2023 Nov 6, US Market

U.S. stocks rose Monday, building on a rally that pushed major indexes sharply higher over the past week.

The S&P 500 added 0.2%, while the Dow Jones Industrial Average inched up 35 points, or 0.1%. The tech-heavy Nasdaq Composite rose 0.3% for its seventh consecutive session of gains, the longest winning streak since January.

Major indexes are coming off their best week of the year, boosted by hopes that the Federal Reserve’s interest-rate hiking cycle is close to done and a strong quarterly earnings season that is in its final innings. The rally took a breather on Monday, with major indexes wavering before eking out modest gains.

The yield on the 10-year Treasury note rose to 4.662%, from 4.557% on Friday. Yields have fallen sharply over the past week after touching 5% for the first time in 16 years.

The mood in the market has quickly turned from dour to optimistic in recent sessions.

Third-quarter earnings so far have mostly impressed investors and are on track to show the first collective increase in a year. Americans have continued to dine out, take trips and shop online, giving a boost to consumer spending and helping drive profits for the country’s biggest corporations. Meanwhile, recent data on the job market have indicated the red-hot labor market is slowing, a sign that the central bank won’t keep raising interest rates.

Gains in the S&P 500’s information-technology sector helped outweigh losses in energy stocks such as Marathon Oil and Schlumberger. Companies including Disney and Roblox report earnings later this week.

The S&P 500 has bounced back recently after falling into a correction—a drop of at least 10% from a recent peak—in October. The benchmark index is up 14% for the year.

Some analysts said they expected the recent market calm to persist. The Cboe Volatility Index, or VIX, has fallen sharply from its highs over the past month.

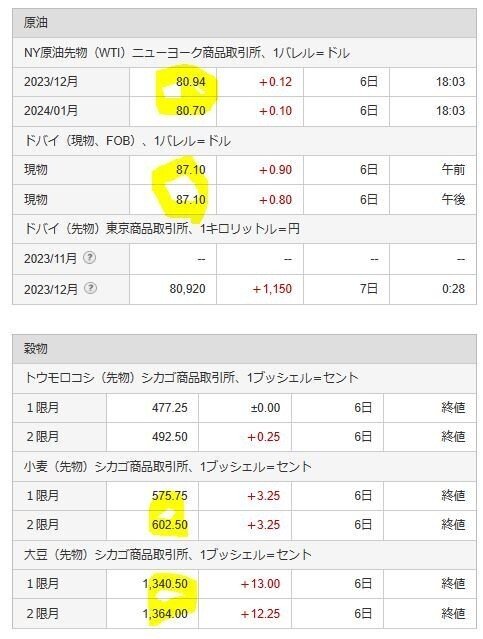

In commodities markets, crude-oil futures edged higher after Saudi Arabia and Russia over the weekend said they would extend production and export cuts into December. Brent futures closed at $85.18 a barrel, 0.3% higher than Friday’s closing level. Oil prices slid almost 5% last week, partly because the Israel-Hamas war hasn’t spread into a wider conflict.

DA Davidson upgraded Booking Holdings (BKNG) to Buy from Neutral with an unchanged $3,400 price target. The firm is looking to take advantage of the recent pullback in the stock - down 7% since the end of September - while reporting "solid" Q3 results and giving "encouraging" commentary for 2024.

Citi upgraded Visteon (VC) to Buy from Neutral with a $149 price target. The firm believes the recent weakness in the shares "presents a more compelling entry point."

UBS upgraded Clorox (CLX) to Neutral from Sell with a price target of $132, up from $124. Even after the stock's 9% rally post results last week, the risk/reward is balanced with concerns around relative share performance and the ability to return to volume growth offset by shares trading at a narrower premium to peers and the potential for a meaningful earnings recovery in fiscal 2025, the firm says.

Keefe Bruyette upgraded Bank of America (BAC) to Market Perform from Underperform with a price target of $30, up from $29. The firm cites the recent decline in long-term rates following the better-than-expected productivity report and weaker than expected jobs report for the upgrade.

Keefe Bruyette upgraded KeyCorp (KEY) to Outperform from Market Perform with a price target of $15, up from $12.50. The firm believes the recent labor productivity and jobs reports are "game changers," resulting in a material easing of the pressure on long-term rates and thus improved visibility on capital.

BofA double downgraded Paramount (PARA) to Underperform from Buy with a price target of $9, down from $32. The firm's prior bullish thesis and valuation methodology was predicated on Paramount's inherent asset value in a potential sale, but it does not appear any significant asset sales are on the horizon despite the company receiving credible bids for several different assets, such as Showtime and BET.

OTR Global downgraded its view on Baidu (BIDU) to Negative from Mixed as its checks found brand advertisers shifted budgets away from Baidu search during Q3 as they sought better search formats and performance in social media, short video and e-commerce.

HSBC downgraded SolarEdge Technologies (SEDG) to Hold from Buy with a price target of $80, down from $243. The firm says the company's revenue and margin guidance cut was worse than expected due to more painful channel destocking in Europe. Wells Fargo also downgraded SolarEdge Technologies to Equal Weight from Overweight with a price target of $82, down from $190.

Raymond James downgraded Bloomin' Brands (BLMN) to Outperform from Strong Buy with a price target of $28, down from $29. The firm continues to see value in the shares and potential catalysts from activist Starboard, but says this is offset by Outback Steakhouse's continued traffic underperformance.

HSBC downgraded Fortinet (FTNT) to Hold from Buy with a price target of $49, down from $75. The company's revenue and billing guidance suggests a structural slowdown in the secure connectivity segment, the firm tells investors in a research note.

Telsey Advisory initiated coverage of Birkenstock (BIRK) with an Outperform rating and $47 price target. The heritage footwear brand "rooted in function, quality, and tradition" has a loyal customer base, "strong" topline trends and "an industry-leading margin profile," all while it has been expanding its portfolio and reach, the firm says. William Blair, JPMorgan, Jefferies, Mizuho, Citi, Baird, Goldman Sachs, BMO Capital, Piper Sandler, Stifel, and Williams Trading also started coverage of Birkenstock with Buy-equivalent ratings. Not as bullish, BofA, HSBC, Morgan Stanley, UBS, and Deutsche Bank initiated the name with Neutral-equivalent ratings.

Barclays initiated coverage of WK Kellogg (KLG) with an Underweight rating and $11 price target. The firm sees the next of couple of years as a "likely challenging transition" period for WK Kellogg, in light of a flat sales outlook in a declining ready-to-eat cereal category.

Mizuho initiated coverage of Bilibili (BILI) with a Buy rating and $18 price target. The firm expects the company to successfully transition its products to more than double the total addressable market, accelerate sales growth to double digits, and reach profitability in fiscal 2024.

RBC Capital initiated coverage of Confluent (CFLT) with an Outperform rating and $22 price target. The firm views the company's 2024 estimates are more reasonable post the Q3 report and sees upside as likely.

H.C. Wainwright initiated coverage of Bitcoin Depot (BTM) with a Buy rating and $6 price target. The firm says the company is one of the very few investment vehicles that provides investors with exposure to the secular growth in bitcoin adoption, and a "durable and growing earnings stream" that isn't directly correlated to bitcoin price levels.

PepsiCo (PEP) CFO Hugh Johnston will leave the company to become CFO of Disney (DIS)

Dish (DISH) announced downbeat Q3 results and announced that CEO W. Erik Carlson will resign

Hilton Grand Vacations (HGV) agreed to acquire Bluegreen Vacations (BVH) in an all-cash transaction, representing total consideration of approximately $1.5B, inclusive of net debt

AAON (AAON) named Matt Tobloski as president and COO

Halliburton (HAL) and Oil States (OIS) entered into a strategic collaboration to provide customers with deepwater managed pressure drilling solutions

Tesla (TSLA) is planning to build a $26,838 car at its factory near Berlin, Reuters says

General Motors (GM) spent an average of $588M per quarter on Cruise over the last year, NY Times says

Lucid (LCID) has cut the prices of its Air range of luxury sedans, Reuters reports

Citi (C) weighs major layoffs as part of CEO Jane Fraser's reorganization, CNBC reports

Cigna (CI) is exploring the sale of its Medicare Advantage business, Reuters says

NRG Energy (NRG) higher after announcing a $950M share repurchase program

Celldex (CLDX) gains after announcing barzolvolimab met the primary endpoint in its Phase 2 urticaria study

Novo Nordisk (NVO) increases in New York after entering a collaboration with Genevant

MoonLake (MLTX) falls in New York after announcing Phase 2 results for Nanobody sonelokimab

Bumble (BMBL) declines after announcing Lidiane Jones, CEO at Slack, will succeed Whitney Wolfe Herd as CEO

Post Holdings (POST) reported preliminary Q4 results and announced CEO Vitale will take a medical leave of absence

OptimizeRx (OPRX) reported Q3 results and provided guidance for FY23 and FY24

TreeHouse (THS) announced Q3 results and cut its FY23 guidance

Freshpet (FRPT) reported Q3 results and raised its FY23 guidance, with CEO

Billy Cyr commenting "FY23 is shaping up to be the kind of year we had hoped it would"

A.O. Smith (AOS) is targeting adjusted EPS CAGR Of 7%-9% in 2024-2028

この記事が気に入ったらサポートをしてみませんか?