【Research Report】Study on Trend of Hometown Tax 2023

Summary

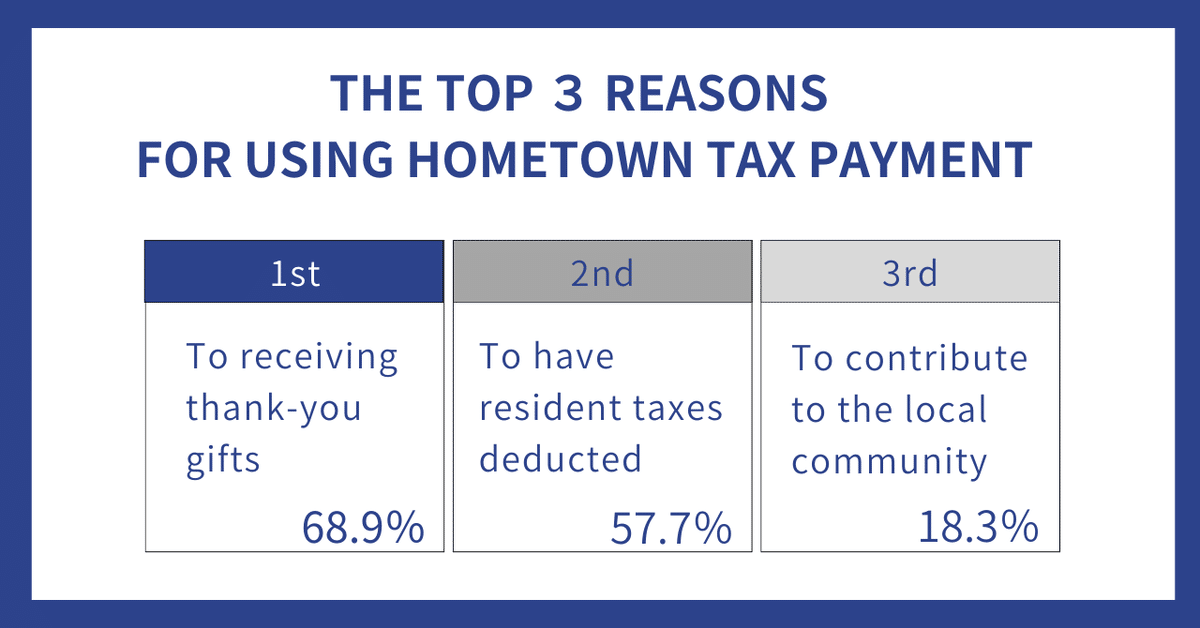

The reasons for using the hometown tax, in order of prevalence, are "to receive thank-you gifts" (68.9%), "to have resident taxes deducted" (57.7%), and "to contribute to the local community" (18.3%). When making a donation, 68.0% consciously choose how their donation will be used, and 68.4% express interest in knowing how the funds are utilized by the local government.

In terms of addressing issues through donated funds, "education and childcare" (36.2%) received the highest number of responses this year, followed by "agriculture, forestry, fisheries, commerce and industry," "medical care, welfare, and nursing care," "nature conservation," and "disaster recovery."

Regarding experiential thank-you gifts, 25.6% have already selected such items for this year, and 23.8% plan to choose them by the end of the year. There is a noticeable generational difference, with a higher percentage of younger individuals expressing a desire to receive experiential thank-you gifts.

Regarding the rule changes in hometown tax donation implemented in October, 80.0% are aware of the changes. Of those, 59.2% made last-minute donations by the end of September before the changes. Regarding the donation amount relative to the deduction cap, the majority (35.5%) donated up to about 30%, and 26.2% donated almost up to the cap by the end of September.

Concerning agriculture and fisheries affected by climate change and global situations, 81.1% express increased interest this year. Regarding the support for seafood, especially scallops, which gained attention from summer to fall, 36.1% made donations and received seafood-related thank-you gifts.

The detailed report in Japanese is available.

◆Research target :

1,088 aged 20 over living in Japan, who have experience with hometown tax.

◆Research period : November 6-7. 2023

◆Research method: Internet research