STO Guidance for Business ~New regulation published in Japan~

The revised Financial Instruments and Exchange Act(the FIEA) regarding security tokens was enacted at the end of May last year and promulgated on June 7 (the effective date will be within one year from the date of promulgation). Under the revised FIEA security tokens are in general subject to strict disclosure regulations, treated as Paragraph 1 securities. ※1

However, the revised FIEA simultaneously stipulates that tokens "specified by a Cabinet Office Ordinance in consideration of liquidity and other circumstances" are exempt from the treatment of Paragraph 1 securities but instead are treated as securities subject to Paragraph 2 rules, which are not as strict as Paragraph 1 rules. As a result, the details of the Cabinet Office Ordinance (requirements for exemption) were attracting attention among financial industry and people interested in STO business.

In this article, I will explain the details and background of these exemptions and also potential impact on future STO business in Japan. Strictly speaking, the term “security token” has a broader concept than the "Electronically Recorded Transfer Right(Denshi kiroku iten kenri)" defined by the revised FIEA, but in this article it is used as a term with the same meaning unless otherwise noted.

※1 Under the FIEA, securities are categorized into two types. Article 2 paragraph (1) stipulates high-liquidity type securities (e.g., stocks, bonds), while Article 2 paragraph (2) stipulates low-liquidity type securities.

Benefits of Security token/STO

The advantage of security token/STO is that we can streamline the existing procedures by utilizing digital technology, such as Blockchain and smart contracts, and reduce issuance and management cost about securities as a result .

With this cost reduction, the development of new financial instruments(tokens) backed by a variety of assets (or projects) that were previously difficult to securitize in terms of cost-effectiveness (e.g. small real estate, sports sponsorship, revenues from animation) is expected.

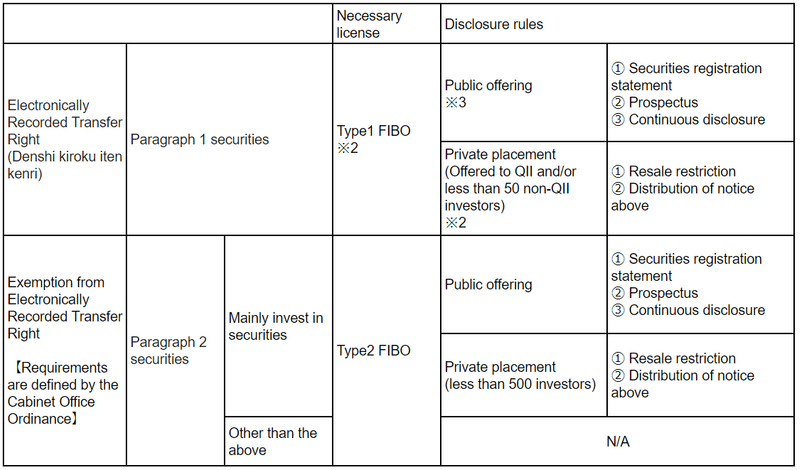

Therefore, in practice, "how much cost can we reduce by using STO structures?" is a major concern for issuers. The issuance cost of Security Token (preparing and filing securities registration statements, ongoing semiannual securities reports) significantly depends on whether prospective Security Tokens are treated as Paragraph 1 securities or Paragraph 2 securities. (see Table 1 below).

【Table1:Summary of disclosure rules in Japan】

※2 FIBO stands for “Financial instruments business operator) and QII stands for “Qualified Institutional Investors

※3 In case the total amount of issuance is less than 100 million yen, there is a small amount exemption (disclosure exemption)

Details of the Cabinet Office Ordinance draft (Exemption requirements)

The following are the requirements for exemption in the Cabinet Office Ordinance draft (Article 9-2 of the Cabinet Office Ordinance on the definitions prescribed in Article 2 of the Financial Instruments and Exchange Act).

(1) The transfer of the ownership of electronically recorded transfer right (Security token) requires the consent of the issuer and

(2) Holders are limited to the following (extracting key requirements):

a) Qualified institutional investors

b) Corporations with 50 million yen or more capital

c) Individuals with a total balance of financial assets and crypto assets exceeding 100 million yen

Of the above requirements (1) and (2) a),b), it is relatively easy for a sales company (FIBO) to confirm that such requirements are met, but for c) the requirement refer to both financial assets (e.g., deposits, securities) and crypto assets, so the question remaining, How do FIBOs confirm whether a certain individual investor meet the criteria?

Although practical guide lines/measures are not specified in the Cabinet Office Ordinance, considering the requirements for individual investors are almost as same as those of existing exemption structure so called “Article 63 exemption” ※4, it is highly likely that FIBOs cannot rely on only self-declaration from investors instead should collect related evidences/documents from them※5.

※4 Under this exemption issuers(such as Fund management companies) can conduct self-offerings to limited investors without registration of FIBO license.

※5 Crypto Asset Exchange Service Providers and other Financial institutions including Securities Brokers and Banks are completely separated in Japan. There is no service which enable asset certification for both financial assets and crypto assets.

Background of this Cabinet Office Ordinance

In order to understand and evaluate this Cabinet Office Ordinance(and the revised FIEA published last year), “Report from Study Group on Virtual Currency Exchange Services” published in December 2018 is quite helpful.

https://www.fsa.go.jp/en/refer/councils/virtual-currency/20181228.html

The study group was established in 2018 under the sponsorship of Japanese Financial Service Agency(JFSA) to discuss regulatory measures for various issues about crypto asset business including ICO. Back then there were many fraudulent cases or faulty project plans regarding ICO, therefore the Group mainly advised regulatory measures from the perspective of investor protection in their report. Considering this report is a starting point of amending ICO/STO regulations, it is understandable that this Cabinet Office Ordinance’s proposal has become stricter than expected.

In addition, in terms of type 2 FIBOs, some of which conduct crowdfunding business, there were some scandals or troubles (such as misusing investor’s money) in 2017 and 2018, thus such incidents may be some of the causes of this stricter rules on Paragraph 2 securities (Exempted tokens).

It should be noted that the criteria for individual investors applied to exemption requirements seems to be similar to those of accredited investor in the United States. However, the requirements for individual investors have only asset basis criterion (no income criterion) and it is said that there are only 2.2% households which meet such criterion in Japan.

Impact of this Cabinet Office Ordinance on STO business

As mentioned above, considering the strict requirements about exempted tokens (Paragraph 2 securities), it is likely that potential issuers do not utilize the exemption procedures but rather issue security tokens under Paragraph 1 securities rules.

It should be noted that issuance/disclosure costs can be reduced by using private placement scheme even if security tokens are treated as Paragraph 1 securities. However, for the following two reasons it is likely that public offerings scheme will be mainstream to issue security tokens.

a) Unlike small private placement on Paragraph 2 Securities, whether a certain case meets small private placement requirement or not is judged by the number of solicited person (not acquirers), thus it is practically impossible to solicit through the Internet

b) In terms of the private placement with QIIs, the number of QIIs in Japan is very small

At this time in Japan, even if security tokens are distributed/managed on electronic data processing system such as blockchain’s distributed ledger, it does not mean we can achieve cost reduction immediately (If STO platform infrastructure is developed substantially in the near future, huge cost redemption of security business will be expected). Therefore, for the time being it is likely that STO cases will be polarized, tokens backed by large-scale projects such as real estate or corporate bonds and small projects (the total amount of issuance is less than 100 million yen) which can take advantage of disclosure exemption.

Other issues

With the announcement of this Cabinet Office Ordinance, regulations regarding the issuance of security tokens have become almost clear. However, solicitation rule regarding STO is still unclear and will be stipulated by self-regulatory rules that are scheduled to be created and published in near future.

It should be noted that the rules for soliciting existing Paragraph 1 securities (e.g., stocks, corporate bonds) are stipulated in the self-regulatory rules of the Japan Securities Dealers Association. However, regarding the rules for soliciting security tokens, it is expected that the Japan Security Token Offering Association (established in October 2019) will play an important role.

About Fintertech.Co.Ltd.

Fintertech is a Fintech subsidiary of Daiwa Securities Group Inc., one of the leading comprehensive financial service firms in Japan. Also we are the member of the Japan Security Token Offering Association.

Our mission is to develop and create new innovative services and redesign existing services by utilizing knowledge/experience in financial field and cutting-edge technology including Token and Blockchain/DLT technologies.

If you are interested in our business or collaborating with us, please feel free to contact us.

https://docs.google.com/forms/d/e/1FAIpQLSclk5f24x-xhLI5BdKPWHSh136ZwsX3ZbFSqecXnQIITRLucA/viewform

[Author Biography] Hideto Shindo

Hideto Shindo works for Fintertech Co. Ltd., as a due-diligence team leader and in-house legal counsel. Before joining Fintertech, he worked at Investment bank/Securities Broker Dealer as a legal officer in both Market and Corporate division.

He obtained his bachelor’s degree from Kyoto University, Master of Law from Duke Law School and Master of Comparative Law from University of Pennsylvania.

Attorney-at-Law admitted in New York.