neutral with a price target of $125, up from $105. The firm cites the company's "resilient" end market exposures, "differentiated" auto exposure, and "underappreciated" margin expansion opportunities for the upgrade.

Deutsche Bank upgraded Goodyear Tire (GT) to Buy from Hold with a price target of $21, up from $13, after the company unveiled operational and strategic plans it looks to execute over the next 24 months, after an in-depth board-led review as part of its agreement with an activist investor.

Raymond James upgraded CommScope (COMM) to Market Perform from Underperform without a price target as it believes the stock's risk/reward has come into balance.

TD Cowen downgraded Target (TGT) to Market Perform from Outperform with a price target of $148, down from $161, post the Q3 report. Target's discretionary comparisons ease considerably in the second half of fiscal 2024, which could drive better numbers, but also imply the "cautious factor" that its guidance is more likely to rely on a strong second half of the fiscal year versus the first half, the firm tells investors in a research note.

BofA downgraded Advance Auto Parts (AAP) to Underperform from Neutral with a price target of $43, down from $60. The company reported a "disappointing" Q3 earnings report, with expectations for continued challenges remaining over the medium term, the firm notes.

Piper Sandler downgraded Deckers Outdoor (DECK) to Neutral from Overweight with a price target of $650, up from $620. The firm says its Overweight thesis has largely played out and the stock's valuation now looks fair.

Northland downgraded Maxeon Solar (MAXN) to Market Perform from Outperform with a price target of $7, down from $25, after the company delivered an inline Q3 and "weak" Q4 guidance driven by restructuring and other one-timers flowing through cost of goods and opex.

Argus downgraded Cboe Global Markets (CBOE) to Hold from Buy. The stock price has exceeded the firm's prior target following its recent run-up, while the Q3 earnings were well above consensus estimates and the management expects organic net revenue to grow 7%-9% in 2023, the firm tells investors in a research note.

Deutsche Bank initiated coverage of DoorDash (DASH) with a Buy rating and $125 price target, implying 30% upside from current levels. With DoorDash capturing only 1% of its overall market via users that represent only 7% of available homes, "there is ample runway for user growth from here," says the firm.

Deutsche Bank initiated coverage of Wayfair (W) with a Buy rating and $55 price target, suggesting 16% upside from current levels. The firm expects the company to continue to build on its share position as it drives industry-leading supply choice, delivery speeds, and price.

Wells Fargo initiated coverage of MongoDB (MDB) with an Overweight rating and $500 price target. The firm sees MongoDB as the best AI play in software infrastructure given its ever-expanding list of new workloads.

Redburn Atlantic initiated coverage of Philip Morris (PM) with a Neutral rating and $95 price target. The stock's premium to the tobacco peers is justified, but there is risk of the company "falling short of ambitious targets," says the firm.

Goldman Sachs initiated coverage of TopBuild (BLD) with a Buy rating and $355 price target, implying 22% upside from current levels. As one of the largest installers and distributors of insulation in North America, execution of TopBuild's strategy along with favorable operating dynamics should drive upside to results and the stock over the next 12 months, the firm argues.

Walmart (WMT) provided a "beat and raise" report for Q3

Cisco (CSCO) reported better-than-expected Q1 results but lowered its FY24 earnings and revenue guidance

Alibaba (BABA) reported upbeat Q2 results and announced that it has scrapped plans for a full spin-off of its Cloud Intelligence Group

Macy's (M) reported better-than-expected Q3 earnings and revenue and narrowed its FY23 outlook

Amazon (AMZN) will launch the sale of Hyundai (HYMTF) vehicles in the U.S. in 2024

Starbucks (SBUX) workers plan to walk out on the company's annual Red Cup Day, NY Times reports

Wells Fargo (WFC) replaced its executive responsible for compliance with the Bank Secrecy Act last year, WSJ reports

Workers at GM's (GM) Arlington, Texas factory voted to ratify a tentative contract with the UAW, WSJ reports

Apple (AAPL) likely to miss goal in push to replace Qualcomm (QCOM) iPhone modem, Bloomberg says

General Motors' (GM) Cruise unit has suspended its employee share program, WSJ says

StoneCo (STNE) higher in New York after BofA upgraded the stock to Buy

Sonos (SONO) increases after reporting quarterly results and announcing a $200M buyback program

VNET Group (VNET) declines in New York after reporting Q2 results

Maxeon Solar (MAXN) falls after reporting quarterly results

Altice (ATUS) lower after HSBC downgraded the stock to Reduce from Buy

Palo Alto Networks (PANW) reported upbeat Q1 results and provided Q2 and FY24 earnings and revenue guidance

Williams-Sonoma (WSM) reported Q3 results and cut its FY24 guidance, with CEO Laura Alber commenting "We are proud to deliver another quarter of strong earnings"

Children's Place (PLCE) reported Q3 results and announced it plans to close 64 more stores by the end of Q4

Bath & Body Works (BBWI) reported Q3 results and provided guidance for FY23 and Q4

Warner Music (WMG) reported Q4 results, with CEO Robert Kyncl commenting "We delivered on our promise of second-half improvement, and reached over $6 billion in annual revenue for the first time in WMG's history"

Treasuries rose as the latest economic data revealed a slight slowdown, fueling expectations that the Federal Reserve could end its most aggressive rate hike campaign in decades.

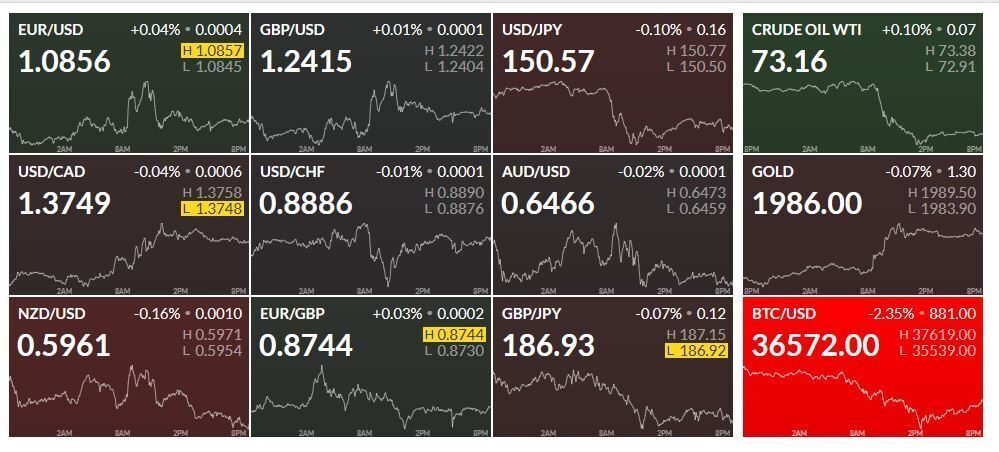

The ten-year yield has dropped eight basis points to 4.45%. The S&P 500 was little altered after a wild rally that sent American stocks close to "overbought" territory. Walmart fell on a gloomy tone about the consumer outlook, while Macy's rose on a profit beat. Cisco Systems fell after a downbeat forecast. Oil fell below $73 per barrel, the lowest level since July.

On Thursday, Wall Street was focused on another set of economic statistics, with continuous claims for US unemployment benefits reaching their highest level in over two years. Factory output declined more than predicted, owing primarily to a strike-related slowdown at automakers and parts suppliers. Meanwhile, homebuilder sentiment peaked in 2023.

Fed's Cook stated that she is concerned about an unduly sharp economic downturn, citing strain in some industries as a result of tighter financial conditions. Loretta Mester, President of the Federal Reserve Bank of Cleveland, told CNBC that she hasn't decided whether another rate hike is still necessary, adding that authorities have time to assess how the economy is evolving.

この記事が気に入ったらサポートをしてみませんか?