World Economic Forum: Li Qiang boasts of China-tech breakthroughs if wary foreign firms can be swayed, SCMP, Jun 28, 2023.

Premier calls for strengthening innovation in science and tech, building a modernised industrial system and boosting domestic demand

But foreign business representatives tell Li Qiang that they are still waiting for further reassurances from Beijing, over long-held concerns

Premier Li Qiang has called for multinational corporations to step up their game in investing in China’s tech and scientific innovation sectors, as foreign businesses continue to seek assurances from Beijing over a raft of concerns.

Li and more than 120 business representatives exchanged some of their most pressing concerns and requests during a closed-door meeting that took place this week on the sidelines of the three-day annual World Economic Forum, often referred to as the “Summer Davos”, in the northern Chinese city of Tianjin.

“We are willing to work with all parties in the push to develop cutting-edge technology, create new areas for cooperation, and open up new space for business investment,” Li told business representatives from more than 20 countries and regions, in a meeting on Tuesday afternoon when the forum kicked off, according to an official Chinese readout.

Li said China could promise “great opportunities for cooperation” as it is set to achieve “breakthroughs in the new round of science and tech industrial revolution” by strengthening innovation in science and tech, building a modernised industrial system and boosting domestic demand.

Source: SCMP

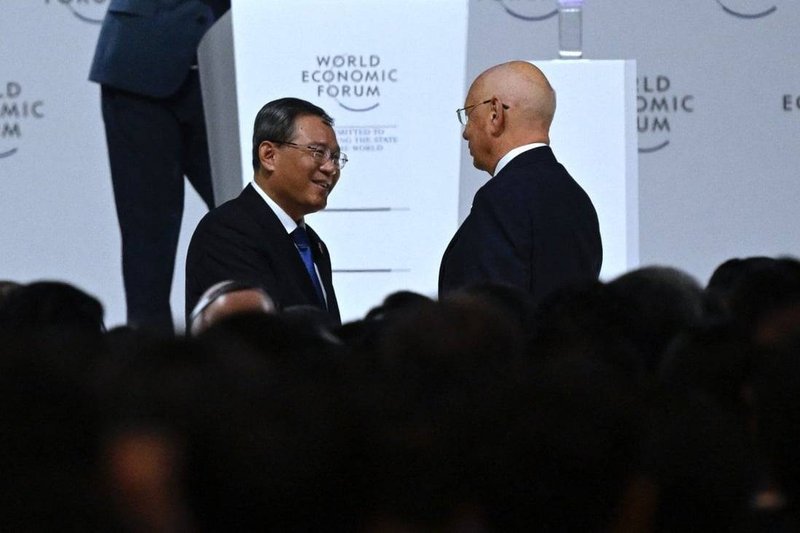

Chinese Premier Li Qiang talks with Klaus Schwab, founder and executive chairman of the World Economic Forum, after his speech during the opening ceremony. Photo: AFP

Premier Li Qiang has called for multinational corporations to step up their game in investing in China’s tech and scientific innovation sectors, as foreign businesses continue to seek assurances from Beijing over a raft of concerns.

Li and more than 120 business representatives exchanged some of their most pressing concerns and requests during a closed-door meeting that took place this week on the sidelines of the three-day annual World Economic Forum, often referred to as the “Summer Davos”, in the northern Chinese city of Tianjin.

“We are willing to work with all parties in the push to develop cutting-edge technology, create new areas for cooperation, and open up new space for business investment,” Li told business representatives from more than 20 countries and regions, in a meeting on Tuesday afternoon when the forum kicked off, according to an official Chinese readout.

Li said China could promise “great opportunities for cooperation” as it is set to achieve “breakthroughs in the new round of science and tech industrial revolution” by strengthening innovation in science and tech, building a modernised industrial system and boosting domestic demand.

The Chinese statement also said Li responded to business representatives’ questions regarding corporate cooperation, data management and climate change.

Li’s invitation for foreign companies’ participation in tech and science sectors came as Beijing faces a major bottleneck in the development in these areas, including telecommunications, semiconductors and aircraft, as it deals with debilitating restrictions in an intense tech rivalry with Washington.

Li, who has been driving China’s economic policy since March, has also been repeating rhetoric to lure foreign investment to China as the country attempts to recover from its years-long zero-Covid policy.

Yet, foreign business representatives in the meeting with Li said they hoped to see further reassurances from the Chinese government.

Our members … told us that they would be willing to invest more in China if industries weren’t restricted Michael Hart, AmCham China

Ralf Brandstaetter, CEO of German carmaker Volkswagen Group in China, said in the meeting that companies need more clarity on cross-border data transfers, and he asked how China plans to cooperate with Europe amid rising political tensions.

“As a globalised industry, the transformation of the automotive sector highly depends on the international exchange of personnel, data and knowledge. We, therefore, need more clarity on cross-border data transfers,” the executive said, according to Reuters. And he reportedly added: “What are the major considerations of China, and how will China cooperate with Europe in this regard?”

Michael Hart, president of the American Chamber of Commerce in China, said that while data protection is a cross-industry concern for its members, many companies face other deterring factors when considering investing in China.

“Companies are very pleased to hear that sort of macro-welcomeness. One of the questions though, is that there are still restrictions on certain types of investments. When we surveyed our members, they told us that they would be willing to invest more in China if industries weren’t restricted,” Hart said. “In some areas, like even financial services, which in theory is open, there’s still a long process to actually make this happen.”

Beijing made promises earlier this year to relax its entity list that prohibits foreign firms deemed “unreliable entities” from engaging in import, export and investment in China, as part of its confidence-boosting campaign to assure foreign investors that China would continue to open its market. But there have yet to be major changes announced in this area.

Meanwhile, Chinese companies may face further limitations in their access to foreign technology, while foreign companies could face increasing uncertainties regarding investing in these areas in China, as the US and European governments insist that they need to “de-risk” their supply chain.

The European Economic Security Strategy, unveiled by Brussels last week and to be discussed further this week at an annual two-day summit, would potentially restrict autocratic governments’ access to European technologies that are seen as key to economic security, such as quantum computing and artificial intelligence.

Foxconn chairman Liu Young-Way, who spoke on the panel about Asia’s manufacturing resurgence at the World Economic Forum, said that a shift in the industrial chain from higher-GDP to lower-GDP countries is inevitable, but added that this should not be seen as further confrontation.

“What China needs to do is to create more value and transform and upgrade its industry,” said Liu, from Apple’s biggest iPhone maker. “I think the international community should now place greater emphasis on sharing cooperation and common prosperity. I hope sharing will not turn into closure and cooperation will not turn into confrontation.”

Separately, Liu told Chinese tabloid Global Times that Apple has no plans to move its supply chain completely out of China.

Yet, the Taiwanese manufacturer earlier announced it would ramp up investment outside China, such as in India, to meet customer demand and lower its reliance on China for production.

Hart, who heads AmCham China, said that apart from companies’ top concerns over geopolitical relations between China and the US, recent economic data from China does not help boost confidence from foreign investors.

“I would just say the things that people look at are signals, if it was consumer spending, consumer competence, private investment. None of those things seem to be signalling a rapid rebound, and that is making people a bit hesitant,” Hart said.

However, Hart noted that industries that are less affected by geopolitical tensions, such as healthcare and food and beverages, still appear to be more interested than others in investing in China due to the long-term consideration of market size.

China’s latest economic data on May released earlier this month showed industrial output and retail sales growth missed market expectations.

Additional reporting by Mia Nulimaimaiti