Prospect on stock market next week (Sep25th~Sep29th)

This report is an AI English translation of the Japanese original. The Japanese version of the content takes precedence.

1.Introduction

The current market is dominated by "U.S. interest rates. Depending on the trend of U.S. interest rates, the trend of the stock market by the end of the year will also change. We are entering a very important phase. One of the themes of this issue is "the financial environment in which the U.S. real interest rate exceeds 2%. First, let us address the key points about the recent FOMC meeting.

2.Surprise for the FOMC, which was supposed to be no-wind

① Market conditions before the FOMC meeting

At the recent FOMC meeting, around 97% of the respondents expected the policy rate to remain unchanged, and from the beginning, the market's attention was focused on Chairman Powell's press conference, the quarterly economic outlook, and the dot chart. The market had assumed that the policy rate would be left "hawkishly unchanged. This was expected to indicate that the policy rate would remain unchanged for the time being, but that it was not yet finished raising interest rates to control inflation, and that it would not immediately begin to cut rates after the rate hike was halted.

Incidentally, the U.S. economic developments since July through September have continued to be satisfactory to Chairman Powell. That is, while it was said last year that it would be "almost impossible" for the Fed to control inflation without a recession, since June, words such as "soft landing" or "no landing" have been frequently heard. The Fed's famous inflationary retreat by Fed Chairman James Volcker in the 1980s has been a major side-effect of the Fed's policy. The side effects were significant. Volcker raised the policy rate to more than 20% under conditions of 14% inflation, and he defeated inflation by force. But the price to pay was that unemployment rose to over 10% and GDP fell into deep negative growth.

Compared to the damage to the economy as a result of this Volcker-era inflation retreat, Chairman Powell's current inflation retreat, while not yet complete, has left the U.S. economy surprisingly strong. Chairman Powell, until last year, was somewhat lackluster, often criticized for downplaying inflation and being slow in responding to it, but of late he has assumed an imposing demeanor that suits his purple tie; he must be confident in the Fed's view and monetary policy.However, it is clear that the Fed is still not optimistic about the situation. The U.S. economy is too strong. This has led to a loosening of the monetary environment even amid rate hikes, which could lead to a resurgence of inflation. The chart below shows the Chicago Fed's Financial Conditions Index, which shows that financial markets are loosening month after month.

Furthermore, in the external environment, crude oil, diesel fuel, and other commodities have been rising sharply. As for Canada, the largest trading partner of the U.S., the CPI statistics just before the FOMC meeting showed very strong numbers. In addition to higher energy prices, rental prices and housing interest costs are also rising, indicating that fighting off inflation will not be easy. This strong Canadian CPI may have also influenced Chairman Powell's hawkish tone this time around.

Given this environment, the market entered the FOMC meeting assuming that the policy rate would remain unchanged, but that the press conference would show a hawkish stance.

② Key points of this FOMC meeting

A detailed explanation of the FOMC meeting will be omitted. I will skip over the details of the FOMC meeting and focus only on the important points. Colby Smith of the Financial Times asked an important question at the press conference. He asked the following question:

"With respect to the 2024 projections, what is behind the decision to reduce the path of interest rate cuts and the need to raise real interest rates 50 basis points higher, even though the inflation outlook has not changed?"

Excellent question. Every time BOJ Governor Ueda holds a press conference, the reporters ask him some ridiculous question, but it is just a waste of time. I wish they would take a cue from the U.S. press when it comes to the quality of their questions.

The Fed's inflation forecasts for core PCE were 3.7% for 2023, 2.6% for 2024, 2.3% for 2025, and 2.0% for 2026, which is the first time the Fed has presented such a forecast. This means that the Fed has not changed its forecast for next year's inflation. In other words, the Fed did not change its inflation forecast for next year. In contrast, the dot chart, which is an aggregate of the Fed members' forecasts for the FF rate, showed a significant upward revision in the median forecast for 2024, from 4.75% to 5.25%. Normally, upward revisions to the dot chart are accompanied by upward revisions to the inflation outlook to achieve consistency, which is exactly what Colby Smith was referring to when he pointed out the question behind the 50 basis points higher real interest rate. The real interest rate here means the Fed's rate hike forecast minus the core PCE forecast. It would be understandable if the Fed raises real interest rates because of the difficulty in fighting off inflation, but why is it necessary to raise real interest rates by 50 basis points when the inflation outlook remains unchanged? This is the kind of question we are asking.

Chairman Powell's answer to this question was less clear. The dot chart is an accumulation of the projections submitted by each member, and there has been no coordination, negotiation, or reconciliation. It's just a median. Therefore, it cannot be called a real plan. However, it still reflects the fact that the economy is stronger than each member had assumed.

However, the market is not convinced by that. The market can easily imagine a case in which the real interest rate is raised even though the inflation outlook has not changed: "the neutral interest rate in the U.S. is rising. This neutral interest rate debate has been a hot topic of discussion many times this year; it is still fresh in our minds that even before the Jackson Hole meeting in August, the market was abuzz with the neutral interest rate debate. And if the neutral rate is rising, the level of the U.S. very long-term interest rate will be raised.

Before the FOMC meeting, U.S. interest rates had been driven by short-term interest rates, but after the FOMC meeting, the 30-year rate led the rise in U.S. interest rates in the form of a sharp increase. This is precisely the reason why.

By the way, the FOMC's outlook for the neutral interest rate (Longer Run) remained unchanged at a median of 2.5% this time. The table below shows the variation in the FOMC's forecast of the Longer Run since last September. The median (yellow) has not changed, but the variation has widened considerably. The red numbers are the number of members who expect the neutral rate to be above 3%. In September of last year, there were two members, but this time the number has expanded to five. It is likely that the disagreement within the Fed regarding the neutral interest rate will intensify in the future.

③ Financial Environment with Real Interest Rates Above 2%

Last year, the relationship between U.S. real interest rates and stock prices was well synchronized. In other words, the term "real interest rates" has become quite familiar, as U.S. stocks have repeatedly plunged when real interest rates have risen sharply.The chart below shows the change in real interest rates since last year. The real interest rate here is the U.S. nominal 10-year rate minus the breakeven 10-year rate. As shown below, it was above -100bp around February of last year. From there, it jumped to +175bp in October. This is the first time in the U.S. that interest rates have risen nearly 300bp in such a short period of time.

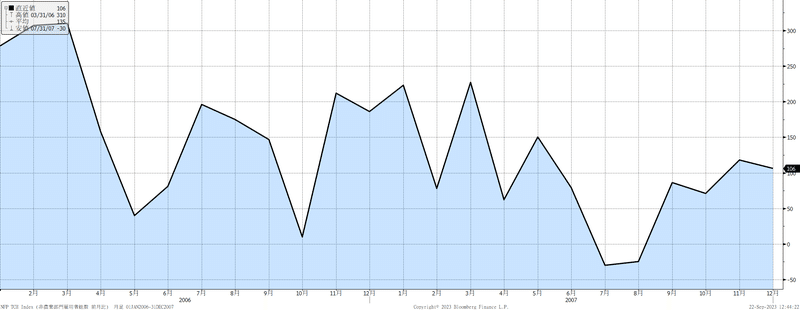

Last year, the upper limit was around 175bp, but after this FOMC meeting, it clearly exceeded 200bp. This is the so-called entry into a financial environment with real interest rates above 2%. Looking back at the past, there is actually a phase that is a bit similar to the present. This is the financial environment in the U.S. from 2006 to 2007.The chart below shows the FF rate and real interest rate at that time. Former Fed Chairman Greenspan raised the FF rate from 1% to 5.25% from 2004 to 2006, and the rate has remained at a high 5.25% for more than a year since then. This is what we now call a "Higher for Longer" situation. The real interest rate during this period was an environment of over 2%. Real interest rates have hovered between 2% and 2.7%.

Let's look a little more at the situation back then. What was the environment like? The chart below shows the CPI, which hovered between 1% and 4%, averaging around 3%, which was higher than the Fed's inflation target.

The core CPI has generally remained stable in the 2% range. (Figure below)

The following chart shows the price of crude oil at that time, which rose significantly through the second half of 2007, driving up the overall inflation rate.

Again, the FF rate remained as high as 5.25% for a long period of time.

Real GDP during this period hovered around the 2% level, but was still below the potential growth rate at the time.

In the labor market, nonfarm payrolls have fallen at a pace of 150,000 jobs and in the second half of the year.

The unemployment rate was stable at the full-employment rate situation at the time, but rose rapidly in the second half of the year.

As for stock prices, as shown in the chart below, they have remained steady even in an environment with real interest rates above 2%.

Finally, the chart below shows real interest rates (bottom) and nominal interest rates (top). In a financial environment where real interest rates are above 2%, the level of the 10-year nominal interest rate in the US is above 5%.

In other words, at this FOMC meeting, the Fed indicated a real interest rate of 2.5% for 2024, and if the current U.S. economy adapts to that environment and remains stable as in 2006-2007, it is not a very strange story for the market to believe that the U.S. long-term interest rate will rise toward 5%. The chart below shows the spread between 10-year and 2-year U.S. interest rates in 2006-2007. It has remained nearly flat for a long time. In other words, under the Higher for Longer strategy, keeping the FF rate high, short-term and long-term interest rates converge at the same level until economic conditions break down.

Currently, the 2-year rate is above 5%, while the 10-year rate is around 4.5%, and if we were to follow the situation in 2006-2007, all U.S. interest rates for various years would converge in the low 5% range. In other words, there is still a possibility that U.S. interest rates will rise.

④ Outlook for U.S. Interest Rates

Although I have mentioned the possibility of a rise in U.S. interest rates, I do not expect U.S. long-term interest rates to rise that much this time around. The reason for this is "the state of the global economy," "doubts about the continued strength of the U.S. economy," and "uncertainty about the neutral interest rate debate. From 2007, the subprime loan problem gradually became apparent, eventually leading to the Lehman Shock of 2008, but this was still a period when the problem was hidden. In contrast, the current global economy is not at its best, but is "holding up well. However, in addition to the slowdown in the Chinese economy, the situation in Europe is also difficult, with the economy of Germany, a major country, leaning heavily, and the situation in the U.K. as well. If the U.S. were to raise real interest rates above 2%, the strong U.S. economy might adapt, but the global economy would be affected. With the U.S., China, and Europe stalling simultaneously in the global economy, it is more likely that other central banks will turn to interest rate cuts sooner. The ECB may cut rates faster than the Fed. In any case, 2024 will be the year that central banks around the world begin cutting interest rates.

There are also doubts as to whether the "U.S. monopoly" that has prevailed to this point will continue. The U.S. labor market remains strong, but there are some signs of change. Then there is the strong possibility of a government shutdown starting in October, as well as the resumption of student loan debt repayment. There is also a risk that the financial instability that occurred in the U.S. in March of this year may resurface. The risk of financial instability was not mentioned at all at this FOMC meeting. The Fed's Higher for Longer strategy is suffering through the outflow of deposits from vulnerable banks and the deterioration of net interest income. income from vulnerable banks. Given the onset of tighter regulation of smaller banks, the US financial system may be strong, but individual bank restructuring and other actions will continue.

The chart below shows the KBW Bank Index, which fell sharply in March due to the financial turmoil and then recovered slightly in July, but has been slowly falling again since August and shows no sign of returning to its pre-financial turmoil level.

The chart below shows the difference between the stock price of JPM, the largest U.S. bank, and the KBW Bank stock price index.

And as for the neutral interest rate argument, the market is increasingly seeing it as having rounded up, but there is no support for this. Indeed, if the natural rate of interest has rounded up to 2% instead of 0.5%, as the Fed says it has, then adding 2%-3% of long-term inflation to that, one could argue that 4%-5% is the appropriate level for long-term interest rates. However, that is a fuzzy argument. Incidentally, the New York Fed has forecast a decline in the natural rate of interest in the U.S. The natural rate of interest was estimated to be near 2.5% in 2006-2007. At this FOMC meeting, Chairman Powell mentioned the possibility of a rise in the neutral interest rate, but did not provide any detailed explanation. It is likely that there are no materials or other evidence to support this. Even if the natural rate of interest has risen to about 1%, adding 2%-3% of inflation to that would mean about 3%-4%, which would require a substantial increase in the risk premium for the U.S. nominal long-term interest rate to move toward 5%. Although there are factors that would cause the risk premium to expand, such as the deteriorating fiscal balance and the supply-demand balance, we do not believe that the risk premium will expand rapidly, given the appeal of U.S. Treasuries as a flight to quality given the recent global economic slowdown and various domestic issues in the U.S.Therefore, we do not expect a sustained rise in U.S. long-term interest rates, although the current environment is conducive to higher rates due to loss-cutting and hedging sales. However, there is no doubt that the range of U.S. interest rates has rounded up. The chart below shows the spread between the 10-year and 2-year interest rates, and as expected, it does not appear to be consistently above minus 100 basis points. Hence, if the 2-year rate remains in the 5% range, it will be difficult for the 10-year rate to fall below 4% in the current financial environment. For the time being, we assume that interest rates will settle in a stalemate up and down around 4.2%-4.6%, although the risk of rising interest rates remains.

However, a condition for the above outlook is that the U.S. 30-year interest rate does not break out of the 4.75% level. If it does break out of this level, the 30-year rate will likely accelerate its pace of increase to 5.25%. If that happens, interest rates for all years would be in the 5% range. At that time, the real interest rate in the U.S. would exceed 2.5%. If such a development were to materialize within a short period of time during the year, U.S. stocks would indeed be down sharply. Conversely, if such risks do not arise and long-term U.S. interest rates stay between 4.2% and 4.6%, there is no need to worry about a major collapse in U.S. equities. Although there is room for a slowdown in the global economy, various individual U.S. issues, and downward revisions in the future earnings of U.S. companies, at the very least, such factors will not cause an index like the S&P 500 to collapse, but rather to return to an upward trend toward the end of the year.This is the end of Part 1 as it has become too long. Tomorrow, we will focus on yen interest rates and other issues. To be continued...

この記事が気に入ったらサポートをしてみませんか?