Mad Money短信 2021/1/15

CNBCの投資情報番組 『Mad Money』。名物コメンテーター『ジムクレイマー』さんが番組で取り上げると、その後、取り上げられた株の株価が動くときがある?ため(筆者主観)、番組で取り上げられた銘柄の速報をこちらにアップしていきます

本編

・イベントが起こって、マーケットが予想通りの内容を認識した場合、マーケットは売りとなる

・バイデン政権の経済刺激政策は期待した通りの内容だったので売りとなった

・JP Morgan、Citi group決算で下げた。ただ彼らは多くのお金を持っている。自分は株価は上がると思っていたが、下落した。自分はマーケットはMis judgeしてると考える。3日待って、買うことをお勧めする。このグループで一番いいJPMか、グループで一番悪いWells Fargo。自分はCランクがB+になるストーリーも好きだからね。銀行は株の買戻しを行い、配当金を引き上げるだろう、そしてそれは株主が望んでいることだ。忍耐が必要だ。

来週のゲームプランはこちら

Tuesday: Goldman Sachs, Bank of America and Netflix earnings

Goldman Sachs

Q4 2020 earnings release: 7:30 a.m.; conference call: 9:30 a.m.

Projected EPS: $7.39

Projected revenue: $9.99 billion

“Only a massive earnings beat based on both revenue growth and lower expenses can propel this stock to higher levels,” Cramer said. “A normal beat is not enough, plus we need a super … raised forecast in order for this stock to rally.”

Bank of America

Q4 2020 earnings release: 6:45 a.m.; conference call: 8:30 a.m.

Projected EPS: 55 cents

Projected revenue: $20.58 billion

“Like Goldman Sachs, Bank of America’s coming in smoking. In the last couple months, well, it’s surged from $24 to $33,” he said. “Once again, when the expectations are this high, it’s not enough to be good, you’ve gotta be great.”

Netflix

Q4 2020 earnings release: 4 p.m.; conference call: 6 p.m.

Projected EPS: $1.36

Projected revenue: $6.62 billion

“I do think Netflix may finally be suffering from some fatigue, thanks to all the new competition these days,” the host said. “If Netflix wants to get its groove back, it needs to blow away the numbers, but I am not holding my breath.”

Wednesday: UnitedHealth, Procter & Gamble and Morgan Stanley earnings

UnitedHealth Group

Q4 2020 earnings release: before market; conference call: 8:45 a.m.

Projected EPS: $2.41

Projected revenue: $64.98 billion

“I expect yet another incredible, amazing quarter that still seems to surprise people,” Cramer said. “The company’s a machine — a money machine — and I would not be surprised if they also raise their forecast very big, too.”

Procter & Gamble

Q2 fiscal 2021 earnings release: before market; conference call: 8:30 a.m.

Projected EPS: $1.51

Projected revenue: $19.26 billion

“I’m expecting a picture-perfect quarter from Procter & Gamble,” he said.

Morgan Stanley

Q4 2020 earnings release: 7:30 a.m.; conference call: 8:30 a.m.

Projected EPS: $1.30

Projected revenue: $11.58 billion

“It would shock me if Morgan Stanley somehow fails to beat the expectations,” the host said. “CEO James Gorman has navigated the brokerage waters better than anyone, except for maybe the people at Robinhood. The only problem I see here is with Gorman himself. He’s so darned self-effacing that he may make the quarter sound less impressive than it is.”

United Airlines

Q4 2020 earnings release: after market; conference call: Thursday, 10:30 a.m.

Projected losses per share: $6.58

Projected revenue: $3.44 billion

“Can United Airlines give these stocks a shot of oxygen? If we have a good vaccine day, then the answer is yes,” he said. “Otherwise, it just will not matter.”

Thursday: Union Pacific, IBM, Intel, CSX and United Airlines earnings

Union Pacific

Q4 2020 earnings release: 8 a.m.; conference call: 8:45 a.m.

Projected EPS: $2.24

Projected revenue: $5.09 billion

“The really good news, though, is that the rails now have a propensity to rally no matter what and that’s because of efficiencies and expense controls that had been lacking,” Cramer said.

IBM

Q4 2020 earnings release: after market; conference call: 5 p.m.

Projected EPS: $1.81

Projected revenue: $20.65 billion

“We think IBM’s going to introduce the management team of what’s affectionately called Newco, the services spinoff that represents the old IBM,” he said. “I think the Street will like what it hears.”

Intel

Q4 2020 earnings release: after market; conference call: 5 p.m.

Projected EPS: $1.10

Projected revenue: $17.46 billion

Intel “just shook up the joint bringing in a new CEO (Pat Gelsinger) after the company suffered some multiple sales misses,” the host said. “I bet he will do a fine job at Intel, too.”

CSX

Q4 2020 earnings: after market; conference call: 4:30 p.m.

Projected EPS: $1.01

Projected revenue: $2.77 billion

“I like what I see as industrial cargoes grow stronger. If it sells off in response to Union Pacific, I’m probably going to be a buyer,” he said.

Friday: Schlumberger earnings

Schlumberger

Q4 2020 earnings release: 7 a.m.; conference call: 8:30 a.m.

Projected EPS: 17 cents

Projected revenue: $5.23 billion

“I don’t expect the quarter to be strong, but the rig count has been rising week after week after week, and that is always good news for the stock known as Slob,” Cramer said.

特集1:Porch

・8000顧客

・Home serviceに関するサービス提供のソフトウェア、マーケットプレイスを提供

・家の売却時に行われる検査、全米の28%の検査は、Porch社のソフトウェアを利用して行われている

特集2 : Upstart

・AI Lending Platformの会社

・銀行にクレジットの審査のサービスを提供

・消費者向けにもUpstartサービスを提供

・他のFintechの会社が銀行の競合となろうとしているが、わが社の戦略はあくまで銀行のパートナーになって銀行にAIのサービスを提供していくこと

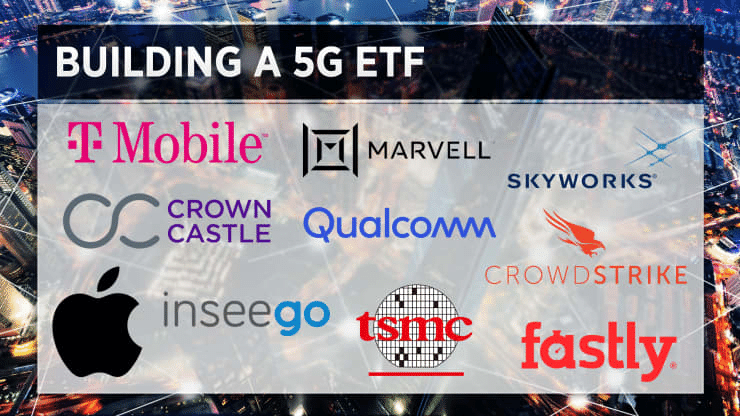

特集2

・5Gのロールアウトはこれまで続いてきたが、投資をするモメンタムが来ている

・いろんな方法での投資があるが、今日はMad Money 5G ETFを紹介する

Carrier: T-Mobile

Investments in the 5G landscape puts them in a great position going forward

Announced new multibillion-dollar agreements with Ericsson and Nokia to expand more

Stock is 6% below 52-week high

Cell tower: Crown Castle

Spent many years and billions of dollars building out 5G network infrastructure in densely populated areas

Investments have yet to pay off in a 4G world

Stock is 12.64% below 52-week high

Hardware: Apple

Launched the 5G enabled iPhone 12 in September

Poised to benefit from a huge 5G upgrade cycle

Stock is 8.39% below 52-week high

Speculative hardware: Inseego

Makes 5G infrastructure, including 5G mobile hotspots

Cleaned up the balance sheet

Stock is 21.38% below 52-week high

Semiconductor: Marvell Technology

Makes chips for networking, communications and storage

Has explosive 5G growth

Stock is 2.25% off 52-week high

Semiconductor: Qualcomm

Technology platform is essential for 5G networks to actually work as advertised

Spent years developing product and fighting some customers, such as Apple, in court

Stock is 3.73% below 52-week high

Semiconductor: Skyworks Solutions

5G cellphones need a lot more Skyworks components than a 4G phone

A huge Apple supplier

Stock is 8.43% below 52-week high

Semiconductor: Taiwan Semiconductor Manufacturing

Strategically positioned as a manufacturer for semiconductor design companies

Boosting capital expenditure budget to help make up for the current chip shortage

Stock is 3.84% below 52-week high

Cybersecurity: CrowdStrike

A cloud-native cybersecurity provider protecting networks connected to 5G devices

Businesses need solutions that can scale, such as CrowdStrike

Stock is 7.98% off 52-week high

Cloud content: Fastly

Next-generation content delivery network for digital media companies

With a new president taking over, there’s less threat of a ban on client TikTok

Stock is 35.38% below 52-week high

Lighting Round

Airline、財務良くないから航空買うならボーイングがおすすめ

CCIの方がおすすめ

ずっとレンジ。株価上がる日はすぐに来ないだろう。

GMいいけど、EVのビジネスならテスラ

It's very good place to be

SPGI is remarkable company

雑感

今週も一週間、お疲れさまでした。

以上です。

最後に、少しでもお役に立てましたら、イイねボタンをクリックしていただけると明日も頑張ってアップロードする気力となりそうです。よろしくお願いします。

あとツイッターにフィードバックもらえると嬉しいです。

お断り

・全ての情報はMad Moneyからの『引用』です。筆者の分析・コメントではありません。本家サイトはこちらからどうぞ

https://www.cnbc.com/mad-money/

・Mad MoneyのLightning Roundという視聴者からの銘柄問い合わせに答えるコーナーでは、短時間で二言、三言でジムがコメントをします。

・銘柄がいいね、その銘柄だったらこっちの方がいいんじゃない、というコメントは良くありますが、その理由まで語られることは少ないです。

・筆者は、Native Speakerでないため、誤訳されている可能性もございます。ご容赦ください。

・更新は不定期で、忘れたり、サボったりすることが多々あると思われます。ご容赦ください。

・なお、あくまでこのコンテンツは個別銘柄や投資法を薦めるものではありません、ただの情報です。また雑感に書かれている内容も個人の意見です。各々の投資に関しては、個人の自己責任でお願いいたします。

サポートいただいたお金は、今後の記事のための情報収集に大切に使わせていただきます。