Rare Earth Reshore, The Wire China, Apr. 23, 2023.

By Luke Patey

Can the European Union overcome its deep reliance on China’s critical minerals supply chain?

This January, at a press conference 1,700 feet underground in Sweden’s Lapland region, one of Europe’s most pressing policy goals seemed to finally be within reach. State-owned miner LKAB was announcing a major discovery in its Kiruna mine: one of the largest deposits of rare earth elements in Europe.

“This is really an important day for Sweden and for the whole of the European Union,” said Ebba Busch, Sweden’s minister for energy, business and industry, while donning a blue hard hat. “It is a significant happening which can play a key role in securing a green transition within the EU.”

Along with other critical minerals, such as lithium and cobalt, the 17 rare earth elements (REEs) are essential for the green and digital transitions. But European leaders are also keenly aware that China dominates the industry, stressing that Chinese suppliers provide an astonishing 98 percent of Europe’s rare earth demand. After the Covid-19 pandemic and Russia’s invasion of Ukraine exposed the risks of supply chain dependencies, many European leaders fear that their fraught relations with China could lead Beijing to cut the regional body out of the green supply chains.

LKAB’s announcement that it is sitting on an abundant supply of rare earths carried a decidedly celebratory mood. Rare earths are used for electric vehicles, wind turbines and fifth-generation mobile networks, and the Kiruna mine feels to many like a step towards “re-shoring” one of the most important supply chains of the 21st century. But only if Europe acts quickly.

“The time frame for us to achieve what we want is very short,” LKAB’s chief executive Jan Moström said as he presented a gift to Busch — a large hourglass filled with mining tailings. “It is a huge challenge.”

The European authorities seem to share LKAB’s sense of urgency. The International Energy Agency (IEA) estimates that overall global demand for minerals will need to grow 30 times to meet the Paris Climate Agreement goals over the next two decades. China currently holds one-third of known rare earth reserves and close to two-thirds of mining production worldwide.

In order to “de-risk” the EU’s reliance on China, the European Commission recently released the Critical Raw Materials Act. The act, if passed, will simplify permitting procedures for miners like LKAB and offer finance and other support for strategic projects involving mining and processing — all of which, EU leaders hope, will jump start the re-shoring process.

A frenzy of diplomatic activity also aims to ensure alternative green supply chains can withstand pressure from China. In late March, the U.S. and Japan penned an agreement committing to diversifying their critical mineral supplies and harmonizing industrial policies, and Brussels is currently negotiating a similar deal with Washington.

Just weeks earlier, European Commission President Ursula von der Leyen released a joint statement with U.S. president Joe Biden, saying the two powers will “deepen our cooperation on diversifying critical mineral and battery supply chains, recognizing the substantial opportunities on both sides of the Atlantic to build out these supply chains in a strong, secure, and resilient manner.”

The Kiruna mine discovery was the bow on top of this geopolitical bonhomie. “Yesterday’s news on the finding of rare earth here in the region were great,” von der Leyen told the Swedish Prime Minister when the two met in Kiruna just after LKAB’s big announcement.

But when it comes to building a supply chain as long and complicated as critical minerals, many observers in the industry express more cautious optimism.

As David O’Brock, an American executive with nearly 25 years of experience in the critical mineral scene, notes, China’s dominance “didn’t happen overnight,” and the West’s efforts to catch up will similarly take time. O’Brock now works for REEtec, a Norwegian processing company that is majority owned by LKAB. Although he’s upbeat about the Kiruna mine’s new deposit, he says that extracting rare earths is difficult while industrializing them presents a whole other challenge altogether.

“China invested tens, if not, hundreds of billions of dollars in research and production to build up its industry over many years,” he says.

Indeed, finding the rare earth deposits is just step one. The EU now faces the meticulous task of ticking off all nodes of the supply chain to turn its green aspirations into an industrial reality. These include processing capacity, metallization (when near pure rare earths are mixed with metals), and magnet making (a remarkably bespoke and complicated industry) — all midstream steps that the EU is sorely lacking in.

For Europe — and the U.S. — to succeed in their new critical mineral ambitions, they will need to build out links far beyond the mine.

“The EU is getting it wrong in terms of dependency on rare earths,” says Thomas Krümmer, director of Ginger International Trade and Investment, a Singapore-based market intelligence firm focused on rare earth supply chain management. “Let us assume that somebody produced the magnet rare earths in Europe at scale,” he says. “Who would buy it? Europe does not have the downstream capacities.”

Krümmer points out that European leaders are wrong when they say the regional body is dependent on China for rare earth minerals. It is far worse: the EU has become a big importer of many of the key components and finished products REEs are used for, including permanent magnets, batteries, fuel cells, electric vehicles and solar pv-modules — energy technologies that, unsurprisingly, China has also come to dominate.

Reshoring, in other words, is more than just reclaiming the anchor of the supply chain. For Europe — and the U.S. — to succeed in their new critical mineral ambitions, they will need to build out links far beyond the mine.

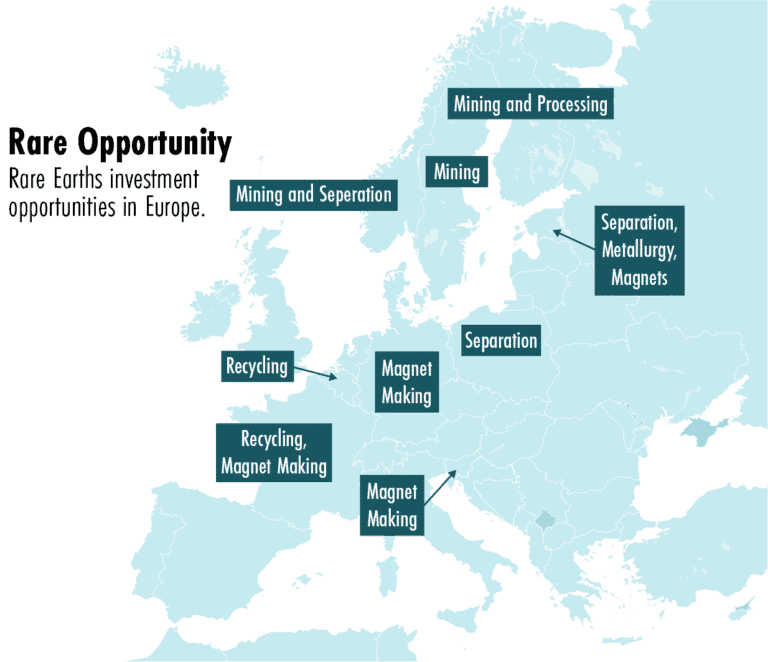

Data: CEPS Modifications made to original graphic to adapt to house style.

NOT YOUR REFRIGERATOR MAGNETS

First discovered in the late 18th century by Nordic scientists, rare earths have long been sought after for their exceptionally conductive and magnetic properties. In the 1880s, the invention of the gas mantle by the Austrian chemist Carl Auer von Welsbach represented the first industrial application of the metallic elements. Thanks to a small amount of cerium, which sparks when struck, stable lighting was suddenly possible across Europe’s expanding cities.

Rare earths have also long been entangled with geopolitics, from colonial conquests for mineral wealth (the British and Germans prospected in India and the Americas for cerium), to the race to build the atomic bomb (which required the intense pyrophoric properties of rare earths).

Although they are used in everything from camera lenses to batteries, rare earths are most sought after today to build ‘super’ magnets — the strongest permanent magnets ever made. Rare earth magnets store 18 times more magnetic energy than the run-of-the-mill iron variety, and are great for electric motors since they are relatively light in weight and heat resistant. (The attracting and repelling forces of magnets create rotational motion, which is the basic function of an electric motor.)

Source: The Wire China

Scientists at General Motors and Japan’s Sumitomo Corporation invented super magnets, otherwise known as ‘neodymium iron boron’ magnets, simultaneously in 1983. Both teams were trying to find a work around to the strongest permanent magnets at the time — samarium-cobalt magnets — since a war in what is now the Democratic Republic of the Congo had caused the price of cobalt to skyrocket. They settled on using the rare earth neodymium because the resulting magnets are both cheaper and provide a stronger magnetic field than samarium-cobalt magnets.

Neodymium iron boron magnets went on to become crucial inputs in a variety of 21st century inventions, including electric vehicle motors and wind turbine generators. Smaller super magnets are also used for image stabilization in smartphone cameras and their strength has shrunk the size and improved sound quality in headphones. There are over a dozen tiny neodymium magnets in most iPhones, and the typical electric vehicle has around six pounds of the powerful magnets inside.

Credit: Hinrich Foundation Modifications made to original graphic to adapt to house style.

Indeed, the phrase “from mine-to-magnet” has become shorthand for the fact that, today, magnets represent close to a third of total global volume demand for rare earths and 90 percent of their market value.

But the shorthand also obscures the many steps involved in turning rare earths into these high value goods.

Although rare earths are not exactly rare — deposits occur abundantly around the world — they are high maintenance. The 17 elements are often only present in uneconomical quantities and they are usually found mixed all together at varying ratios. Given how similar they are to one another, separating them out to pure, individual elements — “processing” — requires specialty knowledge and technology and can produce dangerous wastes.

REEtec, O’Brock’s company, is part of the commercial efforts to expand Europe’s rare earth processing capacity. The Norwegian company, which received initial support of 12.5 million Euros from the EU, plans to process rare earths by 2024, and begin processing from LKAB feedstock by 2027. O’Brock estimates they will eventually be able to produce 5 percent of Europe’s total demand for neodymium and praseodymium (the core ingredients of magnets for electric vehicles) — “a drop in the bucket,” he says.

It’s also still the beginning of the supply chain. After processing, REEs are sent to a metal production facility, where they are heated up to such a high degree that it throws off the oxygen, turning it into a metal form. Then the rare earth metals head to a magnet maker. Neither of these industries involve particularly simple or straightforward industrial processes, but magnet making is especially difficult since it can be done in a variety of ways, each specific to the end use.

An LKAB video highlighting critical minerals and their uses.

“When it comes to magnets, there are so many different types depending on the technology and recipe employed,” says Per Kalvig, research emeritus at the Geological Survey of Denmark and Greenland. “It is a whole world of expertise, and once you open that box, it can become overwhelming.”

UK-based firm Less Common Metals and the German magnet manufacturer Vacuumschmelze (VAC) are, respectively, the only notable commercial metal and magnet makers in Europe. By contrast, China makes up a disproportionate amount of global production, representing over 90 percent in both metal and magnet makers, according to a study from the European Raw Materials Alliance, an EU-backed organization.

Brussels hopes to shore up its capacity. With EU-support, Canada-based Neo Performance Materials plans to build a rare earth permanent magnet factory in Estonia by 2025. This would be a significant step towards Neo’s vertical integration since it already owns the Estonian company Silmet — the only sizable rare earth processor in Europe. And experts note that Neo’s location, close to German automakers, may help it get off the ground.

“Rare earth magnets are not a homogenous product. To hit the quality that the customer demands can be an exacting process,” says David Uren, senior fellow at the Australian Strategic Policy Institute. “But since they’re manufactured to very precise requirements, proximity to the customer can often be an important factor.”

Credit: Rare Earth Magnets and Motors: A European Call for Action Modifications made to original graphic to adapt to house style.

Initially, however, Neo’s production will only cover a small share of EU permanent magnet needs, and Neo may also get caught up in geopolitical risk. Created out from the 2015 bankruptcy of the American rare earths miner Molycorp, Neo maintains significant assets and over a third of its sales in China. Its distinction as the only company running a dual-supply chain for rare earths inside and outside of China, observers say, places it under close watch by decision-makers in Washington and Beijing.

Another problem is that although Neo has expertise in manufacturing one type of neodymium iron boron magnets (“bonded” magnets), it is not the type that industry largely demands (“sintered” magnets are more powerful). As a result, some experts question the company’s capability to scale up this new process in Europe.

Credit: SDM Magnetics via MacroPolo

Modifications made to original graphic to adapt to house style.

As Krümmer notes, Europe seems to have a working concept mine-to-magnet supply chain, but commercial feasibility remains the great challenge.

“People inevitably will encounter Murphy’s Law,” he says. “The miner, whoever it is, will be delivering concentrate under commercial terms for the first time. The processing company will be doing it for the first time at scale. And while being formidable experts, Neo will be running its first sintered magnet facility under the just-in-time performance that automotive companies like VW and Mercedes-Benz expect.”

The elephant in the room is that, even if they all succeed, doing all these steps on European soil does not automatically make them competitive with Chinese suppliers — both on price and on tech know-how. Thanks to a favorable tax policy that keeps prices of rare earths products available to China-based companies artificially low, producing permanent magnets in China is 20–30 percent cheaper compared to Europe.

“China is also decades ahead in nurturing and building human talent in the rare earth business,” adds Marina Yue Zhang Associate Professor at the Australia-China Relations Institute, University of Technology Sydney.

Zhang further highlights an important caveat for western decision-makers to consider: “China is not standing still waiting for others to catch up. It wants to keep its advantages in rare earths at least 10 to 15 years ahead of the West.” To do so, she sees Beijing continuing to adjust its industrial policies moving forward to encourage domestic breakthroughs in innovation and cutting-edge technologies.

To overcome the monopolistic market, many say Europe needs to learn how to stomach more state intervention itself.

“Europe is still too afraid of leaving the market structure,” says Nabeel Mancheri, Secretary General of the Rare Earth Industry Association. “The EU is still reluctant to have state-oriented investment in the mining sector, but in certain cases, we have to do it.”

The question is, do you go back to the whole idea that China can do it cheaper, or do you diversify the supply chain.

“If I was European Commissioner, I would start with the magnets,” Krümmer says. Even low-end projections estimate EV demand for permanent magnets will increase 600 percent by 2025. “It is going to be hair-raisingly difficult, but it can be done if the EU covers the operating losses of magnet makers for some years,” he says.

Roland Gauss, head of innovation and business intelligence at EIT RawMaterials, an EU co-funded network, agrees. “It will take time,” he says, “but if you want to build a supply chain you need to have some stamina.”

The alternative, many note, is not only worrying that China could leverage or weaponize its control of rare earths, but also a significant loss in economic well-being. Many of the final products for REEs, after all, are also manufactured in Europe’s industrial heartlands.

“The question is,” says O’Brock, “do you go back to the whole idea that China can do it cheaper, or do you diversify the supply chain. Because if you don’t, a heck of a lot of Germans are going to lose their jobs in the automotive industry.”

NOT IN MY BACKYARD

No discussion of rare earth supply chains is complete without mentioning Japan’s “rare earths shock” in 2010. Japan’s experience both reinforces the fear regarding supply chain dependencies and encourages the hope for building resilient ones.

During a dispute over a string of East China Sea islands, China imposed a rare earth exports ban on Japan as retribution. Although the ban only lasted two months, Japan was sufficiently spooked and took quick action, offering financing to the rare earths miner Lynas to develop a deposit in western Australia as well as a processing facility in Malaysia.

The effort took time, but it was an unqualified success: processed rare earths now go to Japanese metal and magnet makers, such as Shin-Etsu, in Southeast Asia, before reaching Japan’s automakers. According to Japan’s Ministry of Economy, Trade, and Industry, Japan lowered its rare earth dependencies on China from 90 percent in 2008 to 59 percent in 2020.

“The Japanese approach to the development of Lynas was very effective,” says Uren, at the Australian Strategic Policy Institute. “They had the patents [for rare earth magnets], the investment and the acceptance of risk, and they were able to create the most important non-Chinese rare earth producer out there.”

Japan also had patience and commitment — both of which, observers say, the European Union will need as it faces a world of imperfect choices. Indeed, the rare earths supply chain blends together not only challenges of national security and industrial competitiveness, but also economic and ecological welfare. Given what is at stake, not everyone is as eager to allow LKAB’s sense of urgency to dictate Europe’s actions.

China’s environmental experience with rare earth extraction in Inner Mongolia, Jiangxi province, and elsewhere stand as a stark warning of the consequences of getting things wrong. Remediation efforts are underway, but the toxic tailing ponds, massive groundwater contamination, and other industrial scale pollution have deeply scared mining areas. Although the European Commission’s new critical raw materials act intends to address rights and environmental issues, critical mineral extraction faces local resistance in Sweden, Portugal and elsewhere.

Julie Klinger, a University of Delaware professor, and author of Rare Earth Frontiers, warns that Sweden and Europe’s robust regulatory contexts may fall short on environmental governance due to the present drive to fast-track critical mineral mining permits.

“The particularities of rare earth mining and processing demand a much more detailed policy treatment,” she says. “The ideal approach is for the EU to make policy more sophisticated, not more simple.”

Klinger also says the focus on the mining industry often obscures the necessity for developing recycling infrastructure. The Centre for European Policy Studies finds that if the EU establishes a recycling infrastructure chain for permanent magnets, it could contribute close to a fifth of overall demand between 2025 and 2030, and possibly half by 2050.

“If we’re serious about having a fully functional renewable energy supply chain,” Klinger says, “we need to invest heavily in both mining and recycling to be ready to do the processing once everything reaches end of life.”

The EU’s efforts to diversify suppliers through engaging the Global South also presents its own set of difficulties and dilemmas. Environmental regulation and enforcement can be lacking in many mineral-rich countries.

“It is in our collective interest not to plunder the planet on our way to saving the climate,” says Olivia Lazard, a fellow at Carnegie Europe. “Decarbonization has siloed our thinking and analysis, neglecting the knock-on effects the extractive industry will bring to water availability, food productivity, human health, conflict and global inequalities. We now face reinforcing tipping points on planetary and geopolitical tensions over this new resource competition, and we’re unprepared to deal with them.”

But the EU’s approach may also offer guidance to others.

“The EU has produced the most mature set of environmental and social governance standards and is leading the charge to continue to improve on these and deploy them globally,” says Sophia Kalantzakos, professor at New York University and editor of Critical Minerals, the Climate Crisis and the Tech Imperium.

People don’t understand how critical mineral mining relates to their lives… But they need to understand that somewhere sacrifices are made to enable them to drive an electric car.

Recycling and diversification efforts would lower the demand for critical minerals and ease dependencies on China, but new technologies and production processes could also slow down the mining rush. Hitachi Metals, for instance, has developed techniques to lower the use of rare earth elements in permanent magnet production. The neodymium iron boron magnet is also unlikely to be the last invention in magnet technology. New battery technologies, such as lithium iron phosphate batteries, which are nickel and cobalt-free, and those not needing lithium at all, could also end up altering critical mineral demand.

“At the moment you look at the forecast charts for critical minerals and they rise exponentially far in excess of any available supply today,” says ASPI’s Uren. “But down the track you might find that substitutions take place and rare earths and other critical minerals become less important. That is a risk in rapidly evolving technology.”

But industry experts argue these potentials will take time to realize. “Recycling cannot solve all your problems in the short term,” says Mancheri, “We have the technology, but we don’t have enough feedstock now. The potential will only come after 20–25 years when all those electric vehicles and wind turbines you make now reach their end of life”

Gauss from EIT RawMaterials also notes there is still plenty of technological potential for rare earths and other critical minerals — potential Europe will want to be a part of. “Imagine we cut ourselves off from rare earths,” he says. “Then we’re cutting ourselves off from that world of science, technology and knowledge.”

There may also simply be a price to pay for the EU attaining its coveted “strategic autonomy” in critical minerals.

“People don’t understand how critical mineral mining relates to their lives. They just see the dust, think it’s ‘dirty’ and don’t want it taking place near them,” says Krümmer. “But they need to understand that somewhere sacrifices are made to enable them to drive an electric car.”