For foreigners living in Japan, here is a brief explanation of tax returns. For more detailed information, please do your own research.

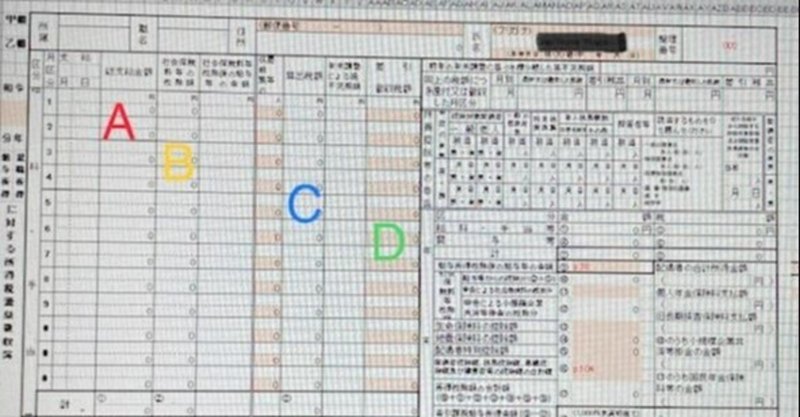

A. Enter the total amount paid (amount received) by month.

B. Enter the amount of the insurance premium.

If you are employed

As for the employment insurance premium, international students are not allowed. If you are a family member, you are obliged to join.

As for social insurance, the minimum requirement is 30 hours per week.

If you are working more than 30 hours per week, you have already acquired VIZA, so your company will account for it.

If you are an individual, please fill in the amount for worker's compensation insurance.

C、Please enter the amount of income tax. (2,980-yen if within 150,000-yen per month)(4,770-yen if within 200,000-yen per month)(6,530-yen if within 250,000-yen per month)

For more details, please check on your own.

D = A - B - C Enter in D the amount obtained by subtracting the amounts in B and C from the total amount (amount received) by A and month.

In the case of an individual tax return, citizen's tax and health insurance premiums will be issued based on the tax return.

For more details, please check by yourself.

It's not difficult, you just don't understand it. Good luck with that!

この記事が気に入ったらサポートをしてみませんか?