2023 Nov 10, US Market

Moody's: Downside risks to the US' fiscal strength have increased.

Moody's changes outlook on United States' ratings to negative.

Moody’s said a key driver to the outlook change was its assessment that downside risks to the nation’s fiscal strength have increased “and may no longer be fully offset by the sovereign’s unique credit strengths.”

Given higher interest rates and without effective measures to reduce government spending or increase revenues, the agency said it expects fiscal deficits will remain very large and debt affordability would be significantly weakened.

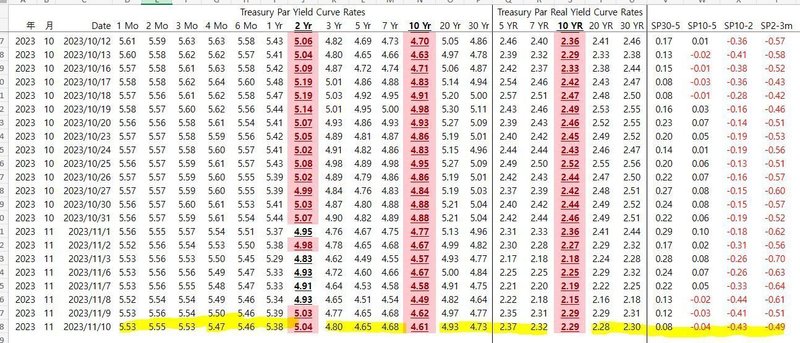

The rise in Treasury bond yields has increased pre-existing pressure on debt affordability, Moody’s said. It expects interest payments relative to revenue will rise to around 26% in 2033 from 9.7% in 2022. Additionally, Moody’s said it sees interest payments relative to GDP will rise to around 4.5% in 2033, from 1.9% in 2022.

Moody’s said its affirmation of the U.S.’s Aaa ratings its view that the nation’s “formidable credit strengths continue to preserve the sovereign’s rating, in particular exceptional economic strength, high institutional and governance strength, and the unique and central roles of the U.S. dollar and Treasury bond market in the global financial system.”

Consumer long-term inflation expectations have reached a 12-year high, but markets dismiss amid a calm bond market

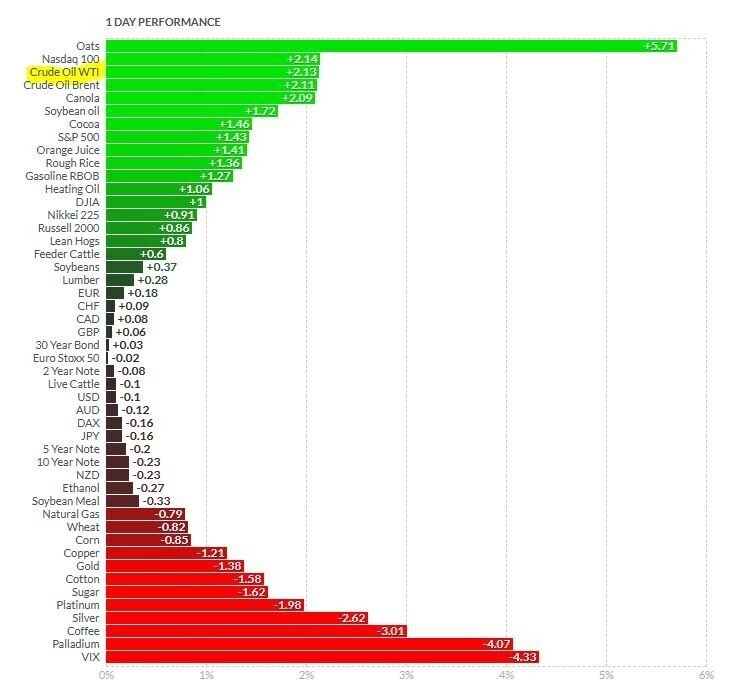

Stocks extended their November rally, propelled by a surge in technology titans, a relatively calm session for bonds, and no major surprises from Federal Reserve speakers.

A rebound in the S&P 500's most influential group lifted the index above its key 4,400 level and the 100-day moving average, both of which are regarded as bullish signals by many chartists. The American equity index reached a seven-week high. The Nasdaq 100 gained more than 2%, with Microsoft setting a new high and Nvidia extending gains for the eighth straight session.

Equities have risen this month as bond yields have fallen on bets that interest rates have peaked. Traders have pushed the market higher despite inflation concerns, gloomy corporate outlooks, and the latest geopolitical developments.

Stocks rose on Friday due to a calmer session in the Treasury market. Ten-year yields were little changed after rising due to a weak 30-year bond sale and Jerome Powell's "sterner" tone on policy.

Wall Street was watching the latest comments from officials, with Fed Bank of Atlanta President Bostic saying policymakers can return inflation to their target without needing to hike further. His San Francisco counterpart, Daly, said the Fed may need to raise rates again if inflation progress slows while the economy accelerates.

Unity (U) shares fell after the company announced a review of its product portfolio and cost structure and also pulled full year guidance along with its Q3 earnings report

Groupon (GRPN) shares are lower after the company reported Q3 results, said it plans to raise about $100M between an equity rights offering and asset sales and announced that co-founder Eric Lefkofsky has decided to resign as a member of the board

Plug Power (PLUG) shares sunk after the company raised "substantial doubt" about its ability to continue operations

Trade Desk (TTD) shares are down after the company gave lower than expected guidance for Q4, but several analysts said the "sharp" pullback in the stock following the company's Q3 results and below-consensus guidance is an opportunity to own "one of the best digital ad platforms"

Illumina (ILMN) shares slid after the DNA-sequencing company reported Q3 product revenue that missed estimates and cut its full-year revenue guidance

Amazon (AMZN) and Meta Platforms (META) are testing a feature that would allow shoppers to buy Amazon products through ads on Instagram and Facebook, Bloomberg reports

Lionsgate (LGF.A) is in final negotiations to acquire an added ownership stake in 3 Arts Entertainment, Deadline reports

Honda (HMC) is giving many of its U.S. factory workers an 11%, WSJ reports

Hacking group publishes data alleged to have been stolen from Boeing (BA), Reuters reports

BlackRock (BLK) has registered to form an ethereum trust, Reuters reports

Microvast (MVST) gains after reporting Q3 results, provided guidance for Q4, and cut its FY23 revenue view

Vizio (VZIO) and Indie Semiconductor (INDI) increase after reporting quarterly results

Doximity (DOCS) higher after reporting Q2 results and raising its FY24 guidance

Adaptive Biotechnologies (ADPT) declines after reporting quarterly results

Iridium (IRDM) drops after Qualcomm (QCOM) terminates satellite messaging agreements

Real Good Food (RGF) reports Q3 EPS and provided guidance for Q4, FY23, and FY24

Soho House (SHCO) reported Q3 results, with CEO Andrew Carnie commenting "This has been another quarter of strong execution against our strategic objectives"

Yeti (YETI) reported Q3 results and narrowed its FY23 adjusted EPS view

Palisade Bio (PALI) reported Q3 EPS higher year-over-year

Treace Medical (TMCI) reported Q3 results and cut its FY23 guidance

Baird upgraded Toast (TOST) to Outperform from Neutral with an unchanged price target of $18. While the stock "was a bit burnt to a crisp" on the Q3 earnings report, Baird appreciates Toast's "strong" growth profile, the analyst tells investors in a research note.

Gordon Haskett upgraded BJ's Wholesale (BJ) to Buy from Hold with an $80 price target. The firm believes that getting more constructive adds to its "arsenal of more defensively postured retailers poised for upward earnings revisions" and turnaround potential in 2024.

Wolfe Research last night double upgraded Southwestern Energy (SWN) to Outperform from Underperform with an $8 price target. Since the winter, the natural gas rig count collapsed and gas demand has been supported by power, industrial recovery, and higher liquified natural gas imports, the analyst says.

William Blair upgraded Dentsply Sirona (XRAY) to Outperform from Market Perform without a price target following the investor meeting. The company has made "meaningful progress," having delivered upside to earnings guidance for the first three quarters of 2023, even when currency and macro headwinds impacted sales in Q3, says the analyst.

DA Davidson upgraded Diebold (DBD) to Buy from Neutral with a price target of $29, up from $25. The company maintains a healthy backlog with inbound orders and demand while seeing material improvements in Product gross margins and healthy OpEx control, and its Services margins are likely to move higher looking ahead, the analyst tells investors in a research note.

JPMorgan downgraded Plug Power (PLUG) to Neutral from Overweight with a price target of $6, down from $10. The analyst says the Q3 earnings report illustrated the "numerous near-term challenges" the company is facing. Shares were also downgraded at RBC Capital, Oppenheimer and Northland.

Wells Fargo downgraded Hawaiian Electric (HE) to Underweight from Equal Weight with a price target of $8.50, up from $8. The analyst says that while some positive developments o the Maui wildfires have "infused some optimism" into Hawaiian Electric shares, there is still risk of a $0 equity value should the company be held liable.

Canaccord downgraded Illumina (ILMN) to Hold from Buy with a price target of $120, down from $210. The analyst says the company's near-term outlook "appears soft amid Grail merger noise."

Exane BNP Paribas downgraded American Airlines (AAL) to Neutral from Outperform with a $12 price target. The analyst sees cost headwinds for the airlines that will be difficult to counter.

Cantor Fitzgerald downgraded 2U (TWOU) to Neutral from Overweight with a price target of $1.50, down from $5.30. Management not disclosing before last quarter that its full-year revenue guidance included a large one-time payment from university partners that are terminating specific degree programs, coupled with 2U's inability to generate positive free cash flow, has resulted in more investors asking questions about 2U's looming debt maturities and its ability to repay or refinance those obligations, the analyst says.

Morgan Stanley initiated coverage of Arm (ARM) with an Equal Weight rating and $55 price target. The analyst says artificial intelligence-related themes are driving sales and margin growth for intellectual property and and design in the global semiconductors sector.

Piper Sandler initiated coverage of Korro Bio (KRRO) with an Overweight rating and $180 price target. The company has a "differentiated" Opera platform technology and target-specific editing strategies to generate multiple RNA editing candidates in large common diseases, the analyst tells investors in a research note.

JPMorgan assumed coverage of Patterson Companies (PDCO) with a Neutral rating and $34 price target. The analyst says the company has to manage through potential softness in dentist demand and any lower volumes of companion animal visits.

BofA initiated coverage of Weatherford (WFT) with a Buy rating and $120 price target. The company has staged a "remarkable turnaround" from a Chapter 11 restructuring in 2019 to generating very strong adjusted EBITDA margin, the analyst tells investors in a research note.

JPMorgan assumed coverage of Henry Schein (HSIC) with a Neutral rating and price target of $69, down from $83. The analyst balances the company's positive acquisitions and easing COVID-19 comps with the current uncertainty around the impacts of the recent cybersecurity event.

この記事が気に入ったらサポートをしてみませんか?