There is good reason to be afraid, but "fear is the mind-killer"

Fear is the little-death that brings total obliteration (Frank Herbert).

Situation

Inflation has risen to levels not seen in 40 years. This was [probably] catalyzed by the unprecedented monetary and fiscal stimulus governments and central banks provided in response to the 2020 Covid-19 pandemic. The pandemic and this stimulus created a mismatch between supply and demand. Supplies were choked off by economies locked down and companies unable to fill job openings to produce, transport, and provide goods and services. Demand skyrocketed. People were given free money and had time on their hands to spend it. To attract workers, companies increased wages; and an economics 101 principle manifested where if demand increases but supply decreases, than the price of everything goes up. To make matters worse, in February 2022, Russia invaded Ukraine. Many countries chose to boycott Russian oil and natural gas in response further limiting the supply, and dramatically increasing the price, of crucial commodities--energy and heat. This further exacerbated the inflation problem. Europe has been disproportionately impacted. In response, central banks around the world, including the United States Federal Reserve, abruptly stopped purchasing assets and quickly pivoted from zero, or even negative interest rate monetary policy, to increasing their policy interest rates at breakneck speed with the objective of hammering inflation back down. Inflation they are at least partly responsible for causing.

Background

On September 21, Jerome Powell and the Federal Open Market Committee (FOMC) increased the federal funds rate (FFR) from 2.50% to 3.25%. At the beginning of this year the FFR was 0.25% and the Fed was purchasing $60 billion in Treasuries and mortgage-backed securities every month. The Fed is now reducing their balance sheet by allowing $95B in assets to mature and "roll off" each month. According to the CME FedWatch Tool, the market anticipates the FFR to rise to 4.50% by the end of this year and peak at 4.75 to 5.00% next year.

The FFR establishes a "risk-free" rate of return that all other assets that aren't risk-free are priced against. If the risk-free rate is increasing, than the yield of assets that aren't risk-free must also go up. In the world of bonds where yield and price move opposite one another, this means that the price of bonds declines as yields go up. As a result, bonds are experiencing their worst year ever. The stock market has reacted too and is off to its fifth worst year on record.

The decline in stock and bond prices is in-part due to a structural repricing from the rise in the FFR. However, there is an element of fear in these price moves too. There is understandable worry that as the Fed continues to increase interest rates and reduce the supply of central bank reserves by reversing their quantitative easing practices, recession may result. Signs of stress have already started to appear. Mortgage interest rates are very sensitive to the FFR and have increased dramatically. This is by design. The Fed intends to reduce the demand for houses by simply making it too expensive to take out a mortgage to buy a home. As a result of this reduced demand for mortgages many mortgage originators are already out of a job. Banks are suffering too as it becomes too expensive for prospective clients to go forward with deals and collect the lucrative fees associated with those deals. Higher interest rates makes borrowing more expensive which creates difficulties for low-quality or "zombie" companies (or even municipalities or countries) to take out new loans or refinance their existing debt. This creates the risk of corporate (or even sovereign) debt defaults. The global debt markets are about $128 trillion dollars in size, so there is good reason to be afraid if suddenly companies or countries can't refinance their debt at anything under 10%+ yearly interest. This contagion may spread beyond financial markets. There is a possibility that despite the Fed's best efforts inflation remains persistently elevated. This would negatively impact consumers, forcing us to continue to spend more on just the essentials like gas and food at the cost of more leisurely spending and the economic activity that results from that discretionary spending. The Fed cannot impact the supply side of the supply & demand curve. The Fed cannot pump more oil, grow more food, or provide more housing. Their tools only impact the demand side of the curve. There is fear the only way to reduce demand, prices, and inflation is by inflicting a "painful" recession.

Assessment

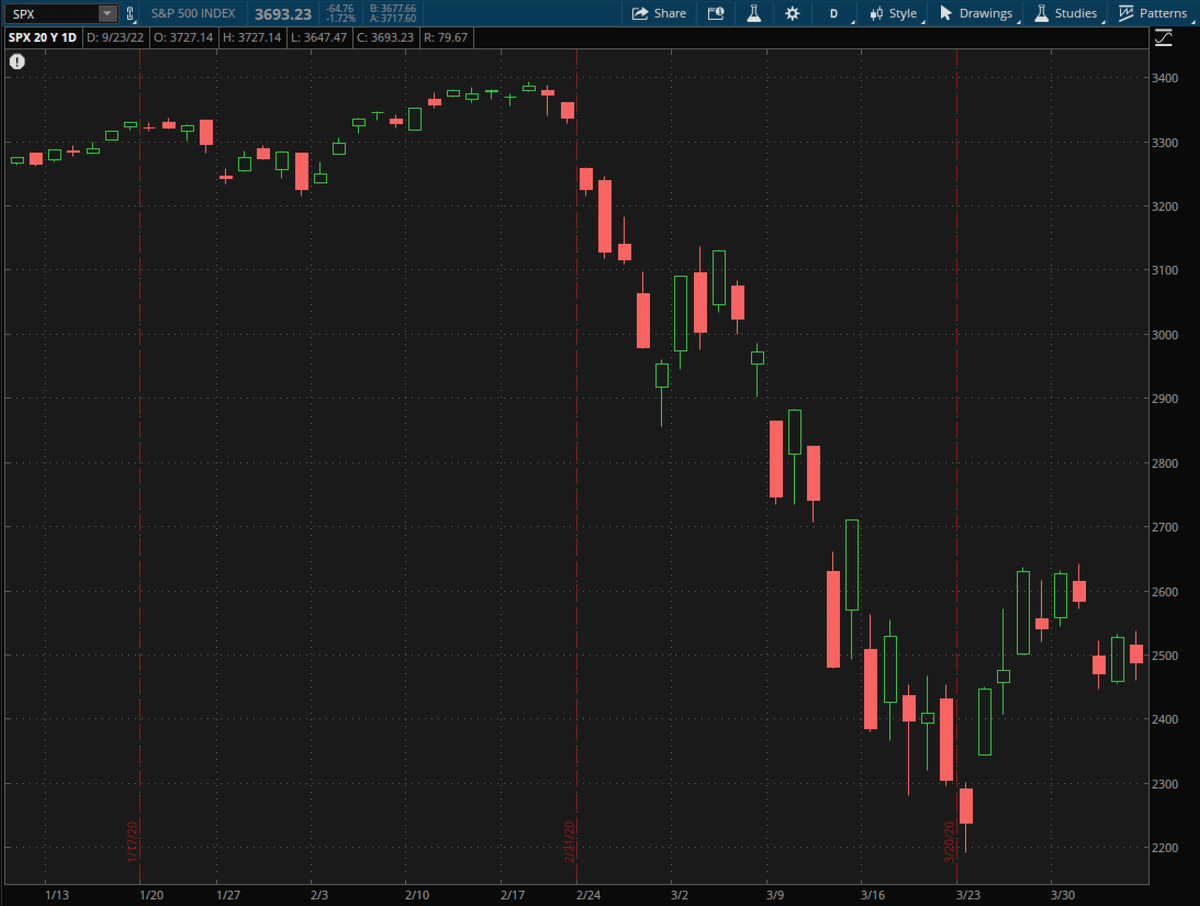

I think it is too easy to look at past charts of the S&P 500 during the 2008 Global Financial Crisis or 2020 Covid-19 pandemic and say, "If only I would have bought back then."

Hindsight is 20-20, but in those moments there was real reason to be afraid too just like today. The reasons to be afraid in 2008 included the potential collapse of the entire financial system. In 2020, there was fear of a 1918-level pandemic with unprecedented death around the world and the economic depression that would result. In both these examples, the worst-case scenarios failed to materialize. Governments rescued the financial system and Covid-19 proved not to be a fabled world-ending pandemic.

The present day contains many significant risks like in 2008 and 2020. The S&P 500 and bond markets are responding to these risks in a similar pattern when times are uncertain.

No one can know how low markets will drop, if a recession will manifest or how bad it will be, or when (or if) inflation will decrease. However, given that stocks are off to their fifth worst year ever and bonds are experiencing their worst year ever, today presents a unique opportunity. The yields on CCC or lower rated debt was a mere 6.5% at the height of the 2021 "everything bubble". Yields on those bonds are now 15% which are levels not seen since the 2011 Greek sovereign debt crisis, Global Financial Crisis, or the bursting of the 2000's "Dot-com" bubble. Similar yield increases have also occurred in CDs, US Treasuries, and investment-rated debt.

Recommendation

In times like these, I look to the wisdom of those more experienced. A quote from Howard Mark's memo Conversation at Panmure House stands out:

Now fast forward from February ’07 to October ’08: Lehman Brothers goes bankrupt on September 15, 2008, and now, rather than being carefree, the pendulum has swung, and people are terrified. Rather than seeing risk as their friend, as in, “The more risk you take, the more money you make, because riskier assets have higher returns,” now people say “Risk bearing is just another way to lose money. Get me out at any price.”

So the pendulum swung, and of course people’s optimism collapsed, the S&P 500 collapsed, and the prices of debt collapsed. So I wrote a memo right around October the 10th of ’08 – maybe that day was the all-time low for credit, I don’t know exactly – that was called The Limits to Negativism, based on an experience I had. I needed to raise some money to delever a levered fund that we had that was in danger of melting down due to margin calls, and I went out to my clients. I got more money. We reduced the fund’s debt from four times its equity to two times. Now we’re again approaching the point where we can get a margin call. Now I need to delever it from two times to one time. I met with a client who said, “No, I don’t want to do it anymore.” And I said, “You gotta do it. These are senior loans, and the default rate on senior loans has been infinitesimal over time. There’s potential for a levered return of 26% a year from what I consider incredibly safe instruments.”

This client – excuse me if I belabor this, but I think it’s interesting – this client said to me, “What if there are defaults?” And I said, “Well, our historical default rate on high yield bonds – which are junior to these instruments – is 1% a year. So if you start with 26% and you take off 1% for defaults, you still get 25%.” So she said, “What if it’s worse than that?” I said, “The high yield bond universe default rate has been 4% a year, so you’re still getting 22% net.” She says, “What if it’s worse than that?” And I said, “The worst five years in our default experience is 7½%, and if that happens, you’re still getting 19%.” She says, “What if it’s worse than that?”, and I said, “The worst year in history is 13%. If that recurs every year for the next eight years, you’ll still make 13% a year.” She says, “What if it’s worse than that?” And I said, “Do you have any equities?” She said, “Yes, we have a lot of equities.” I said, “If we get a default rate on high yield bonds of more than 13% a year every year into the future, what happens to your equities in that environment?”

Howard Marks bought all the way down in late 2008. The following rebound in 2009 generated significant profits for Oaktree. As the saying from Warren Buffet goes, "be greedy when others are fearful". I think it is worth considering questions like what if the worst-case scenarios of a hawkish Fed and inflation crippled recession do not materialize? What if inflation does start to abate and the pace of hikes slows or even stops? What is the true risk of default for the majority of companies, rather than focusing solely on zombie firms that probably should have collapsed long ago anyway?

When presented with these two extremes, the 2021 "everything bubble" and the risks today of a long and "painful" recession, I try to imagine the middle ground. In this case, there will probably be some "pain" as Jerome Powell so eloquently put it. The FFR will probably get to 4.5%+ and stay there for some time; considering that the Fed is following core personal consumption expenditures as their inflation gauge which has a significant lag on what the present inflation level might be. Unemployment will probably increase. We are already seeing layoffs in the mortgage and banking sectors with risks in the retail sector as consumers might spend less this coming holiday season due to being cash-strapped from higher gas and grocery prices. The National Bureau of Economic Research (NBER) may even declare a recession if unemployment starts to materially rise. We have had two quarters of negative GDP growth which is a rule-of-thumb hallmark of a recession, and are possibly on pace for a third according to the trends of the latest Atlanta Fed's GDPNow tool. Are we looking at a collapse of global financial markets where corporate defaults go into the double digits though? I don't know and I have no way of knowing and neither does anyone else. Incredible resilience has been shown in the past under circumstances far worse than what we see today, however. So for now, I am cautiously optimistic that we will weather these present troubles too and may even come out fundamentally stronger. The risks of today might even present some unique profit opportunities to collect yields that were previously unavailable thanks to zero or negative interest rate monetary policy.

この記事が気に入ったらサポートをしてみませんか?