India’s Chance for Chips, The Wire China, July 9, 2023.

The stars are aligning for India to enter the semiconductor scene.

In 1974, at age 19, Anil Agarwal left his family home in Patna, a small city on the banks of the Ganges River, and traveled over a thousand miles west to Mumbai — then Bombay — carrying nothing but a tiffin box and some bedding. Agarwal’s father ran a small aluminum firm, and Agarwal was beginning his own career in the metals trade, buying scrap metal from far and wide before trading it in India’s “Maximum City,” a metropolis of almost ten million people.

But despite being home to more than 800 million people, India at that time ranked lower than the Netherlands in annual GDP, and Agarwal struggled to get nine different businesses off the ground. His tenth company, however, a copper cable firm named Sterlite Industries, caught a lucky break.

The fall of the Soviet Union had pummeled the rupee, forcing New Delhi to open its economy to private capital, and Agarwal quickly gobbled up underperforming mineral works at home and abroad for bargain basement prices (sometimes under dubious circumstances). In 1993, Sterlite became the first private company in India to establish a copper smelter and refinery. In 2002, it snapped up a controlling stake in India’s largest zinc producer.

And by 2003, after Agarwal rode 100 kilometers through England on a bicycle with a senior investment banker at JP Morgan, Vedanta Resources, Sterlite’s parent company, became the first Indian company to list on the London Stock Exchange.

“I don’t think I have ever felt that much pain,” Agarwal later wrote of the cycling adventure, “but the thought of not having my company listed here pained me more, so I pedaled even faster.”

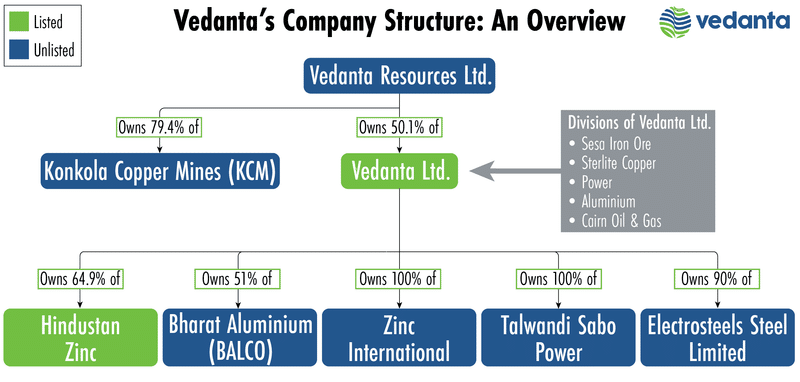

By 2012 Vedanta Resources — which was named after an orthodox strain of Hindu philosophy — had revenues of $14 billion and stakes in copper, steel, aluminum, zinc, iron ore and oil extraction, from north India to South Africa.

Yet despite the successes of Agarwal — as well as his buccaneering compatriots like Lakshmi Mittal, Mukesh Ambani and the Tata family, who similarly pounced on changes in India’s economy in the 1990s — India still ranked narrowly above Australia in GDP and well below China, on whose frozen, Himalayan border the two nations’ troops often clashed. New Delhi could only watch with envy as its vast neighbor near-quadrupled its economy from 2005 to 2012, flooding the world with its products.

“Despite liberalization and reduced controls for foreign investment in manufacturing from 1991 onwards, and also our having a manufacturing base that should have been modernized for competitive production, we used the easy option of cheap imports from China,” says Nirupama Rao, India’s foreign secretary from 2009–2011. “Much of the world slept as a massive export tsunami from China inundated us all.”

Source: The Wire China

Indeed, by 2014, even as growth reached a respectable 7.4 percent, the world’s largest democracy suffered a yawning import deficit. “It is high time for us to look at our natural resources and manufacturing,” Argawal said in March of 2014. “The Indian import bill was $500 billion. All this material we imported we have the capability to manufacture and create new employment.”

Two months later, Narendra Modi, a controversial Hindu nationalist and minister for Gujarat, a sprawling state of 62 million people on the Arabian Sea coast, became Indian prime minister. Almost immediately, he launched Make In India, committing $210 billion to incentivize capital in his first two years and invoking colonial-era calls for swaraj, or self-rule, by hailing a new Atmanirbhar Bharat — a “self-reliant India.” Foreign direct investment (FDI) ballooned from $45 billion in 2014 to $60 billion in 2016, and dozens of Indian industries have benefited since, including IT, textiles and automobiles. This year, India overtook Britain, its former colonizer, to become the world’s fifth-largest economy.

But Make in India’s most ambitious play is just now coming into focus, dovetailing with Argawal’s hopes to “upstream” the mining giant he founded almost four decades ago. If it works, India might not only recreate China’s rapid growth, it might even surpass it.

India has no option but to be atmanirbhar when it comes to semiconductors.

The global market in semiconductors — the microprocessing chips on which every electronic item on Earth relies — is worth an estimated $580 billion, and according to some estimates could be worth $1.4 trillion by the end of the decade. Modi’s administration has launched the India Semiconductor Mission (ISM) as part of Make In India, pledging $10 billion to match investments in the sector, and the aphoristic prime minister has emphasized that “India has no option but to be atmanirbhar when it comes to semiconductors.”

The timing is fortuitous. For starters, the COVID-19 pandemic plunged manufacturing industries, including chipmaking, into crisis, breaking supply chains and waking nations to the dangers of over reliance on a narrow band of sources. Today, about 90 percent of the world’s chips are made at fabrication plants, or ‘fabs’, in just five countries — the U.S., South Korea, Japan, China and Taiwan (which is increasingly seen as under threat of war from Beijing) — and the calls for diversification are mounting.

Geopolitics also seem to be working in India’s favor. In the past two years, Washington has both started and deepened a chip war with Beijing. New U.S. rules and sanctions have strangled access to vital materials and equipment while sowing distrust in Chinese-made hardware. U.S. individuals and firms are now forbidden from aiding Chinese manufacturers of high-end chips, and European and Japanese suppliers have been discouraged from cooperating with Chinese makers. This May, China retaliated by banning products from Micron, the largest U.S. chipmaker, and this week Beijing restricted exports of chipmaking metals to “safeguard national security.”

“Countries, including but not limited to the U.S., are looking to India in their efforts to ‘friendshore’ the chip supply chain,” says Emily Weinstein, at Georgetown University’s Center for Security and Emerging Technology. “The size and technical capacity of India’s workforce could be useful for collaboration in semiconductors.”

Indeed, last May the Israeli-Abu Dhabi chip consortium ISMC announced a $3 billion fab in the southern state of Karnataka. Two months later, Singapore’s IGSS Ventures said it will submit an application for a $3.5 billion chip fab in nearby Tamil Nadu.

Both investments are dwarfed, however, by September’s announcement that Taiwan’s Hon Hai Precision Industry Co., better known as Foxconn, had signed a $19.5 billion deal to build a fab with Vedanta. [Editors’ Note: On Monday, Reuters reported that Foxconn is pulling out of the project, but that Vedanta is still committed to building a fab.]

Foxconn — the contract manufacturing giant that is a key supplier and assembler of Apple products — is barely in the chip space, and Vedanta’s business is still mostly focused on metal and energy extraction. But with Foxconn’s manufacturing prowess and Vedanta’s mining established in seven metals (all of which play a role in the creation of semiconductors), the two firms would argue their joint venture is well-positioned to move up the value chain and make chips itself.

Source: The Wire China

For Foxconn, it is a business decision: the company makes around 70 percent of its revenue in mainland China, chairman Young Liu told The Wall Street Journal this March, and needs to diversify. But for Vedanta, the move into semiconductors is often justified in grandiose, patriotic terms. Agarwal, for instance, has said Vedanta-Foxconn Semiconductors represents one “step closer to India’s own Silicon Valley.” And Akarsh Hebbar, managing director for Vedanta’s semiconductor and display glass division, told The Wire that the effort is helping to “lead the charge for India’s ‘techade.’”

Of course, the supply chain in semiconductors is as dense and brittle as its product, and Agarwal will not have ten shots at success, as he did in Mumbai. But geopolitics in Asia and beyond are presenting a rare opportunity for India.

“There’s a lot more willingness to give India a chance,” says Paul Triolo, a senior vice president for China and technology policy lead at the strategic advisory firm Albright Stonebridge Group. “The stars are starting to align.”

‘MAKE IT YOURSELF’

Indian physics professor Jagadis Chandra Bose was one of the early pioneers of semiconductor technology, patenting a crystal detector called the “cat’s whisker” in 1901. But India wouldn’t attempt to grow an indigenous chip industry until 1974, when then-prime minister Indira Gandhi requested foreign aid to build a design and fab complex in the planned city of Mohali, close to the border between Punjab and Tibet. Nine years and around $8 billion later, the fully state-owned Semiconductor Complex Limited (SCL) opened its doors, manufacturing chips with technology from Santa Clara’s American Microsystems, which is now part of a company called Onsemi. U.S. firms such as Texas Instruments, Intel and STMicroelectronics opened Indian offices, taking advantage of cheap design talent.

But almost as soon as it had gotten off the ground, India’s semiconductor industry was reduced to ashes — in SCL’s case literally, when a massive fire gutted its Mohali fab in 1989. Almost precisely at that moment, East Asia became the world’s chipmaking powerhouse. In particular, Taiwan Semiconductor Manufacturing Company, or TSMC, a Taiwanese foundry headed by former Texas Instruments engineer Morris Chang, scaled up at an unprecedented rate, sacrificing quick profit to make leading-edge chips that powered the latest home computers.

SCL and India never recovered: The country focused on software and fell further behind on hardware. In 2007 India’s government attempted a semiconductor comeback — but lost out on a multibillion-dollar Intel plant when, according to then-Intel chairman Craig Barrett, the government “was a bit slow in coming out with its semiconductor manufacturing proposal.”

Meanwhile, TSMC grew to command over 58 percent of the chip manufacturing industry, and last year recorded almost $75 billion in revenue. Having pioneered the creation of 250-nanometer wafers in 1996, it now produces ones that are a mere 3 nanometer — around the same size as a strand of human DNA. These are the chips that supercharge the latest iterations of artificial intelligence and quantum computing. The company claims it is on course to manufacture a 2-nanometer wafer by 2025, and has reportedly already chosen the location for a 1-nanometer foundry.

India isn’t trying to replicate this progress. Instead, Vedanta-Foxconn says it will focus on 40-nanometer and 28-nanometer chips — technology that TSMC mastered in 2008 and 2011 respectively, and which power consumer electronics like televisions, laptops, smartphones and vehicles.

Incidentally, these are also the stock-in-trade chips of China’s domestic manufacturers. China made a giant leap toward its own domestic chip making industry when it launched the China Integrated Circuit Industry Investment Fund — or the “Big Fund” — in 2014, propelling companies like SMIC, Hua Hong Semiconductor and YTMC onto the world stage. According to the Semiconductor Industry Association, a U.S. trade group, China’s 2015 industry, worth $13 billion, commanded just 3.8 percent of global chip sales. By 2020 those figures had jumped to $39.8 billion and 9 percent of the market.

India has finally bought the argument that you need an ecosystem around which you can build some sort of a manufacturing capability. You need both upstream and downstream pieces of the puzzle.

India has concerns about Chinese tech — including its battlefield use by Russian forces in Ukraine, and increased cyber attacks from China and Russia — but the main focus of India’s semiconductor pivot is to feed its domestic electronics markets, not least an Indian automobile market that has grown at a staggering rate: from under 700,000 units in 2013 to 4.25 million units last year, according to trade group S.I.A.M. India has even outpaced Japan to become the world’s third-largest carmaker, behind the U.S. and China.

“India has finally bought the argument that you need an ecosystem around which you can build some sort of a manufacturing capability,” says Triolo at Albright Stonebridge. “You need both upstream and downstream pieces of the puzzle.” Cars, he adds, “are going to be big consumers of those mature-node chips, above 28 nanometers. That’s where India is beefing up its domestic manufacturing more broadly.”

India is also beefing up how it supports its domestic manufacturing. The Dholera Special Investment Region (SIR) — a dusty, 300-square-mile stretch of lowland on the eastern edge of the Saurashtra Peninsula in the state of Gujarat — is the first in a series of eight undeveloped “greenfield” zones that Modi and his government are betting can be transformed into a modern seaport, propelling Indian products into the world and spurring India’s economic revolution.

Source: The Wire China

So far, Dholera is not much more than a clutch of construction sites and half-built roads, but the government says the almost $2.5 billion site will eventually be an “Indian Singapore,” with a dedicated airport, plus road and rail links to nearby Mumbai and Ahmedabad. It is expected to generate $4 billion in annual economic returns.

A subsidiary of Tata Group, the $128 billion-revenue colossus, has already commissioned a 300-megawatt solar energy plant at Dholera. And Vedanta-Foxconn claims its Dholera fab will eventually have a yearly production capacity of 5 million chips and employ 100,000 people, forming the centerpiece of India’s “Semicon City.”

It is certainly on auspicious territory: less than 25 miles away, in the ancient city of Lothal, one of the world’s first docks served as one of the Bronze Age’s most vital trading centers, dispatching Indus Valley gold traders onto the swirling tides of the Arabian Sea. Only time will tell whether Dholera will join Lothal as an economic and trading powerhouse, but there are reasons to be optimistic about the prospect.

“Recall the journey into the industry for Taiwan, Singapore and South Korea,” says Terry Daly, a former IBM executive who has been appointed as an advisor to Vedanta-Foxconn. “All started with pretty much a blank slate. India must also build out a manufacturing capability, but it is blessed with deep semiconductor design skills. From a resource perspective, it is an enviable starting point.”

‘PICK ME’

Yet, for all Anil Agarwal’s optimism that his company will spearhead a new era of Atmanirbhar, Vedanta won’t make any chips until 2027. And given India’s history of state indecision and technical glitches, that timeline may be wishful thinking.

Indeed, Apple’s recent experience in India may be both blueprint and warning. Caught flat-footed by both pandemic disruptions and geopolitical tensions, the Cupertino giant has cautiously moved some of its manufacturing capacity out of China. According to Reuters, in 2019, up to 47 percent of Apple products were produced in China; by 2021 it had declined to 36 percent.

India has benefitted from Apple’s anxiety: In April Bloomberg News reported that Indian iPhone production had tripled in a year. Today, 7 percent of Apple’s iPhones are made in India, including by suppliers like Foxconn. But efficiency levels in India are way down compared to operations in China, as is quality: a recent Financial Times investigation found that only around half of all casings produced at a Tamil Nadu factory make it to Foxconn’s assembly line. If India is to level up to semiconductor manufacturing — likely the most expensive and complicated manufacturing operation on earth — it will need to master these small stepping stones in low expertise sectors first.

Most notably, the semiconductor industry relies on thousands of suppliers. According to David Reed, a veteran of Texas Instruments, GlobalFoundries and NXP, who is now chief executive of Vedanta-Foxconn Semiconductor, the joint partnership already has 600–700 suppliers lined up, while more advanced operations, like TSMC’s $40 billion expansion of a fab in Arizona, have over a thousand.

This brittle supply chain presents problems for India, which is something of a logistical backwater. China, for instance, was able to drop its Big Fund directly into an export-ready economy with thousands of rail, air and sea links connecting fabs with suppliers. Dholera hopes to solve this shortcoming, but with only a tiny portion of the smart city built, it remains a mirage.

Source: The Wire China

Moreover, semiconductor fabs are estimated to use enough water each day to power 300,000 homes on average; constructing them in India could place a gigantic strain on a country where water supply is already at a premium.

“India is nowhere close to China when it comes to a strong industrial base, especially for sophisticated hardware manufacturers such as semiconductors,” says Anu Anwar, an associate at Harvard University’s John K. Fairbank Center for Chinese Studies. “India’s infrastructure is a few decades behind China, and the business environment is a nightmare.”

There remain significant challenges with regards to the regulatory framework in India — red tape is an issue, infrastructure is an issue — and India just does not have that much experience with fabrication.

Concerns about India’s business environment mounted this month after Bloomberg reported that the Vedanta-Foxconn deal was going to be rejected by New Delhi. Some Indian media has even reported that Foxconn is seeking alternative partners, something Vedanta strenuously denied to The Wire. Hebbar states that it is “amply clear” the state will honor its 50 percent subsidies at Dholera — but that hasn’t stopped commentators from warning of India’s infamous red tape.

“The picture is not that clear, to put it mildly,” says Andreas Kuehn, a senior fellow at ORF America, a U.S.-India policy think-tank, adding that New Delhi has not yet brokered trade agreements for vital chip making equipment from other countries. “There remain significant challenges with regards to the regulatory framework in India — red tape is an issue, infrastructure is an issue — and India just does not have that much experience with fabrication.”

“India offers geography and a huge market,” says author and Force India editor Pravin Sawhney. “But the long-and-short of it is that nothing much has moved yet. India is not in the [semiconductor] game at all. The Indians are talking of national power in the future, but the Chinese are talking of national power today.”

Modi’s model of self-reliance may have vaulted India from 142nd to 63rd place on the World Bank’s Ease of Doing Business ranking. But India’s vastly fragmented democracy stands in direct contrast with China’s all-powerful Politburo, which can redirect vast sums to selected industries at the drop of a red book. For instance, after the Biden administration escalated its chip war with Beijing in October, Reuters reported that Beijing would ready a bumper $143 billion package for its domestic chipmakers.

Interestingly, however, although “China is psychologically more ready to become self-sufficient,” says Junhua Zhang, a senior associate at the European Institute for Asian Studies in Berlin, it comes at a cost. Beijing has already disappeared or detained a dozen architects of its 2014 Big Fund amid a steady slew of corruption scandals.

“China has already poured a lot of money into the semiconductor industry,” Zhang adds. “But it turned out that the [subsequent] corruption and many scandals were quite disappointing for the leadership.”

Although China still appears fiercely committed to the idea of self-sufficiency in chips, it is also becoming clearer that no country has ever been able to in-house the entire semiconductor supply chain. As Weinstein at Georgetown notes, “To think that China would be able to achieve that, when no-one else has, is difficult to imagine.”

China, however, has no other option as major players in the chip industry, like South Korea and Japan, hew closer to Washington’s side of the chip war, further alienating and infuriating Beijing. In October, China’s U.S. Embassy spokesman, Liu Pengyu, told The New York Times that “the U.S. probably hopes that China and the rest of the developing world will forever stay at the lower end of the industrial chain.”

India would raise a hand in opposition to that claim. Despite Modi’s increasingly autocratic, anti-minority rule, on January 31, Biden and Modi announced a sweeping initiative on Critical and Emerging Technology (iCET), which included the establishment of a U.S. Semiconductor Industry Association “taskforce” to strengthen bilateral chipmaking capacity and cooperation. Just this June, Biden hosted a state dinner for Modi and invited him to address a joint session of Congress, where his references to China were thinly veiled.

“The dark clouds of coercion and confrontation are casting their shadow in the Indo Pacific,” Modi told Congress. “The stability of the region has become one of the central concerns of our partnership.”

Ashok Swain, a peace and conflict professor at Sweden’s Uppsala University, notes that the U.S.-India relationship has been improving for almost three decades. In this sense, “Modi’s visit was just another page in this book,” he told The Wire. But there is likely a limit on how close the countries can become. As Swain says, “it is the sheer political expediency and strategic helplessness [in the face of China’s growing assertiveness] pushing Biden to ignore Modi’s terrible record on human rights, minority rights and press freedom.”

Source: The Wire China

Indeed, it is unclear how much Modi’s U.S. visit will help bilateral relations, but according to former minister Rao, it does do one thing: “Our relationship with the United States irks the Chinese to no end. But the pursuit of our national interest cannot be subject to Chinese diktat. It can never be.”

In many quarters, India’s foray into the semiconductor industry reflects its wider relationship with China, which is shifting from one of competition to rivalry. In June 2020 troops clashed with sticks and clubs in the disputed Galwan Valley, leading to the deaths of 20 Indians and an unknown number of Chinese. Since then, Modi has embraced the “Quad” security group of India, Australia, Japan and the U.S.; snubbed Xi at a conference sideline; acknowledged conversations with the Dalai Lama; and even, in a highly-symbolic gesture, reportedly redeployed troops from its febrile border with Pakistan, to the Chinese “Line of Control,” or LAC, that has been enforced since the two countries went to war in 1967.

India has also consistently resisted Belt and Road Initiative projects within its borders, and both countries have imposed restrictions on investment — while overall trade has increased — and have expelled many of each other’s journalists.

“The relationship is pretty much like a moonscape now — very much like the terrain in eastern Ladakh where both our armies confront each other,” Rao says. “There is a complete breakdown of mutual trust. Political-level communication at the highest level has collapsed: our leaders have turned their backs on each other.”

This April, when India surpassed China as the world’s most populous nation, it seemed to many a symbolic moment — one that titans like Agarwal would like to christen with a tech industry and manufacturing economy to challenge its northern neighbor. The Vedanta chair has said, for instance, that “without chips, nothing will happen” for India’s economy, and he often calls semiconductors “today’s oil.”

But Reed, Vedanta-Foxconn’s chief, notes that, for India, semiconductors offer something more stable and lasting than oil.

“Oil is oil,” he told The Wire. “If I can’t get oil out of Indonesia, I’ll get it out of Saudi Arabia. If I can’t get it out of Saudi Arabia, I can go get it out of Venezuela. That is not true for semiconductors. Not all semiconductors are equal nor can they be replaced effortlessly after 40 years of specialization built into the supply chain.”

Now that large-scale national efforts from the U.S., Europe and elsewhere hope to diversify that supply chain, it’s an open question as to where all this new capacity is going to come from. India, Reed says, “has raised its hand and said, ‘Pick me.’”