Market Outlook for Next Week (10/9-10/13)①

1. Introduction

Recently, concerns about rising interest rates have started to surface in the markets. In early October, the 10-year U.S. interest rate briefly touched close to 4.9%, and the 30-year rate hit 5%. Right now, the bond market plays a significant role in influencing the overall market. Stability in the U.S. interest rate is crucial for the stock market and other markets to function smoothly. Interest rates are fundamental to how markets operate.

However, given the current uncertainty and volatility in the bond market, it's challenging to provide a clear explanation. But, I believe that even though we see signs of potential risks, they haven't fully manifested yet. I anticipate that the ongoing rise in interest rates will stabilize soon without leading to severe consequences. While the situation might appear risky, I don't view the market with high alarm at this moment.

Let's dive deeper into the recent developments in the U.S. interest rates and understand the reasons behind the rise.

2. Interest Rate Increases: A Three-Stage Analysis

Phase 1 (mid-July to mid-August)

During this period, from mid-July to mid-August, the primary themes were the "soft landing" of the U.S. economy and discussions around the "potential for a neutral interest rate hike."

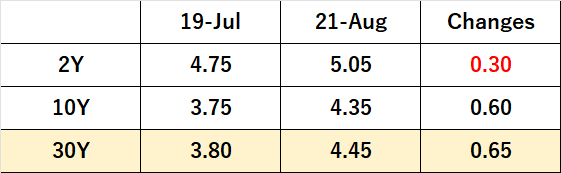

Referencing the table, it's evident that the significant driver for rising U.S. interest rates was the long-term rate. While the 2-year interest rates increased, they only did so at about half the rate of the very long-term rate.

Starting in July, optimism grew around the possibility of the U.S. economy achieving a soft landing. This optimism was fueled by the resilience of the economy, even as inflation began to slow in the wake of the Federal Reserve's rate hikes. A series of questions emerged:

"Why has the economy remained so strong despite the aggressive rate hikes from the Fed over the past year?"

"Has the economy truly been affected by these rate hikes?"

"Why haven’t these rate hikes significantly impacted the U.S. economy?"

Various theories were proposed to answer these questions. One prominent idea was that the "neutral interest rate" level had already been raised, which could make subsequent rate hikes less impactful. This theory gained traction in the market.

By August, Chairman Paul was slated to discuss "Structural Changes in the Global Economy" at the Jackson Hole meeting. This event further spurred conversations about the neutral interest rate, leading to an uptick in the very long-term U.S. interest rate.

Despite the conventional wisdom that rising interest rates are typically bad for stocks, the S&P 500 remained relatively stable during this period, as seen in a chart . This suggests that the stock market was somewhat insulated from the effects of rising interest rates, possibly due to the soft landing and discussions around neutral interest rates.

Phase 2 (Late August to September FOMC Meeting)

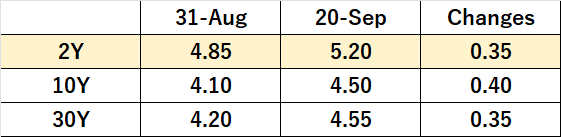

The second phase spans from late August up to the September FOMC meeting. As September rolls in, the market's focus naturally gravitates towards the upcoming FOMC meeting. Comments from Fed officials and the dot chart presented during the meeting influenced the short-term interest rates. Notably, the 2-year rate surged past 5%. This upward movement in the 2-year rate consequently pulled up the 10-year and 30-year rates as well. A key theme during this phase was "Higher for Longer".

The S&P 500 was moving back and forth in the 4,400 range, waiting for the FOMC. (see chart below)

Phase 3 (Post-September FOMC Meeting to Present)

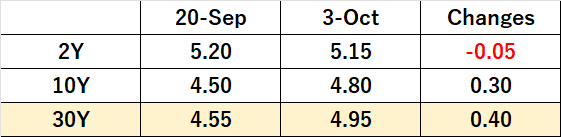

The third phase captures the rising interest rates from the time immediately following the FOMC meeting up to now. Although the FOMC decided to maintain the policy rate, the 24-year dot chart surprisingly indicated a "hawkish" 50 basis point increase. This brought the "Higher for Longer" sentiment back into sharp focus, driving another surge in the very long-term rate. However, this phase is distinct from the first one due to new themes: "risk premium" and "loss-cutters." By October 3rd, the 30-year rate had gone up by around 40 basis points, while the 2-year rate actually decreased slightly.

What is the Risk Premium?

Long-term interest rates can be broken down in various ways. Typically, they're understood by considering the projected path of short-term interest rates, expected inflation trends, and the risk premium. Essentially, the risk premium accounts for everything not directly explained by the Federal Reserve's monetary policy and market forecasts of future inflation.

Several factors are currently pushing up the risk premium for U.S. Treasuries. Two major concerns are the increasing supply of Treasuries and a perceived lack of buyers. Additionally, with the recent removal of House Speaker McCarthy, there's growing speculation about a possible government shutdown, especially if the budget bill doesn't progress by the provisional deadline of November 17. Moody's has hinted at a potential downgrade due to the political instability in the U.S. This political uncertainty also contributes to a higher risk premium.

When interest rates rise due to an increasing risk premium, it's often seen as a "negative rate hike" in market terms. As a result, the stock market is feeling the pressure, as shown in the chart .

In the stock market, any rise in interest rates is typically viewed negatively. It's not seen as a "good rate rise" but rather as a "bad rate rise" or even a "worst rate rise." This is the nature of risky assets like stocks. Yet, companies that grow faster than the pace of interest rate hikes can offset some negative impacts. Still, rising interest rates are generally unfavorable, and a spike in the risk premium falls into the "worst rate rise" category.

However, the current rise in rates is merely a minor indication of these potential risks. As of now, both the 10-year and 30-year U.S. interest rates have crossed significant thresholds. Many U.S. Treasury bond investors are hedging and cutting losses. This action has depressed the selling of U.S. Treasuries. The term "CTD switch" has become common, especially concerning the 30-year Treasury note. It refers to changes in the long-term U.S. Treasury bond futures contract. Without delving too deep into technicalities, it's important to note that such switches usually don't occur frequently. For instance, during the first two rate increase phases, the "cheapest" issue remained consistent. However, since the third phase, it has changed multiple times.

If rates continue to rise, this "cheapest" issue might change again. An extension in duration due to such changes prompts market participants to sell hedges. Normally, this would be manageable, but currently, with a noticeable lack of buyers, it can lead to even higher interest rates. Essentially, this is a technical increase in rates.

Given these dynamics, market trends suggest that this phase of hedge selling might be tapering off. Moving forward, the market might stabilize as investors debate whether U.S. interest rates will climb from 5% to 6% or if the current 5% rate for the U.S. 10-year is already excessive.

・ Could Bond Risk Transform from a Minor Issue to a Full-Scale Meltdown?

The answer is no. Let's consider some historical context. During the Corona shock of March 2020, U.S. long-term interest rates plummeted to around 0.3%. Now they stand at 4.7%, marking a significant change over the past three years. Still, it's not appropriate to label this a meltdown. A meltdown implies a more drastic situation. For example, recall the 2013 Bernanke shock: the 10-year rate jumped from 1.6% in May to 3% by September, a swift 1.4% increase in just a few months. Though shocking, even that wasn't a meltdown. Simply put, U.S. Treasuries, considered ultra-safe assets, have never experienced a meltdown, and it's unlikely they ever will.

However, the present subtle risk hints shouldn't be ignored. There's a potential for these risks to become more pronounced, pushing U.S. interest rates higher at an accelerated pace. Such an increase could trigger a worldwide bond sell-off, potentially destabilizing the stock market in its wake.

While U.S. interest rates are vital, they aren't the only rates worth monitoring. Bonds from other countries need attention, as the ripple effects of global bond sell-offs could be the most alarming scenario. A case in point: Canadian government bonds recently exhibited concerning movement, jumping nearly 30 basis points within a single day!

As for US Treasuries, a check of the MOVE index shows that even with such an increase in interest rates, it is still an orderly rise and not a panic.

Even with a noticeable shortage of buyers, the bond market remains operational. We can gauge the bond market's health by examining the gap between offer and bid prices for cash U.S. Treasuries, commonly referred to as "market depth." Although this gap has widened lately, it's still within a typical range. In short, the U.S. bond market may be cautious, but it's not in a state of panic.

I also doubt we'll see a panic-driven massive sell-off of U.S. Treasuries at the current levels, and here's why:

First, the yield difference between the 2-year and 10-year U.S. Treasuries has already tightened substantially. Considering the 2-year U.S. rate is hovering around 5%, and the 10-year U.S. rate only needs to rise about 30 basis points to match it, it's unlikely the 10-year rate will exceed the 2-year rate by much, especially as the Fed wraps up its rate hikes. The most plausible scenario would see interest rates leveling off around the 5% mark. This situation provides some reassurance to the market. Put simply, the chance of U.S. interest rates suddenly skyrocketing by another 100 or 200 basis points from their current position seems quite slim.

Secondly, I expect we'll soon hear cautionary remarks from both Treasury Secretary Yellen and officials from the Federal Reserve concerning the present long-term U.S. interest rates. The table below illustrates the U.S. Congressional Budget Office (CBO) projections for long-term interest rates. These projections guide the CBO's simulations of the country's financial outlook. For the decade spanning 2023 to 2033, the CBO estimates an average 10-year nominal interest rate of 3.8%. After accounting for inflation, the real interest rate comes to 1.3%. These figures are vital for shaping fiscal predictions.

Although the CBO seems to anticipate a future where a rising risk premium and increasing interest rates are triggered by fiscal challenges, the current rates already surpass those averages the CBO projected for 2044-2053. Given these elevated rates, the U.S. Treasury is likely quite concerned. This sentiment aligns with recent comments made by Treasury Secretary Yellen about long-term interest rates.

Historically, when the stock market has faced significant downturns, government officials have often commented to address these declines. In a similar vein, it's highly likely that if long-term interest rates continue to surge at their current pace, government authorities might issue statements. Such comments could attract buyers back to the U.S. bond market and restore confidence. This pattern isn't exclusive to the U.S. For example, the Governor of the French Central Bank, Bill Lois de Garaud, recently remarked on the sharp rise in long-term rates, suggesting they might be viewed as excessive.

Looking ahead, the U.S. bond market faces key events next week: the release of the Consumer Price Index (CPI) and auctions for 3-year, 10-year, and 30-year Treasury notes. This could be a pivotal moment. If the market navigates these events without major disruptions, I predict that U.S. interest rates will likely stabilize around the 4.5%-5% range for some time, eventually settling between 4.2% and 4.6%.

・The Fourth Phase: What's Next?

The upcoming stage is speculative. I'll delve deeper in the next issue, but in brief, it's all about "decoupling." Countries globally are nearing the end of their interest rate hiking cycles. The prevailing strategy will be "Higher for Longer." Yet, from here on, each country's circumstances will differ significantly. While some will face a tumultuous "hard landing," others might navigate a smoother "soft landing." The extent to which interest rates can be sustained will also differ. Consequently, some countries might commence interest rate cuts earlier than others. This disparity can lead to fluctuations in exchange rates – a subject I'll explore in future discussions.

・The Stock Market and Rising Interest Rates

Now, let's focus on how the recent uptick in interest rates affects the stock market. The impact is evident. A frequently referenced metric is the yield spread, which contrasts the stock market's profit yield with the 10-year interest rate. In contexts where U.S. bonds are seen as risk-free, investors expect a premium for the stock market, given its riskier nature. Thus, the earnings yield – the inverse of the Price-Earnings Ratio (PER) – consistently exceeds long-term interest rates. Traditionally, a spread of about 3% has been the benchmark. When this narrows, the stock market is often perceived as overvalued, triggering sales. As shown in the chart below , the gap between the profit yield and the 10-year interest rate has recently vanished.

People often argue that U.S. stocks are overpriced due to the narrowing yield spread and need adjustment. While this point of view might seem compelling given the current spread, it's essential to note that this argument assumes a stable bond market as its foundation. Historically, a narrow yield spread meant stocks were overvalued, not that bonds were undervalued. But the bond market is now fluctuating. Using it as a stable benchmark to judge the stock market's value may not be reasonable. We're witnessing an adjustment phase where the so-called bond bubble is bursting, making the traditional 3% premium range less relevant.

So, the narrowing yield spread doesn't overly concern us in terms of stock valuations. But for investors focused on dividends, short-term risk-free assets like MMFs and T-Bills, which now yield 5% or more, might look more appealing than stocks. Likewise, for those skeptical about short-term stock growth, 5%+ yielding government bonds can be enticing. The Fed's aggressive rate hikes have certainly shifted investment dynamics, but that doesn't rule out potential stock growth.

However, we must acknowledge that if long-term interest rates rise due to an increased risk premium, it could be a concern for the stock market as it swiftly impacts real interest rates. To reiterate an earlier point, long-term interest rates are influenced by the trajectory of short-term interest rates, expected inflation, and the risk premium. While the first two factors are relatively stable now, the risk premium is unpredictable and can escalate quickly. We saw some market reactions in September when real interest rates surpassed 2%. Now, they're rapidly approaching 2.5%.

The stock market struggles to accommodate such rapid increases in interest rates. We'll be paying close attention to the movement of real interest rates. To draw a parallel, even during 2006-2007—a period that often comes up in comparisons—real interest rates exceeded 2.5% only briefly, as illustrated in the chart below .

Therefore, as we approach year-end, there's a good chance that real interest rates will drop back toward 2%. We believe this shift will bolster a year-end rally in the stock market.

This concludes the first section of the article. Over the weekend, the jobs report revealed a staggering number for nonfarm payrolls. Long-term interest rates initially surged but dialed back a bit as we approached the three-day weekend. Following the job report's release, the stock market took a hit, but in an unexpected turn, all three major indices rebounded significantly by day's end. This development is certainly noteworthy.

In the latter part of this report, I plan to discuss recent U.S. economic indicators, the Japanese yen interest rates, and the overall stock market environment. However, should other commitments arise, I might not be able to present this section. Nonetheless, I believe that the crucial insights are covered in this first part. Wishing you a pleasant weekend.

"This report has been translated from its original Japanese version using AI. The content of the Japanese report takes precedence."

この記事が気に入ったらサポートをしてみませんか?