Will US 10-Year Government Bond Interest Rates Continue to Fall?

Hey folks shoma here.Will US 10-Year Government Bond Interest Rates Continue to Fall? let's try to find the answer today in this blog and i'll give you my analysis and conclusion, those of you new to my blog my name is shoma i'm a High school student trader, would appreciate if you guys press the like button as appreciate your support,

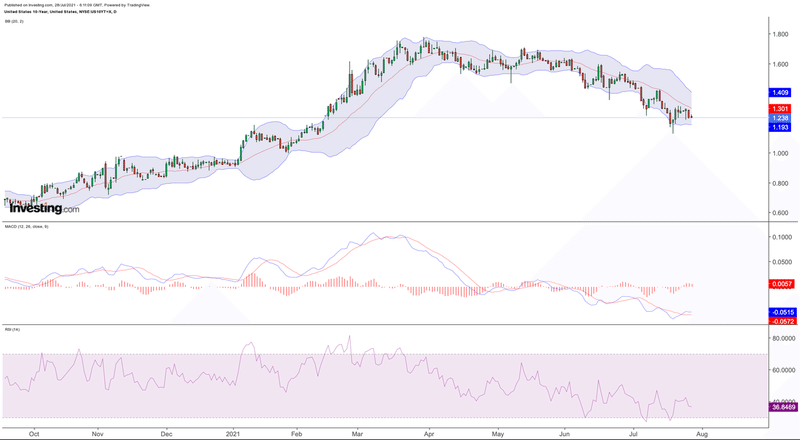

Let's go through US 10-Year Government Bond Interest Rates of Daily chart the MACD (12,26,9) is in a golden cross, which is a signal for an uptrend. But the MACD has not been smooth lately, so I have some doubts about this uptrend signal.the RSI (14) is below 50, indicating a downtrend.

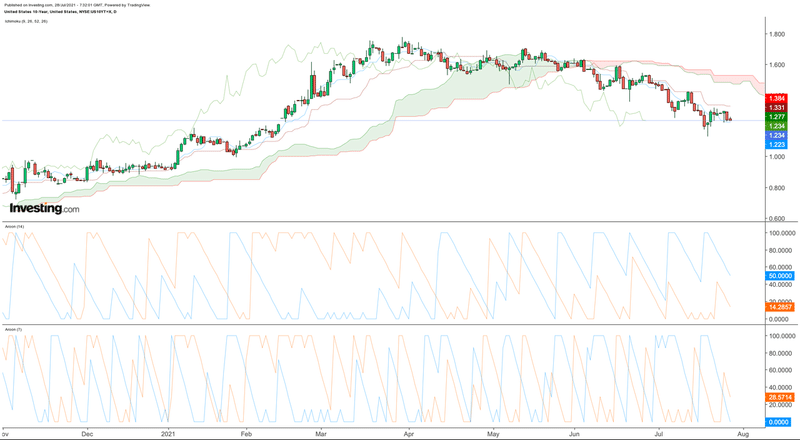

It has been falling since the strong downtrend signal appeared on the Ichimoku.Aroon(7) and Aroon(14) with do not show any signal.

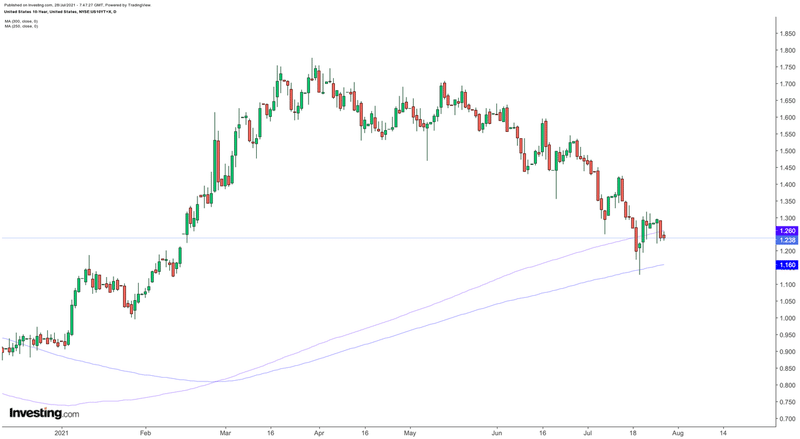

It rebounded at the 300-day moving average on the 18th and broke above the 250-day moving average, but it broke below the 250-day moving average again this week and continues to fall toward the 300-day moving average.

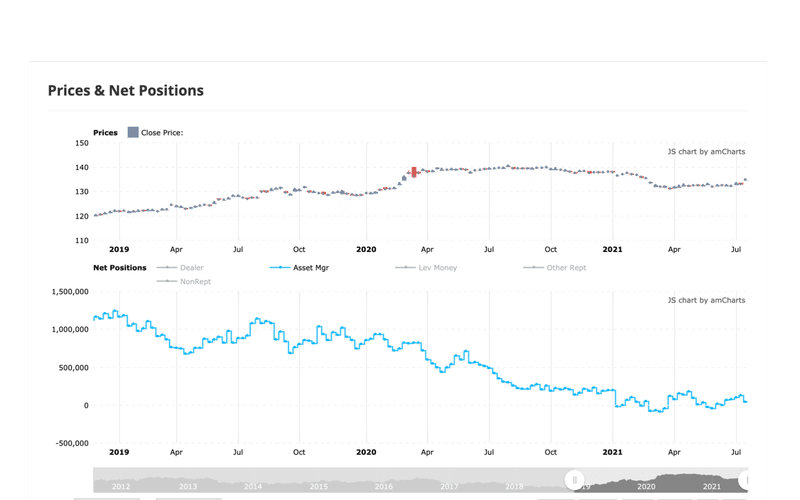

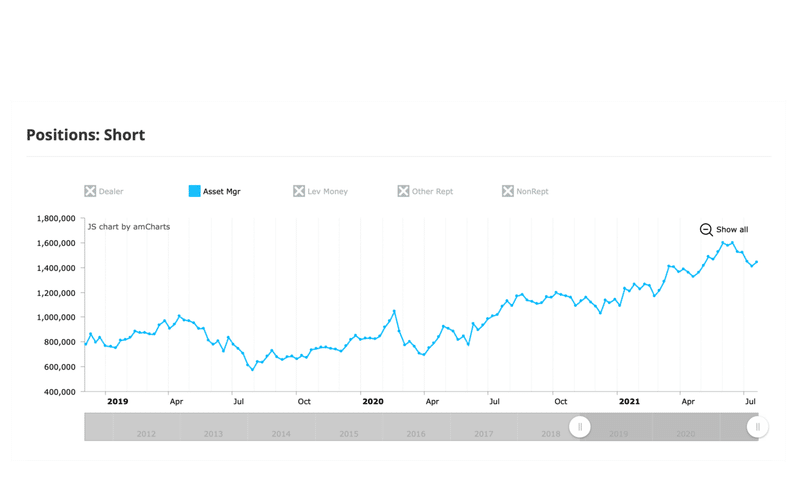

The this chart Asset Manager's Net Position in the US 10-Year Government Bond.Net Position is low, so the US 10-Year Government Bond is still undervalued.as a note, bonds yield less when bond prices rise, and yield more when bond prices fall.

Since the short position is at a high level, it seems that all asset managers are betting that the price of the U.S10-year bond will go down. As the short position is gradually falling, we can see that it is gradually being short covering.

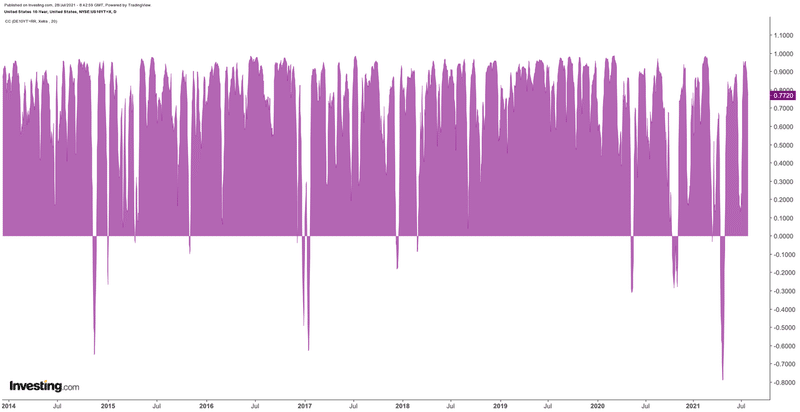

From the graph of the correlation coefficient, we can see that the US 10-year bond yield correlates well with the German 10-year bond yield. Not only that, but I also feel that the German 10-year bond yield has been moving like a leading index of the U.S. 10-year bond yield lately, so I will take a look at the chart of the German 10-year bond yield.

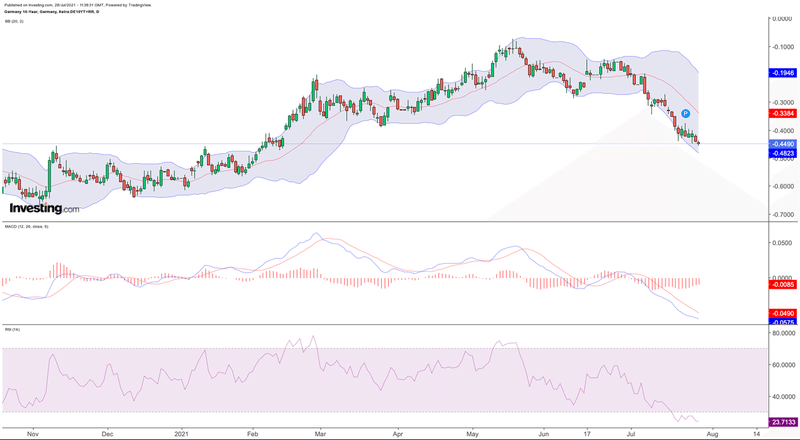

Let's go through the German 10-year government bond Interest Rates of Daily chart the MACD (12,26,9) is in a dead cross, which is a signal for an downtrend.the RSI (14) is below 30, so it may look undervalued, but the downtrend is still continuing.

Conclusion As a result of my analysis, I believe that the 10-year US government bond yield is likely to continue to fall in the short term along with the German 10-year bond yield.We have the FOMC meeting this week, so keep an eye on that.

この記事が気に入ったらサポートをしてみませんか?