Big Strides in a Small Yard: The New US Outbound Investment Screening Regime, Rhodium group, Aug. 11, 2023.

Reva Goujon, Charlie Vest, Thilo Hanemann

fter years of policy signaling and debate, this week the White House released an executive order to create new regulations on certain outbound investment transactions to China. The Treasury Department concurrently issued an advance notice of proposed rulemaking that outlines their thinking on implementation and aims to elicit public feedback. As expected, the proposed approach targets a smaller set of technology categories than prior legislative measures and includes a mix of prohibitions for certain transactions and notification requirements for others. Yet there remain many uncertainties in the regulatory draft language that raise questions about its ultimate scope.

This note breaks down the executive order and draft rules and puts the rules in the context of current US and EU direct investment and venture capital trends toward China. We find that:

The draft rules are a mash-up of definitions from existing regulations, but also extend into novel areas in trying to seal up loopholes. Under the current draft language, for instance, even certain greenfield investments in the US, which are not currently captured in US inbound investment screening, would appear to be covered under the regulations.

The US could extend a long arm into certain transactions, depending on how the final rule is written. The combination of expansive definitions for US persons, “covered foreign persons,” and covered transactions (including those outside of China) raises significant questions over how far the US intends to extend its writ and risk unintended consequences from MNCs compelled to displace US persons.

The scope of the rule is likely to expand over time. Information gathered from notifications—along with growing congressional scrutiny on transactions in China—will be used to inform restrictions. Certain biotechnology segments are under study for potential restrictions, and autonomous vehicle-related technologies are coming under growing regulatory scrutiny. US administrations can also vary in how much they balance a “small yard, high fence” approach in restricting a narrow set of technologies with broader “de-risking” ambitions to reduce China’s coercive leverage in critical supply chains, as showcased in the “semiconductors and microelectronics” section.

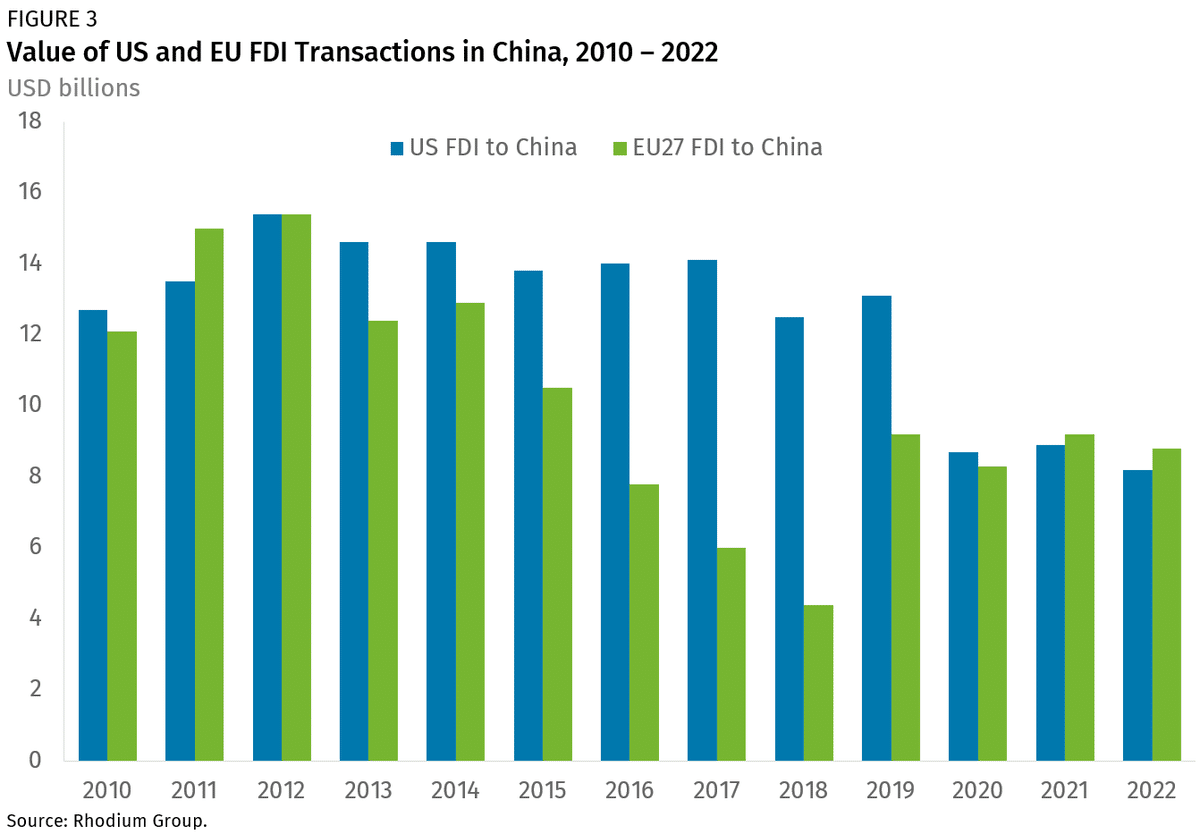

The executive order on outbound investment screening comes at a time of declining US investment in China. Rhodium Group’s proprietary dataset shows that US FDI transactions in China have leveled off from an average of $14 billion per year from 2005 to 2018 to less than $10 billion since 2019. Our data on US venture capital in China shows investment at a 10-year low in 2022 at $1.3 billion, down from the peak of US technology financing in China in 2018, which reached $14.4 billion.

The open-ended questions and caveats throughout the draft rules reveal just how hard it will be to get this regulatory regime right. The uncertainty itself, however, may also deter investors from trying to circumvent screening during the regulation’s infancy.

Rounding out the Sullivan Doctrine

More than two years ago, National Security Advisor Jake Sullivan told participants at an AI summit that the US administration was “looking at the impact of outbound US investment flows that could circumvent the spirit of export controls or otherwise enhance the technological capacity of our competitors in ways that harm US national security.” Following a tug-of-war with Congress over scope, tense discussions with G7 partners, careful observation of Chinese retribution post-October 7 controls, and multiple delays, the US is finally initiating the regulatory regime.

The regulation follows the premise that technology is developing at breakneck speed and that regulators will inevitably struggle to keep up. China’s deliberate blurring of civilian and military boundaries in technological development is raising the risk of US capital and know-how aiding Chinese military modernization, and the geopolitical stakes are simply too high to leave open gaps in export controls. The outbound investment screening is thus a preemptive effort to control investment flows into force-multiplying technologies (currently scoped to semiconductors, quantum technologies, and AI) while other key areas like advanced biotech have been left off for now. For example, the US has extensive export controls on advanced semiconductors, but, until now, not on US investment in China’s indigenous development of those exact same chips. The new regulatory regime intends to fill that gap and also capture capital flows to technologies (like quantum computing and emerging AI capabilities) at the “pre-export control” level when further development is needed before precise technical standards can be set on controlled items.

The administration applied the lens of military, intelligence, surveillance, or cyber-enabled capabilities in trying to determine what applications should be covered. It has also focused efforts on investments that provide “intangible benefits” that come with certain US investments, including enhanced stature, networks, market access, managerial assistance, and access to additional financing.

The policy documents reflect a legitimate effort to address the national security challenge at hand. However, the fact the proposed rules contain over eighty substantial questions for public comment is indicative of the remaining uncertainties over how such a regime will ultimately be implemented and how that ambiguity will inform partner considerations over their own outbound investment policies.

Breaking Down the Draft Regulation

The “Executive Order (EO) Addressing United States Investments in Certain National Security Technologies and Products in Countries of Concern,” signed by President Biden on August 9th, takes a two-pronged approach to managing certain investments in China, starting with a “small yard” of semiconductors and microelectronics, quantum information technologies, and certain artificial intelligence systems. The EO directs the Secretary of the Treasury to develop regulations that:

Require US persons to notify the US government regarding certain transactions with PRC entities involving certain national security-relevant technologies, and;

Prohibit some transactions with Chinese entities involving certain sensitive technologies.

At the same time as the EO was released, Treasury issued a 48-page Advance Notice of Proposed Rulemaking (ANPRM) that describes how regulators are considering implementing the executive order. Importantly, the ANPRM is not the regulation itself. Rather, it is meant to provide insight into the theories of harm informing the draft regulations and includes a laundry list of questions around definitions, scope, and unintended consequences to elicit feedback from industry during a public comment period on a very tight 45-day timeline.

The ANPRM provides definitions for key terms governing who and what kind of transactions would be subject to outbound investment screening:

The executive order specifies three categories of covered technologies: 1) semiconductors and microelectronics, 2) quantum information technologies, and 3) artificial intelligence sectors that are critical for the military, intelligence, surveillance, or cyber-enabled capabilities of a country of concern. The ANPRM describes which specific technologies within these categories that regulators are considering targeting and whether investments in those technologies would be prohibited outright and or subject only to notification requirements (see Table 2).

Key Takeaways

The ANPRM leaves much yet to be determined, reflecting the inherent complexity of drafting the rules and also serving to deter foreign investors from trying to circumvent screening during the regulation’s infancy. The ANPRM also represents a pulling-together of a wide range of language from different US regulations: it combines definitions and draws inspiration from existing regulatory authorities, including the International Emergency Economic Powers Act (IEEPA) in how it defines US persons, from CFIUS in how it defines “covered transactions” and “foreign persons,” from the Treasury Department’s Office of Foreign Asset Control (OFAC) in using a 50 percent ownership standard, from the October 7 rules on advanced semiconductors in where it draws technical thresholds.

There are several key themes that should stand out for multinational companies and investors:

Expansive definitions on foreign transactions

The preliminary draft language includes potential broad definitions of US persons, covered foreign persons, and covered transactions in ways that could significantly expand claimed US jurisdiction over certain transactions involving Chinese persons and entities.

Under the draft language in the ANPRM, the definition of “US person” includes any foreign branches of any entity organized under the laws of the United States. This suggests, for example, that a European-headquartered company with a US subsidiary could meet the criteria of a “US person.” If so, any investments by that EU company that constituted a “covered foreign transaction,” such as a greenfield investment in China or a joint venture with a Chinese company in a third country, would fall under the scope of the EO.

There are also uncertainties around what constitutes the “establishment of a covered foreign person” in scoping a covered transaction. Under a conservative interpretation this would appear to cover investments that create, for instance, a new business entity in China in the covered technologies. A broader interpretation could plausibly include any transaction that establishes individuals as covered foreign persons, such as a joint venture between an Israeli semiconductor company with US persons linkages and a non-Chinese company that has Chinese engineers or managers on staff. The ANPRM will likely clarify these questions as part of the public comment process.

Treasury has made clear that these definitions are under consideration and that the “covered foreign persons” definitions are primarily intended to capture parent companies and their subsidiaries to avoid loopholes and unintended consequences. Given the draft language under consideration, the potential long-arm effect may be significant, and could set off a chain of audits by human resources departments in certain tech MNCs to screen for US persons and “covered foreign persons” combinations. How these definitions evolve post-public comment period will be critical to watch.

Breaking new ground

While the genesis of the definitions in question can be tied to existing regulatory authorities, the combination of these definitions and forward-looking intent in the design of the regulation can produce bigger effects.

For example, while the outbound covered transactions language hews closely to CFIUS language, there is a notable addition of greenfield investments. CFIUS authority for screening foreign inbound investments does not currently extend to greenfield investments—a topic of intensifying policy debate in Washington. Given the combined definitions of US persons and “covered foreign persons,” the outbound investment screening regime could theoretically cover even greenfield investments in the United States (or anywhere), so long as they meet the technology and US and covered foreign persons criteria.

Deterring circumvention and shifting the compliance burden

A big conundrum for the US administration in drafting these rules was how to address the difficulty of understanding the nature of these transactions before restricting them, and prevent companies from exploiting the incremental buildout of the regulatory regime by accelerating restructuring plans to circumvent the rules.

The emphasis on obligations to notify and the scores of open-ended questions in the ANPRM on how the rules could be scoped sends a message to MNCs and investors connected to covered technology investments that it would be prudent not to try and exploit a perceived window, even if the regulatory buildout is at a nascent stage. This can be seen in the following:

The Treasury Department is considering including “indirect” transactions as “covered transactions” in order to close loopholes that would otherwise result, and to clarify that attempts to evade prohibitions on certain transactions cannot find safe harbor in the use of intermediary entities that are not “US persons” or “covered foreign persons,” as defined. Examples of such conduct could include, but would not be limited to, a US person knowingly investing in a third-country entity that will use the investment to undertake a transaction with a covered foreign person that would be subject to the program if engaged in by a US person directly.

Furthermore, the ANPRM asserts that Treasury is not trying to over-extend itself in covering thousands of transactions. Instead, it puts a heavy emphasis on US persons obligations to notify Treasury of transactions and “take all reasonable steps to prohibit and prevent any transaction by a foreign entity” controlled by a US person that “would be a prohibited transaction” if engaged in by a US person. A controlled foreign entity may be defined as a “foreign entity in which a US person owns, directly or indirectly, a 50 percent or greater interest.

Lastly, even though the rules state the reviews for outbound investments are intended to be “forward-looking” and not applied retroactively, there is an important caveat. Treasury is still considering “how to treat follow-on transactions” into a covered foreign person or technology if the original transaction occurred prior to the effective implementation date of the regulations. Treasury also appears to be thinking through how MNCs may attempt to buy out Chinese partners in adapting to the new rules, and makes an exception for US transactions that acquire “all interests in the entity or assets held by covered foreign persons.”

Somewhere between a small yard and wide field

Within the covered technologies, the “semiconductors and microelectronics” section illustrates a fundamental tension in US policy: how to reconcile a “small yard, high fence” approach for a narrow set of technologies with accelerating de-risking efforts to reduce China’s perceived coercive leverage in less sensitive segments of tech supply chains.

The “semiconductors and microelectronics” label mirrors a Senate amendment to the National Defense Authorization Act on outbound investment screening. Rather than just focusing on advanced semiconductors, as defined by the October 7 thresholds, the ANPRM is selective in where it applies those thresholds and casts a broader net in restricting technologies that “enable” advanced integrated circuits.

Treasury is considering prohibition of covered transactions in:

Software for electronic design automation for integrated circuits (no technical threshold specified)

Integrated circuit manufacturing equipment exclusively used for the “volume fabrication” of ICs (no technical threshold specified)

Advanced integrated circuit design and production that exceed the October 7 thresholds for high performance compute capacity (ECCN 3A090 threshold applied here.)

Advanced integrated circuit fabrication (Oct 7 thresholds applied here for advanced chips, e.g., 16/14nm and below for logic chips, 128 layer and above for NAND, 18nm half-pitch or less for DRAM)

The draft rules indicate that Treasury is reinforcing the “freeze-in-place” approach to curbing China’s development in advanced semiconductors by targeting critical chokepoints. The way the rule is drafted, US electronic design software and chip toolmakers would not be allowed to invest in enabling China’s semiconductor development, regardless of the technical threshold. This may be an attempt to prevent US investment from facilitating China’s capacity buildout in legacy chipmaking as policy concerns grow over China’s coercive leverage in that space. It will be important to watch how the outbound investment screening rules are reconciled with the CHIPS and Science Act guardrails. The Commerce guardrails for CHIPS Act recipients, for example, restricted investments in China above a low threshold of $100,000 but also leaves a carveout for capacity expansion that “predominantly serves a foreign market.”

The AI conundrum

As expected, the most open-ended part of the rule is the AI section. This is a fast-moving technology space and most AI applications, from AI-powered simulations and sensors to communications platforms, can easily fall into dual-use territory. Treasury attempts to scope down AI systems to focus on AI applications that confer military, intelligence, surveillance, or cyber-enabled capabilities, specifically listing cybersecurity applications, facial recognition, “control of robotic systems,” as well as listening devices and location tracking that collect information without the users’ consent as AI applications that could be covered.

This section also hinges on a critical caveat. The ANPRM says:

If the Treasury Department were to pursue a prohibition in this category, a potential approach is to focus on US investments into covered foreign persons engaged in the development of software that incorporates an AI system and is designed to be exclusively used for military, government intelligence, or mass-surveillance end uses.

It then caveats that “primarily used” could take the place of “exclusively used” in defining AI systems of concern. This leaves wide open the question of whether outbound restrictions will capture broader, potential dual use applications, especially as US regulatory scrutiny is rising over development and access to certain trained AI models, and risks posed by AI-powered Internet of Things applications, including autonomous vehicles technologies.

Room for scope creep

By compelling companies to report in transactions, Treasury will theoretically have more information gathered over time to further define restrictions on outbound investments. The executive order also creates a mechanism for reviewing and amending the list of covered technologies and the requirements for notification or prohibition. Regulators are to meet annually to review investment trends and assess technology advancement in countries of concern, and then issue recommendations on whether the rules should be adapted.

This would create a process whereby the relatively narrow technological focus of the outbound screening regime could expand to other technology segments that have been discussed in other proposals, such as biotechnology, advanced sensors, and large-capacity batteries. No one, including the current US administration, can be sure where a future White House may set those boundaries. In the Senate amendment on outbound screening, “networked laser scanning systems with dual-use applications” was included in scope, likely reflecting efforts to capture advanced technology segments in the autonomous vehicle space.

Short of a full-fledged outbound investment screening regime, there are also existing measures that can be applied to achieve similar effects in restricting transactions with Chinese entities of concern. These include additions to the Federal Communications Covered List and other cybersecurity restrictions targeting Chinese inputs and connected systems in Internet of Things (IoT) infrastructure, Commerce Information and Communication Technologies investigations, additions to the Commerce BIS Entity List, NS-CMIC Treasury designations, and industrial policy guardrails.

Impacts on Already-Slowing US Investment in China

The executive order on outbound investment screening comes at a time of declining US investment in China. From an average of $14 billion per year between 2005 to 2018, total US investment in China dropped to $10 billion annually over the next five years. During the pandemic, investment dropped to $8.7 billion in 2020 from $13 billion in 2019, and this low level persisted for the subsequent two years. After a small rebound in 2021, total US FDI in China fell to a 20-year low of $8.2 billion in 2022 amid disruptions from zero-Covid shutdowns (see Figure 1).

Despite the slowing pace of investment, the stock of US investment assets in China remains substantial. Estimates from the US Bureau of Economic Analysis place the total assets of US multinational companies in China at $708 billion as of the end of 2020. While the executive order is focused on future investments and cannot unwind existing deals, there are critical open questions about how and whether US companies will be allowed to engage in follow-on investments in joint ventures and greenfield projects covered under the EO. And while the technological scope described in the ANPRM is currently narrow, the creation of an annual process to potentially expand the scope of the EO to new sectors and technologies will raise questions for MNCs and investors today over whether a new investment in an uncovered sector (particularly those such as biotech that are under substantial policy scrutiny) could be added to the list of covered technologies in the future.

Our dataset shows a similar downward trajectory of US venture capital in China, but in a more compressed period. The peak of US technology financing in China occurred in 2018, reaching $14.4 billion, driven by a handful of unicorn fundraising rounds. Growing US-China technology frictions and regulatory scrutiny have driven down US venture funding in China rapidly since then, with investments dropping to a 10-year low of $1.27 billion in 2022.

The composition of investors and technologies has also shifted significantly during that period. Several investors, especially larger professional VC firms with reputational concerns, have abandoned new investments in China, and the investor landscape has become more concentrated. Some investors have separated their China operations from their US and global operations. Those investors that continue to invest in China are increasingly shying away from “deep tech” and technologies that have been scrutinized by the national security community, including technologies such as semiconductors and quantum computing that are under consideration for coverage under the ANPRM. Much of the money in the past five years has been directed toward biotechnology startups and consumer-focused companies.

Questions over Partner Alignment

The ANPRM’s focus on eliciting public comment on potential “unintended consequences” of the new regulations comes for good reason. A snapshot of US and EU FDI flows to China shows that while overall FDI into China has been stalling, US and EU flows into China are nearly neck and neck to date. If the US fails to secure G7 partner alignment, then we could see a much bigger divergence between the US and partners in the FDI outlook. This will weigh heavily on US regulators, especially given stiff Member State resistance to EU initial discussions on an outbound investment screening regime and German industry, in particular, arguing for leaning into the China market to stay competitive in emerging tech industries, including AI software platforms. There have been a number of major investment announcements by EU firms in 2023, including a $700 million tie-up between Volkswagen and Chinese EV startup Xpeng and the $700 million investment announcement by German venture capital fund Bertelsmann Investments.

Divergence between the US and its partners could tempt US regulators to reach for long-arm controls in trying to steer others toward its objectives, similar to the October 7 controls. On the one hand, the EU has largely aligned with the US on the starting list of technologies under scrutiny (semiconductors, quantum, and AI) and the EU Commission has set an ambitious timeline to examine potential outbound investment screening measures by the end of the year while focusing on shoring up restrictions on inbound investments. The dialogue itself may be giving US policymakers hope of potential alignment, but movement by member states on tactics to address like-minded concerns is another matter entirely.

Questions Abound

The release of the long-awaited outbound investment screening executive order marks another step forward in the growing list of US-led tech and investment controls on China. While the technological scope of the executive order is narrower than earlier legislative proposals, there remain many unanswered questions over what kinds of transactions will ultimately be covered. Businesses have only 45 days to offer comment on these substantial questions, which in turn raises questions over how quickly the regulations will ultimately be implemented given the complexities involved. Looming over all is the question of potential Chinese retaliation, as Beijing seeks ways to push back against US controls without undermining private and foreign investor confidence in a period of economic malaise.