Why Incorporate A Company

Whether or not you are essentially starting your business or you have quite recently been functioning as sole ownership or general affiliation, you may consider the upsides of moulding your business as an endeavour. Every now and again, business visionaries accept that fuse is exorbitantly costly or excessively repetitive, nor is the circumstance.

The preferences business visionaries gain by moulding their business as an endeavour ordinarily surpass any obvious hindrances. These points of interest are, a great part of the time, difficult to reach to sole ownerships and general affiliations.

Fuse favourable circumstances include:

• Limited Liability – Corporations give restricted risk security to their owners (who are called speculators). Normally, the owners are not actually liable for the commitments and liabilities of the business; thusly, advance supervisors can't search after owners' near and dear assets, for instance, a house or vehicle, to pay business commitments. Then again, in sole ownership or general affiliation, owners and the business are authentically seen as the proportional and individual assets can be used to pay business commitments.

• Tax Benefits – Corporations habitually gain tax cuts, for instance, the deductibility of medical care inclusion expenses paid for an owner delegate; assets on free work charges, as corporate pay isn't at risk to Social Security, Workers Compensation and Medicare charges; and the deductibility of various expenses, for instance, live inclusion. For information on such evaluation focal points, your business may get by forming as an association, counsel an accountant or assessment counsellor.

• Building up Credibility – Incorporating may empower another business to set up validity with possible customers, labourers, dealers, and accessories.

• Boundless Life – An organization's life isn't reliant upon its owners. An organization has the component of unfathomable life, which implies if an owner fails miserably or wishes to move their favourable position, the association will continue to exist and work together.

• Transferability of Ownership – Ownership in a venture is ordinarily easily adaptable. (In any case, there are impediments on S organization ownership).

• Raising Capital – Capital can be raised even more easily through the closeout of stock. Moreover, various banks, while giving a private endeavour advance, need the borrower to be an intertwined business.

• Retirement plans – Retirement holds and qualified retirements plans, for instance, a 401(k), maybe developed all the more adequately.

Companies don't come without clear likely hindrances.

Possible drawbacks of an organization include:

• Twofold Taxation – The organizations are subject to twofold assessment assortment of corporate advantages when corporate compensation is scattered to the owners as benefits. The twofold cost is made when the obligation is first paid at the corporate measurement. If corporate advantage is, passed on to owners as benefits, the owners settle government cost at the individual measurement on that pay. The twofold cost can be avoided by picking S organization force status with the Internal Revenue Service.

• Formation and Ongoing Expenses – To outline an undertaking, articles of wire must be recorded with the state and the important state reporting charges paid. Various states power advancing costs on endeavours, for instance, a yearly report just as foundation evaluate charges. While these charges normally are not over the top costly for privately owned businesses, the improvement of an association is more expensive than for sole ownership or general affiliation, the two of which are not needed to record game plan documents with the state.

• Corporate shows – Corporations are needed to seek after both beginning and yearly record-keeping tasks, for instance, holding and properly filing start and yearly get-togethers of heads and financial specialists, getting and keeping up mandates and giving proposals of stock to the owners. Sole ownerships, general affiliations, and even LLCs don't achieve the traditions constrained on associations.

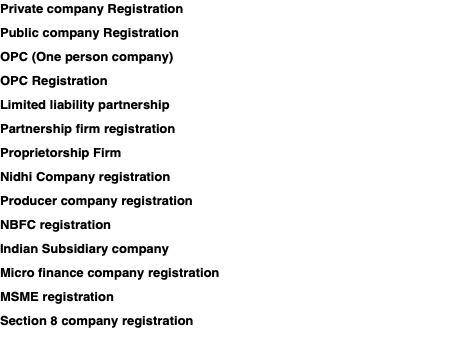

Types of Company Register In India

Estella Consultancy is providing all types of online Business solution like Company Registration, Fssai Registration, ESI Registration & PF Registration, MSME Registration, Trademark Registration, OPC Registration, LLP Registration, Accounting, Book Keeping, GST Registration Related Services, Listing, Delisting, RBI, FEMA, Foreign company entry in India and Secretarial Audit etc.

この記事が気に入ったらサポートをしてみませんか?