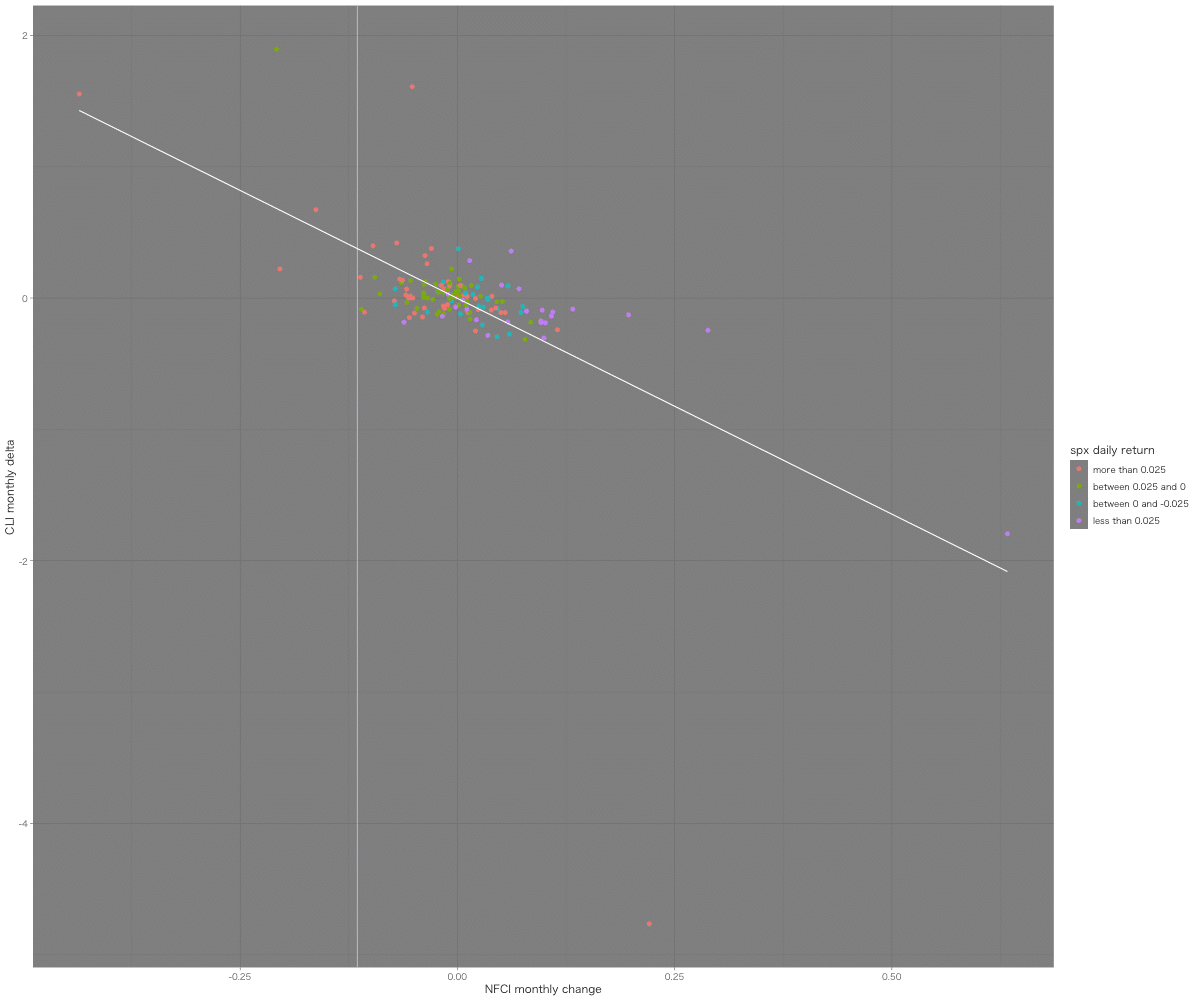

NFCI vs. CLI delta = SPX monthly cut

ソースコード データ準備編

#

TERM <- "2011::2022-11"

FC <- ANFCI

w <- merge(diff(apply.monthly(FC,mean))[TERM],as.vector(diff(cli_xts$usa)[TERM]))

colnames(w) <- c("FC","cli_delta")ソースコード plot編

#後で作業する 暫定コード

plot.default(w$FC,w$cli_delta)

abline(lm(w$cli_delta ~ w$NFCI))

abline(v=0,lty=2)

abline(h=0,lty=2)

abline(v=(diff(apply.monthly(NFCI,mean)) %>% last()))ソースコード回帰分析編

summary(lm(w$cli_delta ~ w$FC))

Call:

lm(formula = w$cli_delta ~ w$FC)

Residuals:

Min 1Q Median 3Q Max

-4.3508 -0.1127 0.0173 0.1365 1.9515

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -0.007963 0.039416 -0.202 0.84

w$NFCI -3.776124 0.425250 -8.880 3.04e-15 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.4679 on 139 degrees of freedom

Multiple R-squared: 0.3619, Adjusted R-squared: 0.3574

F-statistic: 78.85 on 1 and 139 DF, p-value: 3.038e-15ソースコード相関係数編

cor.test(w$FC,w$cli_delta)

Pearson's product-moment correlation

data: w$NFCI and w$cli_delta

t = -8.8798, df = 139, p-value = 3.038e-15

alternative hypothesis: true correlation is not equal to 0

95 percent confidence interval:

-0.6975572 -0.4844940

sample estimates:

cor

-0.6016207 ソースコードggplot 編

TERM <- "2011::2023-01"

FC <- NFCI

CLI <- cli_usa

w <- merge(diff(apply.monthly(FC,mean))[TERM],as.vector(diff(CLI)[TERM]))

colnames(w) <- c("FC","cli_delta")

w <- merge(w,spx=as.vector(monthlyReturn(GSPC)[TERM]))

# w <- data.frame(w,s=cut(w$spx,breaks=c(min(w$spx),-0.025,0,0.025,max(w$spx)),labels=c('d','c','b','a'),include.lowest = T))

w <- data.frame(w,s=cut(w$spx,breaks=c(max(w$spx),0.025,0,-0.025,min(w$spx)),labels=c('a','b','c','d'),include.lowest = T))

# w$s <- factor(w$s,levels=c('a','b','c','d'))

w$s <- factor(w$s,levels=c('d','c','b','a')) # this is critical. never remove nor comment out.

df <- w

p <- ggplot(df, aes(x=FC,y=cli_delta,color=s))

p <- p + geom_point(alpha=0.9)

# p <- p + guide_legend(reverse = TRUE)

# p <- p + scale_color_gradient(low = "green", high = "blue",name = "vix")

# p <- p + scale_color_gradient2( low = "#FF0000",mid="#FFFF00" , high = "#0000FF",midpoint=0)

# p <- p + scale_color_discrete(name='spx daily return',label=c('less than -0.025','between -0.025 and 0','between 0 and 0.025','more than 0.025'))

p <- p + scale_color_discrete(name='spx monthly return',label=c('more than 0.025','between 0.025 and 0','between 0 and -0.025','less than -0.025'))

p <- p + theme_dark(base_family = "HiraKakuPro-W3")

p <- p + stat_smooth(method = lm, formula = y ~ x,se=F,size=0.5,color='white')

p <- p + geom_vline(xintercept=(diff(apply.monthly(FC,mean)) %>% last()), colour="white",size=0.4,alpha=0.5)

p <- p + xlab("Financial Condition monthly change") + ylab("CLI monthly delta")

p <- p + annotate("text", x=last(df$FC),y=last(df$cli_delta), label = "◇",family = "HiraKakuProN-W3",alpha=1,color='red')

plot(p)

出力サンプル

おまけ: PMI差分も統合する

wはdata.frame なのでcbind()を使用してマージする。

TERM <- "2011::2022-11"

FC <- ANFCI

w <- merge(diff(apply.monthly(FC,mean))[TERM],as.vector(diff(cli_xts$usa)[TERM]))

colnames(w) <- c("FC","cli_delta")

w <- merge(w,spx=as.vector(monthlyReturn(GSPC)[TERM]))

# w <- data.frame(w,s=cut(w$spx,breaks=c(min(w$spx),-0.025,0,0.025,max(w$spx)),labels=c('d','c','b','a'),include.lowest = T))

w <- data.frame(w,s=cut(w$spx,breaks=c(max(w$spx),0.025,0,-0.025,min(w$spx)),labels=c('a','b','c','d'),include.lowest = T))

w$s <- factor(w$s,levels=c('d','c','b','a')) # this is critical. never remove nor comment out.

w <- cbind(w,as.vector(diff(PMI)[TERM]))おまけその2:FCIの差分データの計算方法を変更

w[,1] <- (to.monthly(FC)[,4] %>% diff())[TERM]

summary(lm(w[,3] ~ w[,1] + w[,2]))

Call:

lm(formula = w[, 3] ~ w[, 1] + w[, 2])

Residuals:

Min 1Q Median 3Q Max

-0.089678 -0.014008 0.001099 0.020290 0.078188

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.009393 0.002675 3.512 0.000601 ***

w[, 1] -0.282831 0.028159 -10.044 < 2e-16 ***

w[, 2] -0.015143 0.005480 -2.763 0.006494 **

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.03186 on 139 degrees of freedom

Multiple R-squared: 0.4212, Adjusted R-squared: 0.4129

F-statistic: 50.57 on 2 and 139 DF, p-value: < 2.2e-16この記事が気に入ったらサポートをしてみませんか?