Market Outlook for Next week (10/30~11/3)

"This report has been translated from its original Japanese version using AI. The content of the Japanese report takes precedence."

Japan's Mini-Triple Weakness

1) Achievements and Evaluation of the Kishida Administration

The Kishida administration assumed office in October 2021. To assess its performance, we must compare the current economic situation with that at the end of September 2021, just before he took office. This is a chart detailing the performance of the Kishida administration. Although stocks have seen a modest increase in yen terms, they've sharply decreased when measured in dollars and euros. The most striking observations are the depreciation of the yen in the foreign exchange markets and the rising yen interest rates. Notably, the yen has weakened not only against the dollar but also against a broad range of other currencies. The yen interest rates, at around 0.8%, are the highest they've been in quite some time, even though they remain relatively low.

Such volatility in the foreign exchange market drastically alters the appearance of the stock market chart in both yen and dollar terms. The following chart displays the TOPIX market capitalization in yen terms, which achieved a record high this year.

The next chart shows the TOPIX market capitalization in USD terms. It peaked at the levels seen before the Corona pandemic.

It's not my intention to claim that the surge in Japanese stocks is solely due to a weakened yen. Stocks should be evaluated in their local currencies, and their rise in yen terms carries significance. Nonetheless, with the exchange rates exhibiting such volatility, it's undeniable that the TOPIX chart's appearance can vary dramatically. The next chart presents the trading patterns of Japanese stocks by foreign investors since the Kishida administration's inception. The red bar chart illustrates the net cash and futures inflows from October 2021 to the end of 2022. In contrast, the blue bar chart captures the data from January 2023 to now.

Upon the Kishida administration's commencement, the prevailing sentiment was that "this administration isn't kind to Stock markets," which led to a net sell-off surpassing ¥5 trillion (as shown in the red bar graph). The initial policies of the Kishida administration seemed to lean more towards distribution than growth, with a focus on "new capitalism." Given his early remarks about taxing financial income and potentially revising quarterly financial result disclosures, the stock market's reservations were understandable. Additionally, the prime minister's association with the Kochi-kai faction, which has a reputation for advocating tax hikes, played a role in shaping this perception. However, a policy pivot occurred in the spring of 2022. The Kishida administration began to underscore a growth-driven strategy. The Asset Income Doubling Plan and the new NISA were highlighted as cornerstone policies. Further boosting foreign investors' interest in Japanese stocks this year were factors like the TSE's capital policy directive for companies with P/B ratios below 1x, the transition to the prime market, the so-called Buffett effect, and the continued yen depreciation

. Consequently, at one juncture this year, net purchases reached nearly 8 trillion yen. Yet, subsequent sell-offs reduced this to just over 5 trillion yen (depicted in the blue bar graph). This means the net effect since the start of the Kishida administration is roughly neutral. The final chart juxtaposes the net transactions by foreign investors during Abenomics in 2013 with those of this year. Inflows had been increasing at a similar pace to 2013 until about summer. However, while the momentum of Abenomics surged post-summer, this year's inflows seem to have plateaued.

Despite the stagnation in approval ratings for the Kishida administration, I often encounter the question, "What has the Kishida administration accomplished?" Contrary to this perception, the Kishida administration has achieved a considerable amount over the past two years. Here is a summary of those accomplishments:

Defense Spending: An increase of 43 trillion yen over 5 years.

Countermeasures Against Declining Birthrate: An allocation of approximately 3 trillion yen annually.

Green Transformation: Investment of 20 trillion yen over a decade.

Industrial Protection: Policies targeting advanced sectors like semiconductors, including securing investments from TSMC.

Wages: The first significant wage hike in three decades.

Pandemic Control: Managed to downgrade Corona to Class 5.

Diplomacy: Improved relations with South Korea and successfully chaired the Hiroshima G7 summit.

Workforce Development: Allocated 1 trillion yen for re-skilling initiatives.

Bank of Japan Leadership Transition: Seamless appointment of BOJ Governor Ueda, succeeding BOJ Governor Kuroda.

Logistics: Introduced an emergency package to innovate the logistics sector.

Economic Growth: Achieved a positive GDP gap.

Tax Revenues: Recorded the highest tax revenues for three consecutive years, surpassing the 70 trillion yen mark.

Energy Policy: Promoted both nuclear power generation and renewable energy sources.

Environmental Measures: Approved the discharge of treated water from nuclear power plants into the ocean.

LGBT Rights: Passed LGBT-related bills.

Budget: Successfully realized a massive supplementary budget of 39 trillion yen for the fiscal year 2010.

Over the past two years, the outcomes, whether viewed positively or negatively, seem to represent a commendable performance by the Kishida administration. However, there's a puzzling dissonance: the approval ratings have remained static. Strikingly, the public seems to be glossing over these results. In the digital realm, Kishida has been mockingly labeled as the "tax hike glasses," a moniker that sticks despite his proclamations of tax cuts. I suspect a root cause is the perceived randomness in politicians' responses, appearing devoid of a well-structured plan. It's as if the ruling party is advancing policies based on sheer quantitative logic, sidelining meticulous deliberation or meaningful discourse. This method might inflate the list of achievements, but it lacks depth and intent. With the completion of the Hiroshima G7, a significant focus for the Kishida administration, it feels like a guiding purpose has vanished. This sense of aimlessness might deter public support, irrespective of any policy successes.

Historically, foreign investors ramped up their stakes in Japanese equities predominantly during the Koizumi and Abe tenures. Koizumi's advocacy for postal reform and his assertive stance, encapsulated in the phrase, "What the private sector can do, the private sector will do," resonated as a clarion call for deregulation. His audacious declaration to "destroy the Liberal Democratic Party" projected an image of unwavering determination against adversaries. Then came the second Abe administration with its flagship Abenomics. The "three arrows" strategy was both evocative and easily grasped by the masses. In stark contrast, the Kishida administration introduced the nebulous concept of "new capitalism." This idea, which struggled for clarity from its inception, underwent tweaks and shifts. Lately, the repeated emphasis seems solely on "economy, economy, economy," without providing a clear roadmap or vision.

(2) Tax Cut Policy, Yen Interest Rates, and Exchange Rates

In September, the Kishida administration introduced five primary economic pillars:

Price measures,

Sustained wage increases,

Enhancing growth potential and boosting domestic investment,

Initiatives against population decline, and

Fortifying the national infrastructure.

Of these, only the first, about price measures, can be immediately addressed through a supplementary budget, whether it's urgent or not. The other pillars represent medium-to-long-term challenges that will steer Japan's future course. The Kishida administration is contemplating addressing these price measures through income tax cuts and benefits, aiming to return the surging tax revenues to its citizens. Since both tax reductions and expenditure cuts appear to support inflation, it's valid to question if these inflationary policies are the right antidote to the current soaring commodity prices. Shouldn't the Bank of Japan (BOJ) handle countermeasures against such price hikes?

However, this policy might backfire.

Japan is currently grappling with the precariousness of yen depreciation, and its extent remains unpredictable. The government's anxiety over this depreciation was so palpable that it resorted to direct intervention last year. This yen depreciation might spur inflation via rising import costs, further escalating the expenses associated with energy acquisition amid a high geopolitical risk climate. For the stock market, this could suppress the dollar-valued Nikkei 225, leading to the possible exclusion of Japanese companies from indexes like the MSCI World Index, due to the decline in the dollar-based market capitalization of Japanese stocks. The current yen depreciation seems to have more detrimental effects on Japan than beneficial ones. Experiencing the repercussions of a weakened currency is typically a challenge for emerging economies and may reflect a decline in Japan's national power.

Given these risks linked to the yen's depreciation, the government has taken two pivotal steps that might exacerbate the situation: one, the widely debated tax cut. The timing is arguably ill-conceived. Last year, the UK faced the "UK bond shock" when British bonds took a nosedive due to the Truss administration's lavish fiscal policies, reviving the old term "bond vigilantes." The market uses surging long-term interest rates to caution against reckless fiscal policies. This year, the U.S. was shaken by the debt ceiling debate and received a downgrade from Fitch. Currently, the Democrats and Republicans remain divided over the annual budget, intensifying the threat of a government shutdown. Furthermore, "term premium" has emerged as a market buzzword given the concerns about an increase in U.S. Treasuries. For context, the chart below displays the U.S. government debt-to-GDP ratio, underscoring the extent of fiscal apprehensions.

In Europe, nations like Italy and France, which are contemplating expansive budgetary plans that disregard the EU's stipulation of maintaining a budget deficit below 3%, are seeing their government bonds being sold off. Japan, on the other hand, is focusing on returning surging tax revenues to its citizens instead of channeling them toward debt reduction. To global investors, this may make Japan appear financially reckless. Below is a chart detailing Japan's government debt about its GDP. Out of the 190 trillion yen in government bonds issued annually, over 150 trillion yen is dedicated to refinancing existing debt.

In such a climate, tax reduction strategies risk driving yen interest rates upward. A surge in interest rates stemming from Japan's relaxed fiscal discipline is not a precursor for yen appreciation, but rather, a signal for its depreciation. There seems to be a correlation between weakened bonds and a feeble yen, at least as perceived by the global mood in recent times.

Another strategy that might inadvertently devalue the yen is the introduction of the new NISA. Should the trend shift from savings to investments, a notable fraction of these investments will inevitably flow out of Japan. This is partly due to the allure of investing in the stocks of countries like the U.S. and India. Moreover, for Japan's younger demographic, investing overseas becomes a viable hedging strategy against potential long-term domestic risks. If one's entire life — including employment, salary, and residence — revolves around Japan, diversifying investments in foreign assets naturally counterbalances the inherent risks. Given that Japanese individuals possess financial assets totaling ¥2,000 trillion with ¥1,100 trillion in deposits, even a minor percentage shift could lead to significant repercussions. Some argue that the majority of these assets rest with the older population, making the shift inconsequential. But considering the anticipated surge in inheritance transfers due to the nation's aging demographic, it's imprudent to assume that deposits will always comprise over 50% of total financial assets. If the new NISA had been introduced during a phase of yen appreciation, it could have acted as a deterrent. However, its implementation amid the yen's depreciation seems ill-timed. Moreover, as investment methodologies like the accumulation of NISA gain popularity, an automatic flow of dollar acquisitions could ensue, independent of the existing exchange rates. This poses significant risks. The new NISA system, while commendable in intent, might have benefited from a phased introduction, starting with incentives for domestic investments, and gradually expanding to include foreign opportunities. Moreover, the stability of Japanese yen interest rates is largely due to the limited involvement of foreign investors in the yen bond market. This implies that Japanese government bonds (JGBs) are primarily supported by domestic investments. These investments are anchored by deposits in local financial institutions. A shift from deposits to investment products could diminish banks' deposits and consequently reduce investment in yen-based bonds. In the long run, attracting foreign investment for yen bonds will become imperative, demanding higher "term premiums" on yen interest rates. This can inadvertently drive yen interest rates up.

In summary, while the Japanese government ought to be focused on fortifying the yen, its current strategies—namely the tax cut policy and the new NISA—might be accelerating its depreciation. Thus, even if U.S. interest rates plummet, the risk remains that the yen might not experience any significant appreciation, but rather, further devaluation.

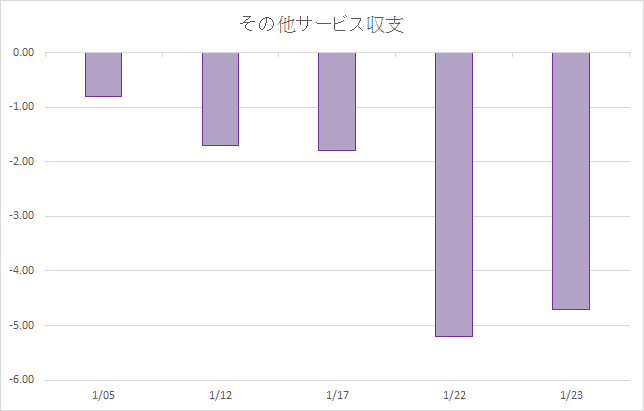

Regarding the depreciation of the yen, one cannot overlook the "escalation in the deficit in the balance of other services," even though it isn't directly tied to governmental policies. The chart below illustrates the rising deficit in the balance of these services. As of August this year, the deficit is already nearing 5 trillion yen. By the year's end, it's anticipated to set a new record.

A significant portion of this "balance of payments for other services" encompasses areas such as computers, information services, and consulting. This is frequently referred to as the "digital deficit." METI's New Opportunities Subcommittee has projected that by 2030, this digital deficit might surpass Japan's oil import deficit. It's expected that expenditures on these new services will surge. For instance, users might spend $20 per month on a premium version of ChatGPT that boasts AI generation or opt for Microsoft's AI services. If Japan's inbound tourism strategy proves fruitful and the governmental target of attracting 60 million foreign visitors by 2030 is achieved, there's potential for an inbound surplus of approximately 10 trillion yen. Yet, by that period, the deficit in the digital balance could surpass 15 trillion yen. Such an emerging structural deficit could gradually exert downward pressure on the yen.

(iii) BOJ Monetary Policy Meeting

A focal point in the market next week is the BOJ's monetary policy meeting. Initially, this October assembly was anticipated to be uneventful. Yet, in October, Rengo proposed a plan to elevate the wage increase target from "5%" this year to "5% or more" in 2012 for the upcoming year's Spring Struggle. A definitive policy will be decided in December. Over the weekend, the Nikkei Shimbun reported that Keidanren will also underscore the importance of foundational wage increases in next year's spring negotiations. Consequently, the sustainability of wage hikes, a prerequisite for the Bank of Japan to abolish negative interest rates, seems achievable. Given the current yen's position at a weak 150 yen against the dollar and yen interest rates inching towards 1%, next week's decision-making meeting will likely be approached with heightened anticipation. The prevailing sentiment suggests there may be some pertinent discussions even if negative rates aren't revoked. I believe that while forward guidance might see an adjustment, we're unlikely to witness a significant policy shift at this meeting, such as an elevation of the YCC's fluctuation range from 1% to 1.5%. However, only time will tell. The rise in yen interest rates, while not benefiting the yen in the foreign exchange market, negatively impacts the stock market. Moreover, these surging rates may prompt interest rates abroad to climb, adversely affecting both European and U.S. stocks and subsequently Japanese equities. This meeting warrants close attention.

2. Key Points for Next Week

The upcoming week promises a flurry of events. In Japan, over 500 companies, including giants like semiconductors, Toyota, and trading firms, are set to disclose their earnings. In the U.S., numerous corporations, such as Apple, McDonald's, and Starbucks, have scheduled their earnings announcements. On the 30th, President Biden is set to issue an executive order on AI. Apple's "Scary Fast" event, also on the 30th, might reveal a new Mac computer. The evolving situation in the Middle East, particularly involving the U.S., could exert pressure on the stock market. Prime Minister Netanyahu has announced the commencement of the war's second phase. To date, neither Hezbollah nor Iran has joined the conflict upon the initiation of Israel's ground operations. However, if the conflict broadens, the market's risk-averse trend might amplify. I predict the upcoming FOMC meeting will lean dovish, mirroring the recent ECB Council assembly. Consequently, U.S. long-term rates might experience a slight dip. The routine quarterly auction on November 1, assuming the projected volume increase, is unlikely to spur a rate hike. Despite the myriad of events, the prevailing sentiment suggests a potential recovery for both U.S. and Japanese stocks from their current lows. Perhaps next week might provide a breather.

この記事が気に入ったらサポートをしてみませんか?