The Rise of Middle Market M&A: Q3 2024 Update, Rhodium Group, Nov. 6, 2024.

Thilo Hanemann, Armand Meyer, Danielle Goh

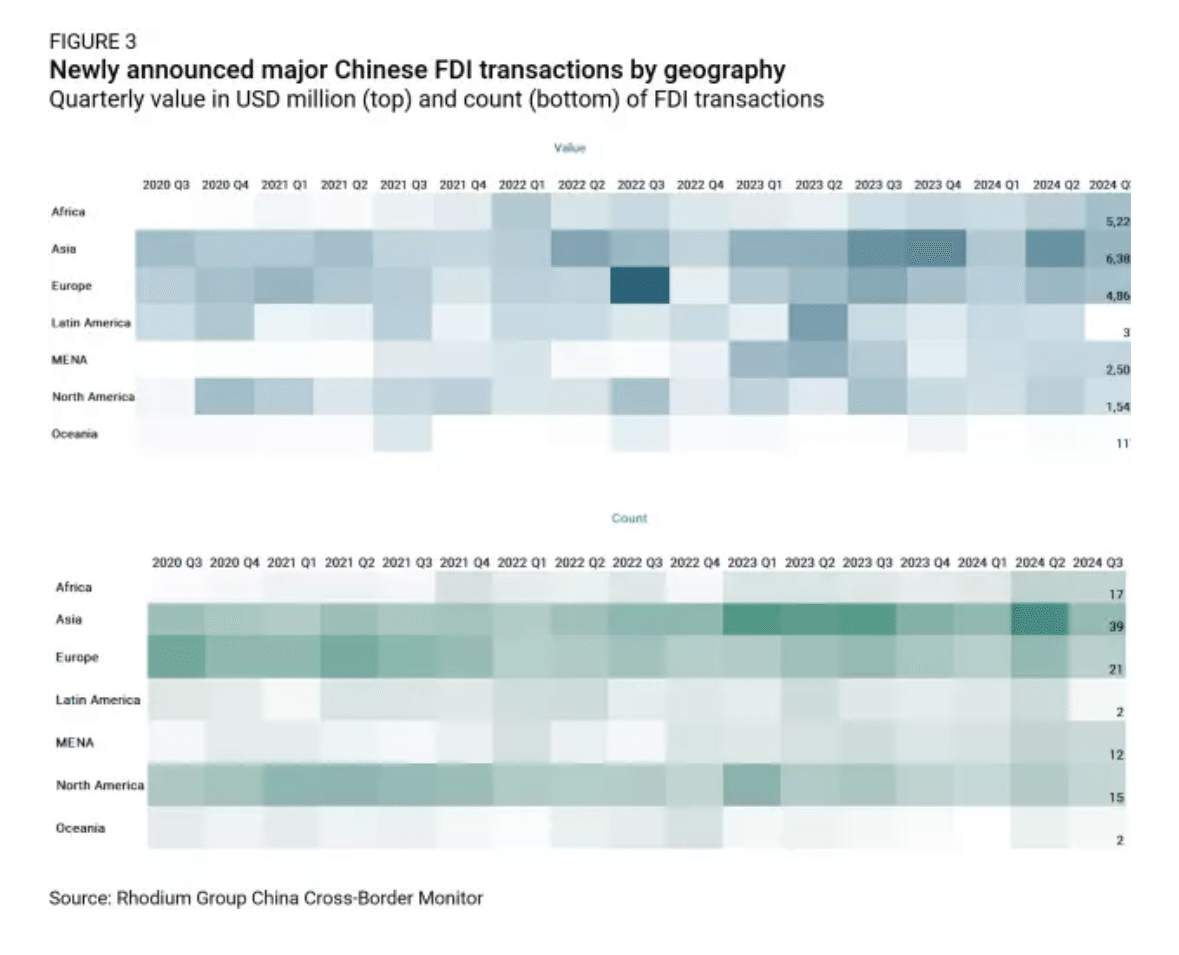

After a weak start to the year, the third quarter of 2024 confirms that the post-COVID rebound remains strong. Chinese investors continue to focus on the automotive, energy, and minerals sectors. Europe and Asia were top destinations, with middle market M&A transactions gaining momentum.

Investment momentum

Chinese outbound investment momentum remains solid. In the third quarter of 2024, we recorded 108 major outbound foreign direct investment (OFDI) transactions by Chinese companies, with a total estimated value of $20.67 billion. This marks a 23% decrease in investment value compared to the second quarter of 2024 but remains around the quarterly average for 2023 and 2024.

Greenfield projects have lost some momentum compared to the previous quarter, with $15.52 billion in new investments, representing a 34% decrease from Q2 2024. New projects were generally less capital intensive, with only one transaction breaking the multibillion-dollar mark—a $3 billion oil refinery project in Liberia built by Sumec. There were four $1 billion transactions, including BYD's electric vehicle manufacturing plant in Turkey.

Newly announced mergers and acquisitions (M&A) jumped to more than $5.15 billion, a 52% increase from last quarter. The main growth drivers are middle-market M&A transactions valued between $100 million and $1 billion, such as China Merchant Capital's acquisition of a 40% stake in HKT Limited’s Regional Link Telecom Services ($870 million), Dongfang Hengxin Asset’s acquisition of Samsung SDI’s battery polarizing film business in South Korea ($834 million), and Global New Material’s acquisition of Merck’s pigments business in Germany ($720 million). Over the past five quarters, the number of middle-market acquisitions has increased by 45% compared to the preceding five quarters, with 52 transactions recorded.

Notable transaction status updates in Q3 include the start of construction on the $1.7 billion Funan Techo Canal public–private partnership project in Cambodia, where China Road and Bridge Corporation holds a 49% stake. ZC Rubber’s also broke ground on its $500 million tire facility in Mexico, and Envision Energy’s commenced work on its $2 billion battery plant in Spain. Completed transactions include Linglong’s $994 million tire manufacturing facility in Serbia and BYD’s $492 million assembly plant in Thailand.

Meanwhile, two battery manufacturing projects in Sweden have been delayed: Volvo Trucks postponed the construction of its battery plant by one to two years and Putailai’s battery plant is still awaiting environmental approval. Alibaba Cloudannounced this quarter that it closed its data centers in Australia and India in September. Government scrutiny of Chinese investment remains strong. In the US, biotech company WuXi is considering divesting some of its US operations while Gotion’s planned battery plant in Michigan has been caught up in electoral politics with Donald Trump voicing its opposition to the project. In the Democratic Republic of Congo, the government is opposing the acquisition of a copper-cobalt mine by Chinese arms manufacturer Norinco.

Investment by sector

Investment in the third quarter was concentrated in the same sectors as previous quarters—automotives, energy, and basic materials, metals, and minerals.

The automotive sector topped this quarter with a total of $7.09 billion (34% of Q3 value), moving up from third place compared to last quarter, with BYD, Minth Group, and Volvo leading the way. BYD announced a $1 billion production plant in Turkey, along with several smaller projects, including a $34 million electric bus manufacturing plant in Azerbaijan and new showrooms in Zambia and Rwanda. Meanwhile, auto part supplier Minth Group received approval for its $943 million plant in Indija, Serbia, and announced the expansion of its $57 million factory in Aguascalientes, Mexico. Volvo also chose Mexico for its truck factory, with a $700 million planned investment in Nuevo León.

Investment in the energy sector remained strong at $5.56 billion, representing 30% of the total Q3 value. Major transactions include a $3 billion oil refinery built by Sumec Corp Ltd. in Liberia, Envision Group's commitment to a $1 billion green hydrogen electrolyzer plant in Spain, and JinkoSolar’s joint venture with RELC and VI in Saudi Arabia to build a $1 billion solar cell and module manufacturing plant.

The basic materials, metals, and minerals sector accounted for $3.77 billion in investments (18% of the total Q3 value), dropping from first place in the last quarter. Following big multi-billion dollar transactions in Kazakhstan last quarter, the transactions announced this quarter were smaller. Sinomach announced a $1 billion iron ore-to-steel project planned in Kogi, Nigeria, and Panhua Group announced a $1 billion steel manufacturing plant in Sarangani, Philippines.

Investment by geography

As in previous quarters, Asia and Europe remain the top recipients of Chinese outbound investment. Announced investment in Africa shot up this quarter but how much of that translates into completed FDI remains to be seen.

With $6.38 billion, Asia remained the top destination for Chinese outbound investment. Southeast Asia has attracted more than 61% of China’s investment value in Asia since 2023. The Philippines recorded the highest value transaction, with a new steel plant for $1 billion by Panhua, its second in the country. Chinese private equity firm Hillhouse has reached a $600 million agreement to acquire Dulwich College International network in Asia.

Europe remains a top destination for Chinese investment, with $4.86 billion recorded in Q3 2024. Most of this investment was in the automotive supply chain, totaling $2.34 billion (48%). However, the top transaction in Europe was in the renewable energy sector, with Envision’s $1 billion hydrogen electrolyzer plant in Spain—the largest manufacturing plant announced in Europe outside the automotive industry. Additionally, after year-long negotiations, Global New Material International Holdings has signed an agreement with Merck to acquire its Surface Solutions pigments business unit for $720 million.

Africa saw a flurry of investment announcements this quarter, with $5.23 billion in new commitments. This marks the region's highest quarterly value since Q4 2007. Many announcements were made during the Forum on China–Africa Cooperation (FOCAC), which is held every three years. However, a significant share of total investment stems from MOUs with state-owned enterprises—such as a $3 billion oil refinery built by Sumec Corp Ltd. Liberia or Beijing Sinomach Amorphous Technology Co., Ltd.'s $1 billion iron ore-to-steel project in Nigeria. It remains to be seen whether these plans are executed as FDI or construction contracts financed by Chinese government loans—or whether they happen at all after the political fanfare dies down.

https://cbm.rhg.com/research-note/rise-middle-market-ma-q3-2024-update