7月24日(金)マーケット情報〜進む低金利と回復横ばいの実体経済(米雇用)〜

7/23 木

— あんこん (@UnconstrainedI) July 23, 2020

米長期金利は4日連続で低下し-2.0bpsの0.58%。

カーブは連日のツイストフラットニング、2s10sは2.2bps縮小し42.9bps、10s30sも4.3bps縮小し65.3bps。

10年BEIは3日ぶりに低下し-3.0bpsの1.45%。

DXYは5日続落し94.8、ドル円も反落し106.8円程度。

◆米新規失業、増加

— 後藤達也(日経の記者) (@goto_nikkei) July 23, 2020

・7/12-18の新規失業保険申請141.6万人 小幅ながら4月以降初めての増加 市場予想は130万人

・コロナ拡大で経済再開が頓挫し、再雇用が遅れている可能性

・企業支援含めた失業対策の必要性も再び高まりつつある pic.twitter.com/CvwUVaH1vf

やっぱり$200-300/週...昨日の$100/週って何だったの? ただのジャブかな?https://t.co/izazI1kN2M

— あんこん (@UnconstrainedI) July 23, 2020

◆金続伸、史上最高値が目前

— 後藤達也(日経の記者) (@goto_nikkei) July 23, 2020

・NY金は1897㌦まで上昇。2011年の最高値(1923㌦)まで1%強

・世界的な金利低下で金の相対妙味が上昇。実質金利の低下でインフレヘッジの位置づけにも

・新興国ではドルに代わる外貨準備としての需要も

・金ETFにも資金流入

▽日経の記事https://t.co/FMaAYlaGDd https://t.co/I0uEBTAQOf pic.twitter.com/HxHi8De53X

FedのBSは通貨スワップの減少が相殺もやや拡大。

— スース (@perp_nc10) July 23, 2020

Main Streetはほとんど出てない。

SMCCFは買入ペースの減速が続く。このペースで行くとあと4〜6週間くらいでゼロになりうる。スプレッドが堅調に推移し買入が減り続ければ、9末で終了のリスクシナリオも少し意識する必要? https://t.co/QEemrDMbog

◆米共和党、1兆㌦の追加対策

— 後藤達也(日経の記者) (@goto_nikkei) July 23, 2020

・23日に政府と議会共和党が対策案

・大人1人最大1200㌦の現金給付

・7月末で期限が切れる失業保険の加算は減額。従来は週600㌦の加算→「以前の給与の7割まで」(ムニューシン)を年末まで

・民主党案は3兆㌦規模。成立へ調整続く

▽日経の記事https://t.co/wV0Wp3gDAl

30-year Treasury yields sneakily making a push toward all-time lows. Down 5 bps today.

— Brian Chappatta (@BChappatta) July 23, 2020

March madness aside, less than 10 bps to go. pic.twitter.com/q96hc9g3Hk

The U.S. government just sold 10-year TIPS at a high yield of:

— Brian Chappatta (@BChappatta) July 23, 2020

-0.93%

A record low. pic.twitter.com/4vymGbNxvV

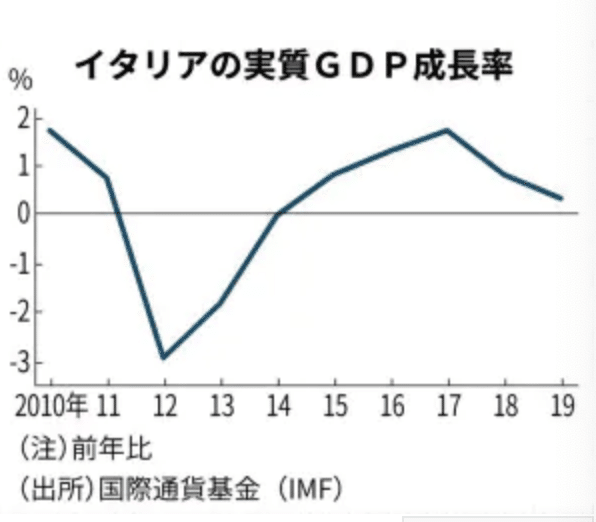

国際:イタリア、3兆円景気対策 EU復興基金が後押し 第3弾 中小・労働者保護に重点

新型コロナウイルスで甚大な被害を受けたイタリアが経済対策を急いでいる。政府は22日、250億ユーロ(約3兆1千億円)の景気刺激策を承認した。欧州連合(EU)の復興基金も約3割が振り向けられるとみており、財政悪化を最小限に食い止めつつ景気を浮揚できるかが焦点になる。

同日の深夜の閣議で承認した。3月、5月の発表に続く第3弾の景気刺激策で、財政出動の規模は計1000億ユーロ以上にのぼる。コンテ首相は「かつてないスピードでより多くの対策を推し進める」と話した。

財政の一段の悪化はさけられない。伊政府は4月時点で2020年の国内総生産(GDP)に対する財政赤字の比率は10.4%と予測していたが、今回の追加対策で12%程度まで上昇する見通しだ。19年(1.6%)から跳ね上がり、2桁まで悪化するのは1992年以来28年ぶりとなる。

投資家に安心感を与えたのが、21日にEU首脳が合意にこぎつけた総額7500億ユーロ規模の復興基金の創設だ。

EUが借金して加盟国に配分する仕組みで、被害が大きい南欧諸国に集中的に投入する。イタリアは約2090億ユーロ、スペインは約1400億ユーロを得られるとみており、両国で全体の半分近くを占める。独自の対策だけでは限界があるだけに、EUからの支援をとりつけた意義は大きい。

国際:米雇用回復に遅れ 失業給付申請、16週ぶり増加

新型コロナウイルスの再拡大で、米雇用の持ち直しが遅れそうだ。米労働省が23日発表した失業保険の新規申請件数は、18日までの1週間で141万6千件となり、前週(130万件)から増加に転じた。申請件数は4月以降、減少が続いていたが、前週比で増加するのは16週間ぶりだ。

Five Things You Need to Know

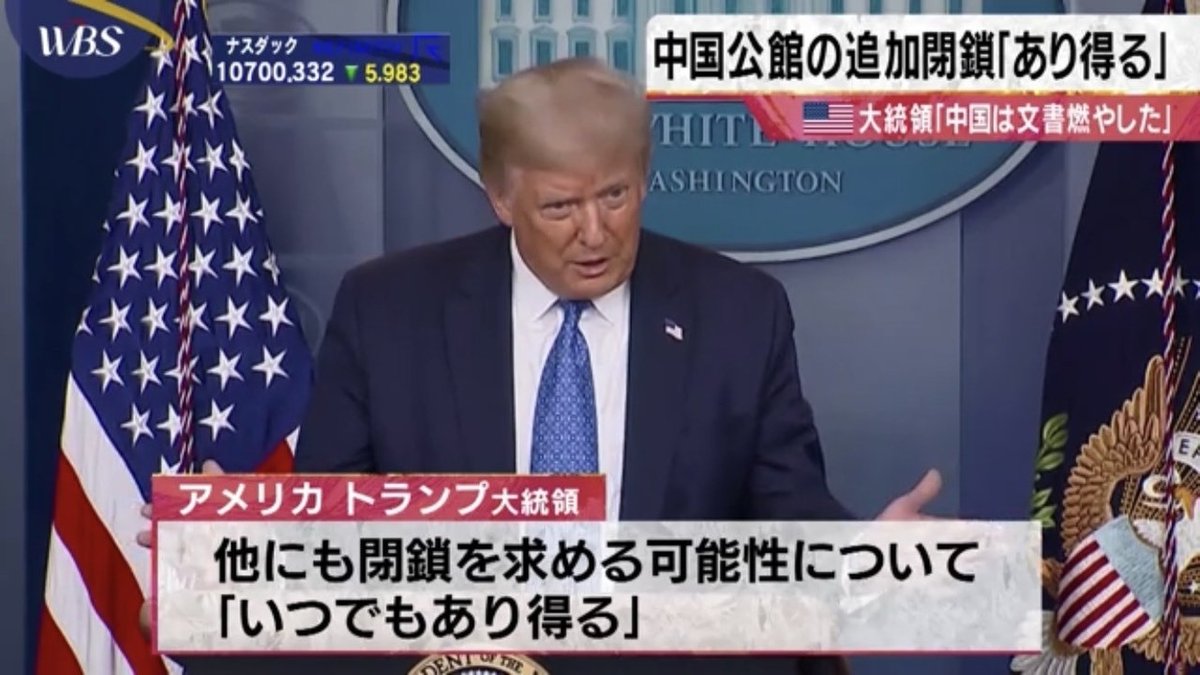

Mike Pompeo labled China's leaders tyrants bent on global hegemony. In Washington's latest salvo against Beijing, the secretary of state called Xi Jinping a "true believer in a bankrupt totalitarian ideology" and cast competition with China an existential struggle between right and wrong. While stopping short of advocating regime change, he urged the Chinese people to work with the U.S., saying the Communist Party fears their "honest opinion more than any foreign foe."

While that's sure to bring a fiery response, Beijing will pull the trigger on its reprisal for the Houston consulate closing on Friday, the Global Times's Hu Xijin tweeted. It will order the shuttering of one American diplomatic mission, the editor said; previous reports identified Wuhan and Chengdu as candidates. Earlier, Beijing said the U.S. is breaking down a "friendship bridge" and sabotaging relations, and the State Department told Fox News that the Houston outpost had been the epicenter of research theft.

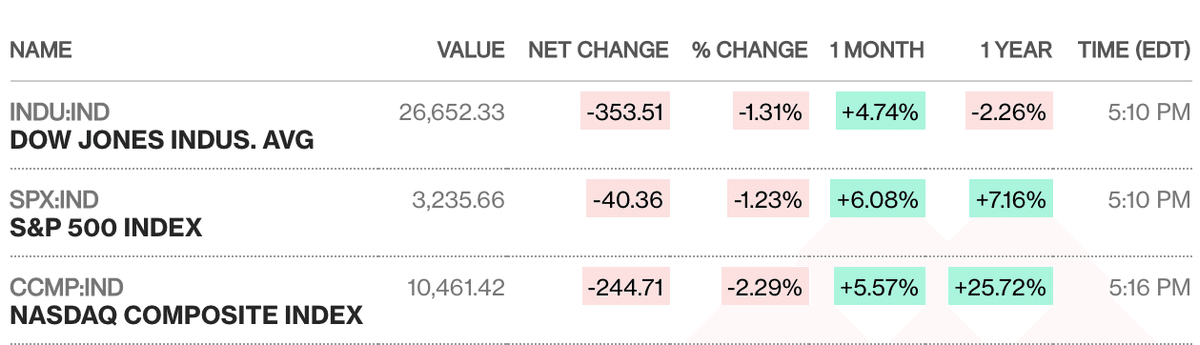

Hang Seng and ASX futures are lower after U.S. stocks tumbled to the lowest in a week. Japan is closed today. Bad employment news rekindled concern the economic recovery has stalled. The S&P 500 slipped 1.2% from a four-month high, led by losses in technology firms and companies that make non-essential consumer goods. The Nasdaq declined 2.3%.The yield on 10-year Treasuries fell one basis point to 0.58%, the lowest in three months. Oil dropped and gold strengthened. The decline in new U.S. jobless claims ground to a halt. Initial filings rose for the first time since March to 1.42 million from 1.3 million last week.

Hong Kong added 111 locally-transmitted Covid-19 cases, for a total of 2,250, and reported its 15th death. It was the second straight day with more than 100 new infections. In the U.S., President Trump canceled Republican convention planned for Jacksonville in Florida, where deaths broke another record. California reported a faster pace of new infections Cases and the positive rate dropped in Arizona as public health experts say the state's outbreak may be peaking.

U.S. earnings wrap: Intel slumped after it said a new 7-nanometer production process was delayed again. Revenue and EPS beat. Earlier, Twitter reported a better-than-expected 186 million daily users, while revenue missed as its ad business got hammered. Southwest's operating revenue beat and its loss per share wasn't as bad as foreseen. American's adjusted loss per share was narrower than consensus. AT&T lost 154,000 regular phone subscribers, fewer than anticipated. Freeport-McMoran lowered its copper sales forecast, inline with estimates. Unilever jumped after revenue got a boost from hand sanitizer and Ben & Jerry's.

Chart of the Day

In China, at least 24 people have become billionaires this year through June from the country's raging market for IPOs, including former teachers, accountants and software developers, according to data compiled by the Bloomberg Billionaires Index.The 118 companies that went public in Shanghai and Shenzhen this year raised about $20 billion through June, more than double the amount in the first half of 2019, Shanghai has become the world’s No. 1 listing venue, beating New York and Hong Kong.

What to Keep an Eye On

Goldman should reach a 1MDB settlement before the U.S. presidential election, or else. Wells Fargo analyst Mike Mayo said failure to reach a resolution could set back not only the bank, but also Malaysia and the U.S. Department of Justice. For Goldman, "no settlement would mean an ongoing stock overhang and uncertainty about a capital hit." He slashed his estimate for Goldman's earnings this quarter by $1 billion to account for a potential $3 billion to $4 billion settlement. The bank and Kuala Lumpur are in talks for a deal worth close to $3 billion, including discounted banking services, Nikkei reported.

Beijing said it may stop recognizing British National Overseas passports as valid travel documents in response to the U.K.'s offer of citizenship to BNO holders in Hong Kong, which China claims breaks an agreement. The move would be largely symbolic: City residents usually enter and exit using their ID cards. PM Boris Johnson's spokesman objected to the threat.

Republicans dropped Trump's payroll tax cut plan but remained at odds over their stimulus aid package even before negotiations start with Democrats. Steven Mnuchin insisted the GOP had a "fundamental agreement" but the deadline to roll out a $1 trillion plan appeared to be slipping into next week. The Treasury secretary suggested the aid bill could be released in piecemeal fashion, something Nancy Pelosi immediately rejected. "No, no, no."

SpaceX's value is set to skyrocket. Elon Musk's company is in talks to raise $1 billion at a price of $270 a share, people familiar said, putting its valuation at $44 billion. That compares with $36 billion reported by CNBC in March. And there's still room for growth, according to Morgan Stanley, which sees SpaceX ultimately worth as much as $175 billion. But that will have to wait: The latest round is unlikely to be completed within the next couple months, one of the people said

Opinion

Twitter is unlikely to repeat its protest- and Covid-driven big gain in user numbers, and it hasn't solved most of its problems, Bloomberg Opinion's Tae Kim writes. Its monetization gap with peers persists because its ad platform is technically inferior. While it's made progress in weeding out misinformation, harassment and hate speech, the recent security breach has undermined trust.

Market Indicators Calendar(24th July)

この記事が気に入ったらサポートをしてみませんか?