第9章 ボラティリティ予測と統計的裁定取引 第6節: 共和分検定とカルマンフィルターを利用したペアトレーディング

この記事では、タイトルの通り、共和分検定とカルマンフィルターを用いてペアトレーディング出来るような資産を見つけることが目的です。

仮想通貨であれば、アルトコイン同士でペアトレーディングするのも中々面白そうではありますよね。

インポートと設定

import warnings

warnings.filterwarnings('ignore')from collections import Counter

from time import time

from pathlib import Path

import numpy as np

import pandas as pd

from pykalman import KalmanFilter

from statsmodels.tsa.stattools import coint

from statsmodels.tsa.vector_ar.vecm import coint_johansen

from statsmodels.tsa.api import VAR

import matplotlib.pyplot as plt

import seaborn as snsidx = pd.IndexSlice

sns.set_style('whitegrid')def format_time(t):

m_, s = divmod(t, 60)

h, m = divmod(m_, 60)

return f'{h:>02.0f}:{m:>02.0f}:{s:>02.0f}'ヨハンセン検定 異常値定義

critical_values = {0: {.9: 13.4294, .95: 15.4943, .99: 19.9349},

1: {.9: 2.7055, .95: 3.8415, .99: 6.6349}}trace0_cv = critical_values[0][.95] # critical value for 0 cointegration relationships

trace1_cv = critical_values[1][.95] # critical value for 1 cointegration relationshipデータの読み込み

DATA_PATH = Path('..', 'data')

STORE = DATA_PATH / 'assets.h5'バックテスト用の価格取得

関連株とETFのOHLCVデータを結合

def get_backtest_prices():

with pd.HDFStore('data.h5') as store:

tickers = store['tickers']

with pd.HDFStore(STORE) as store:

prices = (pd.concat([

store['stooq/us/nyse/stocks/prices'],

store['stooq/us/nyse/etfs/prices'],

store['stooq/us/nasdaq/etfs/prices'],

store['stooq/us/nasdaq/stocks/prices']])

.sort_index()

.loc[idx[tickers.index, '2016':'2019'], :])

print(prices.info(null_counts=True))

prices.to_hdf('backtest.h5', 'prices')

tickers.to_hdf('backtest.h5', 'tickers')get_backtest_prices()

'''

<class 'pandas.core.frame.DataFrame'>

MultiIndex: 313869 entries, ('AA.US', Timestamp('2016-01-04 00:00:00')) to ('YUM.US', Timestamp('2019-12-31 00:00:00'))

Data columns (total 5 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 open 313869 non-null float64

1 high 313869 non-null float64

2 low 313869 non-null float64

3 close 313869 non-null float64

4 volume 313869 non-null int64

dtypes: float64(4), int64(1)

memory usage: 13.3+ MB

None

'''株価の読み込み

stocks = pd.read_hdf('data.h5', 'stocks/close').loc['2015':]

stocks.info()

'''

<class 'pandas.core.frame.DataFrame'>

DatetimeIndex: 1258 entries, 2015-01-02 to 2019-12-31

Columns: 173 entries, AA.US to YUM.US

dtypes: float64(173)

memory usage: 1.7 MB

'''ETFデータの読み込み

etfs = pd.read_hdf('data.h5', 'etfs/close').loc['2015':]

etfs.info()

'''

<class 'pandas.core.frame.DataFrame'>

DatetimeIndex: 1258 entries, 2015-01-02 to 2019-12-31

Columns: 139 entries, AAXJ.US to YCS.US

dtypes: float64(139)

memory usage: 1.3 MB

'''ティッカー辞書の読み込み

names = pd.read_hdf('data.h5', 'tickers').to_dict()pd.Series(names).count()

'''

312

'''共和分検定の計算準備

def test_cointegration(etfs, stocks, test_end, lookback=2):

start = time()

results = []

test_start = test_end - pd.DateOffset(years=lookback) + pd.DateOffset(days=1)

etf_tickers = etfs.columns.tolist()

etf_data = etfs.loc[str(test_start):str(test_end)]

stock_tickers = stocks.columns.tolist()

stock_data = stocks.loc[str(test_start):str(test_end)]

n = len(etf_tickers) * len(stock_tickers)

j = 0

for i, s1 in enumerate(etf_tickers, 1):

for s2 in stock_tickers:

j += 1

if j % 1000 == 0:

print(f'\t{j:5,.0f} ({j/n:3.1%}) | {time() - start:.2f}')

df = etf_data.loc[:, [s1]].dropna().join(stock_data.loc[:, [s2]].dropna(), how='inner')

with warnings.catch_warnings():

warnings.simplefilter('ignore')

var = VAR(df)

lags = var.select_order()

result = [test_end, s1, s2]

order = lags.selected_orders['aic']

result += [coint(df[s1], df[s2], trend='c')[1], coint(df[s2], df[s1], trend='c')[1]]

cj = coint_johansen(df, det_order=0, k_ar_diff=order)

result += (list(cj.lr1) + list(cj.lr2) + list(cj.evec[:, cj.ind[0]]))

results.append(result)

return resultsテスト期間の設定

dates = stocks.loc['2016-12':'2019-6'].resample('Q').last().index検定の実行

ここは恐ろしく時間がかかるので、少ない銘柄で試すことをお勧めします。

test_results = []

columns = ['test_end', 's1', 's2', 'eg1', 'eg2',

'trace0', 'trace1', 'eig0', 'eig1', 'w1', 'w2']

for test_end in dates:

print(test_end)

result = test_cointegration(etfs, stocks, test_end=test_end)

test_results.append(pd.DataFrame(result, columns=columns))

pd.concat(test_results).to_hdf('backtest.h5', 'cointegration_test')検定結果の読み込み

test_results = pd.read_hdf('backtest.h5', 'cointegration_test')

test_results.info()

'''

<class 'pandas.core.frame.DataFrame'>

Int64Index: 264517 entries, 0 to 24046

Data columns (total 11 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 test_end 264517 non-null datetime64[ns]

1 s1 264517 non-null object

2 s2 264517 non-null object

3 eg1 264517 non-null float64

4 eg2 264517 non-null float64

5 trace0 264517 non-null float64

6 trace1 264517 non-null float64

7 eig0 264517 non-null float64

8 eig1 264517 non-null float64

9 w1 264517 non-null float64

10 w2 264517 non-null float64

dtypes: datetime64[ns](1), float64(8), object(2)

memory usage: 24.2+ MB

'''共和分ペアを見つける

ヨハンセン検定

test_results['joh_sig'] = ((test_results.trace0 > trace0_cv) &

(test_results.trace1 > trace1_cv))test_results.joh_sig.value_counts(normalize=True)

'''

False 0.947406

True 0.052594

Name: joh_sig, dtype: float64

'''大体5%くらいはヒットしています。

Engle Granger検定

test_results['eg'] = test_results[['eg1', 'eg2']].min(axis=1)

test_results['s1_dep'] = test_results.eg1 < test_results.eg2

test_results['eg_sig'] = (test_results.eg < .05)test_results.eg_sig.value_counts(normalize=True)

'''

False 0.91128

True 0.08872

Name: eg_sig, dtype: float64

'''Engle-Granger vs Johansen 比較

ここでは両方の検定でどちらにも引っ掛かったものを取得します。

test_results['coint'] = (test_results.eg_sig & test_results.joh_sig)

test_results.coint.value_counts(normalize=True)

'''

False 0.986829

True 0.013171

Name: coint, dtype: float64

'''test_results = test_results.drop(['eg1', 'eg2', 'trace0', 'trace1', 'eig0', 'eig1'], axis=1)

test_results.info()

'''

<class 'pandas.core.frame.DataFrame'>

Int64Index: 264517 entries, 0 to 24046

Data columns (total 10 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 test_end 264517 non-null datetime64[ns]

1 s1 264517 non-null object

2 s2 264517 non-null object

3 w1 264517 non-null float64

4 w2 264517 non-null float64

5 joh_sig 264517 non-null bool

6 eg 264517 non-null float64

7 s1_dep 264517 non-null bool

8 eg_sig 264517 non-null bool

9 coint 264517 non-null bool

dtypes: bool(4), datetime64[ns](1), float64(3), object(2)

memory usage: 15.1+ MB

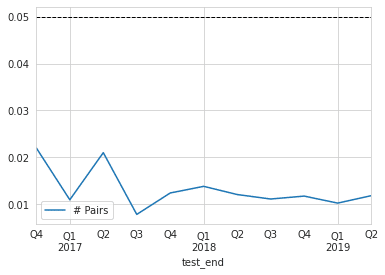

'''ペア数の推移

ax = test_results.groupby('test_end').coint.mean().to_frame('# Pairs').plot()

ax.axhline(.05, lw=1, ls='--', c='k');

候補ペアの選定

def select_candidate_pairs(data):

candidates = data[data.joh_sig | data.eg_sig]

candidates['y'] = candidates.apply(lambda x: x.s1 if x.s1_dep else x.s2, axis=1)

candidates['x'] = candidates.apply(lambda x: x.s2 if x.s1_dep else x.s1, axis=1)

return candidates.drop(['s1_dep', 's1', 's2'], axis=1)candidates = select_candidate_pairs(test_results)candidates.to_hdf('backtest.h5', 'candidates')candidates = pd.read_hdf('backtest.h5', 'candidates')

candidates.info()

'''

<class 'pandas.core.frame.DataFrame'>

Int64Index: 33896 entries, 7 to 24045

Data columns (total 9 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 test_end 33896 non-null datetime64[ns]

1 w1 33896 non-null float64

2 w2 33896 non-null float64

3 joh_sig 33896 non-null bool

4 eg 33896 non-null float64

5 eg_sig 33896 non-null bool

6 coint 33896 non-null bool

7 y 33896 non-null object

8 x 33896 non-null object

dtypes: bool(3), datetime64[ns](1), float64(3), object(2)

memory usage: 1.9+ MB

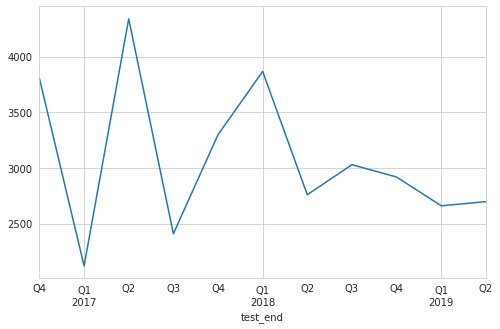

'''候補数の推移

candidates.groupby('test_end').size().plot(figsize=(8, 5))

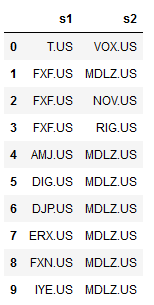

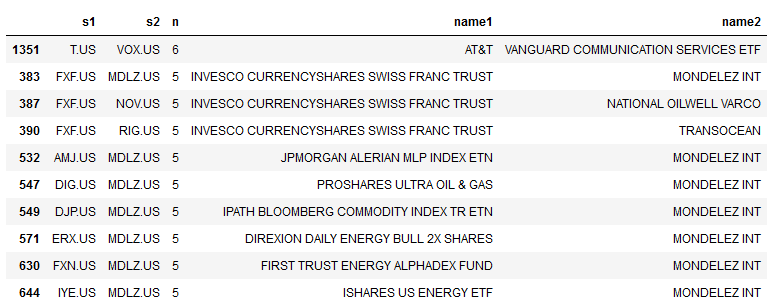

最も共通点が多いペア

時刻によって異常と見なされたペアが異なるので、ここでは、検定に引っ掛かったペアをひたすらカウントして、最もカウントに引っ掛かったペアを出力します。

with pd.HDFStore('data.h5') as store:

print(store.info())

tickers = store['tickers']

'''

<class 'pandas.io.pytables.HDFStore'>

File path: data.h5

/etfs/close frame (shape->[2516,139])

/stocks/close frame (shape->[2516,173])

/tickers series (shape->[1])

'''with pd.HDFStore('backtest.h5') as store:

print(store.info())

'''

<class 'pandas.io.pytables.HDFStore'>

File path: backtest.h5

/candidates frame (shape->[33896,9])

/cointegration_test frame (shape->[264517,11])

/half_lives frame (shape->[33896,4])

/pair_data frame (shape->[4259004,7])

/pair_trades frame (shape->[1,6])

/prices frame (shape->[313869,5])

/tickers series (shape->[1])

'''counter = Counter()

for s1, s2 in zip(candidates[candidates.joh_sig & candidates.eg_sig].y,

candidates[candidates.joh_sig & candidates.eg_sig].x):

if s1 > s2:

counter[(s2, s1)] += 1

else:

counter[(s1, s2)] += 1most_common_pairs = pd.DataFrame(counter.most_common(10))

most_common_pairs = pd.DataFrame(most_common_pairs[0].values.tolist(), columns=['s1', 's2'])

most_common_pairs

ペアトレの候補が出てきましたね(*'ω'*)

with pd.HDFStore('backtest.h5') as store:

prices = store['prices'].close.unstack('ticker').ffill(limit=5)

tickers = store['tickers'].to_dict()cnt = pd.Series(counter).reset_index()

cnt.columns = ['s1', 's2', 'n']

cnt['name1'] = cnt.s1.map(tickers)

cnt['name2'] = cnt.s2.map(tickers)

cnt.nlargest(10, columns='n')

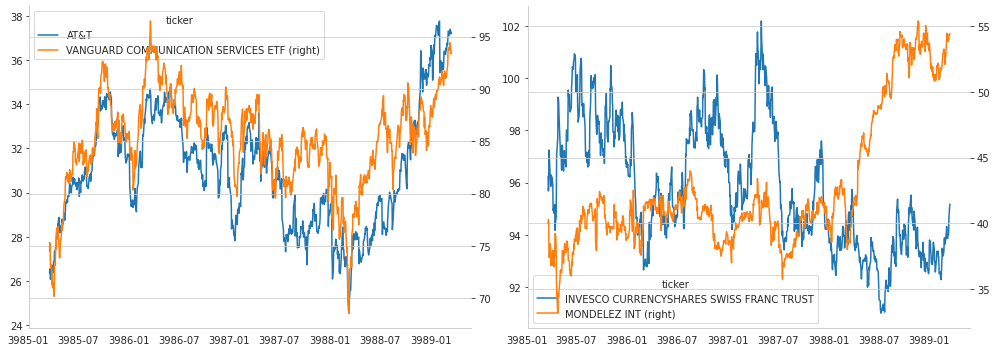

炙り出された似ているペアを確認

fig, axes = plt.subplots(ncols=2, figsize=(14, 5))

for i in [0, 1]:

s1, s2 = most_common_pairs.at[i, 's1'], most_common_pairs.at[i, 's2']

prices.loc[:, [s1, s2]].rename(columns=tickers).plot(secondary_y=tickers[s2],

ax=axes[i],

rot=0)

axes[i].grid(False)

axes[i].set_xlabel('')

sns.despine()

fig.tight_layout()

さて、ペアが見つかったら、いよいよ、トレーディング戦略の方に移ります。

カルマンフィルターによるスムージング

def KFSmoother(prices):

"""Estimate rolling mean"""

kf = KalmanFilter(transition_matrices=np.eye(1),

observation_matrices=np.eye(1),

initial_state_mean=0,

initial_state_covariance=1,

observation_covariance=1,

transition_covariance=.05)

state_means, _ = kf.filter(prices.values)

return pd.Series(state_means.flatten(),

index=prices.index)smoothed_prices = prices.apply(KFSmoother)

smoothed_prices.to_hdf('tmp.h5', 'smoothed')smoothed_prices = pd.read_hdf('tmp.h5', 'smoothed')ローリングヘッジレシオをカルマンフィルターを用いて計算する

def KFHedgeRatio(x, y):

"""Estimate Hedge Ratio"""

delta = 1e-3

trans_cov = delta / (1 - delta) * np.eye(2)

obs_mat = np.expand_dims(np.vstack([[x], [np.ones(len(x))]]).T, axis=1)

kf = KalmanFilter(n_dim_obs=1, n_dim_state=2,

initial_state_mean=[0, 0],

initial_state_covariance=np.ones((2, 2)),

transition_matrices=np.eye(2),

observation_matrices=obs_mat,

observation_covariance=2,

transition_covariance=trans_cov)

state_means, _ = kf.filter(y.values)

return -state_means平均回帰半減期の推定

def estimate_half_life(spread):

X = spread.shift().iloc[1:].to_frame().assign(const=1)

y = spread.diff().iloc[1:]

beta = (np.linalg.inv(X.T @ X) @ X.T @ y).iloc[0]

halflife = int(round(-np.log(2) / beta, 0))

return max(halflife, 1)スプレッドとボリンジャーバンドの計算

def get_spread(candidates, prices):

pairs = []

half_lives = []

periods = pd.DatetimeIndex(sorted(candidates.test_end.unique()))

start = time()

for p, test_end in enumerate(periods, 1):

start_iteration = time()

period_candidates = candidates.loc[candidates.test_end == test_end, ['y', 'x']]

trading_start = test_end + pd.DateOffset(days=1)

t = trading_start - pd.DateOffset(years=2)

T = trading_start + pd.DateOffset(months=6) - pd.DateOffset(days=1)

max_window = len(prices.loc[t: test_end].index)

print(test_end.date(), len(period_candidates))

for i, (y, x) in enumerate(zip(period_candidates.y, period_candidates.x), 1):

if i % 1000 == 0:

msg = f'{i:5.0f} | {time() - start_iteration:7.1f} | {time() - start:10.1f}'

print(msg)

pair = prices.loc[t: T, [y, x]]

pair['hedge_ratio'] = KFHedgeRatio(y=KFSmoother(prices.loc[t: T, y]),

x=KFSmoother(prices.loc[t: T, x]))[:, 0]

pair['spread'] = pair[y].add(pair[x].mul(pair.hedge_ratio))

half_life = estimate_half_life(pair.spread.loc[t: test_end])

spread = pair.spread.rolling(window=min(2 * half_life, max_window))

pair['z_score'] = pair.spread.sub(spread.mean()).div(spread.std())

pairs.append(pair.loc[trading_start: T].assign(s1=y, s2=x, period=p, pair=i).drop([x, y], axis=1))

half_lives.append([test_end, y, x, half_life])

return pairs, half_livescandidates = pd.read_hdf('backtest.h5', 'candidates')

candidates.info()

'''

<class 'pandas.core.frame.DataFrame'>

Int64Index: 33896 entries, 7 to 24045

Data columns (total 9 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 test_end 33896 non-null datetime64[ns]

1 w1 33896 non-null float64

2 w2 33896 non-null float64

3 joh_sig 33896 non-null bool

4 eg 33896 non-null float64

5 eg_sig 33896 non-null bool

6 coint 33896 non-null bool

7 y 33896 non-null object

8 x 33896 non-null object

dtypes: bool(3), datetime64[ns](1), float64(3), object(2)

memory usage: 1.9+ MB

'''pairs, half_lives = get_spread(candidates, smoothed_prices)結果集計

半減期

hl = pd.DataFrame(half_lives, columns=['test_end', 's1', 's2', 'half_life'])

hl.info()

'''

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 33896 entries, 0 to 33895

Data columns (total 4 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 test_end 33896 non-null datetime64[ns]

1 s1 33896 non-null object

2 s2 33896 non-null object

3 half_life 33896 non-null int64

dtypes: datetime64[ns](1), int64(1), object(2)

memory usage: 1.0+ MB

'''hl.half_life.describe()

'''

count 33896.000000

mean 25.167837

std 10.235579

min 1.000000

25% 20.000000

50% 24.000000

75% 28.000000

max 1057.000000

Name: half_life, dtype: float64

'''hl.to_hdf('backtest.h5', 'half_lives')ペアデータ

pair_data = pd.concat(pairs)

pair_data.info(null_counts=True)

'''

pair_data = pd.concat(pairs)

pair_data.info(null_counts=True)

<class 'pandas.core.frame.DataFrame'>

DatetimeIndex: 4259004 entries, 2017-01-03 to 2019-12-31

Data columns (total 7 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 hedge_ratio 4259004 non-null float64

1 spread 4259004 non-null float64

2 z_score 4259004 non-null float64

3 s1 4259004 non-null object

4 s2 4259004 non-null object

5 period 4259004 non-null int64

6 pair 4259004 non-null int64

dtypes: float64(3), int64(2), object(2)

memory usage: 259.9+ MB

'''pair_data.to_hdf('backtest.h5', 'pair_data')pair_data = pd.read_hdf('backtest.h5', 'pair_data')ロングショートのエントリーとエグジットの日付を見つける

def get_trades(data):

pair_trades = []

for i, ((period, s1, s2), pair) in enumerate(data.groupby(['period', 's1', 's2']), 1):

if i % 100 == 0:

print(i)

first3m = pair.first('3M').index

last3m = pair.last('3M').index

entry = pair.z_score.abs() > 2

entry = ((entry.shift() != entry)

.mul(np.sign(pair.z_score))

.fillna(0)

.astype(int)

.sub(2))

exit = (np.sign(pair.z_score.shift().fillna(method='bfill'))

!= np.sign(pair.z_score)).astype(int) - 1

trades = (entry[entry != -2].append(exit[exit == 0])

.to_frame('side')

.sort_values(['date', 'side'])

.squeeze())

if not isinstance(trades, pd.Series):

continue

try:

trades.loc[trades < 0] += 2

except:

print(type(trades))

print(trades)

print(pair.z_score.describe())

break

trades = trades[trades.abs().shift() != trades.abs()]

window = trades.loc[first3m.min():first3m.max()]

extra = trades.loc[last3m.min():last3m.max()]

n = len(trades)

if window.iloc[0] == 0:

if n > 1:

print('shift')

window = window.iloc[1:]

if window.iloc[-1] != 0:

extra_exits = extra[extra == 0].head(1)

if extra_exits.empty:

continue

else:

window = window.append(extra_exits)

trades = pair[['s1', 's2', 'hedge_ratio', 'period', 'pair']].join(window.to_frame('side'), how='right')

trades.loc[trades.side == 0, 'hedge_ratio'] = np.nan

trades.hedge_ratio = trades.hedge_ratio.ffill()

pair_trades.append(trades)

return pair_tradespair_trades = get_trades(pair_data)pair_trade_data = pd.concat(pair_trades)

pair_trade_data.info()

'''

<class 'pandas.core.frame.DataFrame'>

DatetimeIndex: 135490 entries, 2017-01-03 to 2019-10-04

Data columns (total 6 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 s1 135490 non-null object

1 s2 135490 non-null object

2 hedge_ratio 135490 non-null float64

3 period 135490 non-null int64

4 pair 135490 non-null int64

5 side 135490 non-null int64

dtypes: float64(1), int64(3), object(2)

memory usage: 7.2+ MB

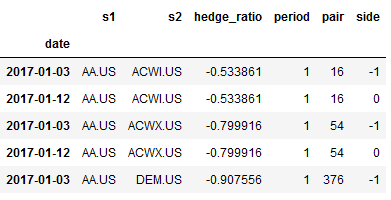

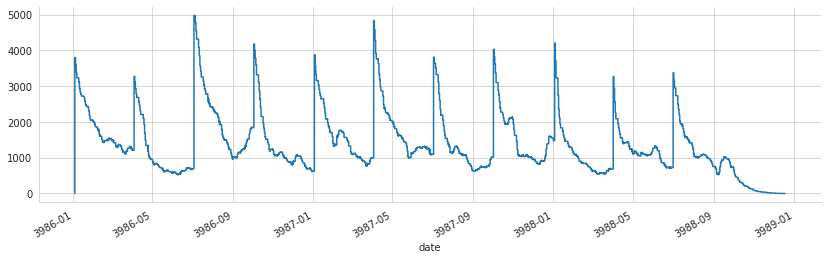

'''pair_trade_data.head()

trades = pair_trade_data['side'].copy()

trades.loc[trades != 0] = 1

trades.loc[trades == 0] = -1

trades.sort_index().cumsum().plot(figsize=(14, 4))

sns.despine()

pair_trade_data.to_hdf('backtest.h5', 'pair_trades')この記事が気に入ったらサポートをしてみませんか?