2024 Mar 14, US Market

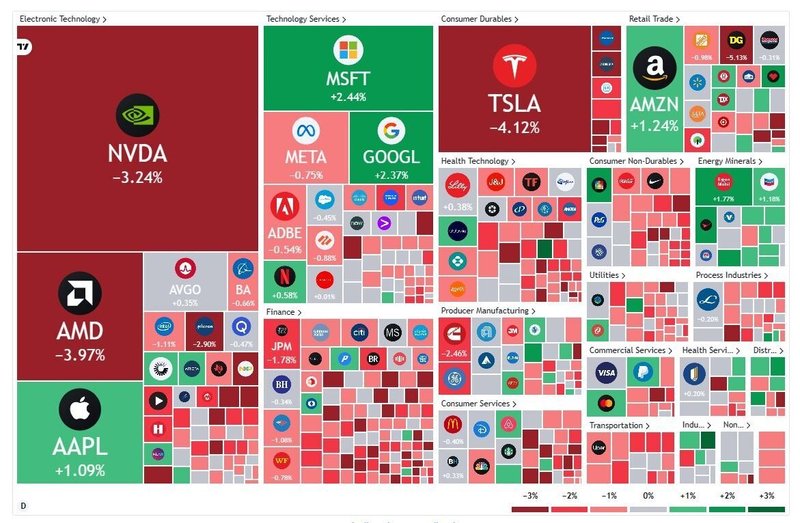

U.S. stocks fell Thursday after another round of inflation data came in hotter than expected.

Producer prices rose 0.6% in February from the prior month, more than the 0.3% increase economists had projected. That was after data Tuesday showed consumer prices climbing more than forecast over the past year.

Investors have been scrutinizing the path of inflation as they try to anticipate when the Federal Reserve will begin to cut interest rates. Fed Chair Jerome Powell has said the central bank wants to be more confident that inflation is returning to its 2% target.

The data Thursday appeared to weigh on investors’ hopes that the time for rate cuts will soon be at hand.

In bond markets, the yield on the benchmark 10-year U.S. Treasury note jumped to 4.297%, from 4.191% on Wednesday, its largest one-day gain in a month. Analysts say yields have climbed this week partly because of concerns that the hot inflation data could lead Fed officials to signal fewer rate cuts this year.

The rise in yields weighed on corners of the stock market sought out by investors for their chunky dividend payments. Real estate was the worst performer of the S&P 500’s 11 sectors, falling 1.6%, followed by utilities, with a decline of 0.8%.

Dollar General (DG) reported better-than-expected Q4 results but provided lower-than-expected FY24 earnings guidance

Dick's Sporting (DKS) reported upbeat Q4 earnings and revenue and raised its annualized dividend 10%

Former Treasury Secretary Steven Mnuchin told CNBC that he's "putting together" a group to buy TikTok

Altria Group (MO) intends to sell a portion of its investment in Anheuser-Busch InBev (BUD) and is using proceeds to increase its share buyback program

Alibaba (BABA) will take on Coupang (CPNG) with a $1.1B investment in South Korea, Nikkei reports

Meta (META) is suing a former VP over allegedly stealing documents, Bloomberg reports

Apple (AAPL) has bought Canada's DarwinAI as part of a race to add features, Bloomberg says

Lithium Americas (LAC) higher after receiving a $2.26B Thacker Pass project commitment from the DOE

Fisker (FSR) sinks after the Wall Street Journal reported that the company is preparing for a possible bankruptcy filing

Argus upgraded Oracle (ORCL) to Buy from Hold with a $145 price target after its Q3 earnings beat. The quarter marked the first time when rapidly growing cloud revenue crossed over to become a higher proportion of revenue than the company's legacy license support revenue, the firm tells investors in a research note.

Daiwa upgraded Goldman Sachs (GS) to Outperform from Neutral with a price target of $430, up from $410. The firm says the bank's negative catalysts have largely played out given its progress with restructuring in consumer operations and the recording of impairment losses on office real estate investments.

Goldman Sachs upgraded Citi (C) to Buy from Neutral with a $68 price target, implying 18% upside. The firm sees a "realistic path" to a 9.5% return on average tangible common equity in fiscal 2026, above consensus expectations.

Bernstein upgraded Instacart (CART) to Outperform from Market Perform with a price target of $43, up from $30. The firm left the company's Q4 earnings report with a more favorable view of the stock as it sees room for Instacart's gross transaction value growth to exceed consensus expectations.

Wedbush upgraded Jack in the Box (JACK) to Outperform from Neutral with a price target of $88, up from $79. The firm believes Jack in the Box's current 45% discount to franchised quick service restaurant peers and 21% discount to its own five-year pre-COVID median multiple "is an overly pessimistic assessment" of management's ability to deliver on same-store-sales growth and unit growth targets.

Evercore ISI downgraded Under Armour (UA) to Underperform from In Line with a price target of $7, down from $8, after the company announced that founder Kevin Plank will return as CEO, replacing Stephanie Linnartz, who joined last February. Plank's return is a "clear signal" that Under Armour's strategy isn't working and supports the firm's field work showing key performance indicators continue to deteriorate in the current quarter, Evercore argues. Exane BNP Paribas and Williams Trading also downgraded the stock but to Neutral-equivalent ratings.

Citi downgraded Chubb (CB) to Neutral from Buy with a price target of $275, up from $238. The firm believes the outlook for Chubb is adequately reflected in the shares, creating a more balanced risk/reward.

RBC Capital downgraded Spruce Biosciences (SPRB) to Sector Perform from Outperform with a price target of $2, down from $9. The company reported a CAHmelia-203 topline miss, with tildacerfont failing to achieve the primary endpoint, the firm tells investors in a research note. Leerink, Guggenheim, H.C. Wainwright, and Ladenburg also downgraded Spruce Biosciences to Neutral-equivalent ratings.

Raymond James downgraded Paymentus (PAY) to Market Perform from Outperform without a price target. The firm sees a "much more balanced" risk/reward profile following the stock's recent rally.

Wells Fargo downgraded UGI Corporation (UGI) to Equal Weight from Overweight with a price target of $28, up from $27. With momentum from the strategic review and "constructive" fiscal Q1 update, the risk/reward on the shares is more balanced at these levels, the firm argues.

Bernstein initiated coverage of Robinhood (HOOD) with an Outperform rating and $30 price target, which represents 83% upside. The "buy-side and sell-side alike refuse to see what we see," namely a "monster of a crypto cycle over 2024-25," the firm says.

Truist initiated coverage of Caterpillar (CAT) with a Buy rating and $390 price target. The firm believes Caterpillar stands to be one of the bigger beneficiaries of stimulus associated with infrastructure and energy transition, with each of its major business lines benefiting.

Guggenheim initiated coverage of Sirius XM (SIRI) with a Neutral rating and $4 price target. SiriusXM operates an industry-leading audio platform, and the firm expects the company to continue to deliver consistent free cash flow generation while returning excess free cash flow to shareholders.

Berenberg initiated coverage of Logitech (LOGI) with a Buy rating and $111 price target, representing 20% upside. The firm says the company is the market leader in multiple categories and sells its products through various brands.

Benchmark initiated coverage of Bitdeer (BTDR) with a Buy rating and $13 price target. Benchmark views the company as differentiated from its publicly traded peers due to its scalable infrastructure with one of the lowest all-in mining costs in the space, diverse revenue streams, and its recent expansion into artificial intelligence, high-performance computing solutions and the design and manufacture of advanced mining rigs.

化粧品小売りのアルタ・ビューティー(ULTA)は取引終了後に四半期決算を発表。

見通しが期待に満たず時間外取引で売られている。

日本株ADR・円換算終値

銘柄名 円換算終値(前営業日・東証終値比)

日立製作所 12403(-52 -0.42%)

ホンダ 1742(-10 -0.57%)

オリックス 3136(-5 -0.16%)

クボタ 2204(-4.5 -0.20%)

パナソニック 1357(-23.5 -1.70%)

みずほFG 2914(+15 +0.52%)

野村HD 903(-3.7 -0.42%)

トヨタ自動車 3426(-19 -0.55%)

この記事が気に入ったらサポートをしてみませんか?