2024 Mar 13, US Market

The S&P 500 edged lower on Wednesday, weighed down by a drop in tech shares.

Four of the S&P 500’s 11 sectors finished the day in the red. The declines were led by the information technology sector—the best-performing segment this year and last. Those stocks fell 1.1%.

Chip maker shares helped pull that sector down, including declines from Intel and Advanced Micro Devices. The PHLX Semiconductor Index shed 2.5%.

Nvidia NVDA -1.12%decrease; red down pointing triangle, the biggest winner of the artificial-intelligence mania that has powered the stock-market rally, dropped 1.1%.

Traders were still digesting Tuesday’s inflation data, which showed consumer prices rose slightly more than expected for the second month in a row. But inflation has eased significantly from its recent peak, and most investors still expect the Federal Reserve to cut interest rates at some point this year. That has given riskier assets such as stocks a boost.

Investors will get a fresh look at how U.S. consumers are faring Thursday morning, when retail sales data for February are released.

Though the mood on Wall Street remains decidedly bullish, some investors have reassessed when and exactly how much the Fed might cut rates this year.

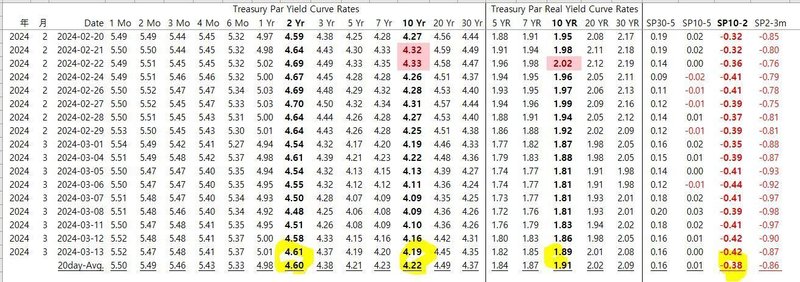

The yield on the 10-year Treasury note settled at 4.191%, up from 4.154% on Tuesday.

U.S. crude oil futures rose 2.8%, settling at $79.72 per barrel. Energy stocks were the best performers in the S&P 500, rallying 1.5%.

Among individual stocks, Dollar Tree shares fell 14% after the retailer reported a quarterly loss and said it would close nearly 1,000 of its Family Dollar stores.

McDonald’s fell 3.9% after the company said at an investor conference that lower-income consumers are eating at home more often.

Eli Lilly (LLY) is partnering with Amazon (AMZN) to deliver Zepbound and other drugs, according to Reuters

Dollar Tree (DLTR) reported lower-than-expected Q4 results and provided Q1 and FY24 guidance

Williams-Sonoma (WSM) reported better-than-expected Q4 earnings and revenue and increased its quarterly dividend 26%

JPMorgan (JPM) CEO Jamie Dimon has endorsed Disney's (DIS) Bob Iger in a proxy fight with Trian Partners, CNBC reports

The HHS has confirmed a probe into the UnitedHealth (UNH) cyberattack

U.S. President Joe Biden is set to voice concerns over Nippon Steel's (NPSCY) proposed takeover of U.S. Steel (X), FT says

The House has passed a measure that could ban TikTok in the U.S., The Verge reports

Shell (SHEL) will eliminate 20% of the jobs in its sales team, Bloomberg reports

Samsung (SSNLF) is halting old equipment sales amid fears of U.S. backlash, FT reports

The Pentagon has dropped is plan to spend $2.5B on a chip grant to Intel (INTC), Bloomberg says

▶Intel Corp.'s shares fell 3% Wednesday as the Pentagon withdrew a planned $2.5 billion chip grant for the semiconductor company, according to Bloomberg.

▶President Biden’s spending package has allocated $3.5 billion in defense funding for Intel, but the company may now have to turn to the Commerce Department.

▶Intel aims to secure more than $10 billion in incentives from the CHIPS and Science Act.

3M (MMM) CEO Michael Roman said the company has raised its Q1 earnings per share guidance

Jefferies upgraded Southwest Airlines (LUV) to Hold from Underperform with a price target of $28, up from $20. The firm believes the recent selloff "finds a floor" for the shares.

Baird upgraded Texas Roadhouse (TXRH) to Outperform from Neutral with a price target of $175, up from $160. The shares "still may have plenty of room to run" even when factoring in the recent strength, the firm tells investors in a research note.

DA Davidson upgraded Nice (NICE) to Buy from Neutral with a price target of $300, up from $250. The company's "strong" Q4 results displayed strong underlying growth dynamics and a better-than-expected profitability ramp, the firm says.

JPMorgan upgraded Cooper Companies (COO) to Overweight from Neutral with a price target of $120, up from $100. Cooper's trends remain robust in contact lenses, where healthy market trends, pricing power, exposure to high growth subsegments, and wins in new fits have driven growth in the high single to low double digits, consistently above the market, the firm tells investors in a research note.

Goldman Sachs upgraded Moelis (MC) to Neutral from Sell with a price target of $58, up from $53, implying 13% total return potential. The merger and acquisition cycle is improving, and the firm believes Moelis is well positioned to benefit.

Wells Fargo downgraded Tesla (TSLA) to Underweight from Equal Weight with a price target of $125, down from $200. The firm expects the company's volume to disappoint as price cuts are having a diminishing impact on demand.

Argus downgraded Humana (HUM) to Hold from Buy. The company faces headwinds to revenue and earnings growth as its profit margin is squeezed by an unanticipated spike in medical utilization among its Medicare Advantage members, and this elevated utilization observed in Q4 is likely to continue in 2024, the firm says.

Baird downgraded FIS (FIS) to Neutral from Outperform with a price target of $78, up from $76. The firm likes the company's "return to solid execution and beat/raise pattern," sees the risk/reward as "pretty balanced."

Citi downgraded Cleveland-Cliffs (CLF) to Neutral from Buy with an unchanged price target of $22. The company's EBITDA "has underwhelmed" relative to the strength of underlying steel markets, the firm tells investors in a research note.

Maxim downgraded SurgePays (SURG) to Hold from Buy with no price target. The company's Q4 results were just below consensus, but more importantly, SurgePays disclosed that the U.S. Government's Affordable Connectivity Program, or ACP, has unexpectedly stopped taking new applications in February, creating uncertainty that the program will be re-funded when its initial $14.2B in funding runs out, firm notes.

Goldman Sachs initiated coverage of Royal Caribbean (RCL) with a Buy rating and $162 price target. The firm says Royal offers "best in class execution," with the most exposure to incremental pricing tailwinds.

Goldman Sachs initiated coverage of Carnival (CCL) with a Buy rating and $20 price target. The firm sees the setup for Carnival into 2024 as the most favorable, with the company providing conservative guidance despite a larger occupancy recovery to come given its higher Europe exposure.

Goldman Sachs initiated coverage of Norwegian Cruise Line (NCLH) with a Neutral rating and $19 price target. The firm says that while Norwegian has made "strong headway" in the past year, it remains on the sidelines, believing the company's 2024 guidance factors in relatively little conservativism.

Goldman also views Norwegian's ongoing cost efficiencies as a "show-me" story.

Evercore ISI reinstated coverage of Campbell Soup (CPB) with an In Line rating and $49 price target, citing a sum-of-parts analysis. The firm expresses "optimism" for snacks and the acquired Sovos business, offset by lack of growth in the legacy Meals & Beverage, or M&B, business.

Argus initiated coverage of Axon (AXON) with a Buy rating and $380 price target. The company's shares should continue to outpace the broader market driven by its strong management team and robust earnings prospects as demand for its products and solutions remains strong, the firm says.

この記事が気に入ったらサポートをしてみませんか?