2023 Dec 15, US Market

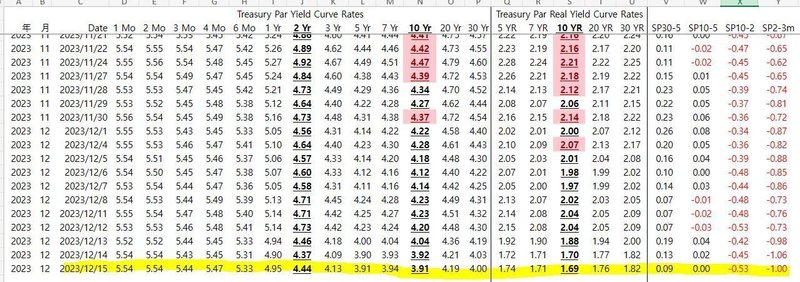

This week, Wall Street threw its weight behind stocks and bonds as Jerome Powell hinted that the Federal Reserve's aggressive rate-hiking campaign may be coming to a stop.

The Nasdaq 100 closed at an all-time high for the first time in two years, with the S&P 500 and the tech-heavy gauge both notching seven-week winning streaks on the back of the Fed's dovish tone.

Resistance from New York Fed President Williams, who told CNBC today that speculating about a March rate decrease was "premature," failed to dampen sentiment.

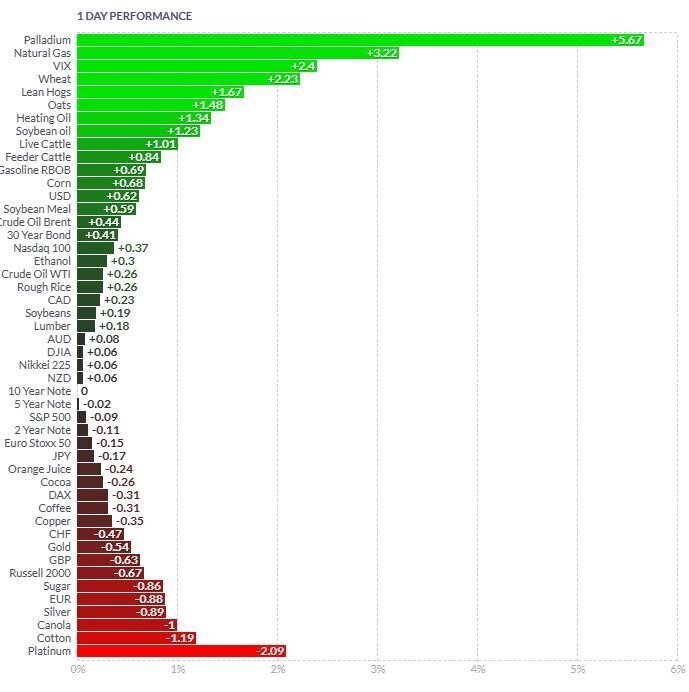

The S&P 500 finished the day unchanged, while the Dow Jones Industrial Average benchmarks climbed 0.2%, with US Treasuries neutral.

The Fed's Bostic claimed that he was only betting on two quarter-point rate reductions in the latter half of 2024, but swaps traders were anticipating up to six rate cuts next year.

Costco (COST) reported what analysts called "solid" fiscal Q1 results coupled with the "early" surprise of a $15 per share special dividend that will be coming early next month

Olive Garden parent Darden (DRI) reported better-than-expected Q2 profit and raised its FY24 adjusted EPS view

The Securities and Exchange Commission denied a Petition for Rulemaking filed on behalf of Coinbase Global (COIN)

Citi (C) is exiting the municipal bond business, WSJ reports

Chobani announced a deal to acquire La Colombe for $900M that involves the exchange of Keurig Dr Pepper's (KDP) minority equity stake in the coffee company into Chobani equity

DocuSign (DOCU) in early stages of exploring sale, WSJ reports

Callon Petroleum (CPE) exploring sale after receiving interest, Bloomberg reports

Google (GOOGL) plans to use Gemini across nearly its entire line of products, The Information says

Activist investor Ancora has built a stake in Elanco Animal Health (ELAN) and is urging for changes at the company, Bloomberg reports

Elevance Health (ELV), HCSC vying for Cigna's (CI) Medicare Advantage unit, Bloomberg says

Homebuilder Lennar (LEN) declined despite reporting what Co-CEO Stuart Miller described as "another strong quarter"

Palantir (PLTR) higher after announcing the extension of its partnership with the U.S. Army's Program Executive Officer for Enterprise Information Systems to continue operating the Army Vantage operations and platform

Hershey (HSY) slips after BofA downgraded the shares

Hanesbrands (HBI) falls after announcing chairman Ronald Nelson will retire and William Simon has been chosen to succeed

Exelon (EXC) lower after BofA, Guggenheim and Evercore downgraded the stock following yesterday's "adverse" Illinois regulatory update

Genius Group (GNS) provided guidance for FY23

Scholastic (SCHL) reported Q2 results and cut its FY24 guidance

Quanex (NX) reported Q4 EPS and revenue that beat consensus, but slid after issuing comments on sales expectations for FY24

Utz Brands (UTZ) reaffirmed its FY23 revenue guidance

BofA upgraded Micron (MU) to Buy and Stifel raised the firm's price target on the shares ahead of the company reporting fiscal Q1 earnings this coming Wednesday

Wells Fargo upgraded General Electric (GE) to Overweight from Equal Weight with a price target of $144, up from $115, following a transfer of coverage. GE combines an "attractive business with high aftermarket mix," as well as solid management team and clean balance sheet, the analyst says.

Bernstein upgraded Illumina (ILMN) to Market Perform from Underperform. Since the firm's initiation, Illumina has pulled prior margin guidance and consensus revenue estimates have dropped the analyst tells investors in a research note.

Morgan Stanley upgraded Omnicom (OMC) to Overweight from Equal Weight with a price target of $100, up from $90. The analyst sees advertising spending growth accelerating in 2024 as retail and commerce media builds, connected TV sees new entrants, technology vertical spending rebounds, and and cyclical factors like politics and Olympics contribute.

Deutsche Bank upgraded L3Harris Technologies (LHX) to Buy from Hold with a price target of $240, up from $184, which reflects 16% upside potential. The analyst sees "three bifurcations" in L3Harris' relative equity story.

BofA upgraded AMD (AMD) to Buy from Neutral with a price target of $165, up from $135. The firm, which expects some intra-sector rotation after a 60% year-to-date run in the SOX, also expects continued secular growth tailwinds in Generative AI, chip complexity, auto content, fab reshoring, and CHIPS Act benefits.

Deutsche Bank downgraded Northrop Grumman (NOC) to Hold from Buy with a price target of $473, down from $541. The firm says its previous investment thesis is "increasingly untenable" in the face of incremental cost challenges on the Sentinel program.

JPMorgan downgraded BlackRock (BLK) to Neutral from Overweight with an unchanged price target of $708. The shares have outperformed meaningfully in Q4 as expectations build for BlackRock to be the leading beneficiary of a transition to fixed income products and exchange traded funds from other asset classes, the analyst tells investors in a research note.

BofA downgraded Kimberly-Clark (KMB) to Underperform from Neutral with a price target of $115, down from $135. The company has seen margin expansion through 2023 due to benefits from pricing, cost savings and improved input costs, but looking out to 2024 the firm sees the gross margin landscape as "less certain" as pricing benefits wane and higher oil prices possibly impact raw material inputs, the analyst tells investors.

MoffettNathanson downgraded Roku (ROKU) to Sell from Neutral. The firm had taken its prior Sell call off the stock heading into Roku's Q3 earnings on a belief that the company was getting more focused on efficiency and margin expansion, but "at over $100 per share now, Roku's share price has nearly doubled since then."

BofA downgraded Axcelis (ACLS) to Neutral from Buy with a price target of $150, down from $180. The firm, which expects some intra-sector rotation after a 60% year-to-date run in the SOX, also expects continued secular growth tailwinds in Generative AI, chip complexity, auto content, fab reshoring, and CHIPS Act benefits.

Jefferies initiated coverage of First Solar (FSLR) with a Buy rating and $211 price target. In times of economic uncertainty, alternative energy companies with exposure to utility-scale, strong backlog and balance sheets have better risk/rewards, the analyst tells investors in a research note.

UBS initiated coverage of Box (BOX) with a Buy rating and $33 price target. While the firm doesn't expect new offerings or plans to launch until late calendar year 2024, it is optimistic Box can deliver margin expansion ahead of expectations in the near-term.

Susquehanna initiated coverage of Palo Alto Networks (PANW) with a Positive rating and $400 price target. Within the broader software universe, the firm is "bullish" on the cybersecurity software space as it see cyber budgets and use cases continuing to grow given "an ever-evolving threat landscape, internal and external innovation, and requirements from both regulators and insurers," the analyst tells investors.

B. Riley last night initiated coverage of Genesco (GCO) with a Buy rating and $43 price target. The analyst views Genesco as a "deep-value stock story with a combination of strategic positioning attributes, multiple self-help profit growth drivers, and one of the more experienced and talented senior management/board of director teams."

Wells Fargo initiated coverage of TE Connectivity (TEL) with an Equal Weight rating and $144 price target. The firm is cautious on margin upside given challenges in various end-markets, the analyst tells investors in a research note.

この記事が気に入ったらサポートをしてみませんか?