2023 Dec 5, US Market

Treasuries resumed their rally on Tuesday, fueling speculation that the Federal Reserve will be able to cut interest rates next year to avoid a recession.

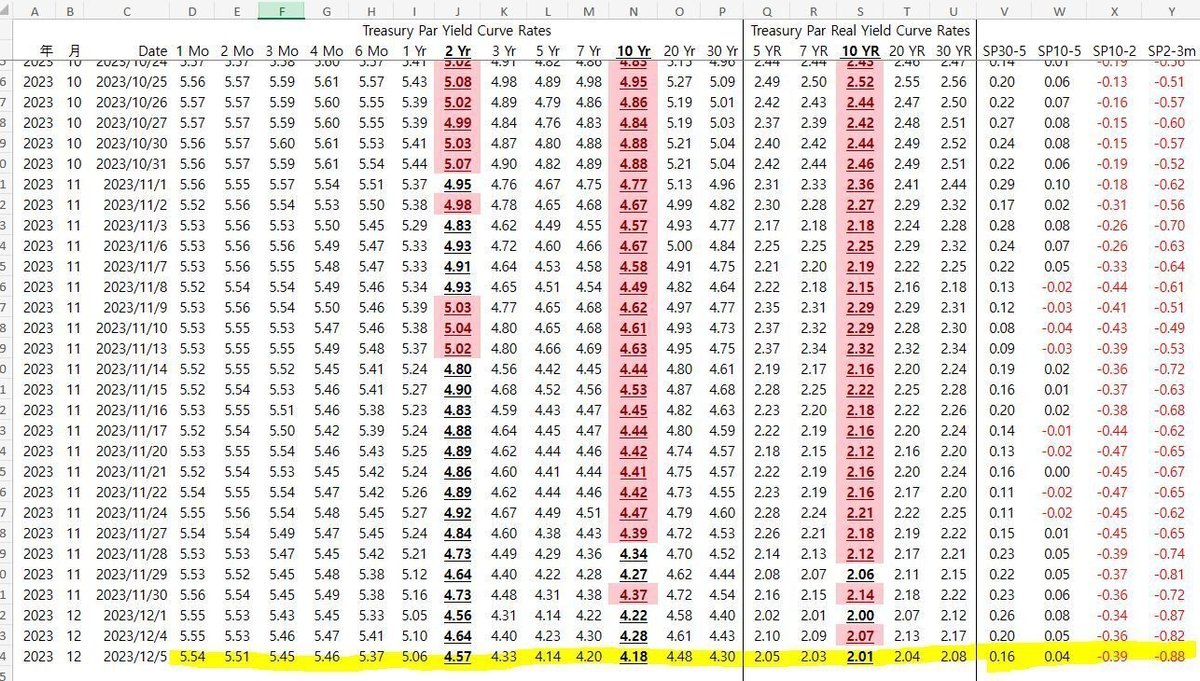

Benchmark 10-year yields fell below 4.2% on Tuesday, after data showed job openings fell to their lowest level since 2021. However, concerns about markets being too quick to anticipate Fed easing have surfaced, emphasising the risks for traders anticipating a pivot. It's a wager that could pay off handsomely if rate cuts occur, or it could backfire if policymakers choose to keep borrowing costs higher for longer.

The Job Openings and Labour Turnover Survey, or JOLTS, trailed all estimates in a survey of economists in a week dominated by labor-market readings. The report came just a few days before the key payrolls report, which is expected to show employers added 187,000 jobs in November.

Treasuries joined a global bond rally after one of the European Central Bank's most hawkish officials said inflation is slowing in a "remarkable" way. The S&P 500 remained relatively unchanged. Banks fell following KeyCorp's outlook for non-interest income. Apple and Nvidia both gained at least 2.1% in the megacap space. Bitcoin has surpassed $43,000.

Swap contracts predicting the outcome of Fed meetings have slightly increased the amount of easing they expect by the end of 2024, with the effective fed funds rate expected to fall to around 4.05% from 5.33% currently. The contracts also assume a 60% chance of a March rate cut.

Wells Fargo upgraded Integra LifeSciences (IART) to Overweight from Equal Weight with a price target of $49, up from $40. The firm now has increased confidence in the company's ability to restart commercial distribution from its Boston facility by mid-to-late Q2 of 2024.

Wells Fargo upgraded Crown Castle (CCI) to Equal Weight from Underweight with a price target of $115, up from $90. The involvement of Elliott and the potential for a strategic shake-up should provide some downside protection for the shares, even if material upside is limited, the firm tells investors in a research note.

BofA upgraded Apellis (APLS) to Buy from Neutral with a price target of $85, up from $52. The company's Syfovre label for geographic atrophy was updated to include the safety events of vasculitis with or without occlusion and did not include a black box warnings, the firm notes.

Mizuho upgraded First Industrial Realty (FR) to Buy from Neutral with an unchanged price target of $55. The firm sees a positive risk/reward at current share levels.

JPMorgan upgraded XP Inc. (XP) to Overweight from Neutral with a price target of $30, up from $27. The firm says XP's take rate will benefit both from asset class mix, as well as fees on a per-segment basis.

Raymond James downgraded Lululemon (LULU) to Outperform from Strong Buy with a price target of $495, up from $440, following the recent stock rally, reflecting some upside being factored in. The firm expects an in-line Q3, but is modeling slower growth for Q4, in line with implied guidance.

Mizuho downgraded Prologis (PLD) to Neutral from Buy with a price target of $125, down from $140. The firm sees a balanced risk/reward and more limited upside to the price target.

UBS downgraded United Rentals (URI) to Neutral from Buy with a price target of $525, up from $504. The firm says a slower cycle and above average multiple equal more limited upside for the shares.

JPMorgan downgraded SAIC (SAIC) to Neutral from Overweight with a price target of $142, up from $130, citing valuation with the stock up 24% year-to-date.

Needham downgraded Staar Surgical (STAA) to Hold from Buy and removed the firm's prior $49 price target following an ophthalmology survey with 35 respondents to get updated checks on key vision care segments. While it's clear Staar's U.S. launch has been slower than expected, the firm believes its survey results are negative and imply there could be downside to the domestic launch.

Scotiabank initiated coverage of Datadog (DDOG) with an Outperform rating and $138 price target. Datadog has emerged as a leader in the observability market with a clear differentiation in cloud-native environments, says the firm, which adds that 2024 estimates are at a level it views as "eminently achievable."

Wells Fargo initiated coverage of Marriott (MAR) with an Equal Weight rating and $220 price target. The firm says Marriott has an attractive fee-based business with multiple growth drivers and favorable exposure to 2024 tailwinds, but at 15-times 2024 EV/EBITDA, Wells views risk/reward as even.

Wells Fargo initiated coverage of Hyatt Hotels (H) with an Overweight rating and $138 price target, implying 15% upside. The firm views the company's ongoing asset-light transition as highly accretive.

Wells Fargo initiated coverage of Hilton (HLT) with an Equal Weight rating and $168 price target. The firm says that while there's a lot to like about Hilton - including compounding fee growth, accelerating NUG, capital return -, at 15-times 2024 EV/EBITDA, risk/reward is fairly even.

Scotiabank initiated coverage of Dynatrace (DT) with an Outperform rating and $62 price target. DPS and Grail should support NRR and help squeeze out point-product peers and the firm sees "a beat/raise story" for FY24 with "the path of least resistance higher for Dynatrace shares."

CVS Health (CVS) introduced a new pharmacy reimbursement model, reiterated its FY23 earnings guidance, and raised its quarterly dividend

Take-Two's (TTWO) Rockstar said that "Grand Theft Auto VI" will release on PlayStation 5 (SONY) and Xbox Series X/S (MSFT) in 2025

Johnson & Johnson (JNJ) provided downbeat adjusted earnings guidance for FY24

J.M. Smucker (SJM) reported upbeat Q2 earnings but lowered its FY24 earnings outlook

AutoZone (AZO) reported better-than-expected Q1 results

A group of 83 Spanish media outlets has filed a $600M lawsuit against Meta (META), Reuters reports

GM's (GM) Cruise faces fines for withholding information on a accident that occurred in early October, TechCrunch says

Allete (ALE) working with bank to explore possible sale, Reuters reports

New PayPal (PYPL) CEO Alex Chriss is fast-tracking upgrades amid competition, The Information reports

Diageo (DEO) is looking to sell part of its beer portfolio, Axios reports

EyePoint (EYPT) higher after announcing a $175M stock offering

Robinhood (HOOD) increases after disclosing customers contributed $1.4B of net deposits in November

Marathon Digital (MARA) gains after announcing it produced 1,187 bitcoin in November

Replimune Group (REPL) drops after announcing the CERPASS trial in CSCC did not meet either of the two primary endpoints

Designer Brands (DBI) falls after reporting quarterly results and cutting its FY23 guidance

GitLab (GTLB) reported Q3 results and raised its FY24 guidance

Signet Jewelers (SIG) announced results for Q3 and widened its FY24 outlook

G-III Apparel (GIII) reported Q3 results, with CEO Morris Goldfarb commenting "we delivered strong profitability… driven by strength across our wholesale segment, our prudent inventory management and our financial discipline"

SAIC (SAIC) announced Q3 results, raised its FY24 guidance, and provided its outlook for FY25

Joann (JOAN) reported Q3 results and provided guidance for FY24

この記事が気に入ったらサポートをしてみませんか?