Alpaca Finance Feature

Good morning. 😊

Today I'll be explaining my in-depth research on Alpaca Finance, which is growing into BSC's core content.

Why is it growing?

Because it is the first lending protocol allowing leveraged yield farming on Binance Smart Chain.

Leverage is the act of borrowing money from other people to invest, which is extremely dangerous. In the real world, FX is famous for this. (Click here if you are wondering what FX is.)

"Isn't leverage kind of dangerous?"

But if you use it well, you can increase your profits safely, or you can avoid using leverage in the first place.

With Pancake, if you want to use the power of compounding, you have to go through the 3-step process of harvesting CAKE, creating LPs with the CAKE, and reinvesting the money, but Alpaca does it all automatically. It's easy.

Since its inception, Alpaca has been a very popular project that has gained overwhelming trust with its easy to use UI, cute characters, and solid management.

After Venus and PancakeSwap, it's time for AlpacaFinance to open the door to the magical world!

Let's get right to it!

1. What is Alpaca Finance?

Alpaca was the first project to bring leverage to BSC.

As a side note, the name "Alpaca Finance" is derived from the fact that alpacas are eco-friendly creatures that emit less carbon dioxide than cows, can earn wool (interest) over and over again, and do not bite (safety). ⇒Introducing Alpaca

What I find attractive about Alpaca is

- Cute characters and

- Good design and easy to use app

- High interest rates 🤤💰.

Not only that, but

- Thoroughly fair launch

=> No pre-sales or preemptive mining among friends or within the admin, making the project user-friendly.

- Thoroughly reassuring.

=> Fine fixes based on user feedback, double audits, rewards for bugs and vulnerabilities finders

- Thoroughly transparent operation.

=> Full documentation, open source, 24h timelock.

We don't know who is running the system, it doesn't matter where they are. The mask may be on, but inside is justice. It's like Tiger Mask.

2. How Profit is Generated

In the world of BSC, where many different projects are created, it is important to understand how profit is generated.

"I don't know what it is, but if a new project comes out, buy $100 worth of tokens!"

"When the convenience store releases a new potato chip product, buy it!"

"Hyah!"

Even if it's good for now, it won't last.

There are three main sources of income for Alpacas.

- Borrowing interest and fees paid by leveraged borrowers.

=> The interest rate is adjusted in the range of 0% to 150% depending on the balance of the collateral. The interest rate is low when the balance is ample, and spikes when the balance is not ample (when more than 90% of the loan is in progress).

Of the interest earned, 90% goes to the lender and 10% goes to the Alpaca Finance.

- The token reward ($CAKE) of PancakeSwap and the transaction fee of the pool.

=> Alpaca's Farm uses PancakeSwap. It is easy to understand if you use no leverage (x1.00). For example, for the CAKE-BNB pair, the interest rates for Alpaca and Pancake will be almost the same.

"Yield Farming" around the top right of the alpaca is almost the same as the APR ($CAKE reward) of the pancake. I don't know why it's slightly different, but maybe it's because of the timing of data acquisition?

Also, Alpaca shows me the "Trading Fees" (pool trading fees) based on the actual trading data for the past 7 days. This is the same for deposits to PancakeSwap. It is interesting to visualize this in Alpaca. (Currently, PancakeSwap is "Data Unavailable" due to inability to retrieve data.)

Thisfarming rewards are passed on to Alpaca's Farm users, excluding the 3% performance fee.

- Liquidation Fee

=> In the event that your debt ratio has gone above the threshold (Kill Threshold), your position will be liquidated. At that time, 5% of the balance will be paid to liquidator (bot) as a bounty.

*The bot is not just for alpacas, but third parties are also participating and competing with each other.

Half of the alpaca income from interest and liquidation will be used to buyback $ALPACA on the market, and the buybacked $ALPACA will be burned to increase its value.

In addition, Farm users will benefit from the ALPACA tokens that will be distributed.

3. Lending

Alpaca currently offers 4 tokens (BNB, BUSD, ETH, and ALPACA) that can be lent (deposited) and receive interest from those who borrow them. The interest rate is variable.

The design is that when the lending rate is high and the balance is low, the interest rate goes up and more people want to lend. It works well.

When you deposit a token, you will receive an ibToken in exchange.

In the figure above, "1 ibBNB = 1.0147BNB" is the value of ibBNB.

The "Lending APR" is the value that will be added to the ibBNB token, and this rate will increase the value of the ibBNB token itself.

The "Staking APR" is the amount of $ALPACA you will receive.

The "Utilization" is the lending rate of the pool, and if this rate exceeds 90%, the interest rate will explode.

4. Leverage Farming

Leverage Farming is available in Farm.

The UI is uniquely designed and very easy to understand, and although there are many copies out there, Alpaca is the original.

Once you have deposited the money, it will be displayed as "Your Position" as shown above.

"Position Value" is the total amount of investment including borrowing.

"Dept Value" is the amount you borrowed.

"Equity Value" is the amount you will receive when you withdraw.

When the "Kill Buffer" reaches 0%, it will be liquidated.

The 4 types of tokens in the lending pool are considered as the base.

In other words, there are 4 types of Farms, divided by base token, and the rule is that it is always the base token that is borrowed. ⇒Reference

- PancakeSwap ALPACA pools ⇒ Borrow ALPACA

BUSD-ALPACA pool

- PancakeSwap BNB pools ⇒ Borrow BNB

CAKE-BNB pool

BTCB-BNB pool......etc

- PancakeSwap BUSD pools ⇒ Borrow BUSD

BNB-BUSD pool

VAI-BUSD pool......etc

- PancakeSwap ETH pools ⇒ Borrow ETH

COMP-ETH pool...etc

For example, if you have a BNB-BUSD pool with x2.0 leverage, the token you borrow is always BUSD. And unlike Pancake, Alpaca does not require a 50 : 50 ratio of tokens at the time of deposit, but allows you to deposit any ratio you want, such as BUSD only, or BNB:BUSD = 3:7.

Then, Alpaca's program will automatically exchange the tokens so that BNB:BUSD = 50:50, and create Pancake-LP and operate it.

So you can see that the exchange fee varies depending on the tokens you deposit, i.e. ...... (assuming a rate of 1BUSD=1$, 1BNB=$500)

- No leverage, In case of depositing 1000BUSD

=> Program will exchange 500BUSD to 1BNB to make 500BUSD:1BNB LP ($500 x 0.2% exchange fee will be charged)

- No leverage, In case of depositing 2BNB ($1000)

=> Program will exchange 1BNB to 500BUSD to make 500BUSD:1BNB LP ($500x0.2% exchange fee will be charged)

- No leverage, In case of depositing 500BUSD+1BNB (total $1000)

=> Program will create a 500BUSD:1BNB LP (no fee) 😊.

In the case of no leverage, it would be the best deal in terms of fees to deposit the money at a value of 50:50.

Now let's consider ...... with leverage (let's say x2.0). It's complicated!

- Leverage x2.0 in the case of depositing 1000BUSD

=> Borrow $1000BUSD from the pool and exchange it to 2BNB to make $1000BUSD:2BNB LP ($2000) ($1000 x 0.2% exchange fee)

- Leverage x2.0 in the case of depositing 2BNB ($1000)

=> Borrow $1000BUSD from the pool and create an LP of $1000BUSD:2BNB ($2000) (no exchange fee) 😊.

- Leverage x2.0 in the case of depositing 500BUSD:1BNB ($1000)

=> Borrow 1000BUSD from the pool and exchange 500BUSD of it into BNB to create 1000BUSD:2BNB LP ($2000) ($500 x 0.2% exchange fee)

If your leverage is more than x2, you can save money in terms of exchange fees by depositing everything in tokens as opposed to borrowers (BNB).

If you think about the above and make transactions, you will save a very small amount of fees, so if you like that kind of thing, please refer to this page.

If you have leverage, you will have to borrow tokens, but the higher the leverage, the more you will be bombarded with borrowing rates if the lending rate of the tokens you borrow is large.

In the past, the popular BUSD has tended to have a high lending rate, so you might want to consider that...maybe. But I can't choose, so I guess I can't help it. (You will be able to choose in the future.)

It doesn't matter if you start with BNB or BUSD, with or without leverage, the ratio is the same in terms of capital, since you will be creating LPs in the end. The only difference is the commission.

Regardless of whether you start with BNB or BUSD, with or without leverage, it does not matter what ratio you start with. The only difference are the exchange fees.

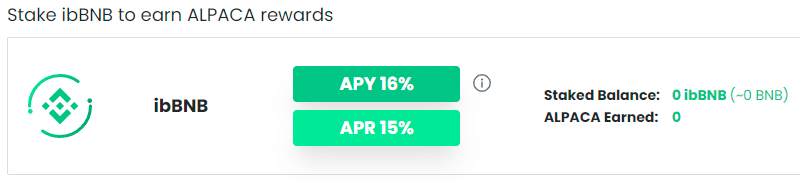

5. Staking

If you are a renter, please do not forget about staking; if you are a farmer, there is no need to stake, it is fully automatic.

When you stake, the current valuation and the $ALPACA you can harvest will be displayed. It's very convenient.

6. Summary

Alpaca is a very popular project with an excellent UI that is very easy to use, and with a combination of safe pancake base and lending, leverage is available.

I've heard that there will be an NFT in the future, and that may be of some use, so check it out. ==> see Medium

Now I need to figure out which LP pairs to operate with as well as pancakes. Pancake is the basic one.

I'll post Alpaca's calculation tool for the case where the price goes up and down after Farming.

I'll post the sheet I created is here, too.

I hope this article will be helpful to you.

See you again, DeFi~(@^^)/~~~

この記事が気に入ったらサポートをしてみませんか?