The Consultant Crackdown, The Wire China, May 21, 2023.

By Grady McGregor and Katrina Northrop

Beijing is making a spectacle of Capvision, whose shareholders and investors include a network of remarkably high profile and state-connected individuals and companies. Why?

In the corner of the Shanghai office, three heart-shaped balloons float silently over rows of empty desks. Laptops sit half-opened, full cups of coffee beside them, and jackets hang on chairs.

The images, shown earlier this month on China’s state broadcaster, China Central Television (CCTV), imply that the office had been teeming with activity just hours before, but that the employees had to leave in a hurry. With interviews from anonymous whistleblowers and uniformed state security officers, the 15-minute segment covered in dramatic detail Beijing’s recent raid of Capvision, a Shanghai-based consultancy.

To many observers, CCTV’s segment felt like the latest shock in an earth-shattering few weeks for the international business community in China. Just weeks before, Chinese authorities detained five Beijing-based employees of the Mintz Group, a global consultancy, for unspecified “illegal business operations,” and raided the offices of Bain & Company. Now, CCTV’s public flogging of Capvision served as confirmation to many that doing business in China has become increasingly risky.

Yet, while the challenges facing foreign business in China are profound, a closer look at Capvision adds nuance to the narrative. For starters, while Bain and Mintz are U.S. companies, Capvision is predominantly Chinese owned and operated. Though it has offices in New York, Singapore and Kuala Lumpur, the vast majority of the firm’s business is in China and its CEO and biggest backers are Chinese nationals.

It’s also not just any Chinese company. The Wire reviewed records of Capvision’s shareholders and investors and found a network of remarkably high profile and state-connected individuals and companies.

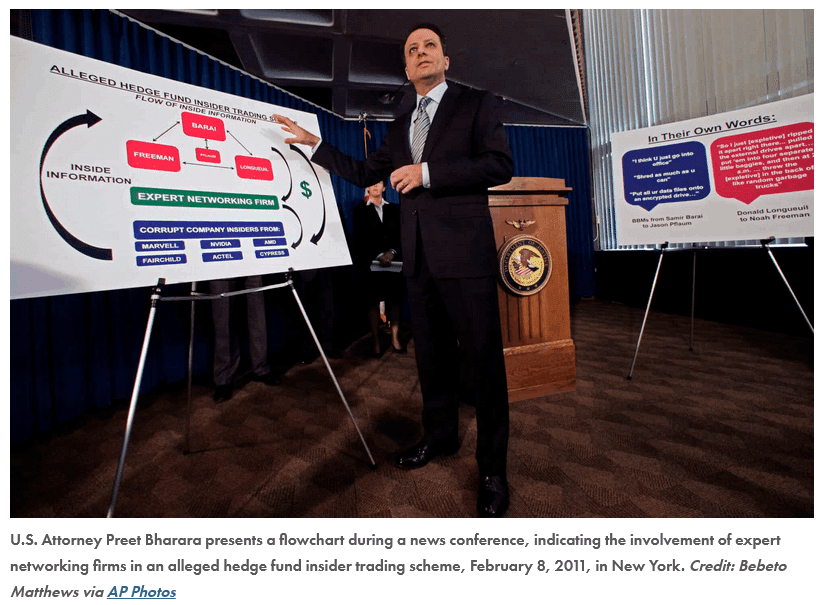

Moreover, unlike Bain and Mintz, which specialize in corporate investigations and consultancy services, Capvision is an “expert network” company and part of an industry that has drawn scrutiny from financial regulators and been mired in controversy due to insider trading scandals. For a fee, Capvision, which is China’s largest expert network company, arranges phone calls and meetings for investors with its rolodex of 450,000 industry experts.

Serving as a central information broker in China’s otherwise opaque market is a lucrative business: in 2020, Capvision grossed $47 million in profits on $92 million in revenue, according to a draft IPO prospectus. But network expert firms are highly regulated in advanced markets.

The Chinese government, then, may have legitimate reasons to crack down on Capvision’s business practices.

Beijing alleges that Capvision was spilling state secrets by giving foreign actors knowledge about the inner-workings of the Chinese state. The CCTV segment, for instance, cites one former employee of a military company who claims that he leaked classified information about a specific type of military aircraft to a foreign entity on a call that Capvision arranged.

“Capvision recruited experts with generous financial offers. The experts believed Capvision was a law-abiding and well-managed company, so the experts let down their guard,” a Chinese police officer says to the camera. “They wound up leaking sensitive content and even state secrets and intelligence to foreign companies and embarking down a criminal path.”

(Screenshots from the CCTV segment covering the Capvision raid carried out by Ministry of State Security officers, May 8, 2023. Credit: CCTV via YouTube)

Capvision, which has 700 employees, did not respond to The Wire’s detailed set of questions. In a statement on its Wechat account after the raid, the company said that it had learned a “painful lesson” and would work to comply with national security regulations in the future. In April, China announced plans to update its anti-espionage law, which expands the definition of espionage to include the transfer of any “documents, data, materials, or items” related to national security.

Although the temptation has been to group all three raids — on Mintz, on Bain and on Capvision — together under the banner of Beijing’s increasingly authoritarian and anti-business moves, there is reason to separate Capvision from the others.

People who are making a big deal of this are not aware of the dynamics in the expert network industry.

“I do not see it as the same story,” says one former Capvision employee, who asked not to be named, noting that improper sharing of inside information in the expert network industry “happens more often than people are aware. People who are making a big deal of this are not aware of the dynamics in the expert network industry.”

Still, Beijing’s very public thrashing of the firm shows the government’s clumsy and often heavy-handed relationship with the financial sector. Victor Shih, an expert on Chinese politics at the University of California, San Diego, notes that had the country’s financial regulator, the China Securities Regulatory Commission (CSRC), led out the raid, foreign investors may not have even noticed.

“That might have even sent the message that the Chinese financial market is a place where participants adhere to the rules,” he says.

<https://youtu.be/JImCsq3fqrA>

Instead, China’s counterintelligence bureau, the Ministry of State Security (MSS), oversaw the raids, which occurred in multiple Capvision offices and resulted in one Capvision expert being sentenced to six years in prison and another expert being investigated, according to CCTV. And unlike the Mintz and Bain raids, Beijing publicly broadcast Capvision’s downfall to hundreds of millions of viewers on national television.

The People’s Daily, a mouthpiece of the Chinese Communist Party, piled on two days after the CCTV segment, writing in an editorial that Capvision “has become an accomplice of foreign intelligence.” The Global Times, another state publication, also published an article that singled out Capvision: “Chinese authorities’ probe of leading consulting company Capvision is an isolated one for the purpose of safeguarding national security rather than an industry crackdown as some foreign media have hyped.”

While it’s not entirely clear why Beijing has made a spectacle of Capvision, it is clear that Beijing is sending a message. Deciphering it starts with understanding what Capvision actually does and the network of powerful business people and state-linked firms behind it.

ORIGIN STORY

In 1998, two recent Yale Law School graduates, Mark Gerson and Thomas Lehrman, noticed that the financial industry was operating at an information deficit when it came to making investment decisions. They hatched a business idea to open a publishing house that specialized in producing in-depth reports on specific industry sectors; hedge funds, they figured, would pay top dollar for such information.

But it turned out that hedge fund executives liked to chat more than they liked to read. Instead of writing long research reports, Gerson and Lehrman found themselves serving as middlemen for calls between investors and industry experts — but the investors were still willing to pay.

“We thought it was kind of ridiculous that the hedge fund business got so much information by asking for favors — ‘Could I please have 15 minutes of your time?’ — when they would certainly pay for that information,” Gerson told The New York Times in 2001.

The expert network industry was born.

Gerson and Lehrman’s firm, named Gerson Lehrman Group (GLG), boomed throughout the early 2000s as stock market investors looked for every advantage they could find. GLG’s revenues grew by an average of 30 percent a year from 1999 to 2006. Hoping to replicate that success in Asia, GLG opened its first offices in Hong Kong and Shanghai in 2005.

But building an expert network, unsurprisingly, is best achieved when you start with a network to pull from, and GLG quickly faced stiff domestic competition. In 2006, two Chinese business executives, Xu Rujie and Kai Hong, founded their own expert network called Capvision.

“They saw GLG enter the market and they said, ‘Oh, we can do that. But let’s do it better and faster and bigger, and more Chinese’ as it were. And so they did,” says Robert Guterma, Capvision’s former head of compliance, who now is CEO of The China Project, a U.S. media company.

Xu and Hong — then each in their 30s — had years of experience working for domestic and foreign companies in China. Xu, who had earned an undergraduate and master’s degree in microwave technology from the Beijing Institute of Technology and Shanghai Jiaotong University, started his career at the massive state-owned conglomerate, China Resources, before joining the German electronics giant, Siemens, and then the American automaker, General Motors. At GM, Xu, who according to public filings is a Chinese citizen, worked as vice president of government relations in China.

“He spoke quite a bit about his government relations access,” one former Capvision employee tells The Wire. “He was known as the guy who could work the Chinese government side.”

Hong, meanwhile, has a more international background. After attending college at a technical university in Germany, he earned his MBA at University of Pennsylvania’s Wharton School of Business and went to work for Siemens, where he overlapped with Xu, according to his LinkedIn profile. He also did stints at Bain and Cisco Systems before co-founding Capvision in 2008.

For many years, insider trading was thought to be common in China. There is very little trust in the Chinese capital markets, and if experts in the Capvision network were engaged in that, it would exacerbate that issue.

A third partner, Yao Zhengye — a Wharton-educated investor who worked at J.P. Morgan and Goldman Sachs in Hong Kong — also helped establish the company. Neither Yao nor Hong responded to requests for comment.

Leveraging their diverse set of business connections, the trio faced a ripe market: investors were starved for information on the Chinese publicly traded companies they had invested in.

“We have been fortunate enough to be in one of the fastest growing markets in the world and were able to capitalize on the fact that information flow in China has always been fairly un-transparent,” Hong told Reuters in 2013.

Capvision, as well as the broader expert network industry, thrived in China even as the U.S. Securities and Exchange Commission (SEC) began to crack down on GLG and other expert networks in the United States. In the early 2010s, the SEC brought several enforcement actions accusing expert networks of facilitating illegal information exchanges between experts and hedge funds — cases that nearly brought down the entire expert network industry in the United States. One high-profile scandal involved S.A.C. Capital Advisors, one of the world’s biggest hedge funds, making a $276 million profit after allegedly getting insider information about the development of an Alzheimer’s drug from a GLG expert.

Similar dynamics could have been at play in the expert network industry in China.

“For many years, insider trading was thought to be common in China,” says Gary Rieschel, the founding managing partner of Qiming Venture Partners, an investment firm with extensive investments in China. “There is very little trust in the Chinese capital markets, and if experts in the Capvision network were engaged in that, it would exacerbate that issue.”

Shih, at the University of California, San Diego, says that “Capvision operated with impunity for years and years,” because China is a relatively lax regulatory environment compared to other markets.

“If [China’s financial regulator] had the same authorities and power as the SEC in the U.S., they would have likely issued all kinds of warnings and injunctions to Capvision along the way,” he says.

Some former Capvision employees disagree with this wild west characterization, and say that GLG’s troubles served as a wake up call for the firm.

“The reason they hired me to build them a compliance program was because of all the legal trouble that had originated in the United States,” Guterma, the former Capvision compliance chief says. “Even though they were in China, many of their Western clients now demanded it.”

Still, while much has been made of Capvision’s foreign clients, it’s worth noting that its top five clients are all based in China, according to the firm’s draft IPO prospectus. Capvision’s client rolodex also includes virtually all of China’s major companies and global investment firms. In 2020, the company said it had more than 1,200 clients, including some of China’s largest securities firms and nine of China’s top ten technology, media and telecoms firms.

An excerpt from Capvision’s draft IPO prospectus.

This focus on the China market seems to be the result of a 2015 shake-up in the firm. According to one former Capvision employee, there was a split in the company’s leadership that year: Xu wanted to double down on the Chinese market, while Hong wanted to expand internationally.

Xu got his way. After buying out Hong and other early equity holders, Xu brought in a group of uniquely high-profile Chinese investors.

Tianfeng Securities, an investment firm with many state-owned shareholders, including AVIC, the defense conglomerate, has a 7 percent stake in Capvision. Another 12 percent stake is held by Gortune Investment Company, a Guangdong-based consortium stacked with big names in Chinese business, including He Xiangjian, the billionaire founder of appliance-maker Midea Group; Pang Kang, the billionaire chairman of Foshan Haitian Flavouring & Food; and Liu Wei, the founder of PCI Technology Group, a public artificial intelligence firm. A Gortune executive sits on Capvision’s board.

A fund set up by the HNA Group, the sprawling conglomerate that imploded in recent years after it declared bankruptcy and two of its top executives were detained, also held a stake in Capvision from 2015 to 2017, according to data from WireScreen.

The second largest individual shareholder in Capvision — behind Xu, who owns nearly a third of the company — is a person named Fang Wenyan. Chinese media has reported that Fang is the wife of Zhang Jianping, a famous investor known as the “No. 1 Niu San,” a Chinese term meaning a big non-institutional trader.

Zhang and Fang, who often trade together, got rich on the Chinese stock market starting in the early 2000s, but have since suffered a string of failures and had multiple run-ins with Chinese regulators. Fang, for example, was suspended from trading on the Shenzhen stock exchange in 2009 for abnormal trading, and the couple was issued a warning letter in 2019 from the China Securities Regulatory Commission. The Wire was unable to independently confirm that the Fang Wenyan listed as a Capvision shareholder is the spouse of Zhang Jianping.

Capvision also set up companies alongside prominent state firms. In 2018, Capvision established a joint venture with China Resources, Xu’s former employer and one of China’s biggest state conglomerates with about $100 billion in revenue. The joint venture, according to a press release, provided expert consultation and industry research for different departments of China Resources. A picture included in the press release shows two men signing the agreement in front of a whiteboard decorated with drawings of the logos for Capvision and China Resources.

Despite its connections and financial success, however, there have also been warning signs about Capvision’s relationship with the government. The company attempted to go public three times — twice in Hong Kong, most recently in February 2022, and once on the mainland — but did not succeed after Chinese regulators issued two rounds of detailed feedback questioning the company about its pricing model, its compliance with securities regulations, the government subsidies the company received1, and shareholder relationships.

After they just watched a bunch of people get trotted out on television, who’s going to see that and then answer Capvision’s call?

CICC, the state-owned investment banking giant, was working with Capvision as it attempted to have shares listed in China in 2020 and the investment banking firm was also slated to underwrite the 2021 Hong Kong IPO. After news of the raid broke, however, CICC scrambled to distance itself from the firm. According to a report published by Reuters, CICC banned its employees from using the firm and said it plans to review its past dealings with Capvision.

Today, Capvision isn’t technically out of business, but some say the reputational damage has been significant.

“I can’t imagine a Chinese expert answering a phone call from Capvision,” Guterma says. “After they just watched a bunch of people get trotted out on television, who’s going to see that and then answer Capvision’s call?”

CATCH-22

Over the past week, the American due diligence community has concluded they aren’t entirely welcome in China. Following Beijing’s investigation of Mintz, some Mintz executives reportedly left Hong Kong. Because of the environment, another American consultancy, Forrester Research, announced on Thursday that it plans to close its China office altogether.

But Capvision appears intent on proving it can live another day — and that its expert network business can be conducted completely above board. In the wake of the raid, Capvision announced that it was setting up a new compliance committee that will be chaired by Xu. The goal of the committee, the company said, will be to “rectify” company operations to ensure the company is not violating national security.

Foreign and domestic investors will likely be cheering for it to succeed. Less than two decades after opening, Capvision’s expert network is a critical piece of architecture in China’s financial industry. Given the nontransparency of Chinese markets and the country’s relatively lax regulatory environment, many say it is exceedingly difficult to conduct investment research or do basic due diligence without it.

“They were very much the people you would go to when you were trying to find information about something,” Rieschel says. Without Capvision, he says, firms looking to invest in China will have to do so “with greatly diminished diligence. This is a step towards creating that black box.”

There may, however, be reason to believe that Chinese authorities are targeting individual actors and are not necessarily intent on wiping out the industry. Some observers noted that authorities have so far only jailed experts accused of leaking information — not Capvision company executives.

Zongyuan Zoe Liu, a fellow at the Council on Foreign Relations, says this treatment should be seen in the larger context of Beijing’s recently updated espionage law and the unique Catch-22 that Chinese business people are being put in. Under President Xi, China’s government has ramped up its civil-military fusion strategy, explicitly calling on private enterprises to integrate more closely with the military and giving more private firms access to sensitive information and government data.

And yet the espionage law, which goes into effect on July 1, includes an expansive definition of what constitutes state secrets, making virtually all information transfers within China potential violations of national security — whether they’re intentional or not. In the CCTV report on Capvision, for instance, a former employee of a state-owned company said he didn’t know he was talking to foreign companies, and therefore leaking internal secrets to the outside world, on some Capvision-arranged calls.

Beijing’s focus on Capvision, according to Liu, at the Council on Foreign Relations, can be seen as “public education or warning to the Chinese public that they may be violating the law even if they are not aware of how their activities might pose a threat to national security. [Because of civil-military fusion] all these private firms have become part of China’s overall national security architecture.”

Dan Harris, an attorney at Harris Bricken, which helps foreign businesses operate in China, also says the effects on the local Chinese “experts” will be most acute.

This is telling the people who are being paid $10,000 [for their expert advice], ‘We are after you, and we are not going to let you keep doing this.’

“The Chinese government does not act randomly when they raid a company,” he says. “This is telling the people who are being paid $10,000 [for their expert advice], ‘We are after you, and we are not going to let you keep doing this.’”

If it hopes to survive, then, Capvision will likely have a significantly smaller footprint for its expert network.

“Folks that work in those non-sensitive areas can continue to use expert networks,” says Mu Chen, co-founder of Shanghai-based research firm Baiguan. “You just have to be aware and follow the law. Don’t induce experts to give state secrets. Don’t seek and use insider information.”

Essentially, under the new law, says Donald Clarke, an expert on Chinese law at George Washington University, “the definition of forbidden information seems to be that if [the authorities] didn’t put it in Xinhua [the state-run news agency] you have no business asking about it.”

Capvision’s network of powerful backers has some adjustments to make as well. Days before CCTV aired its segment on Capvision, Tianfeng Securities, the state-linked investment firm that is one of Capvision’s largest shareholders, gathered its top executives together in a massive conference room to discuss “compliance management.”

In a press release about the meeting, Tianfeng emphasized that the company needs to “eliminate security risks from the source” and “properly handle the relationship between development and security.”

Thanks to Capvision, virtually all businesses in China are now joining Tianfeng in this endeavor.