第9章 ボラティリティ予測と統計的裁定取引 第7節: ペアトレーディングのバックテスト

9章最後になります。

今回はBacktraderを使ってバックテストして、結果をpyfolioで評価したいと思います(*'ω'*)

backtraderのgithubはこちらになります。

インポートと設定

import warnings

warnings.filterwarnings('ignore')import csv

from collections import defaultdict

from dataclasses import dataclass, asdict

from datetime import date

from pathlib import Path

from time import time

import numpy as np

import pandas as pd

import pandas_datareader.data as web

import matplotlib.pyplot as plt

import seaborn as sns

import backtrader as bt

from backtrader.feeds import PandasData

import pyfolio as pfsns.set_style('dark')

pd.set_option('display.float_format', lambda x: f'{x:,.2f}')

idx = pd.IndexSliceSTORE = 'backtest.h5'def format_time(t):

m_, s = divmod(t, 60)

h, m = divmod(m_, 60)

return f'{h:>02.0f}:{m:>02.0f}:{s:>02.0f}'ペアトレーディングのバックテスト

ペアのデータクラス

@dataclass

class Pair:

period: int

s1: str

s2: str

size1: float

size2: float

long: bool

hr: float

p1: float

p2: float

pos1: float

pos2: float

exec1: bool = False

exec2: bool = False

active: bool = False

entry_date: date = None

exit_date: date = None

entry_spread: float = np.nan

exit_spread: float = np.nan

def executed(self):

return self.exec1 and self.exec2

def get_constituent(self, name):

if name == self.s1:

return 1

elif name == self.s2:

return 2

else:

return 0

def compute_spread(self, p1, p2):

return p1 * self.size1 + p2 * self.size2

def compute_spread_return(self, p1, p2):

current_spread = self.compute_spread(p1, p2)

delta = self.entry_spread - current_spread

return (delta / (np.sign(self.entry_spread) *

self.entry_spread))Pandasデータの定義

class CustomData(PandasData):

"""

Define pandas DataFrame structure

"""

cols = ['open', 'high', 'low', 'close', 'volume']

# create lines

lines = tuple(cols)

# define parameters

params = {c: -1 for c in cols}

params.update({'datetime': None})

params = tuple(params.items())戦略の定義

class StatisticalArbitrageCointegration(bt.Strategy):

params = (('trades', None),

('risk_limit', -.2),

('verbose', True),

('log_file', 'backtest.csv'))

def __init__(self):

self.active_pairs = {}

self.closing_pairs = {}

self.exposure = []

self.metrics = []

self.last_close = {}

self.cnt = 0

self.today = None

self.clear_log()

self.order_status = dict(enumerate(['Created', 'Submitted', 'Accepted',

'Partial', 'Completed', 'Canceled',

'Expired', 'Margin', 'Rejected']))

def clear_log(self):

if Path(self.p.log_file).exists():

Path(self.p.log_file).unlink()

with Path(self.p.log_file).open('a') as f:

log_writer = csv.writer(f)

log_writer.writerow(

['Date', 'Pair', 'Symbol', 'Order #', 'Reason',

'Status', 'Long', 'Price', 'Size', 'Position'])

def log(self, txt, dt=None):

""" Logger for the strategy"""

dt = dt or self.datas[0].datetime.datetime(0)

with Path(self.p.log_file).open('a') as f:

log_writer = csv.writer(f)

log_writer.writerow([dt.date()] + txt.split(','))

def get_pair_id(self, s1, s2, period):

return f'{s1}.{s2}.{period}'

def check_risk_limit(self):

for pair_id, pair in list(self.active_pairs.items()):

if pair.active:

p1 = self.last_close.get(pair.s1)

p2 = self.last_close.get(pair.s2)

ret = pair.compute_spread_return(p1, p2)

if ret < self.p.risk_limit:

self.log(f'{pair_id},{pair.s1},{pair.s2},Risk Limit,{ret},')

del self.active_pairs[pair_id]

self.sell_pair(pair_id, pair)

def sell_pair(self, pair_id, pair, reason='close'):

info = {'pair': pair_id, 'type': reason}

if pair.long:

o1 = self.sell(data=pair.s1, size=abs(pair.size1), info=info)

o2 = self.buy(data=pair.s2, size=abs(pair.size2), info=info)

else:

o1 = self.buy(data=pair.s1, size=abs(pair.size1), info=info)

o2 = self.sell(data=pair.s2, size=abs(pair.size2), info=info)

pair.active = False

pair.exec1 = pair.exec2 = False

self.closing_pairs[pair_id] = pair

self.log(f'{pair_id},{pair.s1},{o1.ref},{reason},Created,{pair.long},,{pair.size1},')

self.log(f'{pair_id},{pair.s2},{o2.ref},{reason},Created,{pair.long},,{pair.size2},')

def notify_order(self, order):

symbol = order.data._name

if order.status in [order.Submitted, order.Accepted]:

return

if order.status in [order.Completed]:

p = order.executed.price

s = order.executed.size

order_type = order.info.info['type']

if order_type in ['open', 'close']:

pair_id = order.info.info['pair']

if order_type == 'open':

pair = self.active_pairs.get(pair_id)

else:

pair = self.closing_pairs.get(pair_id)

if pair is None:

self.log(f'{pair_id},{symbol},{order.ref},{order_type},Completed (missing),,{p},{s},{p * s}')

return

component = pair.get_constituent(symbol)

if component == 1:

pair.p1 = p

pair.exec1 = True

elif component == 2:

pair.p2 = p

pair.exec2 = True

if pair.executed():

pair.exec1 = False

pair.exec2 = False

if order_type == 'open':

pair.entry_spread = pair.compute_spread(p1=pair.p1, p2=pair.p2)

pair.entry_date = self.today

pair.active = True

elif order_type == 'close':

pair.exit_spread = pair.compute_spread(p1=pair.p1, p2=pair.p2)

pair.exit_date = self.today

pair.active = False

self.closing_pairs.pop(pair_id)

self.log(f'{pair_id},{symbol},{order.ref},{order_type},Completed,{pair.long},{p},{s},{p * s}')

else:

self.log(f',{symbol},{order.ref},{order_type},Completed,,{p},{s},{p * s}')

elif order.status in [order.Canceled, order.Margin, order.Rejected]:

order_type = order.info.info['type']

self.log(f',{symbol},{order.ref},{order_type},{self.order_status[order.status]},,,,')

def enter_pairs(self, df, long=True):

for s1, s2, hr, period in zip(df.s1, df.s2, df.hedge_ratio, df.period):

pair_id = self.get_pair_id(s1, s2, period)

if self.active_pairs.get(pair_id):

continue

p1 = self.last_close[s1]

p2 = self.last_close[s2]

if long:

size1 = self.target_value / p1

size2 = hr * size1

else:

size2 = self.target_value / p2

size1 = 1 / hr * size2

pair = Pair(s1=s1, s2=s2, period=period, size1=size1, size2=size2,

pos1=p1 * size1, pos2=p2 * size2,

hr=hr, long=long, p1=p1, p2=p2, entry_date=self.today)

info = {'pair': pair_id, 'type': 'open'}

if long:

o1 = self.buy(data=s1, size=size1, info=info)

o2 = self.sell(data=s2, size=abs(size2), info=info)

else:

o1 = self.sell(data=pair.s1, size=abs(pair.size1), info=info)

o2 = self.buy(data=pair.s2, size=abs(pair.size2), info=info)

self.active_pairs[pair_id] = pair

self.log(f'{pair_id},{s1},{o1.ref},Open,Created,{long},{p1},{size1},{pair.pos1}')

self.log(f'{pair_id},{s2},{o2.ref},Open,Created,{long},{p2},{size2},{pair.pos2}')

def adjust_pairs(self):

orders = defaultdict(float)

pairs = defaultdict(list)

for pair_id, pair in self.active_pairs.items():

p1, p2 = self.last_close[pair.s1], self.last_close[pair.s2]

pos1, pos2 = pair.size1 * p1, pair.size2 * p2

if pair.long:

target_size1 = self.target_value / p1

orders[pair.s1] += target_size1 - pair.size1

target_size2 = pos2 / pos1 * self.target_value / p2

orders[pair.s2] += target_size2 - pair.size2

else:

target_size2 = self.target_value / p2

orders[pair.s2] += target_size2 - pair.size2

target_size1 = pos1 / pos2 * self.target_value / p1

orders[pair.s1] += target_size1 - pair.size1

pair.size1 = target_size1

pair.size2 = target_size2

pairs[pair.s1].append(pair_id)

pairs[pair.s2].append(pair_id)

for symbol, size in orders.items():

info = {'pairs': pairs[symbol], 'type': 'adjust'}

if size > 0:

order = self.buy(symbol, size=size, info=info)

elif size < 0:

order = self.sell(symbol, size=abs(size), info=info)

else:

continue

self.log(f',{symbol},{order.ref},Adjust,Created,{size}')

def prenext(self):

self.next()

def next(self):

self.today = self.datas[0].datetime.date()

if self.today not in self.p.trades.index:

return

self.cnt += 1

pf = self.broker.get_value()

cash = self.broker.get_cash()

exp = {d._name: pos.size for d, pos in self.getpositions().items() if pos}

self.last_close = {d._name: d.close[0] for d in self.datas}

exposure = pd.DataFrame({'price' : pd.Series(self.last_close),

'position': pd.Series(exp)}).replace(0, np.nan).dropna()

exposure['value'] = exposure.price * exposure.position

positions = exposure.value.to_dict()

positions['date'] = self.today

positions['cash'] = cash

if not exposure.empty:

self.exposure.append(positions)

long_pos = exposure[exposure.value > 0].value.sum()

short_pos = exposure[exposure.value < 0].value.sum()

for symbol, row in exposure.iterrows():

self.log(f',{symbol},,Positions,Log,,{row.price},{row.position},{row.value}')

else:

long_pos = short_pos = 0

trades = self.p.trades.loc[self.today]

if isinstance(trades, pd.Series):

trades = trades.to_frame().T

close = trades[trades.side == 0].sort_values('period')

for s1, s2, period in zip(close.s1, close.s2, close.period):

pair_id = self.get_pair_id(s1, s2, period)

pair = self.active_pairs.pop(pair_id, None)

if pair is None:

self.log(f'{pair_id},,,Close Attempt,Failed,,,,')

continue

self.sell_pair(pair_id, pair)

if len(self.active_pairs) > 0:

self.check_risk_limit()

long = trades[trades.side == 1]

short = trades[trades.side == -1]

if long.empty and short.empty: return

target = 1 / (len(long) + len(short) + len(self.active_pairs))

self.target_value = pf * target

metrics = [self.today, pf, pf - cash, cash, len(exposure), len(self.active_pairs), long_pos, short_pos,

target, self.target_value, len(long), len(short), len(close)]

self.metrics.append(metrics)

if self.cnt % 21 == 0:

holdings = pf - cash

msg = f'PF: {pf:11,.0f} | Net: {holdings: 11,.0f} | # Pos: {len(exposure):3,.0f} | # Pairs: {len(self.active_pairs):3,.0f} | '

msg += f'Long: {long_pos: 10,.0f} | Short: {short_pos: 10,.0f}'

print(self.today, msg)

self.adjust_pairs()

if not long.empty:

self.enter_pairs(long, long=True)

if not short.empty:

self.enter_pairs(short, long=False)取引履歴を読み込む

trades = pd.read_hdf(STORE, 'pair_trades').sort_index()

trades.info()

'''

<class 'pandas.core.frame.DataFrame'>

DatetimeIndex: 135490 entries, 2017-01-03 to 2019-12-18

Data columns (total 6 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 s1 135490 non-null object

1 s2 135490 non-null object

2 hedge_ratio 135490 non-null float64

3 period 135490 non-null int64

4 pair 135490 non-null int64

5 side 135490 non-null int64

dtypes: float64(1), int64(3), object(2)

memory usage: 7.2+ MB

'''trade_dates = np.unique(trades.index)

start = trade_dates.min()

end = trade_dates.max()

traded_symbols = trades.s1.append(trades.s2).unique()価格を読み込む

prices = (pd.read_hdf(STORE, 'prices')

.sort_index()

.loc[idx[traded_symbols, str(start):str(end)], :])Cerebroの設定

cerebro = bt.Cerebro()

cash = 1000000

cerebro.broker.setcash(cash)データの追加

for symbol in traded_symbols:

df = prices.loc[idx[symbol, :], :].droplevel('ticker', axis=0)

df.index.name = 'datetime'

bt_data = CustomData(dataname=df)

cerebro.adddata(bt_data, name=symbol)戦略とアナライザーの追加

cerebro.addstrategy(StatisticalArbitrageCointegration,

trades=trades, verbose=True,

log_file='bt_log.csv')

cerebro.addanalyzer(bt.analyzers.PyFolio, _name='pyfolio')戦略の実行

start = time()

results = cerebro.run()

ending_value = cerebro.broker.getvalue()

duration = time() - start

print(f'Final Portfolio Value: {ending_value:,.2f} | Duration: {format_time(duration)}')Pyfolioのインプットを計算

pyfolio_analyzer = results[0].analyzers.getbyname('pyfolio')

returns, positions, transactions, gross_lev = pyfolio_analyzer.get_pf_items()returns.to_hdf(STORE, 'returns')

positions.to_hdf(STORE, 'positions')

transactions.to_hdf(STORE, 'transactions/')

gross_lev.to_hdf(STORE, 'gross_lev')ポジションの取得

traded_pairs = pd.DataFrame(results[0].exposure)

traded_pairs.date = pd.to_datetime(traded_pairs.date)

traded_pairs = traded_pairs.set_index('date').tz_localize('UTC')

traded_pairs.to_hdf(STORE, 'traded_pairs')

traded_pairs.info()評価基準の取得

metrics = pd.DataFrame(results[0].metrics,

columns=['date', 'pf', 'net_holdings', 'cash',

'npositions', 'npairs', 'nlong_pos', 'nshort_pos',

'target', 'target_val', 'nlong_trades',

'nshort_trades', 'nclose_trades'])

metrics.to_hdf(STORE, 'metrics')Pyfolioで分析

returns = pd.read_hdf(STORE, 'returns')

transactions = pd.read_hdf(STORE, 'transactions/')

gross_lev = pd.read_hdf(STORE, 'gross_lev')

metrics = pd.read_hdf(STORE, 'metrics').set_index('date')metrics.info()

'''

<class 'pandas.core.frame.DataFrame'>

Index: 676 entries, 2017-01-03 to 2019-09-30

Data columns (total 12 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 pf 676 non-null float64

1 net_holdings 676 non-null float64

2 cash 676 non-null float64

3 npositions 676 non-null int64

4 npairs 676 non-null int64

5 nlong_pos 676 non-null float64

6 nshort_pos 676 non-null float64

7 target 676 non-null float64

8 target_val 676 non-null float64

9 nlong_trades 676 non-null int64

10 nshort_trades 676 non-null int64

11 nclose_trades 676 non-null int64

dtypes: float64(7), int64(5)

memory usage: 68.7+ KB

'''metrics[['nlong_pos', 'nshort_pos']].plot(figsize=(12, 4));

ベンチマーク取得

S&P500をベンチマークとします

start = str(returns.index.min().year)

end = str(returns.index.max().year + 1)benchmark = web.DataReader('SP500', 'fred',

start=start,

end=end).squeeze()

benchmark = benchmark.pct_change().tz_localize('UTC')fig, axes = plt.subplots(ncols=3, figsize=(20,5))

pf.plotting.plot_rolling_returns( returns, factor_returns=benchmark, ax=axes[0])

axes[0].set_title('Cumulative Returns')

pf.plotting.plot_rolling_sharpe(returns, ax=axes[1])

pf.plotting.plot_rolling_beta(returns, benchmark, ax=axes[2])

sns.despine()

fig.tight_layout();

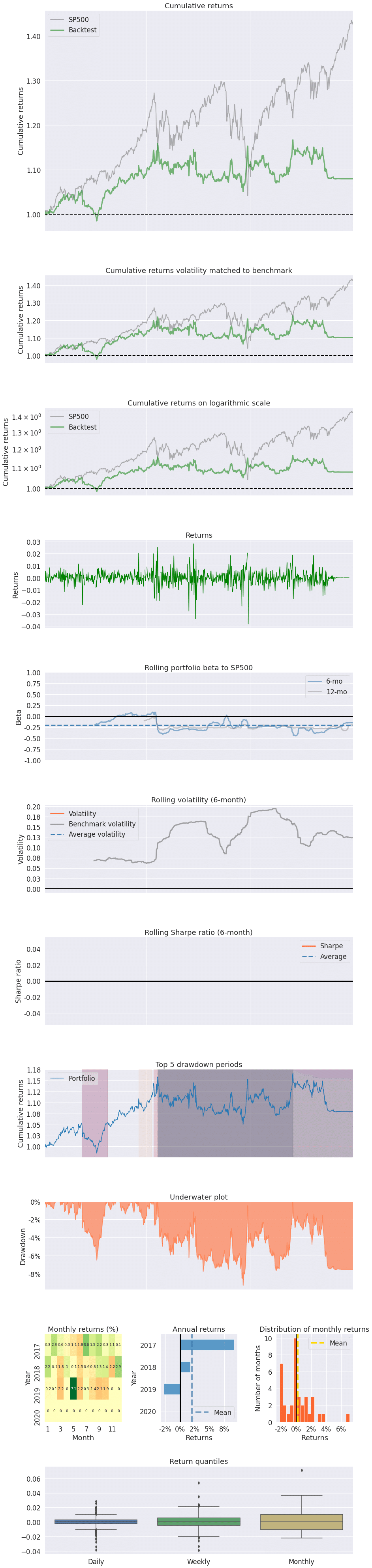

tearsheet

pf.create_full_tear_sheet(returns,

positions=positions,

benchmark_rets=benchmark.dropna(),

estimate_intraday=False)

この記事が気に入ったらサポートをしてみませんか?