Can Deep Learning Improve Technical Analysis of Forex Data to Predict Future Price Movements?

Abstract:

The foreign exchange market (Forex) is the world’s largest market for trading foreign money, with a trading volume of over 5.1 trillion dollars per day. It is known to be very complicated and volatile. Technical analysis is the observation of past market movements with the aim of predicting future prices and dealing with the effects of market movements. A trading system is based on technical indicators derived from technical analysis. In our work, a complete trading system with a combination of trading rules on Forex time series data is developed and made available to the scientific community. The system is implemented in two phases: In the first phase, each trading rule, both the AI-based rule and the trading rules from the technical indicators, is tested for selection; in the second phase, profitable rules are selected among the qualified rules and combined. Training data is used in the training phase of the trading system. The proposed trading system was extensively trained and tested on historical data from 2010 to 2021. To determine the effectiveness of the proposed method, we also conducted experiments with datasets and methodologies used in recent work by Hernandez-Aguila et al. , 2021 and by Munkhdalai et al. , 2019. Our method outperforms all other methodologies for almost all Forex markets, with an average percentage gain of 20.2%. A particular focus was on training our AI-based rule with two different architectures: the first is a widely used convolutional network for image classification, i.e. ResNet50 ; the second is an attention-based network Vision Transformer (ViT). The results provide a clear answer to the main question that guided our research and which is the title of this paper.

Introduction

Nowadays, people are more and more involved in trading currencies. Although cryptocurrencies promise better returns than foreign exchange, the foreign exchange (Forex) marketplace offers solid, extra secure and relatively regulated trading compared to cryptocurrency trading. For this reason, the Forex market has attracted quite a bit of interest from researchers in recent years. Various types of studies have been conducted to accomplish the task of accurately predicting future Forex currency rates.

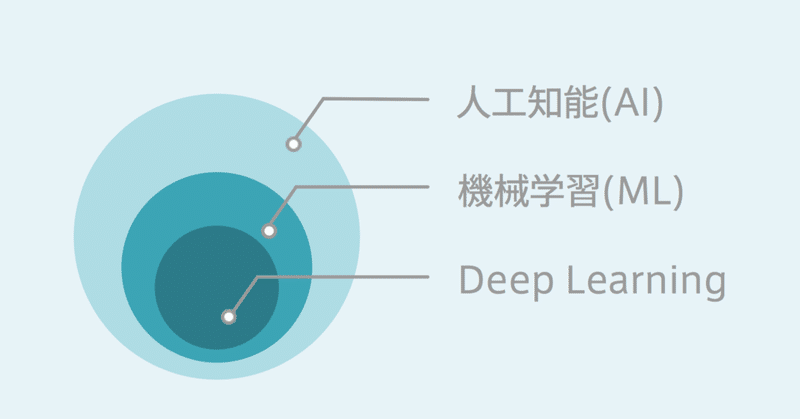

Researchers have mainly focused on neural network models, pattern-based approaches and optimization techniques. The advent of artificial neural networks has played a major role in predicting forex currency rates. In particular, the Gated Recurrent Unit (GRU) and Long Short Term Memory (LSTM) have been extensively studied for the prediction of temporal sequences.

The foreign exchange market is the world’s largest market for trading foreign money, with a trading volume of over 5.1 trillion dollars per day. It is considered to be very complicated and volatile. Foreign exchange trading takes place around the clock (with the exception of the weekend), with buying and selling time divided into 4 basic time zones. Each of these zones has its own opening and closing hours. Forex trading is divided into three specific categories: Majors, Minors and Exotics. The most traded pairs in the Forex market are called majors.

For each Forex pair, we can retrieve the opening, high, low and closing prices. For security reasons, it is not possible for a single person to register and buy in the Forex market, but each individual must use third parties, such as brokers, who are people or companies that have access to the Forex market and are able to buy or sell currencies. In the Forex market, there are only two alternatives: either buying currencies or selling them.

Predicting the Forex market has been a major goal of researchers in recent decades. There are two methods of predicting the market: fundamental and technical analysis. Fundamental analysis takes into account many factors, such as the financial system and political state of a country, the popularity of a company, all internal and external buying and selling news, etc. Technical analysis focuses on predicting future prices based solely on historical data. In this paper, we will focus on technical analysis.

Existing techniques are not suitable for all currency pairs and can give better results only for some randomly selected pairs in certain time frames. Moreover, most of the existing studies are evaluated only considering their prediction error. However, it is equally important to determine their impact on a real trading system where the decision to enter and invest in the market is as important as the decision to exit and disinvest.

In this article, we present our reusable trading system extensively trained on historical data measured in 4-hour intervals with candlesticks of 6 currency pairs: 4 major pairs such as GBP/USD, EUR/USD, USD/CHF and USD/JPY, and 2 minor pairs such as EUR/GBP and GBP/JPY. The entire dataset spans from 01/01/2010 to 04/30/2021, and we have conducted thorough experiments on the above currency pairs in three test series consisting of the entire year 2019, the entire year 2020, and the current time interval for the year 2021 (from 01/01 to 04/30) for all six currency pairs. For almost all currency pairs in the three long time intervals considered, our system has achieved stable and highly profitable results.

The remainder of the work is as follows. Section II presents numerous techniques that have been studied in recent years and can be classified into several categories: Regression strategies, optimization strategies, neural networks, etc. Section III introduces the basics of Forex, the trading system such as Meta Trader 5, as well as technical indicators and trading rules. Section IV explains our proposed trading system. Section V presents the results of experiments with historical data with candlesticks of 6 currency pairs on a long time frame extending from 01/01/2010 to 04/30/2021. We conclude our article by discussing the results and possible future directions in the last section.

ソースはコチラ

pic-ref

この記事が気に入ったらサポートをしてみませんか?