2023 Nov 1st, US Market

UBS upgraded JD.com (JD) to Buy from Neutral with a price target of $39, down from $40. UBS sees an attractive valuation at current share levels with the company's net cash roughly equal to 50% of its market cap.

Loop Capital upgraded Cirrus Logic (CRUS) to Buy from Hold with a price target of $100, up from $83. The stock offers a unique opportunity emerging for both the company and investors, as Cirrus Logic can level up its earnings per share to $7.00 - $10.00 in the coming years from about $6.00 currently amid a "handful of shots on goal" given the steady cadence of new Apple (AAPL) hardware content opportunities emerging, the firm tells investors in a research note.

Goldman Sachs upgraded Boeing (BA) to the firm's Conviction List and keeps a Buy rating on the shares with a $258 price target. The firm believes investors are more focused on near-term disruptions than long-term fundamentals and normalized free cash flow, creating a buying opportunity "in this domestic half of the global aircraft manufacturing duopoly."

Barclays upgraded General Motors (GM) and Ford (F) to Overweight from Equal Weight with unchanged price targets of $37 and $14, respectively. The firm cites "historically cheap" valuations, but prefers GM over Ford.

Stifel upgraded Saia (SAIA) to Buy from Hold with a price target of $425, up from $412, post the Q3 report. Stifel believes "there's opportunity for more," with gradual margin improvement as labor proficiency improves, as density builds, and as core pricing continues to expand.

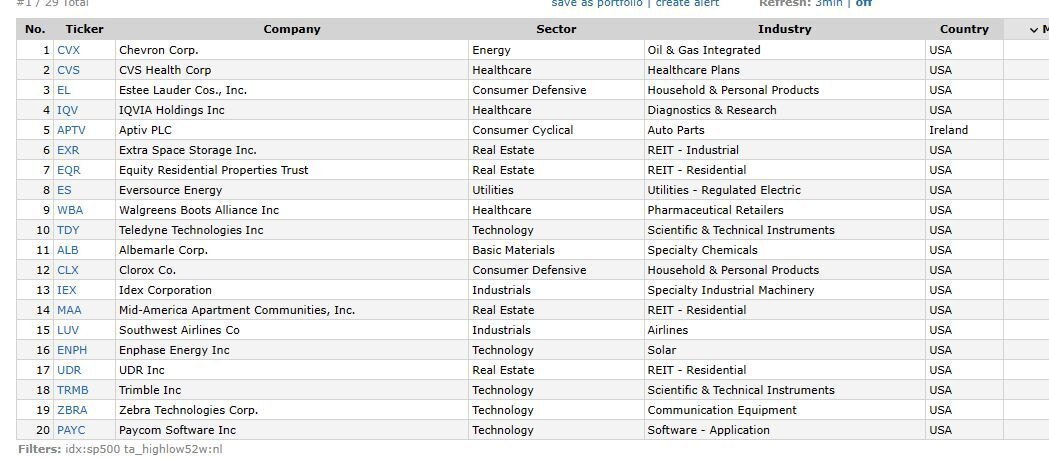

Needham downgraded Paycom (PAYC) to Hold from Buy with no price target. The company's Q3 revenue was below the low end of guidance and its Q4 outlook was below the previously implied midpoint, with BETI revenue cannibalization being much greater than the firm previously estimated, the firm tells investors in a research note. William Blair, Citi, Stifel, Piper Sandler, TD Cowen, Deutsche Bank, KeyBanc, and Oppenheimer also downgraded the stock to Neutral-equivalent ratings.

Goldman Sachs downgraded ZoomInfo (ZI) to Neutral from Buy with a price target of $17, down from $30, following the company's "mixed" Q3 report and "soft" forward guidance.

TD Cowen downgraded Paychex (PAYX) to Market Perform from Outperform with a price target of $202, down from $331. The company's Q3 featured a missed quarter on growth and a transition period through 2024 primarily due to Beti revenue cannibalization impacts on its base, the firm tells investors in a research note.

BofA downgraded Xponential Fitness (XPOF) to Neutral from Buy with a price target of $16, down from $35. The firm views the risk/reward as now more balanced given that it estimates that many franchisees across the Pure Barre, Row House, AKT and Stride brands that required financing may not be profitable and that the recent rise in interest rates may be pressuring the returns of new locations.

OTR Global downgraded its view on PVH Corp. (PVH) to Negative from Mixed, citing checks that showed Q3 sales plan attainment in Western Europe and at U.S. outlets deteriorated quarter-over-quarter.

TD Cowen initiated coverage of American Express (AXP) with a Market Perform rating and $158 price target. The company is seeing headwinds on volume growth as its key spending categories are likely to slow over the coming months, the firm tells investors in a research note.

JPMorgan initiated coverage of Six Flags (SIX) with an Underweight rating and $16 price target. The firm sees theme parks as a "market share donor post-pandemic" and downside risk to Six Flags' consensus estimates over the next 18 months.

TD Cowen initiated coverage of Capital One (COF) with a Market Perform rating and $108 price target. The firm says Capital One will need to demonstrate more significant improvement in efficiency.

Cantor Fitzgerald initiated coverage of VinFast Auto (VFS) with an Overweight rating and $7 price target. The firm believes the company benefits from more affordably priced EVs, vertical integration and manufacturing in Vietnam, and the financial and brand backing of Vingroup.

Piper Sandler initiated coverage of Polestar Automotive (PSNY) with an Overweight rating and $3 price target. Valuations are under pressure for electric vehicle startups, and Polestar is no exception, but unlike many other stocks in this sector, Polestar "warrants consideration," the firm tells investors in a research note.

AMD (AMD) reported better-than-expected Q3 results and gave a Q4 EPS outlook that miss estimates

CVS Health (CVS) provided a "beat and raise" report for Q3

Humana (HUM) reported upbeat Q3 results and reiterated its FY23 earnings guidance

First Solar (FSLR) reported mixed Q3 results and narrowed its FY23 earnings view

The Federal Reserve is keeping interest rates unchanged at 5.25%-5.5%

WeWork (WE) is planning to file for bankruptcy, WSJ reports

Executives from Intel (INTC), TSMC (TSM) and Samsung (SSNLF) have expressed confidence the worst is over for the chip industry, WSJ reports

Six Flags (SIX) and Cedar Fair (FUN) are near a deal to merge, WSJ says

Toyota (TM) has raised pay for nonunion U.S. factory workers, Reuters reports

JPMorgan (JPM) is searching for a potential partner in a private credit push, Bloomberg reports

TG Therapeutics (TGTX) higher after reporting quarterly results and announcing it expects cash to fund operations into cash flow positivity

Apollo Global (APO) and Axalta Coating (AXTA) gain after reporting quarterly results

Crispr Therapeutics (CRSP) increases in New York after announcing the completion of the FDA panel meeting for exa-cel

MasTec (MTZ) falls after reporting quarterly results and cutting its FY23 guidance

Lumen (LUMN) and Canada Goose (GOOS) decline after reporting quarterly results

Caesars (CZR) reported Q3 results, with EPS and revenue beating consensus

Yum! Brands (YUM) reported Q3 results, with CEO David Gibbs commenting, " We're incredibly pleased to report yet another excellent quarter"

Estee Lauder (EL) reported Q1 results and provided an outlook for FY24

Brinker (EAT) reported Q1 results, with CEO Kevin Hochman commenting "The first quarter results are a great start to the fiscal year"

Wayfair (W) announced Q3 results and provided guidance for Q4

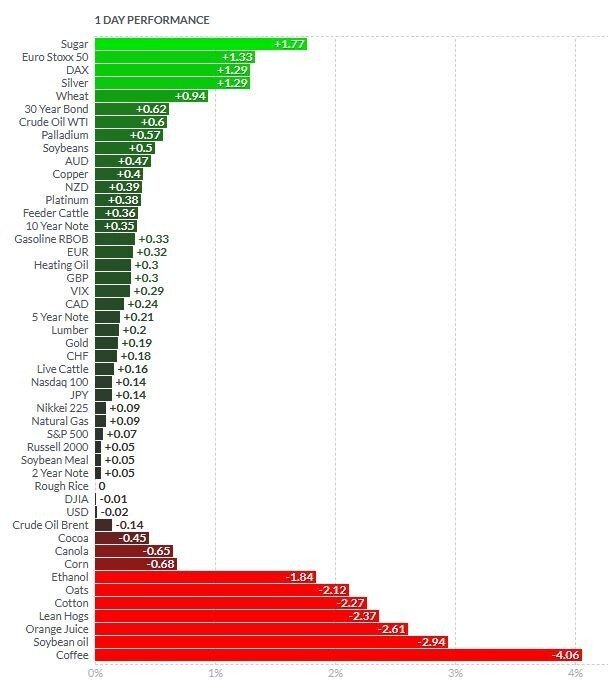

Many investors on Wednesday looked to the Federal Reserve for hints about whether this autumn’s unusual ascent in Treasury yields would help finish America’s inflation fight. The central bank’s message: maybe.

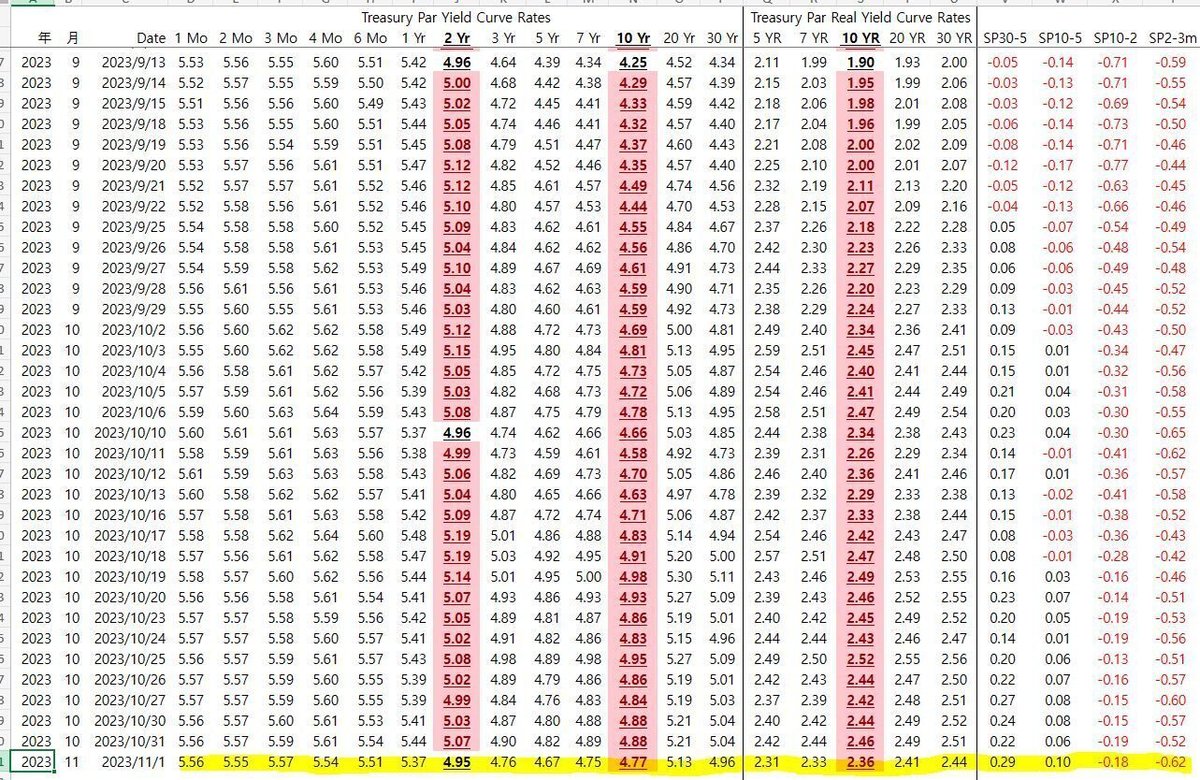

Benchmark 10-year yields began slipping after the Treasury Department said that it would boost the size of long-term U.S. debt auctions in the coming months by less than Wall Street anticipated.

The agency’s choice to instead lean more heavily on shorter-term debt issuance, investors said, could relieve upward pressure on longer-term yields. That, in turn, could boost stocks, which have been hurt by the rise in yields.

Treasury yields fell further later in the session, pulling 10-year yields to 4.790%, after the Fed held interest-rates steady again at 22-year highs.

Fed Chair Jerome Powell said at a news conference that the recent jump in bond yields is pushing up borrowing costs in ways that could ease price pressures and slow the robust U.S. economy. That could affect the central bank’s monetary policy moving forward.

“Financial conditions have clearly tightened, and you can see that in the rates that consumers and households and businesses are paying now, and over time that will have an effect,” Powell said. But “we just don’t know how persistent it’s going to be.”

As Treasury yields have risen in recent months, some bond traders have increasingly tried to time the market and lock in returns at their high point. Still, others are taking Powell’s warnings about additional hikes more seriously.

But the big winner among artificial-intelligence-aligned tech stocks was Advanced Micro Devices. Shares jumped 9.7% after executives forecast robust sales of advanced AI chips next year, putting the firm’s stock on pace for its best year since 2020.

Although more firms than usual have beaten Wall Street’s earnings estimates for the third quarter, many investors have instead zeroed in on projections for clues about how companies navigate an uncertain U.S. economic outlook.