[4419] Finatext Holdings Research Report by Mutual

こんにちは、FinatextホールディングスのIR担当です。当社のIR活動を支援いただいているMutual社によるリサーチレポートの英語版を掲載します。

※日本語版はこちら。

Hello, this is Finetext Holdings' Investor Relations Department. We have prepared an English version of a research report by Mutual, who supports our IR activities.

*The Japanese version is here.

Introduction

In this report I will cover Finatext Holdings (hereinafter referred to as "Finatext"), a company that is trying to transform the Japanese financial industry by ‘reinventing finance as a service’.

The uniqueness of Finatext's business domain, high barriers to entry, and a corporate culture that values its employees is why I decided to initiate coverage of the company.

Since its listing in December 2021, the share price has fallen, and there was a period when it was less than half of the offering price. However, in the past six months, the share price has continued to rise, and I believe that the market is gradually paying more attention to the company.

History

First, a brief introduction of Finatext's founding history.

After graduating from the University of Tokyo with a degree in economics, Finatext CEO Ryota Hayashi studied at the University of Bristol in the UK, where he majored in computer science before joining Deutsche Bank London as the first Japanese local graduate hired as an engineer.

During his experience living abroad, he felt frustrated by the lack of attention and investment into Japan from overseas. At the time, London was in the midst of a fintech boom, and companies such as Wise, which offered low-cost international money transfer services, had just appeared on the scene. When he returned to Japan in 2013, he was shocked to find that Japan's financial services industry was lagging behind.

While fintech services were rapidly spreading overseas and online banking services with excellent UI/UX were commonplace, many banks in Japan did not even offer online banking, and cash-only services were the norm for cabs and restaurants.

Since then, Hayashi has wanted to "bring finance and people closer together," and in December 2013, he founded Finatext to make this a reality.

Businesses

Finatext currently operates three businesses.

Fintech Solution Business

Big Data Analytics Business

Financial Infrastructure Business

The sales composition and strategic positioning of each business are as follows

Fintech Solution Business

The Fintech Solution Business is Finatext's flagship business, which provides financial institutions with one-stop support for planning, development, and operation of financial applications.

At the time of its founding in 2013, Finatext was developing its service with the idea of "First, we need to create a financial service with a cool UI/UX!" At first, they released a prototype with complicated and difficult analytical functions. However, this did not resonate with users at all, so they turned their attention to developing a "service that is easy for users to get a grip on."

In November 2014, they released "Asukabu!" a service for beginner investors. This app ranked first in the free finance category in the App Store and has grown to become a service used by many novice users who were previously unfamiliar with stocks.

The following year, they also released "KaruFX," an application for FX investment education, and since then has continued to build a track record of developing financial services applications.

At that time, various financial institutions were looking to attract younger customers by providing financial services applications. Finatext therefore started a service to provide financial app development technology it had cultivated to financial institutions with such needs. This service is unique in that it does not only provide support for development, but also involves planning and consulting prior to development.

Releasing an application under the name of a client financial institution requires compliance with the institution's strict security policy. The app was published under the name of Finatext, and the client financial institutions were asked to participate as advertising partners and receive sponsorship fees. This business model enabled faster and more flexible service development than when launching apps in the name of a financial institution.

Even though they were developing apps under their own name, it was necessary to develop them while also taking into account the needs of the financial institutions, so the Company was able to learn how to "match" with them, which was useful for the development of the Financial Infrastructure Business.

For example, the asset-building platform "Money Canvas" provided by MUFG Bank was largely developed by Finatext.

Money Canvas is a service that allows users to use a single ID for stock investments, insurance, and crowdfunding, which previously had to be contracted separately.

In this way, the Fintech Solution Business now offers not only application development, but also more in-depth services such as platform development that links APIs with the mission-critical systems of financial institutions.

The Fintech Solution Business is already profitable and is expected to grow steadily in the future.

Prepared by Mutual based on Finatext Annual Securities Report. Unit: millions of yen.

Big Data Analytics Business

The big data analytics business entered the market in August 2016 when Finatext made Nowcast a wholly owned subsidiary through a share exchange deal. Nowcast is a company that provides "alternative data" to various stakeholders such as domestic and foreign institutional investors, government agencies, and think tanks.

Alternative data refers to data that has not been utilized traditionally and includes data such as POS data, credit card data, and location data.

By utilizing such alternative data, it is possible to grasp short-term trends in sales and prices of consumer goods by product and to anticipate corporate financial results and industry trends, which can be used by institutional investors to improve the accuracy of corporate earnings forecasts and by government agencies to quickly analyze consumption trends for economic analysis and policy making. Public agencies will be able to use the data for economic analysis and policy decisions by analyzing consumption trends quickly. (For more information on specific examples of alternative data, please visit Nowcast's website.)

Nowcast business consists of accessing large volumes of data by collaborating with "data holders" such as Nikkei and JCB, cleansing and analyzing them, and providing them as alternative data to institutional investors, government agencies, business companies, and other clients.

In addition, their current main products are as follows

The Big Data Analytics Business is highly profitable and sales continue to grow steadily.

Prepared by Mutual from Finatext Annual Securities Report. Unit: millions of yen.

According to Nowcast, the majority of sales have been to institutional investors, but it appears that Nowcast will start actively providing data services to corporates in the future. Major consumer goods companies have a need for alternative data because real-time consumer trend information is extremely useful in refining their marketing activities.

Since the number of companies with such needs is far greater than that of institutional investors, there is potential for further growth as services for these companies become more widely available.

In addition, in response to the recent rise of ChatGPT, Nowcast has launched the Nowcast LLM Lab and is embarking on research and development of services utilizing LLM.

In its most recent financial results, the company announced that it was able to develop "question generation from IR materials" using LLM. The company's agility in developing a product that seems to be in demand in a short period of time, taking advantage of the fact that it already has a customer channel of institutional investors, is noteworthy.

What I found interesting about the Big Data Analytics Business is what Hayashi talks about in the video below (starting at around 19:03) about the "strength of being able to collaborate with data holders.

Data received from data holders such as credit card companies is naturally highly confidential. The fact that Finatext is utilizing such information in cooperation with major data holders and has not experienced any problems such as information leakage so far gives an impression that Finatext can create high-quality services in cooperation with major data holders and is a company that is secure enough to be trusted with sensitive data.

This sense of trust, which is strengthened by the cooperation with data holders, has been useful in adding new customers in the Fintech Solution Business and the Financial Infrastructure Business.

I find it very interesting that the development of the Big Data Analytics Business opens up the potential for further synergies across the entire group.

Financial Infrastructure Business

As Finatext developed its Fintech Solution Business, it became keenly aware that in order to create high-quality financial services, it is not enough to improve the UI/UX on the front-end, but the core system itself on the back-end must also be improved.

If the core system is an on-premise system developed in an old programming language, it may be difficult to integrate the API with the application in the first place, or the UI/UX for users to buy and sell financial products may not be compatible with the application. In other words, no matter how sophisticated the system looks, the UI/UX of the system will not be good enough and no matter how sophisticated the app looks and how easy it is to use, if the underlying core system itself is not well-built, it will be difficult to achieve a quality UI/UX for users.

This is why Finatext decided to launch their Financial Infrastructure Business in 2018, which provides the core systems necessary to provide financial services on a cloud-based platform.

What value does this cloud-based core system provide to customers?

The first value-add offered is the ability to implement an easy-to-use business system at a low cost and in a short period of time.

For example, suppose a company decides, "Let's create a new asset management service that allows us to invest in interesting stock themes". In addition to front-end development such as application design and UI development, a business system with various functions for securities business such as account opening screening, registration with Japan Securities Depository Center (JASDEC), fund segregation, and execution management would be required. However, developing these systems from scratch requires a great deal of resources and cost.

In this context, the cloud-based core system provided by Finatext allows clients to build such a business system quickly and at low-cost.

Another important value-add is that it enables the provision of financial services through a variety of channels.

Until now, each financial institution had a vertically integrated structure that used separate systems for sales, making it difficult, for example, for Company B to sell financial products originated by Company A. However, by using Finatext's cloud system, it is now possible for clients to offer financial products through other systems/channels.

It also makes it possible to integrate financial services into applications and websites that already have a large number of users.

In summary, by implementing the core system provided by Finatext, clients can

Easily and quickly launch their financial services,

And deliver financial services to more people through various channels.

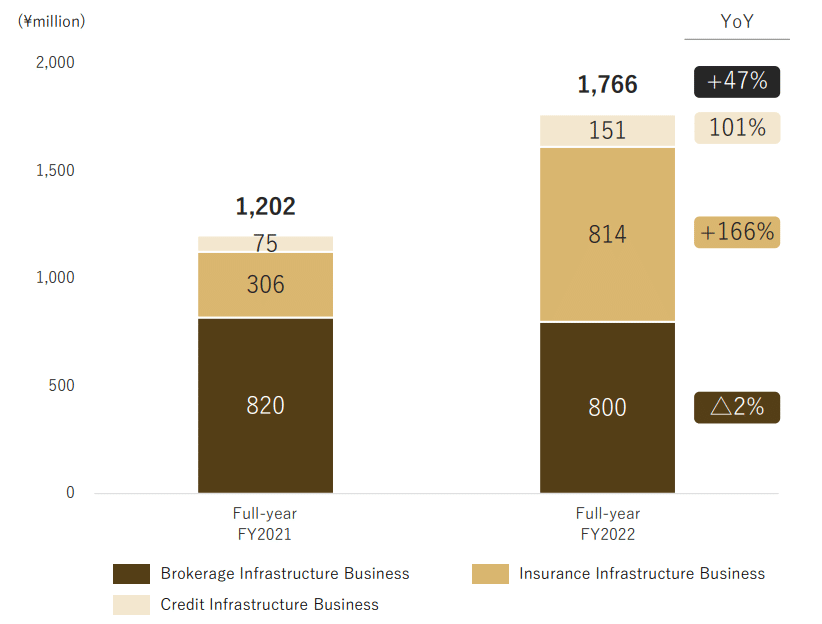

Finatext currently offers this core system in three areas: Brokerage Infrastructure (asset management services), Insurance Infrastructure (insurance services), and Credit Infrastructure (consumer financial services). The core system product for Brokerage Infrastructure is named "BaaS", the Insurance Infrastructure core product is named "Inspire" (the name of the Credit Infrastructure product has not been disclosed at the time of writing).

The sales composition of each product is as follows.

Here is a brief description of the services offered by the Brokerage Infrastructure and Insurance Infrastructure.

Brokerage Infrastructure

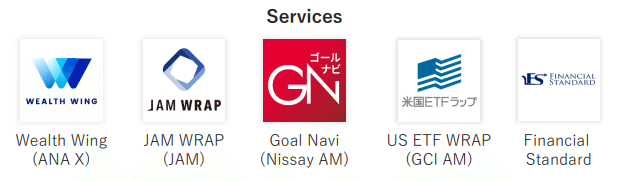

Brokerage Infrastructure offers services in the areas of (1) Digital Wealth Management (DWM) and (2) Embedded Investment (Embedded Finance).

(1) DWM aims to provide high-quality asset management services to a wide range of customers by combining digital and face-to-face services, with five services in operation at the time of writing.

The above image shows BaaS being provided as a core system for existing financial institutions and start-ups that are about to launch new asset management services.

In addition, since the core system is built on the cloud and API linkage is possible, these asset management services can also be sold by other companies. For example, Nissay Asset Management's Goal Navi has Hekikai Shinkin Bank and IwaiCosmo Securities as its sales partners.

(2) Embedded Investment is a service that aims to develop potential clients for asset management services by collaborating with a company that already has a large client base and leveraging the client contacts of said company, with three services currently in operation.

Embedded Investment makes it easy to launch asset management services for businesses that have a large number of customers, such as Credit Saison and Seven Bank, etc. Since Finatext provides one-stop support for front-end planning, clients benefit from being able to easily launch financial services by leveraging their large number of customer contacts.

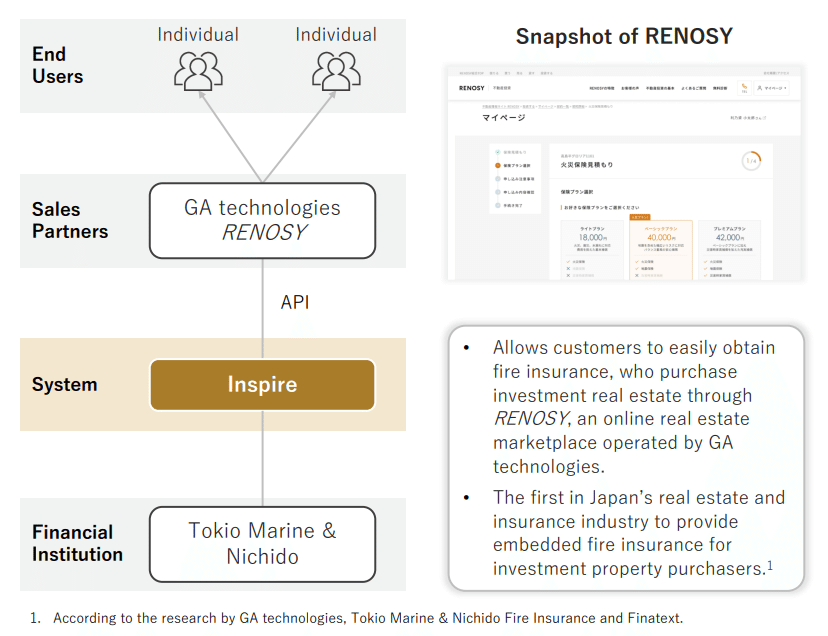

Insurance Infrastructure

Insurance Infrastructure offers services in the areas of (1) digitalization support for major insurance companies and (2) Embedded Insurance.

The digitalization support service provides major insurance companies with Inspire, a core system that enables them to implement insurance sales, premium calculation, and policy administration in a single system, allowing them to offer digital-only insurance products in a short period of time and at low cost.

In addition, (2) Embedded Insurance is a service that incorporates small-amount short-term insurance policies provided by Smartplus Small amount Short-term Insurance, a Finatext group company, and insurance policies from the major insurance companies partnered in (1) above, onto existing services.

Most recently, a service has been launched that allows customers who have purchased investment properties through GA Technologies' "RENOSY" to easily purchase Tokio Marine & Nichido Fire Insurance within the same website.

Credit Infrastructure

Although specific services have not yet been announced at the time of this report's writing, this one basically follows the same procedure as the Insurance Infrastructure, offering (1) digitalization support for installment sellers and (2) Embedded Lending.

It may be difficult to understand the whole picture at first sight, but as mentioned earlier, by providing the core systems necessary for developing financial services in the cloud, it is easy and fast to launch financial services and deliver financial services to a large number of people through various channels.

Financial analysis

Finatext's consolidated net sales and operating income/loss are shown below.

The average annual growth rate of net sales from the fiscal year ended March 31, 2021 to the fiscal year ending March 31, 2023 is approximately 45%, boasting high growth potential. On the other hand, we see that the actual operating income/loss has been continuously negative.

The following table shows sales and operating income by segment.

Prepared by Mutual based on financial results materials for each period.

Prepared by Mutual based on financial results materials for each period.

While the Financial Infrastructure segment has the highest revenue growth rate, the deficit in this segment is a contributing factor to Finatext's overall operating loss.

In the following sections, I will focus on three points that I consider important when looking at Finatext's financial figures.

Narrowing trend in operating loss

The most important point to note when looking at Finatext's performance is that the operating loss has been shrinking at a considerable pace and is expected to return to the black in the fiscal year ending March 2024.

Financial Results for the 4th Quarter of FY2022

The operating loss has narrowed because (1) stock revenues are accumulating in the Financial Infrastructure Business and (2) the burden of development costs for common infrastructure is decreasing.

Regarding (1), Finatext has the following three types of revenue streams.

This revenue trend by revenue type, broken down by business, is shown in the figure below.

Although the breakdown of Fintech Solutions and Big Data Analytics is not disclosed, it is clear that stock and usage-based revenues in the Financial Infrastructure Business have grown significantly. This is mainly due to the rapid increase in the number of services in operation in the Financial Infrastructure Business over the past few years, which has led to an increase in stock revenues.

Financial Results for the 4th Quarter of FY2022

The services provided by Finatext cannot be so easily transferred to another core system because it is a business system for financial institutions to provide financial services. This means that switching costs are very high and churn rates are extremely low.

This way, once a customer is acquired, revenue can be earned over a long period of time with little or no cost. The first factor behind the improvement in profitability is the large increase in stock revenue that has accompanied the increase in the number of services under this structure.

Next, I will explain that (2) the burden of development costs for common infrastructure is also decreasing.

Earlier, I mentioned that the negative operating income/loss for Finatext as a whole was due to the Financial Infrastructure Business.

Prepared by Mutual based on financial results materials for each period.

According to Finatext, this was mainly due to the heavy investment in the development of common functions in core systems. Core systems such as BaaS and Inspire are not provided as-is to each client, but are customized for each company on a common infrastructure product.

The development costs required for customer-specific customization are basically covered by the flow revenue received at the time of order receipt.

On the other hand, the development costs for functional enhancements to the common infrastructure, such as the addition of U.S. stock trading functions, are purely an up-front investment for Finatext. In the early stage of business development, it is necessary to implement various functions in the common infrastructure, and the burden of development costs is large, which is why Finatext has been in the red so far.

Finatext has already completed the implementation of common infrastructure functions to some extent, which means that (2) the development cost burden for common infrastructure is decreasing.

The reduction in the operating loss range due to the effects of (1) and (2) above is expected to continue, and Finatext has stated that it will aim to achieve an operating margin of 20% in the medium to long term.

Financial Results for the 4th Quarter of FY2022

Potential for greater sales volatility

In the Financial Infrastructure Business, the transaction amount per service is large because the number of services is small.

If the development period is prolonged and completion is pushed back from the originally planned time, the amount of flow revenue may be lower than expected.

Also, if a project is abandoned in the middle of development, the recurring revenue may also be lower than originally forecast.

The reverse is also true, of course, but at any rate, it should be recognized that the large amount of transactions per service may cause sales to be volatile compared to the forecast figures. However, this large sales volatility is expected to decrease as Finatext's sales scale grows and the percentage of recurring revenue increases, so it may not be necessary to pay much attention to it in the medium to long term.

If you want to know the number of services in operation in a timely manner, it is advisable to carefully follow the information on new service releases on the Finatext news release page.

Also, at this point, information on order backlogs, etc. is not disclosed on the Finatext website, but if such information becomes available in the future, it may serve as a leading indicator of the number of services in operation, so this is also a point to keep an eye on.

Effects of seasonality and foreign exchange rates

Finatext's sales are seasonal, with a slight bias toward the second half of the year.

Financial Results for the 4th Quarter of FY2022

This is because, while many of Finatext's clients are large companies, large companies tend to place orders with Finatext toward the end of the fiscal year from the standpoint of budget allocation, and flow revenues recorded at the time of order placement tend to be biased toward the second half of the fiscal year (most flow revenue is recorded in the 3Q or 4Q of each year).

Financial Results for the 4th Quarter of FY2022

In addition, Finatext's performance is somewhat affected by foreign exchange rates.

In the fiscal year ended March 31, 2011, the weaker yen had the effect of boosting sales by 19% y-o-y.

Financial Results for the 4th Quarter of FY2022

On the other hand, Finatext uses AWS as its cloud infrastructure, so if the yen depreciates, its data management costs will increase.

In any case, the impact on Finatext's profit is considered to be limited unless the exchange rate moves considerably, so the impact of the exchange rate may not be that much of a concern.

Barriers to entry and competitive advantages

This section describes Finatext's barriers to entry and competitive advantages.

High barriers to entry

Finatext has been developing its Financial Infrastructure Business since 2018. Due to the nature of mission-critical systems, which do not allow for mistakes and are difficult to switch to once implemented, an extremely high level of security, stability, etc. is required.

Therefore, simply proposing a system implementation that is quick and inexpensive because it is cloud computing is extremely unlikely to lead to a successful implementation.

In this respect, Finatext already has a track record with several major companies through its Fintech Solution Business, which it has been developing since 2014. In addition, in the Big Data Analytics Business, which Finatext entered in 2016 upon its integration with Nowcast, has a track record of receiving highly confidential data from major data holders and providing services to institutional investors, government agencies, and others.

This track record ensured trust in Finatext's technological capabilities, security level, etc., and enabled the company to smoothly acquire new clients when launching its Financial Infrastructure Business.

Even if an unproven startup were to launch a new business similar to the Financial Infrastructure Business and offer services at a lower price than Finatext, it would be difficult to acquire new customers without a proven track record.

Then, what about the possibility that existing players, such as SIers who have been supporting the construction of mission-critical systems for major financial institutions, will enter the Financial Infrastructure Business?

In this regard, existing players are focusing on providing services to existing customers and earning high fees. In such a situation, providing services that lead to significant cost reductions for customers would in fact worsen their own profitability, so they are unlikely to deploy services that incorporate new technologies.

In summary, the business of providing cloud-based mission-critical systems in financial services is extremely difficult for new entrants to enter the market, and it is also difficult for existing players to enter the market, which means that there are high barriers to entry, at least for now.

PR ability to attract customers

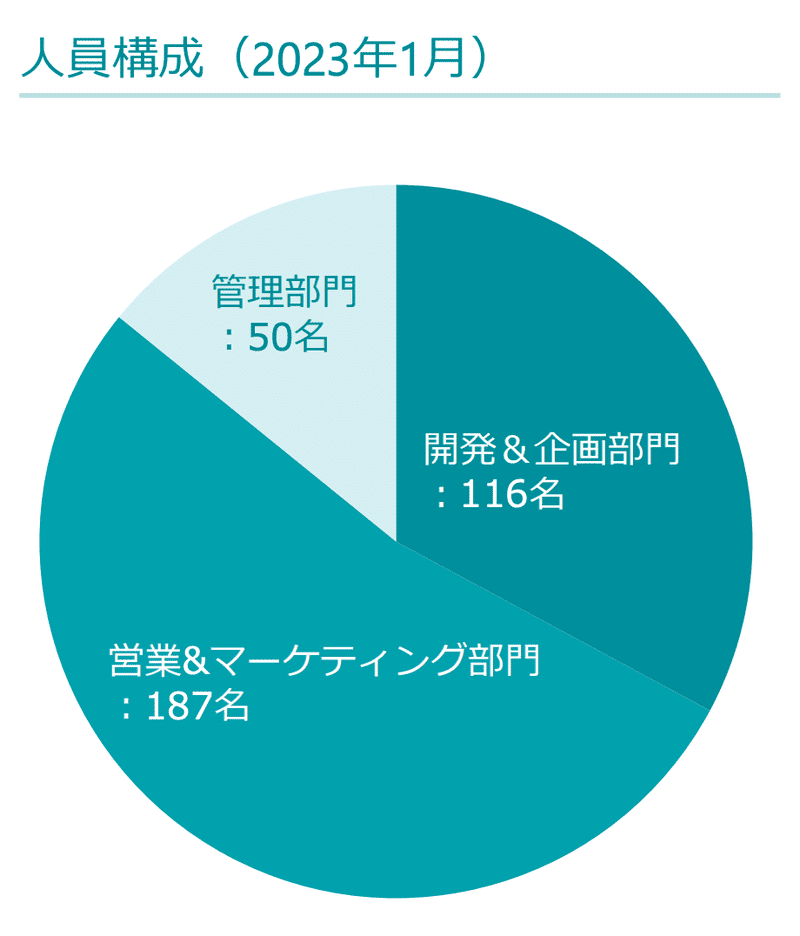

Finatext's staff composition shows that it has more engineers and other product development personnel than other SaaS companies, and conversely, it has fewer sales and other personnel.

Business Plan and Growth Potential Matters (June 2023)

https://jp.corp-sansan.com/newgrads/data

Matters related to business plans and growth potential

This may have something to do with Finatext's business model. Finatext's Financial Infrastructure Business is structured to deal with a specific small number of clients at scale, which Hayashi describes as similar to whaling and fishing. Under these circumstances, sales activities to make appointments with a large number of potential clients and large-scale advertising investments are not considered very necessary.

In this regard, Finatext emphasizes thorough PR activities when acquiring customers. In other words, by actively contributing and posting its knowledge of the Fintech domain through financial magazines and social networking services, etc., Finatext is increasing its visibility in the Fintech domain, and emphasizing the establishment of a mechanism to remind companies of Finatext when they decide to launch a new financial service.

According to Finatext, by continuing these efforts, they are able to acquire new clients much more efficiently than if they had started their business with no contact points. Since it is not possible to raise awareness and presence in the industry overnight, the fact that Finatext is able to increase sales efficiency through such proactive PR activities is also considered to be one of its strengths and a barrier to entry.

Development of in-house services

Finatext's Financial Infrastructure Business provides core systems in three areas: Brokerage Infrastructure, Insurance Infrastructure, and Credit Infrastructure.

What is very interesting in this regard is that Finatext is developing its own services using these core systems through its group companies.

Specifically, the company has established subsidiaries in the areas of Brokerage Infrastructure, Insurance Infrastructure, and Credit Infrastructure, through which it provides services using core systems such as BaaS and Inspire.

Smartplus, for example, has a commission-free community-based stock trading application called "STREAM," and BaaS is used as the backbone system behind this service.

Smartplus Small Amount and Short-term Insurance also offers "Maternity Insurance Hug," an insurance policy to alleviate financial worries caused by risks during pregnancy and childbirth, and cancellation insurance for travel, restaurants, etc. Inspire is used behind the scenes for these services.

In other words, Finatext is not only providing core systems to financial institutions, but also developing its own services through its financial subsidiaries.

When a company develops its own services while also using the core system it has developed, it has a better understanding of customer issues and needs than when it simply develops products on consignment in response to customer requests, which can lead to greater customer development and satisfaction.

Therefore, Finatext's strength lies not only in the development of its own products, but also in the development of its own services created using its own products.

Appropriate cost discipline

I believe that one of the most important factors in determining whether a company will continue to grow is top management's awareness of cost management. This is because if top management lacks awareness of cost management, the cost discipline of the entire organization will instantly become loose, and waste will easily occur everywhere.

Naturally, the larger the size of the company, the more difficult it becomes for top management to check every detail of costs. However, companies that continue to grow strongly while maintaining high profitability are likely to have top management constantly watching for "waste" within the company. (M3, which I discussed earlier, is a typical example.)

In this regard, Hayashi, the top management of Finatext, and Yuichiro Ito, the CFO, are always conscious of properly grasping the details of each cost item. For example, in the case of outsourcing costs, they are monitoring whether there is any waste by grasping the outsourcing unit price, the details of outsourced operations, and the utilization status, etc. one by one.

At first glance, one might think, "Does top-level management really go that far? However, as cash levels become more comfortable due to fundraising, etc., or as the size of the organization grows, cost discipline tends to loosen, but Finatext's efforts to exercise appropriate discipline will probably work to its advantage in the medium to long term.

Points of focus going forward

Change in profitability due to increased transactions with existing clients

Until now, Finatext's Financial Infrastructure Business has increased the number of services it provides mainly through the acquisition of new clients. However, in the future, the number of services is expected to expand through the provision of additional services to existing customers.

Finatext is currently implementing BaaS for Nissay Asset Management's Goal Navi, and may be able to implement BaaS when Nissay Asset Management launches another new asset management service.

It is also possible to have Inspire implemented when an existing client in the Insurance Infrastructure area, such as Tokio Marine & Nichido Fire Insurance, creates a new insurance product.

Thus, it can be inferred that when an existing customer introduces a core system to a newly launched service, development resources can be reduced compared to the case where a core system is introduced to a new customer. This would allow the company to reduce the initial development investment, build up stock revenues, and increase usage-based revenues, thereby improving profitability.

In reality, for example, insurance services may require a certain amount of man-hours to connect the core system to the customer's infrastructure even for the second product, so it is not clear to what extent profitability will really improve.

However, the company should continue to monitor the growth in the number of services provided to existing customers and the resulting changes in profitability.

Acquisition of system transfer projects

Currently, Finatext is entering the backbone systems of financial institutions offering new digital asset management services or launching small-scale insurance services, and the size of each project is generally several hundred million yen.

In this regard, if an existing financial institution is able to acquire a project to transfer the main core system it is using, the size of the project can quickly grow to several billion yen to several tens of billions of yen. Therefore, according to Finatext, in order to reach a scale of over 100 billion yen in sales in the medium to long term, it will be necessary to acquire such major financial institutions' core system transfer projects as well.

However, in order to proceed with large-scale transfer projects that require more development resources and man-hours than the current projects, it is necessary to have not only product development capabilities but also organizational skills to manage the project while bringing together a large number of engineers. Therefore, it is not possible to take on such projects right away.

For this reason, Finatext will first focus on medium-sized financial institutions that sell investment trusts and provide core system transfer services.

Specifically, while the fixed costs of investment trust sales systems are a reasonably large burden for medium-sized financial institutions, the sales volume of banks and mutual fund companies has been sluggish, and there is a need to transfer to investment trust sales systems that are cost-effective and easy to use, and they intend to capture this need here.

Such a move is occurring at other companies as well; for example, AEON Bank will transfer AEON Bank's mutual fund accounts to Monex, effective January 1, 2024.

This will allow AEON Bank to concentrate its own resources on improving customer service by outsourcing system management and back-office operations related to its asset management business to Monex, Inc.

Thus, we can expect to see more such moves by mid-sized financial institutions that are facing cost and resource problems in managing their asset management services to transfer their accounts to other companies.

Finatext plans to release specific services through system transfers in the fiscal year ending March 2024, and it is important to keep a close eye on how many of these system transfer deals are taken, as it will be an important factor in determining Finatext's growth potential over the medium to long term.

Growth of usage-based revenue

As mentioned above, in addition to flow and stock revenues, Finatext has variable usage-based revenues based on the AUM and insurance income of customers who have implemented the core system. In other words, this usage-based revenue grows the more the financial services of Finatext's customers are used, or conversely, if the core system is installed but the customers' financial services are not used, the revenue does not grow much.

According to Finatext, the appeal value of core systems such as BaaS and Inspire to customers lies in the fact that they can be implemented inexpensively and in a short time with a business system that is easy to use while conventional core systems are difficult to use.

Naturally, however, if the services created by such mission-critical systems are not used at all, it will be difficult to launch a second or third service. Therefore, in order to continue to expand the network of core system installations, it is necessary not only to appeal to value from the aspect of cost reduction, but also from the aspect of revenue growth, as the business will be firmly established and grow through the use of the system.

In this regard, according to Finatext, for example, Financial Standard, with which they partnered in January 2023, has seen a rapid increase in AUM since the launch of its "Smart Manager" management service platform.

"Wealth Wing," launched in collaboration with ANA X, has also been performing well, with a profitable account ratio (the ratio of profitable accounts for clients using the service, calculated as realized gains or losses including costs. The profitable account ratio (calculated by realized gains/losses including costs) was 97.8% as of the end of June.

Thus, the solid growth of services with Finatext’'s core system will be key to further expanding the number of services in the future. The company's forecast for the fiscal year ending March 31, 2024, calls for significant growth in usage-based revenues, which should be monitored at the time of the earnings announcement.

I will keep an eye on the earnings announcement to see if the company is making progress as expected.

Financial Results for the 4th Quarter of FY2022

Growth of Big Data Analytics Business

In examining Finatext's growth potential, it is necessary to check not only the Financial Infrastructure Business but also the Big Data Analytics Business.

As previously mentioned, Finatext has been providing "AlternaData" to institutional investors, but is now looking to expand its business of providing alternative data to business companies as part of its marketing support.

According to the financial results presentation, in the first year, the company will initially focus on five companies to provide analytical support and accumulate knowledge of services for the real estate industry.

In the short term, the growth of AlternaData and macroeconomic data services for institutional investors will probably determine the growth potential of the Big Data Analytics Business, but it will be interesting to see how much the data analysis support services for business companies in this area grow.

In addition, as previously mentioned, Finatext has launched the "Nowcast LLM Lab" and has started demonstration tests of services utilizing LLM.

Currently, Finatext is testing the automation of fraudulent comment detection in its own product "STREAM" and the automatic generation of questions from IR materials.

These are still in the demonstration stage and are unlikely to contribute significantly to earnings in the short term, but there is a possibility that products with the potential for significant growth over the medium to long term will be released in the future, so it is important to keep a close eye on trends in LLM-related services.

Conclusion

I wasn't sure whether to write this in the competitive advantage section, but I personally find Finatext's HR policies very interesting.

First of all, in an interview with NewsPicks, Hayashi said the following points that he is conscious of when hiring personnel.

There are only three things I am strongly conscious of when it comes to the people I work with.

First, the work they want to do and what the company wants them to do must match. When we hire, we are very careful to make sure there is no mismatch.

Second, we hire people with good personalities. This is to create a good environment within the company.

Third, pay fair compensation. I hate making the office look cool and wasting money on expenses, and if I had that kind of money, I would want to raise everyone's salary.

NewsPicks「シゴテツー仕事の哲人ー林良太の哲学」

On top of that, Finatext is characterized by a fairly extensive benefits package. In particular, when a child is born, 500,000 yen is paid per baby, and when an employee or his/her spouse is found to be pregnant, Finatext will fully subsidize the monthly premiums for the "Maternity Insurance Hug" provided by Smartplus Small Amount and Short-term Insurance. (For details of the benefits, please click here.)

The reason why Finatext provides such generous life support to its employees seems to be greatly influenced by Hayashi's own original experience. For more details, please read this article on NewsPicks.

[Ryota Hayashi] My wife suffered from postpartum depression, and I want to help the suffering mother and her family.

Combined with the above hiring policy and benefit program, Finatext has a low turnover rate of 11.5% compared to other venture companies (from the FY22 Annual Securities Report), five founding members are still active, and almost no engineers have quit. In addition, while it is becoming very difficult to hire engineers, Finatext is receiving many applications every month.

Perhaps Finatext's greatest strength is that it is able to attract and retain people by fostering an organizational culture that values its employees and their families.

So, this is another very long article on Finatext Holdings, which is rapidly growing in the Fintech area. I believe that DX in the financial industry is still in its infancy, so I will continue to watch Finatext's trend continuously in the future.

Disclaimer

This report is prepared by Mutual Corporation (hereinafter referred to as "Mutual") for the purpose of being widely viewed by investors as reference information for stock investment, and is not intended as a recommendation or solicitation to buy or sell any specific securities or financial instruments. The contents and descriptions in this report are based on publicly available information and interviews with companies. The information contained in this report is believed to be accurate and reliable, but its accuracy has not been objectively verified. We are not responsible for any consequences, including direct or indirect loss or lost profits and damages, resulting from the use of or reliance on this report.