Out of Bounds, The Wire China, Oct. 1, 2023.

By Luke Patey

Pushback to President Biden's executive order on outbound investment has been swift from all sides.

At this spring’s China Business Conference, the president and chief executive officer of the U.S. Chamber of Commerce made an impassioned case for restraint. When it comes to America’s China policy, Suzanne Clark said she wanted the D.C. audience of politicians, executives, bureaucrats, journalists and scholars to remember one thing: “Not every economic interaction with China poses a national security risk.”

Clark had spent the first five minutes of her address outlining the Chamber’s long list of criticisms of the Chinese Communist Party, and she made clear that the world’s largest business association supported “targeted and responsible” trade and investment restrictions when American security was at risk.

But at the same time, Clark insisted that the American private sector did not want to undermine the vast commercial opportunities still available in the world’s second largest economy. “We can’t take a blunt approach on China — like decoupling,” she said. “We need to take the surgical approach of de-risking.”

At the time of the conference, rumors were swirling that just across Lafayette Square, the Biden White House was putting finishing touches on a plan to restrict U.S. investments in China — an unprecedented step that could limit the billions of U.S. dollars that fund Chinese businesses each year. Clark’s address was very much a response to this potentiality, and it seems her message — that overbearing bureaucratic controls would sap profitability and technological competitiveness — landed well with its target audience.

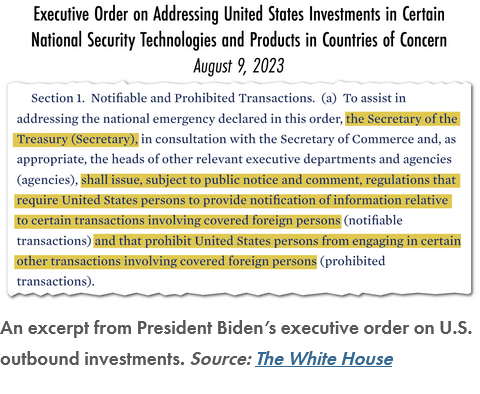

When President Biden’s executive order on U.S. outbound investments finally arrived in August, it was both extraordinary — a notable step away from America’s devotion to open trade and investment principles — and largely inconsequential, given its narrow scope.

The order only targets subsectors in semiconductors, artificial intelligence and quantum computing that are critical for military, intelligence, surveillance or cyber-enabled capabilities.

Moreover, unlike the hard-and-fast October 7th export controls that clamped down on U.S. semiconductor trade with China last year, the executive order on outbound investment only directs the Department of the Treasury to propose rulemaking. In other words, the particulars of the notification and prohibition program are far from set. At the earliest, the final rules will come into effect at some point in 2024.

Neither the U.S. Chamber of Commerce nor the Business Roundtable, an association representing chief executive officers of leading American corporations, responded to the Wire’s requests for comment, but both organizations are likely relieved about the outcome. Congress had pressed the Biden administration to act after a similar plan died on the vine in 2018, in part because of U.S. industry lobbying. To avoid that same fate, the White House consulted with 175 stakeholders from the private sector this time around, and the Business Roundtable even thanked the Biden administration “for proactively engaging the business community before releasing its executive order.”

For multinational corporations with diverse global footprints, it becomes hard to pin down the aggregate risk. And if investment transactions are not covered today, they might be tomorrow.

Still, not everyone is pleased with the process or current outcome — not even businesses, who remain worried that the relatively relaxed screenings could tighten over time.

Indeed, pushback to the rule has been swift from all sides. A bipartisan group of critics now assert the Biden administration worked too closely with American industry. It was not lost on observers, for instance, that on the day Clark gave her speech at the China Business Conference, President Biden was en route to New York City for a $25,000-a-ticket campaign fundraising event at the private residence of Hamilton “Tony” James, a former executive at Blackstone — a U.S. private equity giant that is well-connected in Chinese political and business circles.

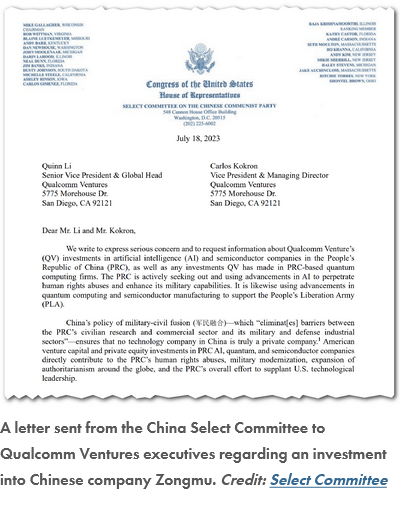

Critics also say the current outbound investment rules suffer from too light of a touch. Republican Congressman Mike Gallagher, who heads the Select Committee on the Chinese Communist Party, called Biden’s plan “a small step in the right direction” but with “loopholes wide enough to sail the PLA Navy fleet through.”

Although the plan covers mergers and acquisitions, greenfield joint ventures, private equity, venture capital and even some debt financing, Gallagher and other lawmakers want the proposed program to cover so-called passive investments, such as public stocks and mutual and index funds.

Congresswoman Maxine Waters, the top Democrat on the financial services committee, has also called for American private equity and venture capital firms to divest already existing investments in targeted industries since the proposed program is not retroactive. American VCs — such as GGV Capital, GSR Ventures, and the investment arms of Qualcomm and Intel — have already invested tens of billions of dollars into the three industries targeted by the outbound investment regime, according to a study released by Georgetown University’s Center for Security and Emerging Technology. The Chinese AI company iFlytek, for instance, has been accused of providing voice-recognition technology to Chinese authorities for cracking down on Uyghur Muslims and was added to Washington’s Entity List in 2019 — but GSR Ventures still co-invested with the blacklisted Chinese company shortly after.

Some critics also say the prolonged process outlined in the executive order is something of a stalling tactic, and the regulations may never actually come to pass — the result of Treasury’s deep entanglement with the interests of the U.S. financial sector, which wants to keep its options for investing in China open.

“Treasury did not want to do anything at the beginning on outbound investments; it does not want to do anything now; and unless Congress forces it, it won’t do anything in the future,” says Derek Scissors, a senior fellow at the American Enterprise Institute (AEI).

Congress could force the issue. A congressional probe is investigating whether or not American private equity and venture capital firms funded Chinese technologies to carry out human rights abuses and advance Beijing’s military capabilities. Its findings may very well provoke lawmakers into action.

A recent Senate amendment to the National Defense Authorization Act could also harden notification rules on outbound investment into law and expand the scope into other sectors, such as hypersonics and satellite-based communications.

For American business, then, the situation is far from settled.

“For multinational corporations with diverse global footprints, it becomes hard to pin down the aggregate risk,” says Reva Goujon, a director at the Rhodium Group. “And if investment transactions are not covered today, they might be tomorrow.”

The twists and turns of Washington’s debate on outbound investment rules reveals an America in self-examination. Who wins and who loses from the potential restrictions depends on where one stands in America’s deep and complex economic relationship with China as well as how one perceives the national interest is best served.

If the budding regime wilts away over time, then the power of business interest groups in Washington, coupled with voices of engagement in the Biden administration, will have won a victory over supposed steadfast, bipartisan commitment to confronting China as a peer rival.

Yet if Treasury plows ahead on a strong foundation laid by congressional legislation, it will be another step away from Washington’s laissez-faire policy adherence and a signal that national interests are not always aligned with those of the business community.

“This is a loaded weapon,” says Goujon. “The ambiguity in the rules — which is partly by design and partly a reflection of uncertainty — adds to the chilling effect on investments. Because no one can say with certainty how it could be applied in the future.”

HISTORY RHYMES

On the final day of 1967, the Secretaries of Treasury, Commerce and State, alongside a procession of other high-level officials, disembarked from a Lockheed Jetstar at the Lyndon B. Johnson Ranch in Stonewall, Texas. They were visiting President Johnson at his beloved “Texas White House” to hash out the last details of an executive order that would curb and control American foreign investment.

There had been a voluntary program in place, but limiting outbound capital and investment was now mandatory, Johnson argued at a press conference the following day, in order to tackle the mounting balance of payments crisis.

“Your job, the prosperity of your farm or business, depends directly or indirectly on what happens in Europe, Asia, Latin America or Africa,” President Johnson told Americans. “We cannot tolerate a deficit that could endanger the strength of the entire free world economy, and thereby threaten our unprecedented prosperity at home.”

He went on to outline his plan to reduce America’s balance of payments deficit by at least $1 billion, and promised that his program would “guarantee fairness among American business firms with overseas investments.”

With a new office set up within the Commerce Department to oversee the program, Johnson’s order established a multi-tier process that required financial institutions and investors to report and evaluate their investments abroad. Although the program technically lasted into the Reagan administration, its aims became largely irrelevant by the early 1970s, when the U.S. ended gold convertibility and shifted to a flexible exchange rate, thus easing the balance of payments crisis.

The Commerce Department noted some success in the first couple years of the program — there was a sharp reduction in capital transfers from the U.S. in 1968 beyond the $1 billion target — but a 1975 Senate Committee report found that its ultimate effectiveness was “open to question.”

Corporate America, of course, condemned the program from the beginning. “There is the danger now of killing the goose that lays the golden egg,” Christopher H. Phillips, the head of the U.S. Council of the International Chamber of Commerce, told The New York Times the day after Johnson announced the executive order.

Corporate leaders were reportedly in the dark about Johnson’s mandatory program — a notable contrast to the Biden administration’s “robust and sustained engagement” with industry representatives — but their criticism sounds strikingly similar to Clark’s. Indeed, industry in America has long warned about bureaucratic interventions possibly tripping up investments and undermining profits.

But America’s history with outbound investment restrictions suggests that U.S. multinationals tend to exaggerate the impact of government regulation. A senior Commerce Department official later noted that Johnson’s program did not overly upset the flow of American overseas investment; U.S. multinationals simply turned to foreign borrowing to offset the government’s capital quotas.

This raises questions about the potential impact of the present-day outbound investment regime on American firms’ competitiveness: Just how significant is China as an investment destination for U.S. multinationals?

As an experiment, say industry’s worst fears come true and Congress expands the rules to cover a far wider scope, ensnaring a host of gray-area investments across China’s often nebulous military-civil fusion divide.

A Rhodium Group study used a previous bill forwarded by American lawmakers to show the effects of such a program. The bill would have included nearly a dozen “critical sectors” for review, from AI to shipbuilding, and would have covered 43 percent of all U.S. foreign investment made in China over the past two decades — amounting to roughly $110 billion.

That is an impressive figure — but not when it is put into context.

According to data from the U.S. government’s Bureau of Economic Analysis, China and Hong Kong only account for 3.3 percent of total U.S. foreign investment stock. By contrast, American investment in the European Union makes up over 40 percent of the global total. Even Canada, with an economy nine times smaller than China’s, has attracted double the amount of U.S. investment, which highlights the often under-recognized significance of regional integration.

“The overall investment number [in China] sounds big, but in a global context, it is not, and certainly not when you consider how prominent China has been in driving global growth,” says Stewart Paterson, a research fellow at the Singapore-based Hinrich Foundation.

Paterson points out that China’s sizable consumer market and infrastructure across manufacturing sectors still offers a compelling and enduring value proposition for some U.S. multinationals. For example, American technology companies Apple, Intel and Qualcomm respectively generated 19 percent, 27 percent and 62 percent of their total global sales last year on the mainland.

The handful of multinationals with big bucks in the China game, Paterson says, are the ones making “noise” around Washington’s trade and investment regulation. And industry representatives often argue that these sales fund R&D and drive innovation, making them crucial for American competitiveness.

The Chinese government has done far more to dissuade people from investing in China than the U.S. could ever do with any number of restrictions.

But these companies might be more resilient than many give them credit for. “Apple generates so much cash that if it lost all of China it would still have plenty to invest in R&D,” says Richard Windsor, founder of the research company Radio Free Mobile and a former equity analyst at the global investment bank Nomura Securities.

Apple made nearly $400 billion in revenues in 2022, but its R&D budget was $26 billion or about 6.5 percent of its sales. Qualcomm, which spends 18 percent of its revenues on R&D, has a much higher exposure to China. But for the time being at least, the American semiconductor chip designer is difficult to replace.

Perhaps more importantly, the majority of American companies — even tech giants such as Google and Microsoft — aren’t reliant on China. Paterson’s research shows that U.S. multinationals collectively generate only 2.6 percent of their sales revenues from China.

“If I was forced to make an argument against outbound investment controls, it would be that they may erode the institutional basis on which market economies work,” Paterson says. “Because if you look at the arithmetic of the actual numbers involved, the welfare loss to the U.S. economy and American consumers from the potential loss of corporate investment and sales works out to be nothing more than a rounding error in the context of the overall economy.”

Even before Washington’s outbound investment regime, many American investors seem to have decided that China simply isn’t worth it. U.S. foreign investment in China fell from an average of $14 billion per year between 2005 and 2018 to $10 billion annually in the following five years. Last year saw a 20-year low at $8.2 billion, and U.S. venture capital is heading in an even sharper downward direction.

“The Chinese government has done far more to dissuade people from investing in China than the U.S. could ever do with any number of restrictions,” says Windsor, citing Beijing’s private sector crackdown and growing political risks on consulting and due diligence work.

The proposed outbound investment rule will only exacerbate this trend.

“Even in the interim, before it is finalized next year, the rule will have a chilling effect on the willingness of American companies to invest in China,” says Emily Benson, director for the Project on Trade and Technology at the Center for Strategic and International Studies (CSIS).

U.S. venture capital firms, for example, which already fled from investing in the semiconductor and quantum computing sectors, are now shying away from China’s lucrative biotech sector — a likely sector-candidate in any expanded outbound rules. The American firm Sequoia Capital took things a step further by spinning-off a whole new outfit for China. And the Silicon Valley firm GGV Capital recently announced it will make a similar move.

“For some companies, market share in the U.S. and G7 ecosystems is not worth the China entanglement,” says Rhodium’s Goujon. “But others can’t forgo the Chinese marketplace.”

But if even these China-devoted companies agree — as Clark said at the Chamber of Commerce — that American capital shouldn’t fund military end-users in China, then how, exactly, should the U.S. regulate them?

CHAIN REACTION

One of the most interesting elements of the proposed outbound investment regime is that its critics tend to agree on its faults — but often for wildly different reasons.

On artificial intelligence, for example, the plan is often criticized for being too ambiguous. Biden’s proposed program remains undecided on whether to focus on AI used “exclusively” or “primarily” for military, intelligence and mass surveillance end uses.

The difference matters, says Giovanna Cinelli, partner at Morgan Lewis, a D.C.-based multinational law firm. “There is no sector that doesn’t have AI,” she says. “Whether it is weapons systems, electric vehicles, or your Roomba vacuum, AI is all over the place.”

Cinelli takes umbrage with the ambiguity because she thinks it could result in the investment regime’s expansion. “Without adequate definition,” she says, “the tentacles of the program can just continue to extend.”

Scissors, at AEI, agrees that the lack of specificity is a problem, but in his view it is because it could leave legal room for loopholes and circumvention. He sees the lack of clarity as a sign that the Treasury Department doesn’t actually intend to follow through with the restrictions. “The proposed rulemaking leaves every important issue unresolved in favor of doing nothing,” he says.

Benson, at CSIS, falls somewhere in the middle, acknowledging that parts of the order are “brilliant” while others read as if “a student handed in a college paper that still needs feedback from the professor.”

Benson is also slightly more optimistic than others, noting that the plan’s ambiguity could be intentional — an opportunity for the U.S. government to get a better sense of where to draw the boundaries.

“One of the primary functions of this new tool is to create more data,” she says. “Just getting some of the big institutional capital players to participate will draw in more information about how to tailor something that can have an effect.”

But in the meantime, some worry that foreign investors will simply fill any gaps left by shrinking U.S. investment in China. Only a small number of American allies and partners, such as South Korea, have outbound investment regimes of their own. Others are mulling over the idea. The European Commission — the executive arm of the European Union (EU) — recently announced plans to develop an outbound investment tool as part of its China-focused economic security agenda.

“The U.S. is relying on diplomatic efforts to get allies and partners to stand up similar mechanisms on outbound investment and not backfill for U.S. investors and tech companies,” says Emily Kilcrease, a senior fellow and director of the Energy, Economics, and Security Program at the Center for a New American Security. “Ultimately, that’s going to be a more durable approach than a U.S. unilateral tool.”

But it’s not certain to succeed. The issue is hotly debated in the EU, and German investment seems determined to make its way into China’s EV space. Just last year, the German automaker VW invested over $2 billion in a joint venture with Beijing-based Horizon Robotics. Intel Capital actually provided Horizon with seed funding in 2017, but now — with VW’s backing — Horizon is edging into Intel’s market territory by developing microchips for the automobile industry.

Critics also note that even if the Biden administration succeeds in rallying allies to its “small yard, high fence” strategy, it’s not clear it will slow down China’s progress in advanced and emerging technologies.

Douglas Fuller, associate professor at the Copenhagen Business School, notes that for Chinese start-ups, attracting investment from the venture arms of Western tech leaders like Intel offers some “prestige value.”

“But beyond the capital investment,” he says, “China already has the necessary venture capital management and operational skill set.”

Others argue that trying to reduce these technologies to a simple horse race is a mistake.

Investors are the glue that hold the two economies together. Removing it reduces the possibilities for scientific collaboration, technology transfer, and spillovers.

“The bottom-line is, as written, the advanced notice of proposed rule-making will have little effect on American competitiveness,” says Kevin Klyman, a technology policy researcher at Harvard Kennedy School’s Belfer Center for Science and International Affairs. “But competitiveness is not only defined by who is number one at the leading edge.”

Klyman points to Ford Motor’s cooperation with Chinese battery maker CATL as a valuable opportunity for a U.S. company to gain market information from China’s mastery of process technology and the components essential for the digital and green transition — like lithium-ion batteries for electric vehicles.

“Investors are the glue that hold the two economies together,” he says. “Removing it reduces the possibilities for scientific collaboration, technology transfer, and spillovers.”

Just this week, Ford announced it was pausing its plans with CATL, after Congress began scrutinizing the partnership — a development that shows just how far we still are from the end of the de-risking story. Beijing’s willingness to apply export restrictions on critical minerals for semiconductor and battery technologies makes matters worse.

“There is a chain reaction to keep in mind,” says Goujon at the Rhodium Group. “As China feels the urgency to close gaps with the U.S. in foundational technologies and to get industrial policy funding in the right places, the U.S. argues this is further evidence of Chinese state interference that justifies new regulation.” Even outside the cutting-edge technology space, she warns, that “dynamic should weigh heavily on any investor.”

It is clearly weighing heavily on the U.S., as well. In chipping away at the bedrock principles of free and open trade and investment, Washington is confronting the critical question of how the U.S.-China economic relationship does or does not serve the national interest. The outbound investment rule brings a new variable into this adversarial space — even if it is never fully implemented or expanded.