Foreign Investors Are Leery of China Bets, Despite Rebound Expectations, Wall Street Journal, Jan. 9, 2023.

By Rebecca Feng

An exodus of foreign capital in 2022 marked a decisive break from past years’ inflows

Market strategists say the stars are aligned in 2023 for Chinese assets to stage a comeback—but a return of foreign capital may take longer.

Foreign investors have pulled more than $100 billion out of China’s bond market since February, according to two major Chinese clearinghouses. They have also dramatically slowed their investments in the country’s stock market. Foreign institutions bought a net $13 billion worth of yuan-denominated shares last year via a Hong Kong stock-trading link, down sharply from $63 billion in 2021.

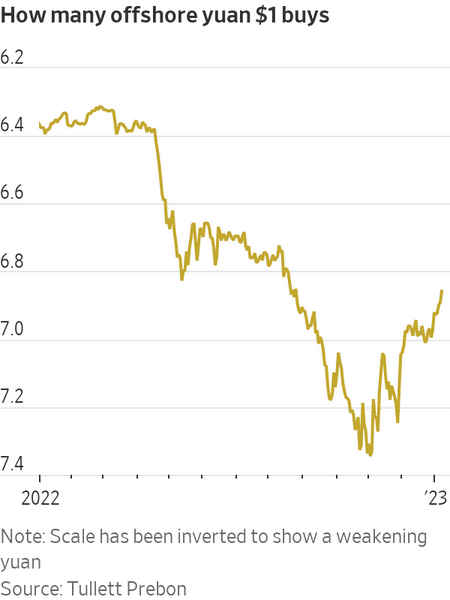

Many international investors sold Chinese assets after Russia invaded Ukraine, fearing Beijing’s close ties to Moscow might lead to U.S. sanctions on Chinese entities. They were also deterred by China’s strict zero-Covid policy, which hampered economic growth. The yuan also weakened significantly last year against the U.S. dollar. Some of those concerns have since been addressed—near the end of last year, China’s government lifted most of its pandemic restrictions, said it would refocus on growth and unveiled a rescue plan for its beleaguered property sector.

That doesn’t mean foreign investors will rush back in. The Chinese government’s abrupt changes to key policies have made some nervous—and led to missed opportunities.

The rapid policy loosening caused a sharp rally in Chinese stocks after a year of declines, making it difficult for many long-only investors to make their investment decisions, said Hugues Rialan, chief investment officer for Asia at Pictet Wealth Management. “It takes time to adjust to new situations, but the market was moving very, very fast,” Mr. Rialan said.

“Most foreign investors are still asking whether they should come back at all, instead of the timing of coming back,” he said. Mr. Rialan added that Pictet has a “fairly positive” outlook for Chinese assets in 2023.

Foreign investors may be even more reluctant to put money back into the Chinese bond market, as a key advantage Chinese government bonds once had over their U.S. counterparts disappeared in the middle of last year, investors say. The 10-year Treasury note was recently yielding 3.56%, significantly above the 2.88% yield on 10-year Chinese government bonds.

“There’s not a realistic case for spreads between Chinese and U.S. yields narrowing substantially in the near term. And that’s really what’s keeping bond-market inflows on the back foot,” said Logan Wright, Washington, D.C.-based director of China markets research at Rhodium Group, an economics- and policy-research firm.

In October, most economists thought China wouldn’t meaningfully dial back its zero-Covid policy until March, after a key political meeting. But Chinese authorities moved quickly. On Nov. 11, China shortened quarantines for inbound travelers and those identified as close contacts of infected patients. In December, it announced the removal of the last major pieces of the zero-Covid regime, including scrapping the daily publication of infected cases.

“The speed of reopening and the speed of infection peaking have both been faster than expected,” said Jian Shi Cortesi, investment director for Asia equities at GAM Investments.

Ms. Cortesi said that infections may have already peaked at the end of December and that she expected activities to normalize after the Lunar New Year holidays in late January. She added that her portfolio is already positioned for a China rebound.

Investors returned to the stock market after the policy announcements, leading to a 10% rally in the domestic benchmark CSI 300 Index in November and December combined. The Chinese yuan also regained some ground in the final months of 2022 after weakening to a more than 14-year low against the dollar. The more freely traded offshore yuan ended last year 8% weaker against the greenback, according to FactSet.

Some investors took losses toward the end of last year and closed out positions in the Chinese stock market, meaning they missed the rally in the past six to eight weeks. They now face a dilemma about whether or not to re-enter Chinese markets, said Jasmine Duan, an investment strategist at RBC Wealth Management.

“They lack the confidence in Chinese equities at the moment and they may want to see more evidence such as improving economic data and a pick-up in consumption, to turn more positive on China,” Ms. Duan said.

The reopening of China’s economy after the end of the zero-Covid policy stepped up a gear on Jan. 8, after the government removed almost all border restrictions. The move, which enacted a policy announced in December, has fueled optimism among those who see Chinese shares as a good buying opportunity.

“The news flow we’ve seen over the past weeks is basically removing all the concerns and major overhangs that have been weighing on the market for so long. It’s all coming together,” said Marco Klaus, Hong Kong-based chief investment officer at Silverhorn Group, an owner-operated investment firm.

But although there is plenty of good news for investors in China, it may not quite be good enough to drive major inflows.

“My take right now is that a lot of allocators are still sitting on the fence, simply because the fear about investing in China has been so high that they will first have to get over that hurdle,” Mr. Klaus said.