China’s New Company Law: Considerations for Foreign Stakeholders and FIEs, AmCham China, May 24, 2024.

By Qian Zhou and Arendse Huld

The New Company Law brings substantial changes with implications for new and existing foreign invested enterprises and stakeholders. Foreign investors must assess if adjustments to existing structures or new business negotiations are necessary.

Despite recent economic challenges, many organizations’ China operations provide unparalleled access to one of the world’s largest and most competitive global supply chains. Over the past 30 years, a significant number of foreign invested enterprises (FIEs) have been established in China. As of the end of 2022, the number of FIEs operating in China had exceeded 1.12 million.

Compared to their domestic counterparts, FIEs demonstrate greater caution regarding legal revisions and are diligent in making swift adjustments. This stems not only from the closer scrutiny FIEs face from regulatory authorities but also from their commitment to compliance and maintaining a competitive edge.

The New Company Law, as a fundamental regulation overseeing corporate governance in China, introduces significant changes to the legal landscape for FIEs. In this article, we summarize key issues that foreign investors should pay attention to in the New Company Law, explore their potential impact, and propose preliminary strategies that can be adopted. The changes discussed in this article pertain specifically to limited liability companies, as joint-stock companies constitute only 0.1 percent of FIEs, according to recent available data from the Ministry of Commerce.

New Capital Rules and Shareholder’s Obligations

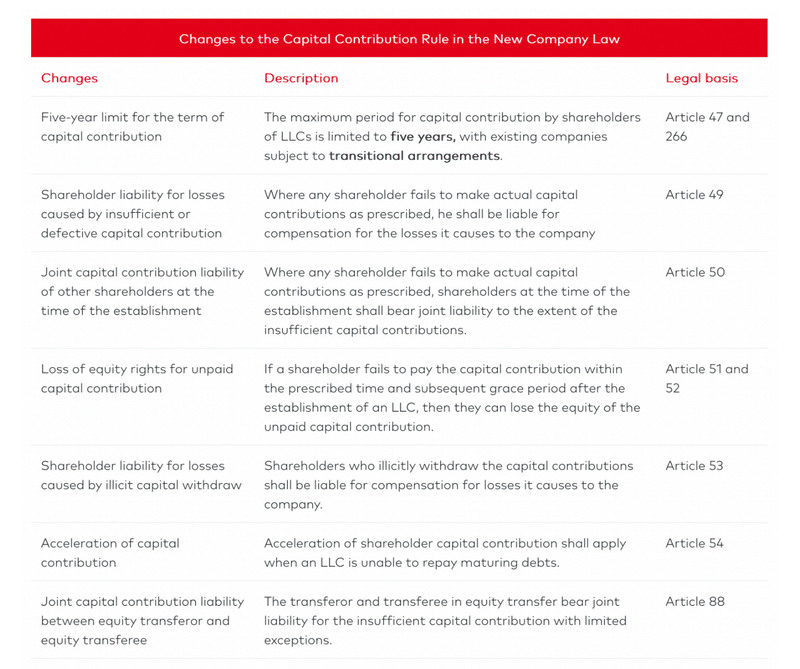

Article 47 of the 2023 Company Law stipulates that shareholders of a Limited Liability Company (LLC) must pay their subscribed capital in full within five years of the company’s establishment. This change has been introduced to tackle issues with shareholders over-subscribing capital at the initial stage, as well as very long payment terms, which has sometimes resulted in the subscribed capital never being paid in full.

In addition to the five-year contribution term, the New Company Law comprehensively strengthens the supervision of shareholders’ capital contributions. It introduces provisions related to the liability of shareholders for defective capital contributions, accelerated capital maturity, supplementary capital contribution obligation by other shareholders at the establishment of the company, and the loss of equity rights for unpaid capital contributions.

Clearly, there has been a shift in China’s corporate regulations—from merely encouraging an increase in the number of companies to focusing on attracting mature enterprises and higher-quality investments. While the transition from a broad approach to a more refined one may cause short-term challenges, it ultimately benefits the company’s long-term development. By returning to the original intent of setting registered capital, it not only protects the interests of creditors but also shields shareholders from the operational risks of the company.

Implications for Existing FIEs

In China’s foreign investment landscape, while most FIEs exercise commercial prudence in determining registered capital—factoring in capital expenditures, operational costs, and setting aside surplus funds—some opt for higher registered capital levels to avoid future capital increase procedures. This typically involves lengthy document signing and registration changes, lasting 1-2 months.

Joint ventures (JVs) often impose stricter payment deadlines for registered capital in their articles of association to ensure both parties’ simultaneous contributions align with operational needs. Conversely, wholly foreign-owned enterprises (WFOEs) tend to favor flexibility in payment deadlines, often allowing full payment before the company’s operational period expires.

Given these circumstances, despite the generally stronger capital adequacy among foreign companies compared to domestic entities, many FIEs could be affected by the new capital contribution rules.

As per the draft version of the Provisions on the Registered Capital Registration Management System (“draft provisions”), existing companies in China will be granted a three-year transition period to comply with the new rules on registered capital. If adopted as is, this transition period will span from July 1, 2024, to June 30, 2027.

Under the draft provisions, existing FIEs must adjust their subscribed capital payment terms (“contribution period”) according to the rules outlined in the table below:

Alternately, existing FIEs have the option to decrease their registered capital during the transition period, thereby lessening shareholders’ contribution obligations. If the reduction in registered capital doesn’t affect the actual paid-in capital, a simpler process may apply. This process involves publicly announcing the reduction through the National Enterprise Credit Information Publicity System for a 20-day period, subject to meeting specific conditions.

Moreover, FIEs can opt to transfer a portion of their equity and bring in new shareholders. This option becomes pertinent if existing shareholders encounter difficulties in paying the subscribed capital within the revised contribution period, yet they prefer not to decrease the registered capital due to various reasons. However, in practice, foreign investors may not base their equity transfer decisions solely on the new capital requirements. Both WFOEs and JVs exercise caution when considering new partners, taking into account various factors beyond the capital regulations.

Implications for New Foreign Investment

In light of the heightened emphasis and scrutiny on shareholders’ capital contribution obligations, new foreign investors must exercise heightened caution when deciding on their initial registered capital. On the one hand, they must ensure adequate reserve capital to meet ongoing operational requirements. On the other hand, they should avoid setting excessively high registered capital amounts to prevent surplus and mitigate the risk of being unable to fulfill capital obligations. If funding needs are uncertain, foreign investors can address them through future capital increases.

Given the joint liability shared by shareholders who haven’t fully paid their subscribed capital within the specified period and other shareholders at the time of establishment, it’s vital for foreign investors to establish effective mechanisms in joint venture contracts, shareholder agreements, and articles of association. These mechanisms ensure that all shareholders synchronize their capital contributions and prevent compliant shareholders from being implicated by defaulting ones.

In terms of mergers and acquisitions (M&A), the joint liability associated with insufficient capital contribution borne by the transferor and transferee means that foreign investors selling their unpaid-in equity can no longer simply transfer the capital contribution obligation to the buyer. Similarly, foreign investor buyers must carefully assess the actual payment status of the target company’s registered capital. This diligence goes beyond ensuring compliance with the articles of association and should involve requesting the counterparty to complete payment of any outstanding portion of registered capital before finalizing the transaction.

Changes to the Corporate Governance Structure

The New Company Law introduces significant adjustments to the regulation of corporate governance structures. Specifically for LLCs, it offers shareholders considerable flexibility in selecting the company’s governance framework.

Supervisor(s)

One of the major changes in the New Company Law is the provision to allow LLCs to establish an “audit committee” within the board of directors, in which case it would not need to establish a board of supervisors (or appoint any supervisors). The audit committee can be “composed of directors on the board of directors [and] exercise the powers of the board of supervisors”. Meanwhile, Article 83 specifies that small-scale LLCs or those with a limited number of shareholders can appoint a single supervisor. And with unanimous shareholder consent, they can forgo appointing a supervisor altogether.

To put it simply, an LLC can forgo establishing a board of supervisors or appointing individual supervisors if it either creates an audit committee within its board of directors or gains unanimous consent from its shareholders.

That said, should an FIE eliminate the board of supervisors or individual supervisors completely?

Over time, supervisors have been tasked with overseeing both the board of directors and executive management. However, their role can become largely ceremonial as their appointment and funding are often controlled by major shareholders. For WFOEs, supervisor appointments may primarily serve registration requirements without substantial supervisory responsibilities. While the authority of supervisors remains largely unchanged under the New Company Law, their duties and responsibilities have significantly increased (more details in the later sections). Eliminating supervisors may align better with the needs of most WFOEs.

However, for JVs the case is different. Since the appointment of supervisors often facilitates JV partners in controlling the company and safeguarding their interests, it’s less likely that JVs will entirely eliminate supervisors.

Nevertheless, there is another issue that foreign investors should pay attention to. Under the existing Company Law, small LLCs have the option to appoint one to two supervisors instead of establishing a board of directors. In the case of JVs, it’s common for practical considerations to lead to the appointment of two supervisors, with each side (Chinese and foreign shareholders) appointing one supervisor. However, Article 83 of the New Company Law explicitly eliminates the option of having two supervisors. Consequently, existing JVs may need further clarification on whether they can retain the two-supervisor structure without establishing a board of directors.

If such JVs are obligated to strictly adhere to the provisions of the New Company Law and opt to set up a board of supervisors, they may need to appoint at least four supervisors to maintain the principle of parity, with each side appointing two supervisors. This would add complexity and increase personnel costs to the governance structure.

Then, should FIEs replace the supervisor(s) with an audit committee? Our answer is negative—we recommend that FIEs refrain from setting up an audit committee for the moment. The primary reason is that the New Company Law lacks clear provisions regarding the audit committee’s deliberation methods and voting procedures. Without well-defined mechanisms and practical experience, achieving internal coordination between the executive functions of the board of directors and the supervisory role of the audit committee may pose significant challenges. Consequently, the audit committee might still struggle to fully fulfill its supervisory function.

Finally, can FIEs opt to neither establish an audit committee nor appoint supervisor(s)? Although the New Company Law does not explicitly define “small-scale LLCs” or “LLCs with a limited number of shareholders”, FIEs should meet the conditions, considering that they are typically wholly owned companies or JVs established by few shareholders. Depending on the future practices of company registration authorities, we believe it is feasible for FIEs to neither establish a supervisory board nor set up an audit committee under the board of directors.

Employee Directors

Another significant change in corporate governance is that the New Company Law strengthens democratic management of the company and adjusts the requirements for appointing employee directors.

In contrast to the existing Company Law, which requires only companies with State-owned capital to have employee directors, the New Company Law mandates that LLCs with more than 300 employees must include employee representatives on their board of directors unless the company has already established a board of supervisors and there are employee representatives in it.

Given that the New Company Law stipulates that the board of supervisors must include a certain proportion of employee representatives, an FIE will not need to appoint employee directors if it has already established a board of supervisors. This is because all boards of supervisors should inherently include employee representatives by default.

For FIEs, introducing employee directors may raise some concerns among shareholders. While having employee representatives participate in decisions related to employee interests can help reflect and safeguard those interests, the majority of board decisions are not directly tied to employee matters. The qualifications and abilities of employee directors to make rational decisions, as well as their ability to maintain confidentiality, need to be tested in practice.

Consequently, as a short-term strategy, FIEs can consider having executives with employee status (such as managers) concurrently serve as employee directors or supervisors, and in doing so avoid substantial changes to the board’s structure. Future clarifications are needed on how the employee director mechanism works in practice.

Power Division Among Shareholders, Directors, and Executives

The New Company Law grants greater flexibility in the allocation of powers among shareholders’ meetings, boards of directors, and executives. Notably, the statutory powers of shareholders’ meetings have been somewhat reduced. Matters that were previously reserved for shareholders’ meetings, such as decisions on the company’s business policies and investment plans, now fall within the purview of the board of directors under the New Company Law. Additionally, beyond the enumerated scope of board of directors’ powers, shareholders’ meetings can explicitly grant additional authority to the board of directors. For instance, shareholders’ meetings may authorize the board of directors to make decisions regarding the issuance of corporate bonds (Article 59). Simultaneously, the new law eliminates the specific listing of managerial powers found in the existing Company Law. Managerial authority is now entirely subject to the company’s articles of association and the agreements of the board of directors (Article 74).

For foreign investors, this adjustment holds particular significance. In practice, overseas shareholders of FIEs face challenges in closely monitoring and making decisions about the daily operations of domestic companies. Furthermore, many foreign companies adhere to a board-centric governance model, where the board of directors is responsible for operational and investment decisions, while corporate executives handle day-to-day operations. This change in power allocation aligns better with the operational habits of foreign investors, allowing them to optimize governance structures based on their specific circumstances and enhance management efficiency.

Rules of Procedures for Decision-making

The New Company Law has adjusted the rules of procedures for shareholder meetings and board meetings of LLCs. Some of the existing rules applicable only to joint-stock companies now extend to limited liability companies. These include:

Shareholder meeting resolutions must be approved by shareholders representing more than half of the voting rights (Article 66).

Board meetings must have a majority of directors present to be held. Board resolutions require the agreement of more than half of all directors (Article 73).

If the number of attendees is insufficient or the number of people agreeing to a resolution does not meet the requirements of the New Company Law or the company’s articles of association, the resolutions of the shareholder meeting or board meeting are not valid (Article 27).

Under the existing Company Law, there are few restrictions on the rules and voting procedures for LLCs. Enterprises enjoy significant flexibility to mutually agree upon procedural rules. To prevent decision-making delays caused by inadequate attendance, some companies—except for matters mandating approval by two-thirds or more of all voting rights shareholders—may specify that decisions are valid based on the actual number of attendees. This could be unanimous, an absolute majority, or a simple majority. Furthermore, if a shareholder or director consistently fails to attend meetings or voice opinions after receiving notices, the company’s articles of association may stipulate that the actual number of attendees constitutes the statutory quorum for specific meetings.

Given that the New Company Law has clearly defined voting mechanisms and statutory meeting attendance requirements for LLCs, the feasibility of the above mechanisms will be challenged. Efficient and stable business operations for FIEs heavily rely on the successful passage of shareholder and board resolutions. FIEs should reevaluate their existing meeting rules, assess potential risks, and take preliminary measures. For instance, FIEs can consider setting up replacement mechanisms for directors who are frequently absent, to avoid decision-making delays caused by failure to meet the statutory number of directors in board meetings.

Dismissal of Directors

Article 71 of the New Company Law stipulates that if a shareholder meeting unreasonably removes a director before their term expires, the director may request compensation from the company.

This provision diverges from the long-standing perception held by foreign shareholders. Foreign investors generally believe that shareholders have the authority to arbitrarily remove directors they nominate without cause, as this reflects their shareholder rights.

Considering the implementation of the director compensation system under the New Company Law, whether for WFOEs or JVs, prudent evaluation is essential when removing directors before their term expires. Companies are advised to confirm in writing with the director that there are no unresolved disputes or compensation matters between them and the company. This proactive step helps prevent potential disagreements with departing directors in this context.

Senior Management Duties

The personal liability of directors, supervisors, and executives (“senior management”) has always been a hot topic for foreign investors. Executives here refer to managers, deputy managers, chief financial officers, the company secretary of a listed company, and other individuals specified in the company’s articles of association. The strengthened fiduciary duty and diligence obligation of senior management personnel, as well as their liability towards the company and third parties is another focus of the New Company Law.

Specifically, the New Company Law clarifies the duty of senior management personnel in the following aspects:

It establishes principles and standards for the fiduciary duty and diligence obligations of senior management; includes supervisors and “close relatives of directors and supervisors, as well as enterprises directly or indirectly controlled by them” in the scope of regulation for related-party transactions and industry competition (Article 180).

If senior management personnel cause harm to others while performing their duties, the directors share compensation liability responsibility with the company, where they act intentionally or with gross negligence (Article 191).

It reinforces the obligation of senior management personnel to independently comply with their duties. If they engage in actions harmful to the company or shareholders based on instructions from controlling shareholders or actual controllers, they will be jointly liable (Article 192).

It emphasizes the duty of senior management personnel to maintain the company’s capital adequacy. Directors and supervisors who fail to fulfill their responsibilities will be jointly liable or subject to compensation liability (Article 51, 53, 163, 211, and 226).

It clarifies the duty of directors as liquidators of the company and the compensation liability for failure to perform such duties (Article 232).

In this context, senior management personnel need to fulfill their statutory duties and obligations actively and comprehensively. This shift is expected to impact the personnel arrangements and workflow of many FIEs.

Generally, within the current management structure of foreign companies, senior management personnel are simultaneously bound by their fiduciary duties to the company and the management system and constraints within the entire group. While alignment is often feasible, conflicts may arise in certain situations.

For example, consider a foreign-nominated director within the company who approved a significant investment based on instructions from the overseas headquarters. If that investment fails and causes losses to the company, scrutiny will focus on whether these directors appropriately fulfilled their fiduciary and diligence obligations.

Moreover, in many FIEs, some senior management personnel, especially those affiliated with the headquarters and based overseas, may not substantially participate in the company’s operations and decision-making due to practical constraints. This is no longer suitable under the New Company Law. We recommend appointing individuals familiar with the company’s business and deeply involved in actual operations as senior management personnel to mitigate the risks associated with failing to meet the fiduciary and diligence standards under the new law.

Equity Transfer

Article 84 of the New Company Law introduces two significant changes regarding equity transfers:

Removal of consent requirement: Previously, when a shareholder transferred shares to an external party, other existing shareholders had the right to consent or object. Now, under the New Company Law, if other shareholders receive written notice of the share transfer and do not respond, it is deemed that they have waived their pre-emptive purchase rights.

Clarification of “same conditions” for the pre-emptive purchase rights: The New Company Law now explicitly defines the same conditions as details such as quantity, price, payment method, and deadline specified in the share transfer notice. This legal refinement enhances the implementation process of pre-emptive purchase rights.

As mentioned earlier, FIEs especially JVs tend to exercise caution when introducing new partners. In many cases, foreign companies establish JVs with domestic enterprises based on business cooperation needs. Such partnerships resemble a “marriage” between two entities. The changed provisions on equity transfer, according to which a shareholder can directly transfer their shares without the other party’s consent, may disrupt the stability of the “marriage”.

Particularly, when foreign companies are minority shareholders, sudden departures by majority shareholders can leave the remaining minority shareholders in an awkward position. They may lack the resources to acquire the majority shareholder’s shares and end up having to deal with completely unfamiliar new shareholders.

Luckily, Article 84 of the New Company Law provides an exception – if the company’s articles of association stipulate otherwise regarding share transfers, those provisions shall prevail. Therefore, to maintain stability in the cooperative relationship between both parties, parties of the JV are highly recommended to stipulate equity transfer restrictions in the JV agreement and articles of association.

Non-proportional Capital Reduction

Article 224 of the New Company clarifies that when a company reduces its registered capital, the corresponding reduction in the contribution amount or shares should be made according to the proportion of shareholders’ contributions or holdings. That is to say, proportional capital reduction is the principle.

Exceptions are made in the following cases: where the law stipulates otherwise; if there are specific agreements among all shareholders of an LLC; or the articles of association of a joint-stock company specify otherwise.

Non-proportional capital reduction, or targeted capital reduction is not a common practice for FIEs. It is usually applied in some equity investment projects, where investors require the company to buy back its equity under certain circumstances. However, under the New Company Law, foreign investors may view targeted capital reduction as a viable method for a shareholder to exit the company, given that the new law explicitly permits targeted capital reduction based on unanimous shareholder consent. To ensure the effectiveness of this withdrawal mechanism, a clear and detailed agreement outlining the conditions of targeted capital reduction should be established, confirmed, and signed by all shareholders.

Key Takeaways

Overall, the New Company Law introduces significant revisions, with a focus on optimizing corporate governance structures, strengthening shareholders’ responsibilities regarding capital contributions, and enhancing the duties of directors, supervisors, and executives. These changes will have a substantial impact on various types of companies, including FIEs.

For FIEs, regardless of whether they have already adjusted their organizational structure according to the existing Company Law, it is crucial to consider the implications of the revisions introduced in the New Company Law. Understanding how the new law aligns with or differs from the existing one is essential. Specifically, attention should be given to whether the new law merely triggers technical adjustments to relevant organizational documents or if it necessitates substantial changes to existing business arrangements (such as board member structures or capital arrangements). In the latter case, FIEs may need to engage in new business negotiations with partners promptly.

Furthermore, FIEs affected by changes introduced by the New Company Law, such as the 5-year capital contribution requirements or employee director mandates, should diligently track supplementary clarifications issued by regulatory authorities. This monitoring is particularly important with regard to the transition of requirements from old to new laws for existing companies.

How to Prepare for the New Company Law?

Understand the new provisions introduced in the New Company Law.

Review existing structures and corporate documents and identify areas that need adjustment.

Evaluate the implications of the changes from multiple perspectives and consider them when making business decisions.

Pay attention to future developments for areas needing further clarification.

Provide necessary training to relevant personnel such as shareholders and directors.

Seek legal counsel and expert advice when necessary.

In summary, the New Company Law significantly modifies China’s corporate governance landscape and has broad implications for foreign investors and FIEs across various aspects. Businesses are advised to stay informed about the latest legal requirements and subsequent clarifications issued by regulatory authorities. Assessing the urgency and complexity of necessary adjustments based on their specific circumstances is essential. When necessary, seeking assistance from external legal service teams is advisable.

This article was first published by China Briefing, which is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in China, Hong Kong, Vietnam, Singapore, India, and Russia. Readers may write to info@dezshira.com for more support.